There are different types of execution in the forex market, in which market execution often considered as the better one. Why is that and which brokers provide this execution?

To access the currency market, you need to register with a forex broker. The primary function of a broker is to connect the trader and the market, as well as facilitate the trade and execute the orders.

Many brokers offer various types of trading accounts and other features such as leverage, spread, and minimum deposit. Every trader would have to consider these things before picking a broker as well as checking if the broker's legit and trustworthy.

But apart from those aspects, have you ever heard about market execution? Indeed, this feature is usually not displayed explicitly on the broker's website but rather discovered only after you explore the broker's specifications.

There are a few brokers that provide market execution transparently, here's the list:

So in this article, we will talk about the types of execution in those forex brokers and why market execution could be a better choice for you.

Brokers with Market Execution

The following brokers claim to provide market execution in some if not all of their accounts:

1. FBS

FBS is a renowned global broker that holds multiple regulations worldwide, including ASIC, CySEC, FSCA, IFSC, and FCA. Operating since 2009, this broker guarantees clients the fastest possible order execution speed, with 95% of orders being executed within 0.4 seconds.

All FBS accounts utilize market execution for orders, meaning orders are executed at actual market prices, and requotes are not possible. Orders are executed using NDD, ECN, and STP technologies, ensuring they are directly matched with the liquidity providers' systems.

Since 2009, the action of FBS Holding Inc. or known as FBS in the world of forex trading has been recognized by various international institutions. With clients reaching 14 million as of 2019, FBS has received the title of Most Transparent Forex Broker 2018, Best Investor Education 2017, Best Customer Service Broker Asia 2016, IB FX Program, and many others.

FBS is regulated by FSC Belize and CySEC Cyprus. This broker has been trusted by millions of traders and 370 thousand partners from various countries. Based on their data, FBS garners about 7,000 new traders and partner accounts every day. And, 80% of the clients stay in the FBS for a long time. No wonder the broker is growing rapidly due to the incredible growth in the number of clients.

Trading products offered by FBS range from forex, CFD, precious metal, and stock. For forex trading, CySEC-regulated FBS offers leverage up to 1:30 on Cent and Standard Accounts. Clients who want to try higher leverage than that can alternatively register an account under FBS Belize.

FBS spread begins from 0.5 pips for Pro account type and from 0.7 pips for Standard and Cent accounts. On a standard account, volume orders can be made from 0.01 to 500 lots. Therefore, this account is recommended for experienced traders.

Whereas on Cent Accounts, volume orders can be carried out with a maximum of 500 cent lots or the equivalent of 5 standard lots. Cent Accounts involve a different level of risk. FBS recommends Cent Accounts for beginner traders. All account types support the following trading instruments: 36 Forex pairs, 8 metals, 3 energies, 11 indices, 127 stocks, 5 crypto pairs.

Before plunging into the real forex market, traders can practice with FBS Demo Account which consists of two types, i.e Standard and Cent.

FBS uses the MetaTrader 4 and MetaTrader 5 platforms. They offer them on Windows and Mac as well as Android and iOS mobile. These platforms provide a trading experience at traders' fingertips, allowing traders to progress as a trader anywhere at any time.

MetaTrader platforms also have a variety of mainstay features, including the possibility to create, buy, and use expert advisors (EA) and scripts, One-click trading and embedded news, technical analysis tools, the possibility to copy deals from other traders, hedging positions, and VPS service support.

Another advantage provided by FBS is a deposit bonus of 100% for clients who fulfill certain requirements. The process of FSCing and withdrawing funds can be run easily and quickly. Based on clients' testimonies, each process usually takes no more than 3-4 hours, except on holidays.

Traders also have the opportunity to develop a side business when trading with FBS, namely as an Introducing Broker (IB) or Affiliate. The FBS partnership system provides partner commissions that are already in 3 level positions. Only by introducing new clients to FBS according to certain procedures, traders can earn extra income.

Traders will also get trading education experience at FBS. They have prepared a comprehensive forex course. The course consists of 4 levels: beginner, elementary, intermediate, and experienced. Traders can take courses that will turn them from newbies to professionals. All materials are well-structured. Besides, FBS provides various forex analyzes, webinars, forex news, and daily market analysis that can be accessed easily on their site.

Traders can access the FBS website with many language choices. Of course, this will increasingly provide comfort for traders. Available languages include English, Italian, French, Portuguese, Indonesian, Spanish, and others. Live chat support is also provided 24 hours 7 days a week.

In conclusion, FBS is a widely known broker among retail traders around the world. It continually grows to become a preferred broker because of flexible trading conditions that enable its clients to trade with various instruments, low deposit, and other trading advantages.

