For some people, Stop Loss is a taboo and very uncomfortable to be applied. But you need to know that Stop Loss can be useful to protect your trading balance.

I admit that Stop Loss isn't the first thing I learned when I started Forex trading. So, let's be frank; I just noticed how beneficial Forex Stop Loss is after I lost my live accounts. I could have saved it from unnecessary losses had I known how to use Forex Stop Loss earlier. There, please don't wait to be a sore loser like me. Start learning to avoid excessive losses with Forex Stop Loss by reading the guide here!

What is Forex Stop Loss?

As the name suggests, Forex Stop Loss is an automated mechanism to stop out your position(s) when the price goes against your expectation. The leading utility of this feature is to cut current loss before it snowballs into bigger losses automatically. Therefore, a very vital feature for high-risk-high-reward markets like Forex.

Look at the EUR/USD chart above. As you can see, the Stop Loss was set at 1.06500. So, what good will that red line do to your trading position? Say, you entered at 1.05800 and expected the price to decrease to 1.05000. Hence, you opened a short (sell position). However, instead of coming to your estimation, the price keeps increasing.

Forex Stop Loss is an automated safety net to secure your position from volatile market price movements. It'll automatically close your position if the price move against your estimation.

The next thing you know, the price soared to 1.07000, far from your initial prediction. But thanks to Forex Stop Loss, your position was automatically closed at 1.06500. In other words, you have set a security net that has saved you from further -50 pips loss. Well, in the end, it was still a loss. But at least, you incurred less loss than you would if you didn't use Forex Stop Loss.

Why is Forex Stop Loss Important to Learn?

While it's true that the Forex market promises vast returns, it also comes with high risks. If you catch my drift, the profit is only half of the cake. Once, as a beginner, I usually let positions run without Forex Stop Loss. I didn't see the point of using it before, mainly because I was a reasonably successful scalper. I always manually close my position if you didn't get it already. Well, until that time when my friend introduced me to news trading.

Before I Started to Use Forex Stop Loss

Scalping during news trading was, to my experience, akin to riding a jet coaster with a loose security strap. I remembered that it could reap considerable profits in a short amount of time, but that was only half the story. During the news release, price volatility jumped rapidly. You can't expect the price to keep moving in one direction.

Because of that, some of my positions already scored profits, but still, more positions accrued losses after losses. I didn't quite understand what went wrong at that time. The next thing I knew, I suffered the symptoms of overtrading. I kept opening positions during the news release, even though, in the end, I lost more than I could gain. Later, I decided to close my live accounts to stop myself from making worse financial mistakes. Even though I stopped live trading, I was still curious about what worsened my trading performance.

I returned to my friend and consulted about my trading issue there. From there, he identified my trading problem right away. He explained that the main issue was the absence of Forex Stop Loss. Specifically, I closed the profiting position too fast and let the losing position run too long. That's because without Forex Stop Loss I was forced to intervene directly with my active positions. Subsequently, I closed my positions manually based on my fear and anxiety.

So, I tried his advice and started using Forex Stop Loss.

After I Started to Use Forex Stop Loss

At first, I tried to slap all my positions with random Stop Loss values. Well, I didn't see any noticeable improvements, so I kept consulting with my friend. Turned out that I didn't use it the right way. I must also learn about Taking Profit to benefit from Forex Stop Loss optimally. No question asked, I followed his suggestions. A month later, I saw slight improvements in my trading performance. Here's why:

- Forex Stop Loss closed all the losing positions before it turned worse.

- Take Profit "locked-in" all the profiting positions. Especially valuable when a reversal is about to happen, and the price reaches its peak.

- Simply put, Stop Losses reduces the losses while Take Profit secures your gains.

Now, whenever I open a position, I'd set it with preset Forex Stop Loss and Take Profit. Now, I won't let any position run without it anymore.

See Also:

How to Use Forex Stop Loss?

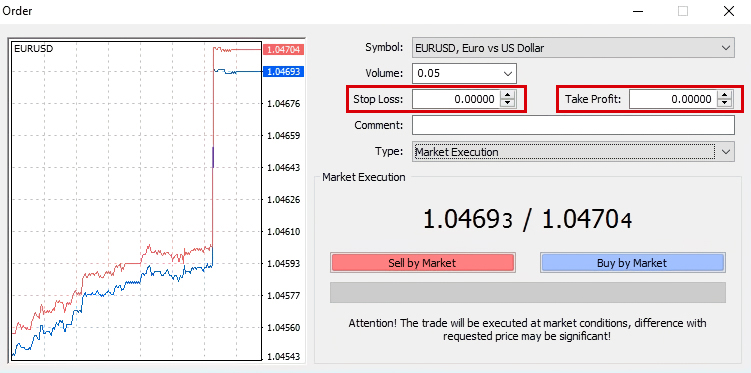

Each trading terminal comes with a different user interface. Commonly, you need to look at Forex Stop Loss and Take Profit input bars, like this picture below:

MetaTrader4 user interface

Standard Use of Forex Stop Loss

Depending on the current price and your intended entry position, you can adjust Forex Stop Loss by long or short.

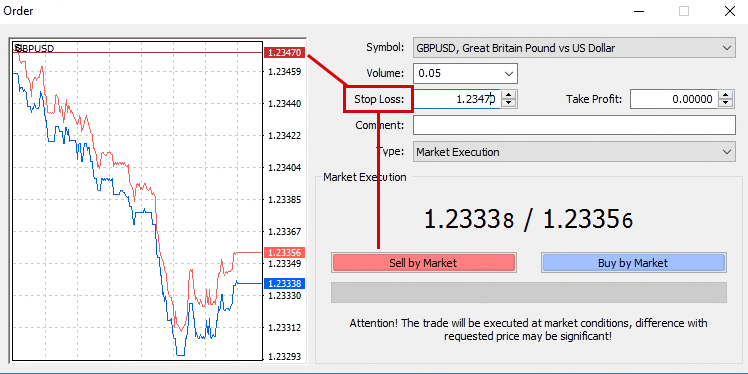

Long Position Forex Stop Loss Setup

Use this setup when you are going to buy it. Set Forex Stop Loss value lower than your current ask price ("buy by the market" or higher quote). With this setup, the Stop Loss will trigger when the price drops to your set Stop Loss level.

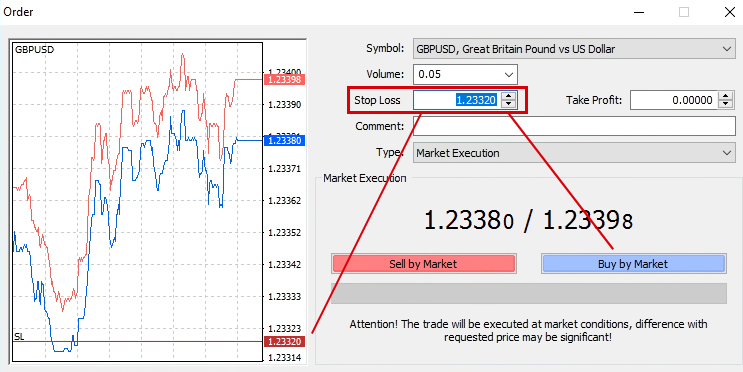

Short Position Forex Stop Loss Setup

Conversely, Use this short position setup when you are about to sell. Set Forex Stop Loss to value higher than your current bid price ("sell by the market" or lower quote). Therefore, the Stop Loss limit will be triggered when the price moves up to your set Stop Loss level.

Well, that's the most basic setup you can do with the Forex Stop Loss level, but that won't be enough. As I said, you must adjust Stop Loss and Take Profit levels according to the risk vs. reward ratio. In addition, there are also trailing Stop Loss and break-even Stop Loss features. Both are usually preferred over regular Forex Stop Loss when you are swing trading.

Using Trailing Stop Loss or Break Even Stop Loss for Swing Trading

First and foremost, if you're not accustomed to swing trading, leave this section. That's because both are only optimal if your Forex Stop Loss and Take Profit goals are somewhat distanced from your entry. In other words, trailing and break-even Stop Losses will only work effectively if you intend to gain from massive pips movements, like in a range of hundred pips away.

How Trailing Stops works

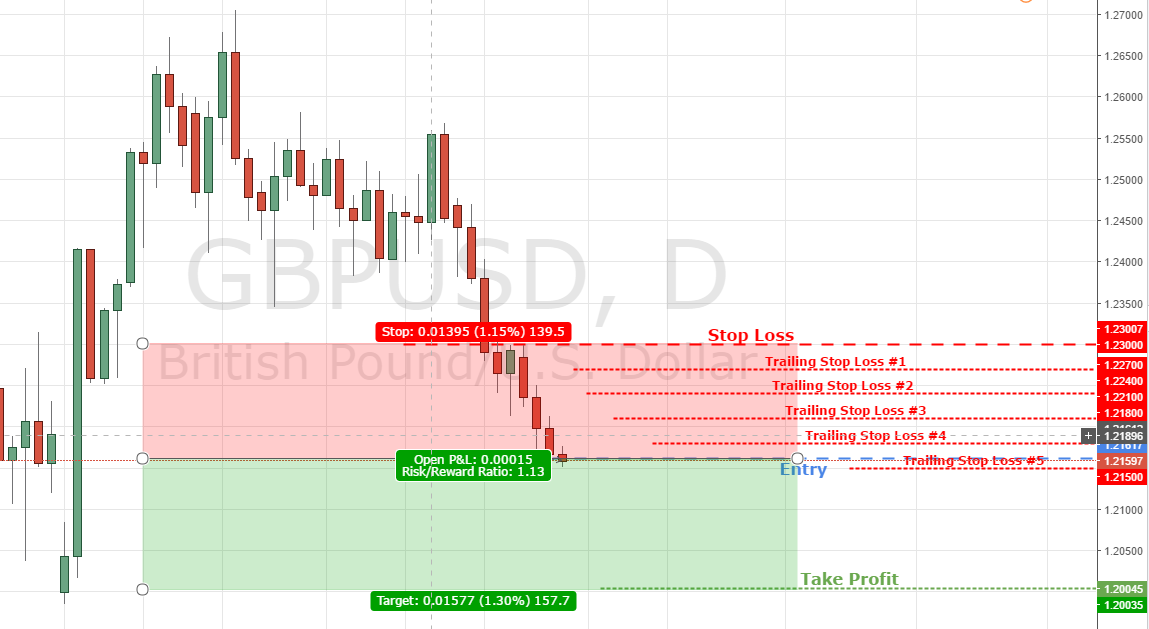

Let's say you are going to short GBP/USD @ 1.2161. You set Forex Stop Loss @ 1.2300 and Take Profit @ 1.2004. In other words, you set your Stop Loss 140 pips away and Take Profit 158 pips away from your entry price level. That is the defining and clear distinction of swing trading.

Trailing Stop Loss will only work when the position is already in the profit (green zone). So, if you set the trailing stop at 30 pips intervals, it will move 30 pips forward each time the position reaches a certain threshold. Technically speaking, each trading terminal has its definition of what and how this threshold works.

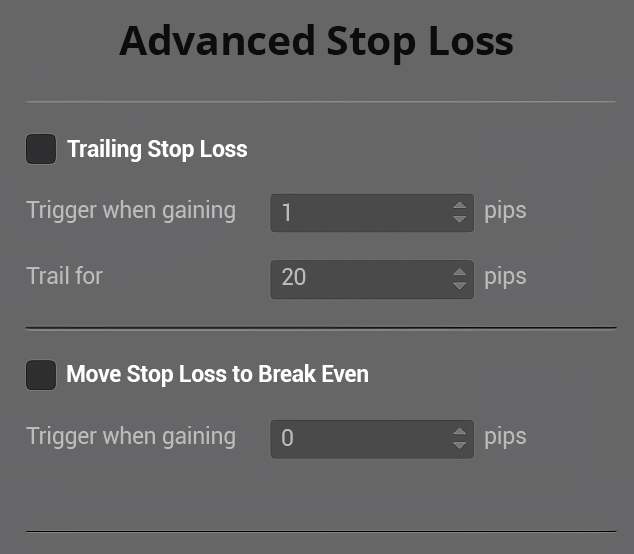

For instance, the cTrader trading terminal comes with its so-called "Advanced Stop Loss" mechanism. In their term, trailing stops will "Trail for" defined intervals each time a designated position makes a "Trigger when gaining" positive pips. So, if you set it to "Trail for" 30 pips and only "Trigger when gaining" 40 pips, the stops will trail 30 pips forward each time the position gains 40 pips into the direction Take Profit limit.

How Break Even Stops work

This mechanism will move your original Forex Stop Loss to your initial entry point. I rarely use this setup because the price is usually reversed and triggers break even Stop Loss before it bounces back up again. Therefore, I recommend you use this setup only when the current trend is strong. But honestly, it's a rare occasion to see any use of this particular setup simply because there weren't many strong trends that could stay moving in one direction for a considerable length.

Precaution for Using Trailing and Break Even Stop Loss

Unpredictable market volatility often renders both of those advanced Stop Losses useless. That's because the price won't stay moving in one direction. Therefore, setting your trailing Stop Loss too tight (read; scalping) will trigger the trailing stop loss too early. Conversely, if it's too far away and you miscalculate the current trend's strength, you won't make any profit either.

Conclusion

Forex Stop Loss is one of the vital tools to protect your running positions from unchecked losses. Before trying a live Forex trading account, you should learn and simulate it on demo accounts.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

4 Comments

daniel

Jun 10 2023

When it comes to managing stop losses, two popular techniques often discussed are trailing stop and break-even stop. While they can be powerful tools, it's essential to consider their effectiveness, especially for beginner traders.

Considering the unpredictable nature of market volatility, both trailing and break-even stop losses can sometimes prove useless. Market prices tend to fluctuate, making it challenging to determine the optimal points for setting these stop losses. If set too tightly, the trailing stop may be triggered prematurely, limiting potential profits. On the other hand, if set too far away, misjudging the strength of the current trend may result in missed profit opportunities.

With that in mind, for novice traders seeking a balance between risk management and maximizing profits, which stop loss technique would be more suitable? Should beginners focus on implementing trailing stops or opt for break-even stops? Are there any specific considerations or strategies to keep in mind when utilizing these stop loss methods effectively?

Sandy

Jul 7 2023

@daniel: In simple terms, when it comes to managing stop losses, trailing stops and break-even stops are popular options. But for newbie traders who want to balance risk and profits, there are a few things to consider.

Trailing stops are great for locking in profits as the trade moves in your favor. They adjust automatically with market movements, letting you ride the trend and capture more gains. But beware, setting them too tight might kick you out too soon, leaving potential profits on the table. On the other hand, if you set them too wide, you might miss the boat on maximizing profits.

Break-even stops are like safety nets. Once the trade has moved in your favor, you can move the stop loss to your entry point or a little above it. That way, you secure your initial investment and trade risk-free. But keep in mind, you might lose out on further profits if the trade keeps going your way.

For beginners, break-even stops can be a good starting point to trade with reduced risk. As you gain experience, you can gradually introduce trailing stops to capture more profits. Remember to adapt your stop loss approach to market conditions and combine it with other risk management techniques. Practice, learn, and find what works best for you!

Ramsey

Jul 8 2023

Should traders use stop loss orders during news trading and is scalping a recommended strategy in such volatile market conditions? From personal experience, scalping during news releases can be likened to riding a roller coaster with a loose security strap. While it can yield significant profits in a short period, it's important to consider the other side of the coin. News releases often trigger rapid price volatility, making it unpredictable and challenging to anticipate price movements. Given this unpredictability, is it advisable for traders to utilize stop loss orders to manage risk effectively during news events? Additionally, considering the fast-paced nature of scalping, is it a suitable strategy to employ when markets are highly volatile due to news announcements?

Brian Joshua

Jul 9 2023

@Ramsey: Using stop loss orders during news trading can be a prudent risk management strategy. News releases often result in increased market volatility, which can lead to rapid and unpredictable price movements. By setting stop loss orders, traders can define their acceptable level of risk and automatically exit their positions if the price moves against them, helping to limit potential losses. Stop loss orders can provide a safety net during periods of heightened volatility.

As for scalping during news releases, it's important to approach it with caution. While scalping can be profitable in volatile market conditions, it requires quick decision-making and execution. The rapid price movements during news events can make it challenging to accurately predict short-term price fluctuations, increasing the risk of losses. Traders should carefully assess their risk tolerance and trading skills before employing scalping strategies during news announcements. It may be beneficial to consider factors such as liquidity, spread widening, and slippage, as they can impact the effectiveness of scalping during volatile market conditions. (read : Trading around Headlines: Is It Worth the Risk?)