Getting ready to be a forex trader? There are 10 basic rules every beginner needs to learn, starting from when and where you can trade forex to how you should consider margin appropriately.

If you just started your journey as a forex trader, you may be wondering about how to properly trade in order to earn profit. Many people might think that to earn money in forex trading, you simply have to buy at the lowest price possible and then sell it at the highest price possible.

Unfortunately, in reality, it's not that simple. To get the hang of forex trading and make constant profits, you need to understand the basic rules of forex trading, which we have summarized below.

Here are 10 essential points to know about forex trading:

- Forex Trading is available anywhere and anytime.

- A stable internet connection is needed for smooth forex trading.

- Forex is traded in currency pairs.

- The goal of trading is to profit from price changes.

- The forex market has bid and ask prices.

- Price movements are measured in pips.

- Margin trading allows control of larger positions with less capital.

- Margin is a double-edged sword, amplifying both profits and losses.

- You don't need to constantly watch the market; set clear trading strategies and objectives to reduce stress and emotional decisions.

- Timing is crucial in forex trading; wait for the right opportunities that align with your trading plan for successful trades.

Let's dive deeper into the ten points above.

1. Forex Trading is Available Anywhere and Anytime

The forex market operates globally and is accessible to traders from all corners of the world. It functions 24 hours a day, five days a week, thanks to the overlapping trading sessions in different time zones.

Now that forex trading is available online, traders can directly access the market from practically anywhere in the world 24 hours a day, five days a week.

The trading day begins with the Sydney session, followed by the Tokyo session, then the London session, and finally the New York session. As one session closes, another one opens, ensuring a continuous flow of trading activities.

With the advent of online trading platforms, accessing the forex market has become incredibly convenient. Traders can participate in forex trading from virtually anywhere with an internet connection. Whether you are in Asia, Europe, America, or any other region, you have the opportunity to engage in forex trading at your preferred time.

This can happen due to the connection scheme between traders, brokers, and the forex market. Brokers have infrastructure such as dedicated servers placed in reliable and secure data centers. These servers serve to connect traders to the forex market and process trading orders.

For example, IC Markets, as a broker, has servers located in NY4 and LD5 data centers, centered in New York and London, respectively. They also have dedicated fiber optic cross-connects with pricing providers, ensuring the lowest latency and fastest possible trade execution for their clients worldwide.

The flexibility of forex trading allows individuals to fit it into their daily routines seamlessly. For instance, you can trade on your morning commute, during lunch breaks, or even from the comfort of your home after work hours.

2. You Need Internet Connection

In order to trade forex, you need to use a computer, laptop, or smartphone that's connected to the internet. You also need to install trading software which you can get from the broker that you've registered with. The broker would give you access to the market through the trading software.

Therefore, the first step of forex trading is to sign up with a certain broker, then install the trading software that the broker supports.

If you want to trade forex but are still hesitant to invest with real money, you can simply open a demo account. Almost all brokers offer a free demo account in their service, so you can use this opportunity to practice forex trading without spending any money.

To expand your skills further, you can also search for free learning materials on the internet.

3. Forex are Traded in Pairs

Forex trading is basically the act of buying and selling foreign currencies, so every transaction must involve two different currencies. This is why the currencies in forex trading always come in pairs, like EUR/USD, GBP/JPY, etc.

The common rule is to put the stronger currency upfront. For example, the British Pound is currently stronger than the US dollar, so the appropriate term would be GBP/USD.

Currently, there are eight major currencies that are commonly traded in the forex market, namely:

- The US dollar (USD), also known as the "Greenback" or "Buck".

- European euro (EURO), also known as the "Single Currency".

- Japanese yen (JPY)

- British pound (GBP), also known as "Sterling" or "Cable".

- Australian dollar (AUD), also known as "Aussie".

- New Zealand dollar (NZD), also known as the "Kiwi".

- Canadian dollar (CAD), also known as "Loonie".

- Swiss franc (CHF), also known as "Swissy".

Every USD pair is called the major pair, while the combination of any major currency that excludes the US dollar forms a cross-currency pair.

Some of the examples are GBP/JPY, EUR/JPY, and EUR/GBP. Because it consists of major currencies, cross currency pairs are among the most commonly traded currency pairs in the world.

On the other hand, we also have exotic currency pairs which involve a major currency (usually USD) and a currency from a developing market. One of the examples is USD/SGD. Exotic pairs are rarely used in the forex market due to their high risk, volatility, and trading fees.

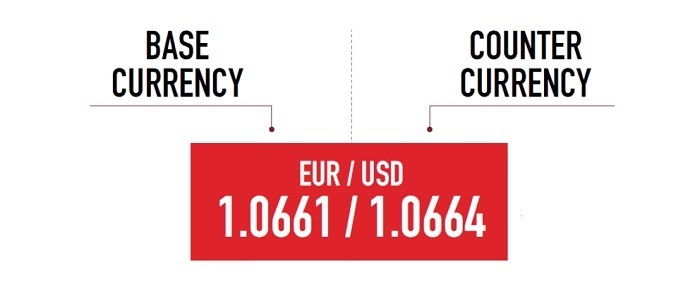

Since the currencies are always traded in pairs, it means that when we buy one currency, we automatically sell the other currency. Take a look at the illustration below.

Based on the example above, EUR is called the base currency, whereas USD is the quote currency. It means that if we open a buy position, the exchange rate would tell us how much quote currency we need to pay in exchange for the base currency.

To put it simply, if we want to buy 1 EUR, we would have to pay 1.0664 USD. Meanwhile, if we open a sell position, the exchange rate would tell us how much quote currency we'll get by selling one unit of the base currency. In other words, we will get 1.0664 USD by selling 1 EUR.

4. Make a Profit from Price Changes

Forex trading is all about understanding the market condition and making a prediction whether the price of a certain currency will rise or fall. Traders would then execute that prediction by opening a trading position.

In forex trading, there are two kinds of positions that you can choose, namely:

Buy or Long Position

Opening a buy position means we want to generate profit from the rising price of a certain currency. So if you want to buy, you need to make sure that the base currency value will increase. The idea is to basically buy at a low price, then close the position at a higher price.

Sell or Short Position

In contrast, opening a sell position means we want to generate profit from the falling price of a certain currency. So if you want to sell, you need to make sure that the base currency will decrease in value.

The idea is to basically open at a high price, then close the position once the value of the base currency is lower than the entry level.

With that being said, forex traders can actually make a profit if they're in the right position to catch the rise or fall of a currency pair. Interesting isn't it?

5. Bid and Ask Prices

Have you ever gone to a money changer to exchange foreign currencies? Then you must be familiar with the term "buying rate" and "selling rate".

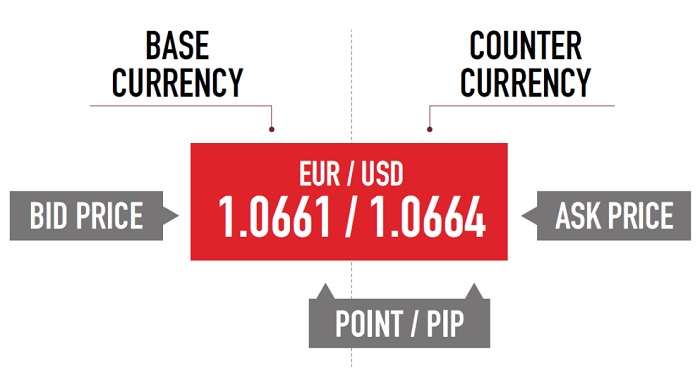

The same concept is also used in forex trading, but the terms used are "bid" and "ask". The bid price is usually lower than the ask price. To fully understand them, let's look at the example that we used before.

The bid price is the price that a forex broker is willing to buy the base currency and sell the quote currency for. This is the price that we use when we want to sell a currency pair.

In contrast, the ask price is the price that a forex broker is willing to sell the base currency and buy the quote currency for. So, referring to the example above, we have the option to sell Euro at 1.0664 or buy Euro at 1.0661.

More importantly, the difference between the bid and ask prices is called a spread. This is typically given as the fee that traders pay to a broker in return for providing access to the market and the trading platform.

6. Calculating Price Movements with Pips

A pip stands for "percentage in points" and represents the smallest price change. We can also say that pip is a unit of measurement that shows the price changes between two different currencies.

In forex trading, pips typically represent the fourth number after the decimal point (0.0001). However, some pairs like Japanese yen pairs only use two decimal points. For example, if the USD/JPY pair moves from 91.23 to 91.24, then it means that there's a change of 1 pip.

Along with the technological development in the finance sector, more brokers are starting to provide trading services that could monitor the prices to even smaller fractions.

Therefore, some brokers no longer use two or four-digit pricing but move on to the five-digit pricing (or three-digit in the case of JPY pairs). This is called "fractional pips", "pipettes", or "points".

For instance, if USD/JPY moves from 91.234 to 91.237, it means that there's a change of 3 points or 0.3 pips.

So, how to calculate profit with pips? Since exchange rates differ for each currency, then we should also use different ways to calculate the pip value for each pair. Here's an easy example.

Let's say you want to trade USD/CAD at a broker that provides four-digit quotes. Suppose the exchange rate for USD/CAD is 1.0200. It means that a change of 1 pip means a change of 0.0001 CAD. So, the dollar value per pip per unit traded:

= (0.0001 CAD) x (1 USD/1.0200 CAD)

= (0.0001 CAD/1.0200 CAD) x 1 USD

= 0.0009804 USD per unit

Therefore, if you trade 1 mini lot in the USD/CAD pair (1 mini lot = 10,000 USD), then the dollar value per pip is approximately 0.98 USD.

It may look complicated, but don't worry about it because you won't have to calculate everything by yourself. Instead, you can let the platform do the work or use online pip calculators to check the price.

7. Margin Trading

Apart from regular trading, you can also choose to do margin trading. In a nutshell, margin trading allows traders to open a position with much smaller capital. The idea is that the trader borrows some money from a brokerage company and uses that money to trade.

So, you basically put a small amount of money as collateral (margin), take out a loan, use the lent money to trade, and then repay the loan at a later date.

Interestingly, there's no need to pay interest for the lent money because forex trading is non-physical. In fact, the broker doesn't have to hand over the physical money to its traders.

It would be enough for traders to pay the trading fees in the form of spreads and commissions.

Here's a possible scenario in forex trading:

Suppose the exchange rate for EUR/USD is 1.6612 (1 Euro is equal to 1.6612 USD). The following day, the value rises to 1.6712. If we decide to buy 100 Euro, then we'll get (1.6712 - 1.6612) x 100 Euro = 1 Euro as profit.

Now, 1 Euro certainly sounds worthless as you probably imagined forex traders to generate millions. But the reason why the profit here is so low is because the trader invested only 100 Euro to begin with. Had the trader invested, let's say, 10,000 Euro, the gains would have been 100 Euro.

That being said, the higher the capital we invest in forex trading, the higher the profit. While this logic certainly makes sense, it's not necessarily favorable for small traders who can only afford to invest in small amounts. This is where the concept of leverage comes in.

In forex trading, leverage refers to the borrowed money offered by the broker to help amplify our trades. Small traders in particular need this kind of "push" to increase their position size and earn a significant profit.

Leverage is usually written in the form of a ratio, like 1:100 or 1:50. This shows how much money you'll borrow relative to your initial capital. So, let's say you put 100 Euro and trade with a 1:50 leverage, this means that you'll get to trade with (100 x 50) = 5,000 Euro instead of your initial 100 Euro. The profit you'll get is also higher.

Meanwhile, the initial 100 Euro that you give to the broker is called the "margin". In other words, margin is the amount of money that you need to put as collateral in exchange for the money you borrow.

Margin is usually shown in the form of a percentage relative to the funds that you use to open a trading position. Based on the margin amount, we can calculate how much our maximum leverage is.

8. Margin is a Double-edged Sword

Based on the previous explanation, you may think that margin and leverage are always good for traders. Unfortunately, this isn't entirely correct.

I prefer to call it a double-edged sword because while it can help traders generate more profit, it can also make them lose money more quickly. In the previous example, the trader ends up getting a profit of 50 Euro because the value of EUR/USD rose to 1.6712.

However, if this didn't happen and the value went even lower, the trader would've lost his money. So, to lower the risk, it is recommended to use medium leverage of around 1:100 or 1:200.

Aside from that, it is also important to learn about other terms in margin trading such as:

- Margin Requirement/Margin Required – basically the same as margin, which is the money that you need to give to the broker as collateral.

- Account Margin – the total amount of money in your account balance.

- Used Margin – the amount of money in your balance that is locked during a trade. You can't access it until the position is closed or if you hit margin call.

- Usable Margin – the amount of money in your balance that you can use to trade.

- Margin Call – If the value of your asset drops and the collateral falls below the maintenance level, the broker would automatically close the position in accordance with the market value. Getting a margin call means your trade is losing.

9. You Shouldn't Watch the Market All the Time

Online forex trading is certainly not the same as traditional trading. Today, there are various technology, features, and tools that you can use to enhance your experience and make your trading journey smoother.

For instance, now you don't have to stare at the screen the whole day because you can set a stop loss that will close your trade automatically if the price reaches your target.

This can also be used to avoid getting losses from margin calls. Just set a stop loss on a losing trade before it reaches the margin limit. This way, you won't have to worry about unexpected loss anymore.

10. Trade When the Time is Right

If you think that the price of a certain currency will rise in the future but the current price is still unfavorable, then there is no need to open a position at that very moment nor should you glue your eyes to the screen to capture the opportunity.

Instead, you could use various features available on your trading platform to notify you or even execute your position when the right setup comes.

Apart from the stop loss order that could automatically close your position, there are other types of orders such as sell limit, buy limit, and so on.

Keep in mind that these tools are useful only if you know how to use them, so make sure to explore and learn about them before you open your first trade.

One popular tool that helps automatically execute orders in such an advanced way is called OCO. What is it and how to utilize it in your strategy? Learn further in How OCO Strategy Works.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

1 Comment

Charlie Stuart

Nov 23 2022

I have experience watching the market all the time and agree that I am not allowed to watch the market all the time. Constantly looking at something about winning or losing can change the way you think. You feel confident when you first enter the market, but as you watch the candles rise and fall, you will feel your confidence waning and panic set in for a while. I've been through it and it's true, I always close my position when the win screen turns blue or green, so I'm increasing my win rate, but even though my win rate is high, my profit rate is Low and far from the target. All closing position quickly because we are always looking at the market all the time.