2. IC Markets

IC Markets is one of the top ECN brokers regulated by ASIC and is widely known to have a good reputation among traders. Like FBS, the broker uses a market execution type that applies to all kinds of accounts.

Although the broker doesn't provide detailed information about this feature, you can check it directly on the IC Market's trading platform. The interesting part is the broker claims that they can execute the orders faster than other brokers because they use NY4 and LD5 servers.

IC Markets is an online forex broker operating under the company of International Capital Markets Pty Ltd. Traders under the Australian jurisdiction are provided with the trading service of IC Markets AU that is headquartered in Australia and licensed by the Australian Securities and Investments Commission (ASIC).

On the other hand, non-Australian traders who open an account in this broker are registered under IC Markets SEY that is based in Seychelles, and regulated under the Seychelles Financial Services Authority (SFSA). The dual operation is a result of the relatively new rules from ASIC that prohibit their regulated broker to offer trading services outside Australia.

Classified as an ECN broker, IC Markets provide clients with MetaTrader 4, MetaTrader 5, cTrader as platform trading options. This broker also follows market trends to include Cryptocurrencies as one of its products, enriching its already wide selection of trading assets that include Currencies, Indices, Metals, Energies, Softs, Stocks, as well as Bonds.

The minimum deposit in IC Markets is in the middle range compared to other ASIC-regulated brokers, as it reaches $200 for every client. Market analysis materials are also prepared regularly for trading insights on IC Markets's official website, proving their competence to serve their traders with important contents created by market experts that work specifically for them.

For payment methods, IC Markets allows funding and withdrawal via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, as well as Bitcoin via BitPay. The more interesting aspect from this broker is its multi-base currencies that include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

As the trading technology in IC Markets is highly equipped with co-located servers and extremely low latency (especially on cTrader), the broker is widely known for its capability in hosting traders with the special needs for high-frequency trading as well as scalping.

To sum up, IC Markets is a fitting destination for active traders looking for a well-regulated broker. IC Markets is also flexible in terms of base currency and payment methods, signaling their commitment to welcome traders beyond their home country. As of late 2019, IC Markets provided their website in 18 international languages including English, Korean, Indonesian, French, Spanish, Italian, Malay, German, and Chinese.

3. Exness

Exness is a well-known broker that offers various types of trading accounts; some of them use market execution. The interesting part is that there is an account that can use instant execution and market execution at once.

The choice of broker is adjusted to the needs of each trader. If you are a trader who only needs a basic platform and trading features with the best attributes, then Exness can be your best choice.

Exness covers its lack of feature variations with other advantages like low spreads starting from only 0.1 pip. This is very suitable for traders who use scalping strategies (Scalper). Spreads on major pairs in certain account types can also be as low as 0.0 pip, depending on market conditions.

Not only that, but traders can also enjoy other advantages such as automatic fund withdrawals. Exness processes the majority of client withdrawals instantly, without manual checks; however, withdrawals may be subject tos depending on the payment provider or method of choice.

The safety of traders' funds is also guaranteed as Exness is one of the European-based STP/ECN brokers. Exness's ability to become an official partner of the Real Madrid soccer team for 3 years, starting July 2017, also provides evidence that the company has high solidity.

Deposits and withdrawals may be made 24 hours a day, 7 days a week. However, it is important to note that the company shall not be liable fors in processing deposits and withdrawals if suchs are caused by the payment system.

Traders do not need to worry about transaction fees when depositing and withdrawing. Exness doesn't charge any transaction fees to traders even though some charges may be incurred depending on the payment provider of choice. A variety of payment methods are provided for traders, including Wire Transfer, Bank Card, Neteller, Skrill, and many others.

The financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the four largest public accounting firms globally.

Moreover, Exness is one of the mote transparent brokers in the online trading industry. Traders can find out all information about this company on the website, such as trading volume, number of active clients, client deposits, company funds, and many more.

The platforms provided by Exness vary in MetaTrader 4, MetaTrader 5, Web, and Mobile platforms. This makes it easy for traders when trading on Exness, as they can also access Exness platforms anywhere and anytime.

Over the years, Exness has developed into a broker that attracts traders. Trader's trust is further enhanced by its compliance with financial regulations like the FCA and CySEC.

One measure of client confidence can be put on the trading volume. By December 2018, their clients' monthly trading volume reached USD348.4 billion and active traders around the world surpassed 50,342.

Through the program offered by Exness, traders also have the opportunity to earn extra income by becoming their partners. From the Introducing Broker (IB) program, partners can earn up to 33% spread commission from every new client that registers with them.

Additional income can also be obtained from Exness Partners. Traders can get a spread commission of up to 25% per transaction made by traders who register through an affiliate link.

When trading with Exness, clients can also make use of its free VPS hosting services. A VPS (Virtual Private Server) offers increased reliability and stability for traders as they can maintain their trades and expert advisors without interruption in the event of unexpected technical issues, such as internet or electricity downtime.

From the review above, it can be concluded that Exness is a favorite broker for traders because of low spreads and flexible account types. This condition is very suitable for traders with limited funds but is in need of more opportunities to get maximum profit. This broker is also well known for its maximum support on both new and existing partners.

4. XM

XM provides detailed information about their order execution types and even puts it on a specific page that explains that the broker uses market execution. Some of the advantages offered are no requote, fast performance, and orders are allowed even on weekends and holidays.

Because the broker doesn't mention if the execution type only applied to certain account types, so it can be considered that market execution is available for all types of accounts.

XM Group is a group of regulated brokers and it is owned by Trading Point Holdings Ltd. Entities under XM Group have significant experience as financial services providers worldwide.

Trading Point of Financial Instruments Ltd was established in 2009 with headquarters in Limassol, Cyprus, Trading Point of Financial Instruments Pty Ltd was established in 2015 with headquarters in Sydney, Australia, XM Global Limited was established in 2017 with headquarters in Belize and Trading Point MENA Limited was established in 2019 with headquarters in Dubai.

XM Group is regulated by the CySEC (Cyprus Securities and Exchange Commission) - Trading Point of Financial Instruments Ltd, FSC (Financial Services Commission) – XM Global Limited, the ASIC (Australian Securities and Investments Commission) - Trading Point of Financial Instruments Pty Ltd and DFSA (Dubai Financial Services Authority) - Trading Point MENA Limited.

XM is one of the more experienced brokers in the world of online forex trading today. Since its founding, the broker has experienced a lot of changes, including the addition of the Ultra-Low Account and EN Live Edu that is instructed by 16 global experts.

In terms of trading instruments, XM is a well-known diverse class assets provider, varying from Forex, Crypto, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, & Shares. XM prides itself to be the ideal broker in trading execution, offering a stat of 99.35% orders to be executed in less than 1 second. Trading in XM would be also provided with a strict no requotes policy, no virtual dealer plug-in, no rejection of orders, real-time market execution, and the choice for traders to place orders online or by phone.

Spreads on all majors can reach as low as 0.6 pips in Ultra-Low Account, while spreads on other accounts usually start from 1 pip.

To protect the client's fund in the event of extreme volatility, XM presents each account type with Negative Balance Protection. Minimum deposit of $5 applies to Standard, Micro, and also Ultra-Low Accounts. Traders who open accounts in XM are enabled a condition similar to a Cent Account environment in the Micro Account, in which the Contract Size for every lot is only 1,000 units. If it is applied with the smallest lot size in the MetaTrader platform which amounts to 0.01, it means that traders can go as small as 10 units per trade.

For the deposit, XM applies zero-fee deposits in most of its available payment methods. Traders can choose to fund or withdraw their accounts via wire transfer, credit card, as well as the most favorable e-payment choices like Skrill, Neteller, and FasaPay.

To give their clients the best experiment in trading, XM has given access to both MT4 and MT5 platforms, each is available for more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android, and Android Tablet).

All in all, there is no doubt that XM has gone global with its deep commitment to providing services in more than 30 different languages across the world. Aside from easing traders' experience with mainstream trading platforms and high-quality trading execution, XM is open to various types of traders, from small capital traders to the more experienced ones with big deposits at the ready. Traders are even provided with a Cent Trading environment should they choose to register under Micro Account.

For their global approach, XM has ensured that traders from various countries could access their service easily. This results in the provision of different domains specified for traders in certain jurisdictions. For example, traders from Indonesia could access XM via this link.

5. OctaFX

Based on OctaFX's official website, all account types use market execution with less than 0.1 seconds processing time. Like XM and IC Markets, this broker also offers three types of accounts: micro, pro, and ECN.

The minimum deposit for micro and ECN accounts is $100, while the pro account is $500. That amount may sound pricey, but the rest of the trading cost is relatively low compared to other brokers.

OctaFX doesn't charge any additional commission apart from the floating spread in the zero accounts.

6. Admiral Markets

Admiral Markets is another broker that provides market execution for all accounts. The broker's lowest minimum deposit is $200 USD. Some other features provided by this FCA-regulated broker are the add-on MetaTrader Supreme Edition, One-click Trading, Volatility Protection Settings, and Market Depth with Level II Pricing.

7. Alpari

Compared to the previously mentioned brokers, Alpari offers a broader range of account types. Unfortunately, only the ECN accounts use market execution. Despite the limitation, market execution in Alpari is quite reliable as the broker itself is supported by years of experience that prove its competitive edge.

Alpari International is one of the largest forex brands. They always try to work hard to make sure traders make the best trading and investment decisions. Established on 24th December 1998, Alpari has started from a small group of men who are looking to start a business in finance in one of the most economically precarious years in Russia's history.

During 20 years of experience in the forex industry, there are about 2 million traders choosing Alpari as the broker to trade with. Alpari has a head office on the 5th Floor, 355 NEX Tower, Rue du Savoir, Cybercity, Ebene 72201, Mauritius. The company is regulated in St.Vincent and the Grenadines (the licensed number is 20389 IBC 2012), IFSC Belize (the licensed number is IFSC/60/301/TS/18).

This broker uses MetaTrader 4 and MetaTrader 5, both of which offer great flexibility, charting tools, and an easy-to-use interface. For higher volumes, the company also provides the Alpari International Direct platform which offers enhanced features for advanced investors.

The company offers an array of live trading accounts to choose from. Each one offers different opportunities and allows traders to trade in different ways. All of their accounts use USD, EUR, GBP, and NGN as the options for base currency. But, NGN accounts are only available to clients in Nigeria.

Each kind of account has a different spread. At Standard Account provides spreads from 1.2, the spread of Micro Accounts is from 1.7, and ECN Account and Pro Account have spread from 0.4. A trader can open an account in Alpari and opt to trade currencies (FX majors, FX minors, FX exotics, and FX RUB), spot metals, spot commodities, stock trading, spot indices, and crypto-currencies.

A trader can find out what the minimum spreads, pip value, swaps, and trading session times are for each instrument before start trading. If the trader is still not sure where to begin, they can found the answer in a guide provided by Alpari on their official website.

Their guide to trading is designed to break down the terminologies and answer the most frequently asked questions by traders. A trader will be trading more quickly and with more confidence in no time.

Besides, Alpari offers PAMM (Percent Allocation Management Module) which allows a trader to choose their desirable Account Manager. This allows traders to have a chance in gaining more profit without advanced knowledge of forex trading. These managers usually have a wealth of experience in the markets, with tried-and-tested strategic trading decisions.

This program also gives opportunities for well-seasoned traders to become Strategy Managers. As Strategy Managers, they can use their trading experience and earn more from profitable trades. They have privileged access to Alpari's advanced programs and all the tools they need to cultivate a massive following of investors. The investors then will help Strategy Managers to earn more through commission fees up to 40%.

Their website also provides various Forex Trading Strategies. Because to increase the chance to profit, it's important to know as much about the markets and the trading strategies behind them as possible. Alpari believes that strategies provide traders with a roadmap for trading, reducing panicked decision-making that can occur in the heat of the moment. In other words, trading in Alpari allows traders to learn about any kind of forex trading strategy.

For educational purposes, the company provides Trading Webinars, one of the variants of technology that allows users to hold seminars, talk shows, and discussions online, without having to communicate face to face.

Alpari creates a very convenient funding and withdrawal experience for each trader. A trader can transfer with any kind of methods, such as e-payment (example: FasaPay, Local Transfer, TC Payment, etc), credit cards (Visa, Mastercard, and Maestro), E-Wallet (Neteller, Skrill, VLOAD, TC Pay Wallet, WebMoney, Perfectmoney, Bitcoin), and bank transfer. If there's been no trading activity on the trader account for at least 6 months, an inactivity fee of 5 EUR/USD/GBP will be applied.

All Back office transfers are processed during standard business hours, 03:00-19:00 GMT+2 (GMT+3 during DST), Monday-Friday. If traders still feel confused, they can contact Alpari's team by any method, such as Live Chat, Telegram, or email.

8. FxPro

FxPro is an FCA-regulated broker that uses market execution. Uniquely, this broker doesn't categorize its accounts based on lot, spread, or execution type but focuses more on the trading platform.

You can get all the advantages of market execution in all types of accounts in this broker, especially in the MT4-based account that allows you to use both market and instant execution.

Ever since its establishment in 2006, FxPro has successfully expanded to serve retail and institutional clients in more than 170 countries. Their head office is in London, UK.

FxPro UK Limited is authorized and regulated by the FCA since 2010. Meanwhile, other subsidiaries such as FxPro Financial Services Limited is authorized and regulated by CySEC since 2007 and the FSCA since 2015. Because of that, traders do not need to worry again about their funds safety. As a strong proponent of transparency, it established the highest standards of safety for clients' funds, as the company chooses to keep the funds in major international banks, fully segregated from the company's funds.

They always try to provide transparent and ethical practices across the global trading industry. In 2018, 74.65% of market orders were executed at the requested price while 12.8% of the client's orders were executed with positive slippage. Also, only 1.4% of all instant orders received a requote with 0.72% of them receiving better price when executed.

The total number of trades in FxPro has increased from year to year. In 2018, the number of trades achieves 53.6 million. Based on trust from their clients, FxPro received awards as Most Trusted Forex Brand UK 2017 by Global Brands Magazine. Besides, they became the first broker to sponsor an F1 team in 2008. There are around 60 UK and International Awards which had been achieved by FxPro.

They are committed to create a dynamic environment that equips traders with all the necessary tools for their trading experience. Opening an account in FxPro grants access to more than 250 CFDs on 6 asset types, including forex, shares, spot indices, futures, spot metals, and spot energies. They want to provide their clients with access to top-tier liquidity and advanced trade execution with no dealing desk intervention. The average execution time is less than 11.06 millisecond with up to 7,000 orders executed per second. Those advantages enable traders to benefit from tight spreads and competitive pricing.

Furthermore, FxPro is recognized as an innovative broker. The company allows its clients to enjoy a wide range of trading platforms, such as MetaTrader 4, MetaTrader 5, cTrader, and FxPro Edge. Web-based versions and mobile applications are also available so that traders can access financial markets at any time and anywhere.

Traders can choose platforms according to their needs. Fans of MT4 is provided with instant execution and easy-to-use trading platform. In this account, leverage is up to 1:500 and spreads start from 1.6 pips without commissions.

If traders want to get experience with more modern technology, traders should choose FxPro MT5 Accounts. In this account, spreads start from 1.5 and leverage is up to 1:500 without commissions.

Another type of accounts is FxPro cTrader. It is suitable for traders who give priority to the speed of execution with the most restrictive spreads compared to other account types'. FxPro cTrader is a powerful trading platform offering the best available bid and ask prices, with orders filled in just milliseconds. The platform also provides Market Depth and trading analysis tools. In this account, spreads start only from 0.3 pips. But, traders have to pay commissions $45 per $1 million traded (upon opening and closing a position) in forex and metals.

The key difference between MetaTrader 4, MetaTrader 5, and cTrader lies in the range of the CFD products that are available. The MT4 platform gives traders a chance to open positions on all of the 6 asset classes, whereas the MT5 doesn't support shares, and cTrader doesn't support shares and futures.

Besides 3 types of platforms above, trading in FxPro also enables access to FxPro Edge. This platform offers clients a new way to trade the markets in the form of spreads betting.

Each broker has pros and cons, and FxPro is not an exception. Aside from the advantages as explained before, FxPro has a high minimum deposit. Also, there are not many types of payment and withdrawal methods available at FxPro. Some types of methods even require traders to pay fees. However, it is still important to note that clients can trade forex, shares, indices, metals, and energies, with limited risk account at no additional cost in Fxpro

Regardless of the advantages and disadvantages, FxPro can be traders' choice as one of the best brokers with sophisticated technology. The company is suitable for traders prepared to trade with funds starting from $500.

9. FXTM

At first glance, FXTM is similar to Alpari because both only use market execution for their ECN accounts. That is why this broker might be more suitable for experienced traders in terms of its market execution providing.

One can expect various choices of trading instruments if they open an account in this broker. After all, FXTM is well-known for its commitment to provide the most accomplished trading service for retail traders from the get-go.

FXTM was initially launched in 2011 with a unique vision to provide unparalleled superior trading conditions. Opening an account in FXTM would also bring about access to advanced education and sophisticated trading tools in the forex industry.

Now, FXTM is registered under the Financial Conduct Authority of the UK with the number 600475. The company is also regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12, and is licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, with FSP No. 46614

FXTM has 1 million registered accounts with more traders joining every day. The company continually tries to improve their performance and have got many awards such as Best Trading Experience 2019 by World Finance Awards, Best Online Forex Trading Company Nigeria 2018 by International Finance Awards, Reputable Investor Education Forex Broker Award 2018 by Hexun.com, Forex Brand Of The Year China 2018 by Fxeye.Com, and many more.

As a responsible broker, they determine leverage (expressed as a ratio of transaction size relative to trader's buying power) according to the trader's level of knowledge and experience in trading, which is evaluated by the Appropriateness Assessment. The company also enables trading with leverage up to 1:1000.

As for spreads, FXTM offers low spreads starting from 0.1 pip, so traders can withdraw profits at the start of trading. The company, which has headquarters in several countries, uses No Dealing Desk (NDD) technology and partners with credible liquidity providers to provide the best bid and ask prices.

For beginners, there is an automatic trading facility called algorithmic trading provided. When trading in FXTM, traders can develop their trading strategy or adopt other traders' strategies. Furthermore, the strategy is applied to automated trading systems, such as Expert Advisors. The purpose of this system is traders do not have to worry about losing opportunities while not observing the market so that profits can still be earned.

Three types of ECN accounts use the MT4 and MT5 trading platforms. There are also mobile and Tablet Apps trading platforms. Aside of providing many account variants, FXTM goes above and beyond to ensure that their client receives excellent support that they deserve, making their trading experience optimal and user-friendly.

FXTM also provides a diverse range of products. In addition to over 50 currency pairs, they provide gold, silver, CFD on commodity futures (oil), CFD on ETFs, and indices.

Education about the basic concepts of the forex industry is also accessible in this broker. Traders can read all the concepts provided in the form of e-books, video tutorials, articles, webinars, and forex seminars. There are 17 languages provided on the FXTM website to make it easier for traders to learn about forex.

Traders are also given various choices for payment methods, including Credit Cards (Visa, Mastercard, Maestro) and E-Wallet (Neteller, Skrill, Western Union). For withdrawing funds, traders are not charged a fee with a length of 2 hours to 2 days. Traders can live chat to ask further questions and contact the admin via email. There is also a question and answer page about forex trading on FXTM.

10. ThinkMarkets

ThinkMarkets is the next Australian broker mentioned in this list after IC Markets. If you check the official website of ThinkMarkets, you won't find a specific page that explains the execution type used by the broker. They only wrote that they use the institutional model connected to the Equinix server's service.

As for the trading accounts, you can choose between standard and ThinkZero accounts. The difference between the two is quite apparent because, in the standard version, the minimum spread starts from 0.4 pips, while in the ThinkZero account, the spread can be as low as 0 pips.

Also, the operating balance in the standard account is 0, while the ThinkZero account sets the limit at 500.

As a multi-asset online brokerage, ThinkMarkets present a wide range of trading assets starting from Forex to Precious Metals, Commodities, Indices, Shares, and Cryptocurrencies. The Australian-based broker is established in 2010 and has since opened additional headquarters in London and regional offices throughout Asia-Pacific, Middle East, North Africa, Europe, and South America.

Along with its history operation, ThinkMarkets has been awarded and recognized many times in various aspects. Most recently, they won the Best Value Broker in Asia at the 2020 Global Forex Awards.

Average FX spreads for traders opening an account in ThinkMarkets start from 1.2 pips for the standard account, while ThinkZero provides the best trading experience with 0.1 pips spread. Still, traders may need to consider that ThinkZero applies commission from $3.5 per side for every 1000,000 trading volumes.

As a global online brokerage, ThinkMarkets operates under various financial regulatory institutions. For example, ThinkMarkets Australia is managed by TF Global Markets (Aust) Limited and is licensed by the Australian Financial Services as well as the Australian Securities and Investment Commission (ASIC) with ABN: 69158361561. ThinkMarkets UK is registered under the Financial Conduct Authority (FCA) by the company name of TF Global Markets (UK) Limited (number: 09042646).

ThinkMarkets consistently try to improve their trading environments with various advanced products. Automatic trading fans are provided with free VPS Hosting, while passionate traders who'd like to experience beyond MetaQuote platforms can try ThinkMarkets' proprietary platform called ThinkTrader.

The trading platform is available on 3 different interfaces specifically designed for Web Desktop, Tablet, and Mobile displays. Furthermore, customized tools such as 80+ drawing tools and more than 125 indicators for technical analysis accessible even through Mobile screens would certainly provide a brand new trading on-the-go experience.

As far as market updates go, trading in ThinkMarkets would be accompanied with news from FX Wire Pro that is known for its strict policy toward upholding objective journalism and delivering critical, trusted information in real-time. Information segments covered by FX Wire Pro include Economic Commentary, Technical-level Reports, Currency and Commodities, Central Bank Bulletins, Energies and metals, together with Event-driven Flashes.

For payment methods, ThinkMarkets offer the gateway via bank transfer, credit card (Visa and MasterCard), Skrill, Neteller, POLi internet banking, BPay, and Bitcoin wallet.

All in all, it is safe to say that for a company that started business since 2010, ThinkMarkets is an accomplished broker in terms of legal standing and innovation in trading technology. As an additional safety assurance for traders, this broker underlines its commitment to provide a $1 million insurance protection program which is made possible by ThinkMarkets' insurance policy with Lloyd's of London that protects clients' funds for up to $1 million in the unlikely event of insolvency.

11. FXOpen

FXOpen is mostly known to be the pioneer in facilitating Bitcoin CFD trading among forex brokers. This broker offers the advantages of market execution in all types of accounts except the micro account.

Spreads only apply to crypto and STP accounts, while the commission is charged in the ECN account ($1.5 USD standard lot) and crypto account (0.5% per half-turn). If you want to start small, you can choose between crypto and STP because the ECN account requires you to deposit at least $500.

It is important to note that there is a maintenance cost of $10 per month, and if your account is inactive, the broker can deactivate it and charge a $50 fee before a trader can re-activate it.

FXOpen started its operation as an online trading provider for retail clients since 2005. The company was founded by a group of traders with a mission to provide services that refer to the interests of traders. FXOpen claimed to be one of the firsts to offer ECN trading via MetaTrader 4 (MT4). With FXOpen's unique proprietary price aggregating technology, their clients can benefit from the industry's most competitive spreads (from 0 pips) and low trading commissions.

In 2006, FXOpen also became the first broker to offer a micro account and a swap-free account. After that, they continue to be the pioneers of several new and high-tech services, including the first Crypto account that can provide trading facilities on 24 Cryptocurrency pairs such as Bitcoin, Litecoin, and Ethereum.

Furthermore, the company provides One Click Trading and Level 2 MT4 plug-ins, enabling traders to place trades with just one click of the mouse. Traders do not need to worry about trading security at FXOpen. They have registered in Nevis, the UK FCA, and ASIC Australia.

A variety of trading accounts are provided such as STP, Micro, ECN, and free unlimited demo accounts. The minimum deposit for each account depends on the account type; USD1 in Micro Account, USD10 in STP and Crypto Accounts, and USD100 in ECN Accounts. As for leverage, FXOpen offers up to 1:3 (for Crypto Accounts), and up to 1:500 (for Micro, STP, and ECN Accounts).

Besides, traders can enhance their trading capabilities with Myfxbook and Zulutrade automated trading systems. Both of these services allow anyone to copy the transactions of experienced traders. Thus, traders can replicate the results of professional traders' strategies.

The FXOpen PAMM Service allows copying trades from a Master account to one or more than one Follower account and automates the distribution of profits and losses. The Master operates personal capital through a PAMM account, and his trading strategy is replicated to the Follower's capital. The owner of the Follower account can view and analyze the performance of the PAMM account with the help of advanced analytics. There are 3 PAMM accounts in FXOpen, namely STP, ECN, and Crypto PAMM.

On ECN accounts, traders will get direct price quotes from leading liquidity providers, including Dresdner, SG Paris, Standard Chartered, Barclays Capital, Bank of America, CRNX, JP Morgan, Morgan Stanley, Deutsche Bank AG, RBS, CITI, and UBS. This is one of the reasons why FXOpen's ECN account has become a trader favorite.

After seeing the various advantages offered by FXOpen, traders can easily register an account, simply by filling out the form in the registration menu on the FXOpen website. Traders will be asked to verify documents in advance if the trader will make a deposit or withdrawal of funds. Based on traders' experience and information since FXOpen was founded, there have not been any major complaints about payments (depositing or withdrawing funds) from clients.

Once registered with the FXOpen broker, traders also have the opportunity to get other benefits. One example is the FXOpen cashback program for the first 90 days from registration as a new client. The minimum cashback is USD5 and the maximum is USD1,000.

Furthermore, free VPS is available for ECN, STP, and Crypto account holders. Traders can use FXOpen VPS without any fees for 1 month if they can maintain equity of USD5,000 at the end of the month or trade with a trading volume of USD10,000,000 per month. The advantages of VPS on FXOpen are excellent accessibility, flexibility, and speed.

Trading on FXOpen is made easier because traders can add insight into trading by entering contests. FXOpen Broker offers weekly and monthly trading contests on demo accounts through the ForexCup.com site. Traders can join competitions that are free of charge to hone their skills. If a trader wants a bigger challenge, there is also a trading contest on a real account.

The company also offers Forex partnership programs to traders, Forex brokers, and website owners who publish information about fiat and crypto-currency trading. There are 3 types of partnership levels, including Forex IB (Forex Agent) that attracts new clients to FXOpen using a referral (affiliate) link, Forex Rebate, and individual partnership conditions.

In Conclusion, FXOpen is a well-rounded forex brokerage for traders with a desire to try various trading instruments, a trading environment in ECN account, low minimum deposits, the best cryptocurrency trading condition, as well as interesting trading features like PAMM and demo contests.

Types of Execution Order

In a broader sense, trade execution means processing traders' orders in the market. In this case, the broker should carry the orders to the market according to their role as the intermediary between the trader and liquidity provider in the market.

In the process, various things can happen. Did you know that sometimes an order can be executed at a different price than what is the trader intended? You may suspect that the broker's cheating or there's a glitch in the trading platform.

But they're not always the case. In fact, such a condition can sometimes happen because in the nature of forex trading, the price can change faster than the execution speed.

Moreover, there are two ways in which orders are executed, namely market execution and instant execution.

Market Execution

Market execution is a type of execution that fully relies on the available market price, so traders are only required to place an order and specify the volume of the trade. If there is a difference between the updated market price and the price at the time you ordered, the broker will automatically execute the order at the best price closest to your request.

In other words, your order will definitely be executed, but the price is flexible, depending on the market situation. The condition where the completed price is different than the asked price (it can be higher or lower than it should be) is called slippage, and this condition can occur if you use this type of execution.

The Advantages of Using Market Execution

- Brokers are more likely honest and transparent because they use the market price.

- Faster performance without any requotes.

- It's possible to get positive slippage.

- Orders will definitely be executed.

- Mostly used by non-dealing desk brokers.

- Low or even zero spreads.

The Disadvantages of Using Market Execution

- Usually charges a trading commission.

- There is no control over slippages, so it's possible to get negative slippage.

- In some brokers, stop loss and take profit can only be added after the order is executed and the price is known.

Instant Execution

In contrast to market execution that executes an order based on the market price, instant execution will execute the order at the trader's desired price. So in this type, traders must place an order and specify both the volume and the price.

If the expected price is not available in the market, the broker cannot change the execution price. Instead, they can reject the order and send a requote to the trader, which then can be accepted or rejected.

To avoid requotes, some trading platforms provide the maximum deviation feature to set the maximum difference between the targeted price and the requoted price so that traders can adjust the tolerance limit at their desired level.

Keep in mind that even though this feature will not eliminate requote, it can help you control the execution at an acceptable price range.

The Advantages of Using Instant Execution

- No slippage.

- You can use the maximum deviation feature to avoid requotes.

- Gives more control over when the asked price is not available in the market. Traders can choose to accept or deny the requote offered by the broker, even if that meansing the order.

- Traders can set the stop loss and take profit before opening an order.

- No additional commission.

- The spread is usually fixed.

The Disadvantages of Using Instant Execution

- Orders are not always executed; it can beed or rejected, especially if the price exceeds the maximum deviation.

- It's possible to get requotes from the broker so that the order can beed, making it unsuitable for scalpers and news traders who need to execute orders instantly.

- Used by the majority of market makers or dealing desk brokers.

- Higher spreads.

- Execution is not as fast as market execution.

How to Identify a Broker's Execution Type?

Now that we know the importance of a broker's execution type, how do we identify it in a broker? First, you can research the broker's official website.

Although the information regarding order execution is rarely displayed explicitly by the broker, you can dig up this information as a first step. A good broker would be transparent and very detailed in providing information about their services.

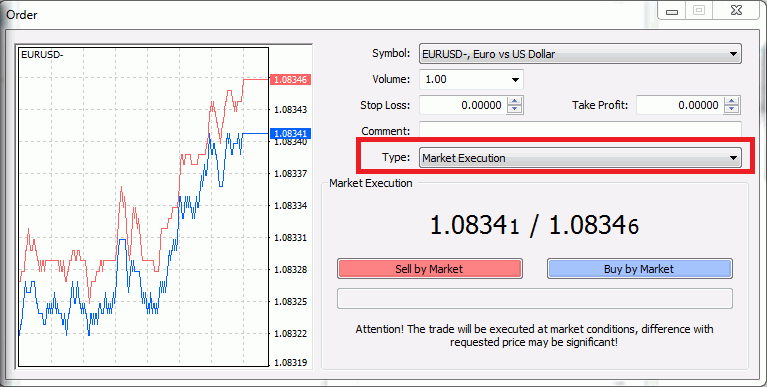

The second thing that you can do is to look at the MT4 Order Window. However, this method requires more processing time because you have to register an account and install the trading platform first.

On the MT4 Order Window, you can check the execution type as shown below:

Keep in mind that the information is not always accurate because only the broker knows for sure which type they use. Therefore, as a trader, you can also judge from your experience whether the broker acts in accordance with the execution that they claim or not.

You can also discuss it with other traders to identify which broker is honest and dedicated to their words. In the earlier steps, to anticipate the risk of getting a dishonest broker, you can read the review from other traders before you choose or start trading with a certain broker.

Conclusion

Based on the explanation above, the market execution type seems to have more advantages and a good reputation because it uses the real market price. The market price benchmark makes the market execution brokers more transparent, while in the instant execution type, brokers can easily manipulate the price.

But even so, it is not wise to think that all instant execution brokers are prone to cheating. Sometimes there is not enough volume by the requested price in the market, so they can't process the orders. This will then increase the number of requotes from the broker and could affect the quality of execution.

The truth is there are many instant execution brokers who genuinely want to develop their business in the long term and treat their clients as best as they can, especially those who are already licensed by credible regulatory bodies.

That is why instant execution brokers still exist and are quite popular in the forex trading industry, despite the general perception that favors the market execution brokers. When it comes to choosing the best type, you need to consider both types' advantages and disadvantages.

A hybrid broker usually provides two execution models in two separate account types. For example, on the cent and standard accounts, a broker uses instant execution, while on the ECN accounts, it uses market execution.

Still curious about the other brokers? You can compare them using the forex broker comparison tool.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance