Various charting tools and chart settings are used to analyze price action. The most common ones include the bar chart, line chart, and the Japanese candlestick chart. Candlestick patterns, in particular, are a crucial part of price action trading. They are simply reoccurring formations in price action that traders can easily identify and then use to create trade ideas that can be applied in the market. The idea behind this form of trading is that these patterns tend to behave in similar ways. Thus, the trade ideas created using these patterns might have higher chances of profitability.

Forex Brokers That Accept Trueusd Payment Method for Deposit and Withdrawal

Over the last decades, the forex market in the US has emerged as one of the most regulated markets anywhere in the world. Rules that were introduced and backed up by Federal laws have made it quite challenging for forex companies to operate in the US. Presently, only three brokers still operate in the US forex market: Oanda, GAIN Capital LLC, and TD Ameritrade.

Below you will find a list of Forex Brokers accepting US traders as clients.

Scroll for more details

Additional FAQ

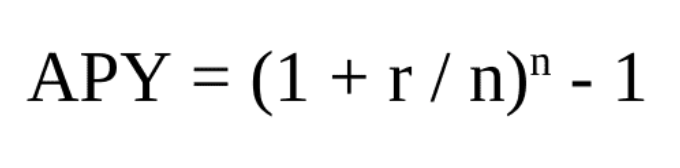

What is the APY calculation formula for crypto investments?

Here's how you calculate APY in crypto investments:

Note:

- r = interest rate

- n = compound interest period (on APY, usually n = 12 months)

Continue Reading at APY and APR in Crypto Investments Explained

How to use price action in crypto?

Crypto traders use price action depending on the analysis of the price action of a particular crypto to generate profits. This allows them to identify trade setups to ensure they make the right trading decision. These traders can combine specific technical indicators with their price action analysis to fine-tune the process and increase the chances of being profitable. This ensures that the trading signals generated are more reliable.

Continue Reading at Can We Use Price Action Strategy on Crypto?

What is Elon Musk's stance on investing during times of inflation?

Elon Musk discourages traders from investing solely in cryptocurrencies, suggesting that diversification is a more prudent approach in the face of inflation.

Continue Reading at Tips from Billionaires: How to Deal with Inflation

What is proof of reserves in crypto?

Proof of Reserves in the crypto space refers to an independent audit by a third party to confirm that the entity or custodian has sufficient reserves to support all of its clients' deposits.

Put, crypto exchanges will ask a third-party organization to conduct the attestation. The auditor will then publish the results in a snapshot that shows whether the firm owns enough funds to match customer balances. The main goal is to assure customers that the company is not at risk of a liquidity crisis and that customers can withdraw their funds anytime.

Continue Reading at Proof of Reserves: Why is It Crucial after the FTX Fallout?

Broker Categories

Minimun Deposit

License

Country

Established

Instruments Traded

Features

Trading Platform