There are several indicators to measure broker's transparency, such as pricing and regulations. How about Eightcap's transparency and why is the broker known to be quite excellent at it?

Broker transparency is a critical aspect of the financial industry to ensure clients have access to clear and comprehensive information about the services and operations of a brokerage firm. There are five indicators to asses a broker's transparency:

- Pricing: Logically, how can consumers buy a product if there is no price tag? As such, brokers' transparency could be determined by how they provide and inform about their spreads, commissions, deposits, swap fees, and other related trading costs. This enables traders to make decisions and comparisons with other brokers and helps them avoid losses due to hidden costs.

- Regulations: Traders must choose a broker whose operations are legal, and regulations are the primary standard. There are many regulatory bodies worldwide overseeing broker performance. Some well-known ones include ASIC, FCA, CySEC, CFTC, FSA, FINMA, and IFSC.

- Order Execution Type: Clear order execution is vital for comprehending the trade-handling process. Transparent brokers disclose whether they function as a DD or an NDD model, shedding light on potential conflicts of interest and a commitment to fair trading practices. This information enables traders to take execution speed into account.

- Whole Trading Service: Transparent brokers are those who openly share all the services they offer. This includes the available trading instruments, the platforms or technologies used, types of trading accounts, leverage options, the availability of negative balance protection, permitted trading strategies, and so forth.

- Educational Resources: Transparent brokers provide educational resources like articles, tutorials, webinars, and market analysis to empower clients with the knowledge necessary for informed decision-making. This commitment to education underscores their dedication to client success and ethical trading practices.

If a broker meets all the criteria mentioned above, then it can be considered transparent and trustworthy. In that regard, Eightcap, an Australia-based broker, is classified as one of the globally transparent brokers. Especially in terms of pricing, Eightcap provides the most comprehensive information.

Eightcap's Transparency in Details

After briefly reviewing the key points regarding broker transparency above, now it's time for us to explore how Eightcap, a broker that has been operating since 2009, meets all these criteria.

1. Transparency in Pricing

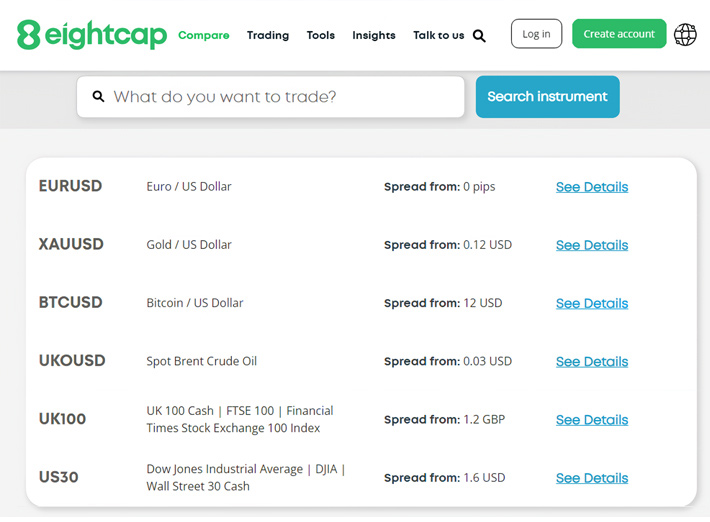

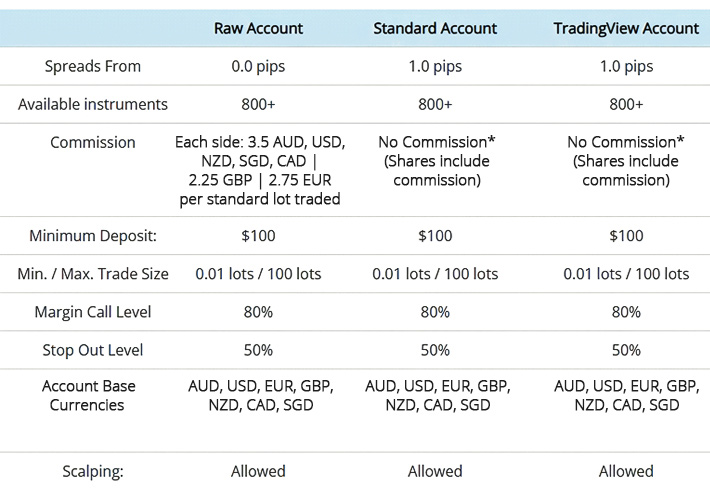

As mentioned earlier, a good transparent broker is the one that provides clarity regarding pricing. Eightcap displays a complete spread table for the trading instruments it offers on its official website.

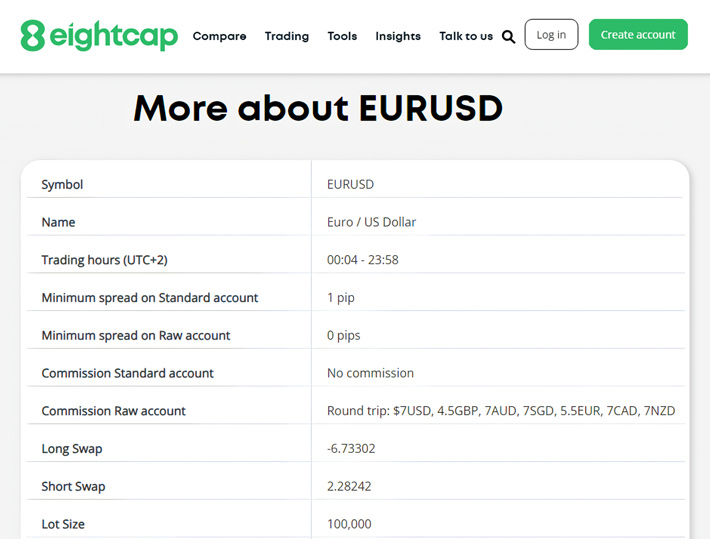

As you can see in the image above, there is a "See Details" link next to the information about instrument spreads. Try clicking on one of the instruments, and you will be redirected to a page like the one below.

It is evident there that Eightcap doesn't hold back in providing information about spreads and other fees. In fact, Eightcap elaborately details spread in each account type. This way, you can calculate an overview of your trading costs more easily.

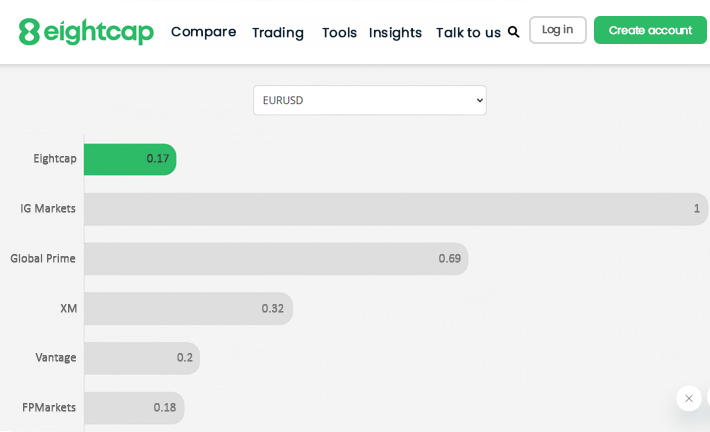

What's even more interesting is that Eightcap dares to compare its spread with other popular brokers, as shown in the following image.

In the example above, the presented comparison is spreads for the EUR/USD pair. It appears that the EUR/USD spread at Eightcap is 0.17 pips, while other brokers' spreads are slightly higher.

With such a presentation, traders can easily compare trading costs between brokers. It's entirely reasonable for traders to compare one broker to another to get the best prices, and that is what exactly provided by Eightcap.

As a reference, the spread comparison is based on the TradeProofer data as of May 5th, 2023.

2. Transparency in Regulation

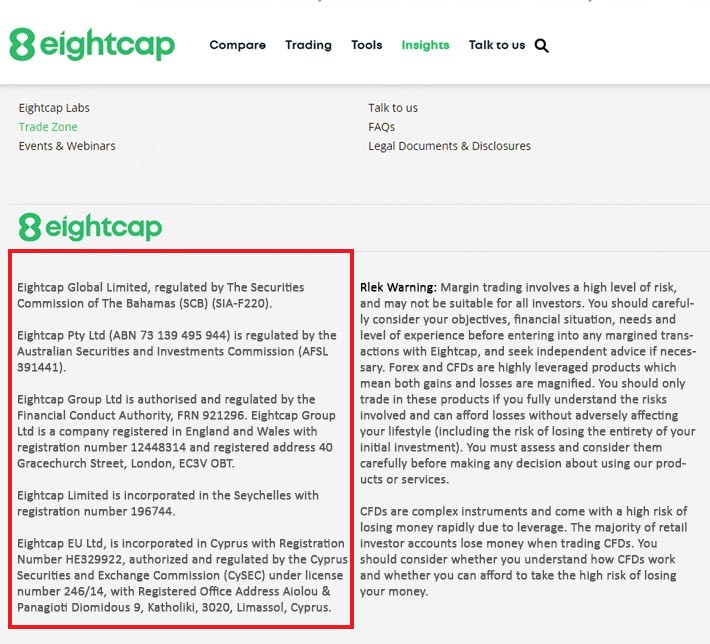

Eightcap is also transparent regarding its regulations. To check, you can visit Eightcap's official website and scroll down. In the bottom-left corner, you'll find text like this.

That is a list of the regulations held by Eightcap, complete with registration numbers. You can verify the numbers on the official websites of the regulatory bodies to confirm the information.

We can see that it holds three significant regulations, namely ASIC, FCA, and CySEC. To validate this, we need to visit the websites of regulatory bodies.

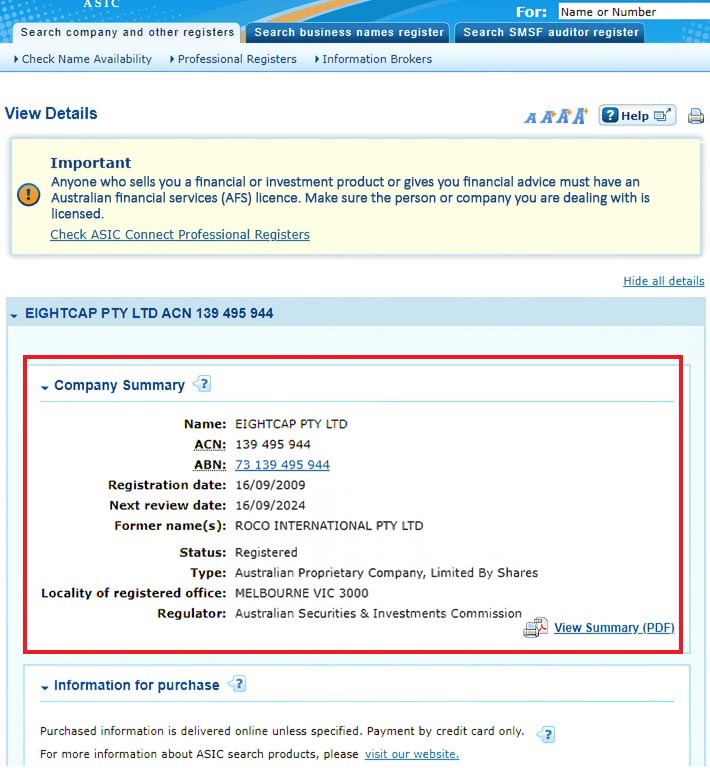

Below are the search results for Eightcap on the ASIC regulator's website.

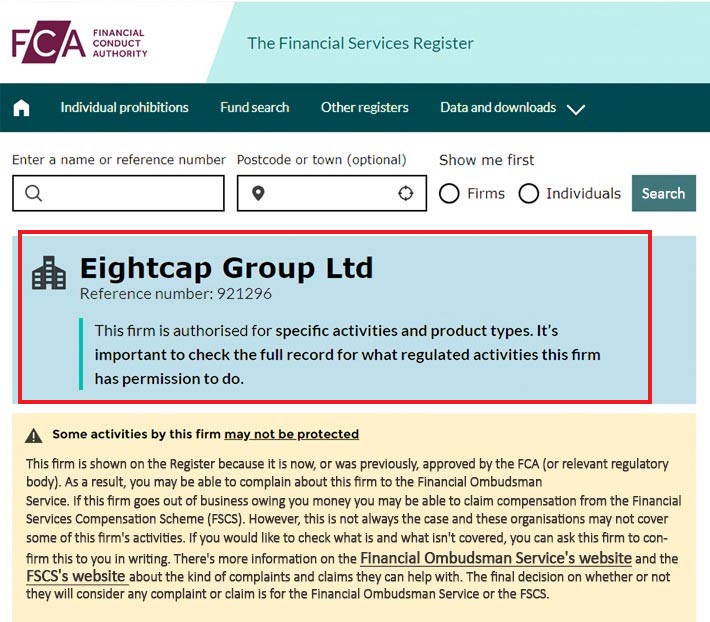

Upon further investigation on the FCA website, Eightcap also appears, and its regulatory number matches.

Lastly, on the CySEC website, Eightcap is also validated and registered with this regulatory body.

As seen above, the names and regulation numbers listed on the Eightcap page are indeed registered on the regulator's websites. So, it can be said that trading with Eightcap is secure as it is protected by authorized bodies in the UK, EU, and Australia.

3. Transparency in Execution

According to customer service, Eightcap is an NDD-type broker. This means that client orders are routed directly to the interbank market or liquidity providers without the broker acting as a counterparty.

NDD brokers usually provide tighter spreads and faster order execution since there is no dealing desk intervention. Following that notion, Eightcap implements execution speeds with an average speed of 2.3 milliseconds.

4. Transparency in Trading Conditions

If you visit the official Eightcap website, you will find that this broker provides comprehensive information about all its trading services. There is a dedicated menu for information on fees, account types, deposit and withdrawal procedures, instruments, platforms, and much more.

Regarding negative balance protection, Eightcap offers the feature for all retail clients. Wholesale clients or partner clients are not covered by this protection.

If you don't find what you're looking for, contact customer service through live chat. You will be connected with an Eightcap agent who can answer all your questions. Moreover, the service from the agents is excellent and delivered in an informative manner.

See Also:

5. Transparency in Educating Traders

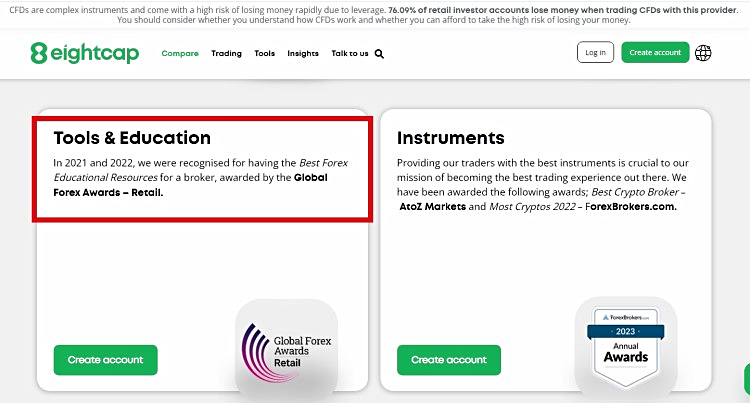

Do you know that Eightcap won the Best Forex Educational Resources by the Global Forex Awards – Retail? Eightcap even secured this award twice in 2021 and 2022.

Trading education resources are provided by Eightcap under the "Labs" section, which you can find in the "Insight" tab on its website. There, you'll find comprehensive materials on fundamental education and trading strategies. Additionally, there are free ebooks available for reading and download.

If you prefer visual learning, you can explore free live trading sessions. You can also watch the recordings at your convenience. Moreover, Eightcap frequently organizes webinars for interactive learning.

Conclusion

Up to this point, it can be concluded that Eightcap stands out as an impressive transparent broker. One Eightcap's advantage that is hard to find from other brokers is the transparency regarding pricing, and how it dares to compare itself with other brokers.

This means Eightcap gives you the freedom to explore their services as much as you want. Other advantages concerning Eightcap's transparency include regulations, order execution, trading services, and educational resources.

Eightcap is a regulated broker by ASIC and FCA, headquartered in Melbourne, Australia. Operating since 2009, this broker provides 800+ CFD instruments with sophisticated features such as TradingView integration, professional insights, daily ideas, and code-free automation.

Receive Daily Forex Signals from Trading Central

Receive Daily Forex Signals from Trading Central Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus