Online forex trading in Nigeria is on the rise. However, trading activities in that country may not exactly be safe due to the lack of regulations.

Online forex trading on the African continent keeps on getting more popular day by day. One of the most dominant countries in this regard is Nigeria. How so?

Well, Nigeria has the most significant number of daily forex traders around 200,000, still bigger than South Africa which ranks second. As a country that has the second-largest volume of forex transactions from retail traders, Nigeria has enormous potential. It is estimated that the average daily forex transaction volume in Nigeria is around $10m-$15m.

Now, with the increasing number of Nigerian traders actively conducting forex transactions online, many parties are starting to pay attention to the extent of security in forex trading in this country.

How safe is forex trading in Nigeria? Here's the full review.

Contents

Online And Offline Forex Trading in Nigeria

As a newly developed industry, online trading in Nigeria is currently unregulated. This is in contrast to offline forex trading which is well-regulated.

Nigeria is one of the highest producers of crude oil in Africa. Offline forex trading is dominated by trading in crude oil and oil exports requiring forex for international transactions.

With a clear structure and regulations that work well, this offline market is growing rapidly. Many parties are involved, including several commercial banks, legal buyers and sellers, oil companies, and the central bank of Nigeria as a supervisor.

Overall, the foreign exchange transaction activity in the offline market is supported by law. Some of these include the Central Bank of Nigeria Act of 1958, the Foreign Exchange (Monitoring and Miscellaneous Provisions) Act of 1995, the Exchange Control Act of 1962, the Banks and Other Financial Institutions Act of 2007, and the Investments and Securities Act of 2007.

When it comes to online trading regulation, the ambiguity of laws in Nigeria contrasts with other African countries that have already implemented regulations. For example, South Africa's Financial Sector Conduct Authority (FSCA) and Kenya's Capital Markets Authority (CMA) have already regulated online forex brokers in their countries. Furthermore, South Africa has even established rules for forex trading taxation

Dominated By International Forex Brokers

The online forex industry in Nigeria is dominated by international forex brokers that international commissions and authorities regulate.

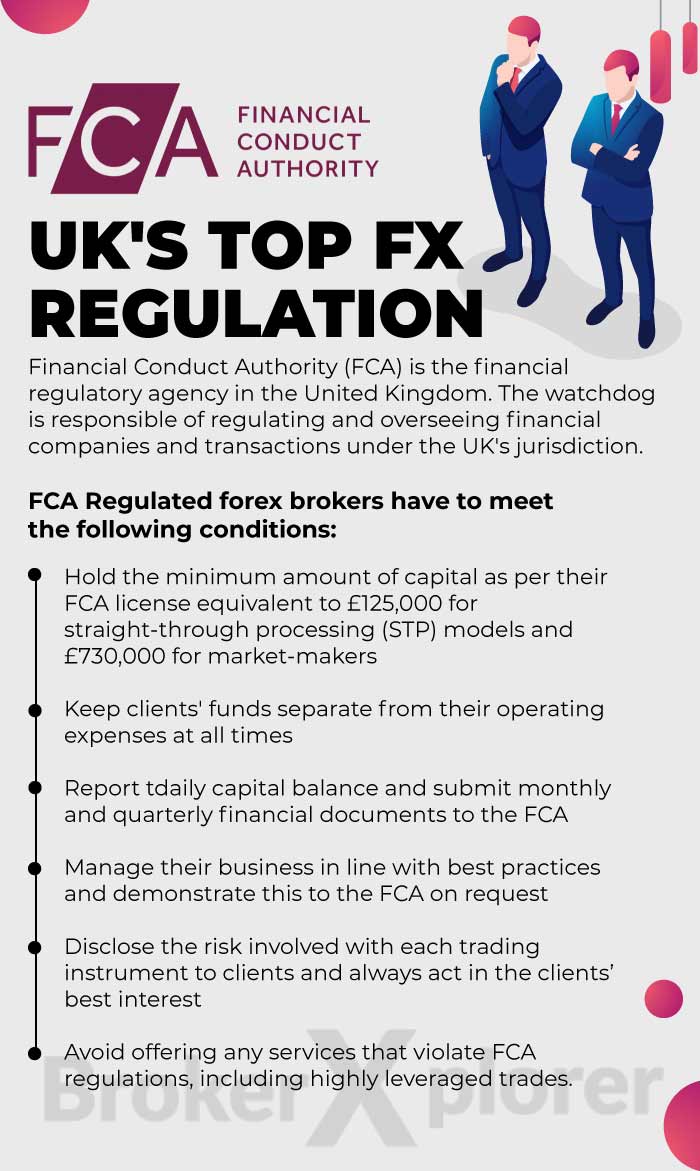

Some of these international forex brokers are HF Markets and Deriv. As one of the most used international brokers by Nigerian traders, HF Markets is regulated by the Financial Conduct Authority (FCA) in the UK, the FSCA of South Africa, and the Cyprus Security Exchange Commission (CySEC).

HF Markets is an award-winning forex and commodities broker. Established since 2010, the company provides trading services and facilities to both retail and institutional clients. For more than 9 years in business, HF Markets has around 1,500,000 live accounts opened and 200 employees globally.

Based on its services, HF Markets can be regarded as middle-class category. Clients do not need to prepare a big deposit for joining to trade with this broker. Also, there are various account types, trading software, and tools to facilitate individuals and institutional customers to trade forex and CFD online.

HF Markets is a registered brand name of HF Markets (Europe). Based on the location, the company is regulated by various financial regulators. Here are the details:

- HF Markets (SV) Ltd, registered in St. Vincent & the Grenadine as an International Business Company with the registration number 22747 IBC 2015.

- HF Markets (Europe), authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with Licence Number 183/12.

- HF Markets SA (PTY), is authorized and regulated as a Financial Service Provider (FSP) by the Financial Sector Conduct Authority (FSCA) in South Africa, under license number 46632.

- HF Markets (Seychelles), incorporated under the laws of the Republic of Seychelles with registration number 8419176-1, regulated by the Seychelles Financial Services Authority (FSA) under Securities Dealer Licence number SD015.

- HF Markets (DIFC) Ltd, authorized and regulated by the Dubai Financial Services Authority (DFSA) under license number F004885.

- HF Markets (UK) Ltd, authorized and regulated by the Financial Conduct Authority (FCA) under firm reference number 801701.

If traders have more experienced, knowledgeable, and sophisticated trading environment, they can join to become Professional Clients, who can manage and assess their own risks. For that reason, these kinds of clients are granted access to more favorable rates but afforded lesser regulatory protections than retail clients.

Trading with HF Markets can enable traders to access a variety of trading instruments like CFDs on Forex, Cryptocurrencies, spot metals (gold, silver, and others), energies (oil and gas), commodities (such as coffee, copper, and sugar), indices, bonds, and popular shares such as Google, Apple, and Facebook.

HF Markets offers some of the tightest spreads in the market, starting from 0 pips in Zero Account. This broker quote major foreign exchange currency pairs to five decimal places. Therefore, traders have the opportunity to get more accurate pricing and the best possible spreads.

HF Markets receives numerous highly prestigious titles, including the huge honor of being ed to join the ranks of the World Finance Top 100 Global Companies. Others are Best Client Funds Security Global by Global Brands Magazine, Best Global Forex Copy Trading Platform by Global Forex Awards 2019, Fastest Growing Forex Broker Mena 2019 by International Business Magazine, and many more.

After opening an account in HF Markets, traders will obtain various forex trading platforms to accommodate all of their trading demands. Whether traders like to trade on desktop or prefer to trade on-the-go, they can use MetaTrader 4 on desktop (terminal, multi-terminal, and web terminal) and phone (iPhone, iPad, and Android).

Clients' funds are held in segregated accounts. Only major banks are used by Markets because they believe that successful traders have to give their full attention to their trading rather than worrying about the safety of their funds.

Traders do not need to worry about transaction fees when depositing and withdrawing. Transaction fees are not charged, and diversity of payment methods enable them to choose between Wire Transfer, Bank Card, and online payments (Neteller, iDeal, Sofort Banking, and Skrill). HF Markets ensures that traders make fast transactions 24/5 during the standard hours.

Traders can earn extra income by joining the affiliate program offered by Markets. Clients who join this program will get some advantages, such as 60% of Net Spreads based on the volume traded by sub-clients, up to $15 per a lot of net revenue, and many more. More information about HF Markets can be obtained on their official website which is supported in 27 languages.

From the review above, it can be concluded that HF Markets is one of the award-winning forex and commodities brokers. There are various account types traders can choose in HF Markets, and the broker itself becomes a favorite among traders for its low spreads. This condition is very suitable for traders with limited funds and a desire to get more opportunities to gain maximum profit.

As for Deriv, it is regulated by the Malta Financial Services Authority (MFSA), the Vanuatu Financial Services Commission (FSC), the British Virgin Islands Financial Services Commission (FSA), and the Malaysian Labuan Financial Services Authority.

Even though the regulation of online forex trading in Nigeria is still lax, online forex brokers in Nigeria must comply with statutory regulations in order to operate legally in this country. Only licensed brokers are allowed to operate in the country.

Previously, the Association of Online Forex Trading Agents in Nigeria (OFTAN) was formed in collaboration with the Central Bank of Nigeria (CBN) and other regulators to establish a framework for online forex trading. However, no further news has been heard from the association to this day.

The Emergence of Forex Scams

The rapid development of online forex trading in Nigeria and the lack of regulation is being used by irresponsible parties to make profits. Under the guise of a trading company or broker offering investments, these scammers take investors' money away.

For example, in 2021, the CEO of MBA Capital and Trading Limited Maxwell Odum took away investors' money of $518.3 million. Apart from that, a company called Headway Trade Patterns Limited also brought billions of Naira in investment money.

Ensured by International License

Local brokerage executives and regular traders in Nigeria believe that forex traders will be safe trading within their own risk limits. Many traders in these countries feel safe when trading with foreign brokers.

They feel safe because the international brokers they use is a European broker and is regulated by European regulators. Despite this, trading experts in Nigeria believe that the notion would only apply to experienced traders; beginners would still be at high risk as they tend to be gullible.

To avoid forex scams, novice traders must play it safe by doing personal and thorough research first when there is a new broker or investment offer. Do not be easily tempted by the lure of profit.

What's Next?

Experts agree that specific regulations governing forex trading can help strengthen the forex industry in Nigeria. They suggested setting up a regulatory body that would license and oversee the activities of the forex brokers in Nigeria.

In addition, a collaboration between the government and financial institutions to raise awareness could be a good first step. Collaboration between brokers and forex educators can also be encouraged to equip novice traders so they don't easily fall into scam traps.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance