The emergence of a pin bar pattern on the H1 supply zone raises the opportunity to short EUR/AUD at 1.5450.

Hi fellow traders! EUR/AUD seems to keep on with its consolidative movement on Friday, 10th February. This pair survives in the consolidative phase since it has not been able to get out of the neutral bias. If we look at the current H1 timeframe, EUR/AUD seems to wear out. This is because the price is rejected from the supply zone which is indicated by the presence of a pin bar in that area, giving a short-term short opportunity.

Analysis and Recommendation

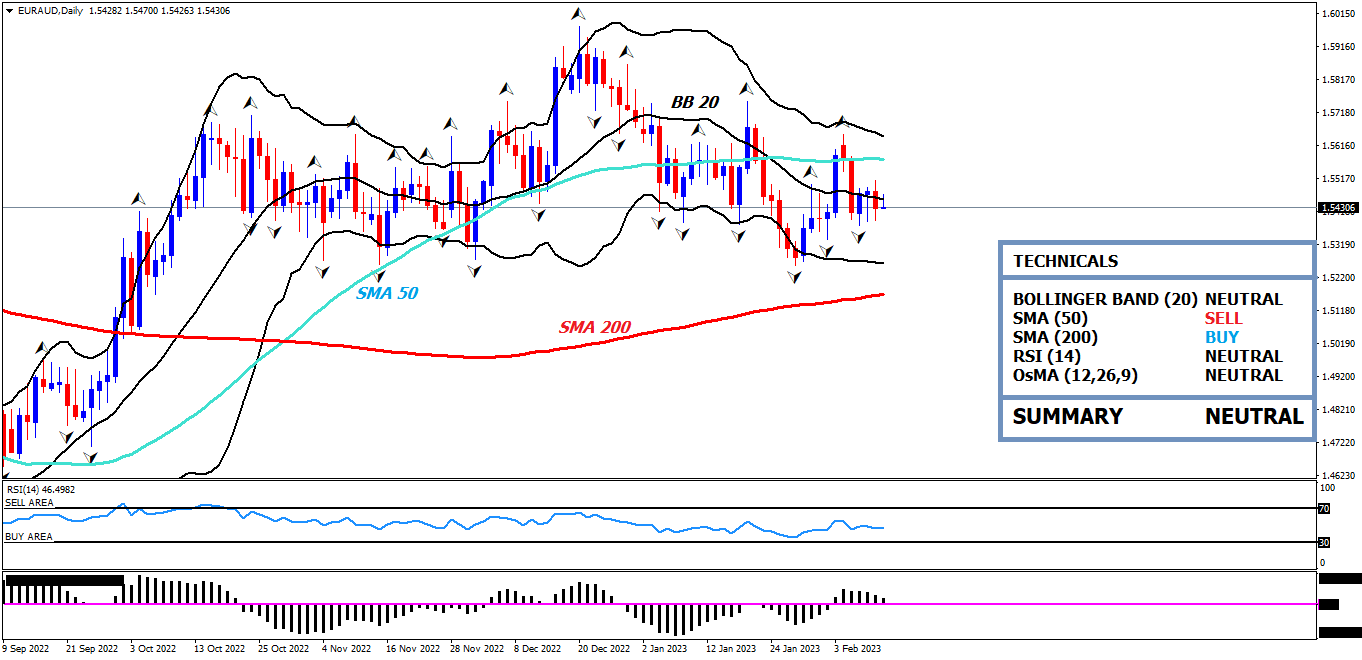

Let's take a look at the following EUR/AUD H1 chart below:

Based on the H1 chart above, it has been pointed out that EUR/AUD is currently moving down after being rejected from the supply zone of 1.5450 – 1.5476 since there is the presence of a pin bar in that area. That's why, it makes a valid short signal for short-term trading with targets up to the demand zone of 1.5400 – 1.5368.

Be aware if the price rises again until it clears the supply zone of 1.5450 – 1.5476. The reason is if the price can pass the 1.5476 level, then EUR/AUD has the potential to advance and tests the higher supply zone. That way, alternative buy scenarios can be arranged when there is a breakout.

Here are two trading scenarios that can be prepared:

- Therefore, set a short position at 1.5450 when the price manages to enter the supply zone and a bearish signal confirms it. Stop loss may be positioned at 1.5476, while the profit target is at 1.5400.

- Alternatively, set a long position at 1.5476 when a significant breakout signal confirms it. Stop loss may be positioned at 1.5450, while the profit target on 1.5513.

Keep in mind to always use risk and money management before trading! In addition, to make use of trailing stops, don't forget to exit the market as soon as you find a reversal signal!

EUR/AUD key levels:

- Resistance: 1.5546, 1.5513, 1.5476, 1.5450

- Support: 1.5400 (psychological level), 1.5368

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance