Have you ever wondered what APY and APR mean in crypto investments and what is the difference between the two?

Entering the crypto world basically means that you will be bombarded by various new terminologies related to blockchain. Some of them are also related to banking industries and investments, which may not be familiar to many people. Therefore, it's easy to understand why many investors, especially beginners, might get confused with all these new terms and jargon.

When you invest, take a loan, or lend digital assets, you might come across two important terms: Annual Percentage Yield (APY) and Annual Percentage Rate (APR). While the two terms may sound similar, they are actually quite different. As an investor, it's highly necessary to understand them in order to maximize the interest on investments and minimize the interest paid when taking a loan.

In this article, we will explain everything you need to know about APR and APY and understand the difference between the two.

Contents

What Is APY?

Annual Percentage Yield or APY is the actual rate of return on an investment that takes the effect of compounding interest into account. It is essentially a metric used to calculate an investor's annual nominal income. In other words, APY is a technique used to measure how interest accumulates over time.

Put simply, the interest that you earn on your funds is called compound interest. It refers to the amount received on both the principal (the money you deposit into your account) and the interest you earn from the investment. Compounding makes it possible to earn money in the long term, so it is certainly a great strategy for investors.

This is also part of the reason why many investments and loans use a compound interest rate to calculate the annual interest earned by the investors. However, it is worth noting that this is not the same as "simple interest", which refers to the interest gained on the main deposit only.

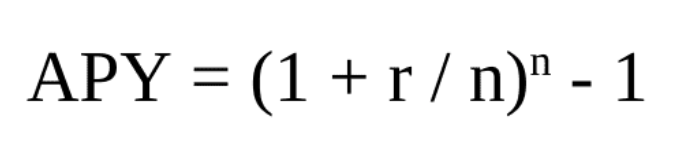

Here's how you calculate APY in crypto investments:

r = interest rate

n = compound interest period (on APY, usually n = 12 months)

In the crypto space, compound interest is used in crypto savings where investors deposit their assets and receive a rate of return over a certain period of time. This allows investors to get a higher fixed rate of interest. Moreover, there are loads of crypto yield programs to choose from out there. Just make sure to do proper research before signing up for one. Factors like fees, types of crypto, and interest-earning procedures might vary from one service to another.

Apart from that, there are also APY programs that are offered by crypto exchanges. You should be careful before registering because some of these programs offer high APYs to attract new clients only to drastically drop the rates after gaining enough clients. So, if you come across a program that offers unbelievable APYs, make sure to check the credibility of the exchange first.

What Is APR?

On the other hand, the Annual Percentage Rate or APR is essentially the annual rate of return that you will get within a year or the amount of interest that the borrower needs to pay to investors, expressed in percentage. APR calculates additional costs related to the transaction, and unlike APY, it does not take into account the compounding interest of the investment within the year. APR is often known as a simple interest rate as the profit depends solely on the original investment.

In the crypto space, APR is often used in crypto lending programs. You can either lend your crypto to earn APR or borrow some crypto assets and pay some fees to the lender. Since different platforms offer different rates, it is highly encouraged to stake your assets in multiple platforms to get a high APR.

Generally speaking, there are two types of loans offered by crypto exchanges:

- Fixed lending that requires investors to secure their money for a specific period of time (usually seven to nine days) to get a fixed amount of rate. The advantage is that this method typically offers a higher rate of interest.

- Flexible lending that is very similar to a savings account. This method allows you to withdraw your assets at any time, so the rate of return is usually lower.

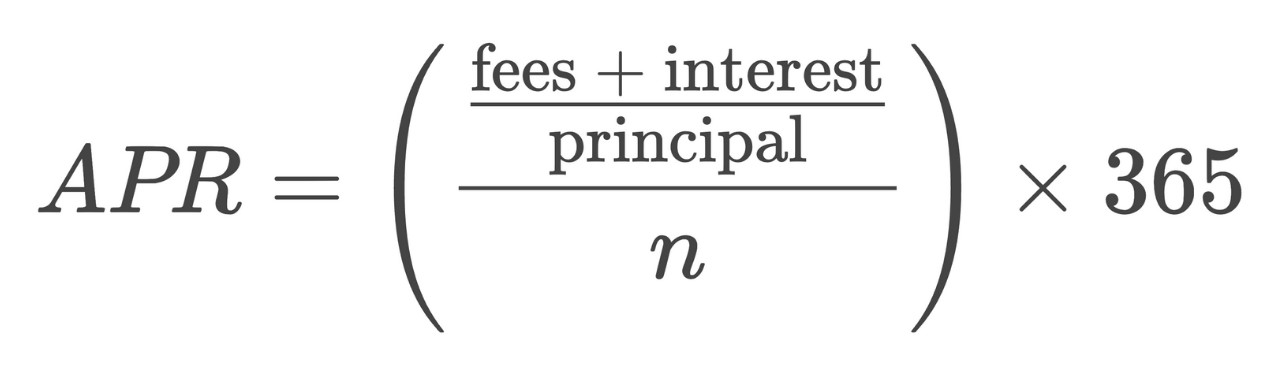

Here's how you calculate APR in crypto investments:

n = the loan period (in days)

Every crypto investor should understand that cryptocurrencies are extremely volatile. Therefore, the amount of interest that you'll earn may vary from time to time. Crypto lending is highly attractive for investors who want to hold their assets in the long term and earn passive income. However, the change in the price of the crypto would give an immediate impact on the revenue. Please consider the asset's volatility before investing as you won't be able to exchange the assets that are locked up in a lending program.

How to Distinguish APY and APR Easily?

That being said, APY and APR are not the same. The first difference lies in the function. APY generally refers to the total interest earned, whereas APR refers to the interest that needs to be paid. APY is a percentage rate of the total amount of interest earned on a specific investment based on a fixed interest rate for one year. Meanwhile, APR is a percentage rate that reflects the cost of credit in a year.

Which One is More Profitable?

Both APR and APY can be profitable in their own way, so the answer mostly depends on whether you are an investor, a lender, or a borrower.

As an investor or a lender, you would want to get the highest interest rate possible. In this case, the compounding effect in APY is considered more profitable because it can offer a higher yield. This means that you will earn interest on interest and you can add the extra profit to the initial sum of investment.

Meanwhile, as a borrower, you should pay off the balance as time goes by, so you should look for the lowest possible rate. In order to minimize the interest that you should pay, it's better to avoid compound interest and stick with APR. This concept works in various cases, including personal loans, credit card debt, and crypto loans.

The most important thing is to make sure that you choose the best program to your advantage; legit and offers the best interest for you. Also, always pay attention to the type of interest that the platform offers because some of them might present the yields in APR, while others might use APY.

Understanding the difference between APR and APY is important for crypto investors to manage personal finances, both in the form of savings accounts and investments. Since each platform offers different rates of interest, it's highly recommended to compare several platforms before deciding to invest.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano

7 Comments

Silva

Sep 22 2022

In the article, it emphasizes the importance of borrowers paying off their balances over time and seeking the lowest possible rate to minimize interest expenses. It suggests avoiding compound interest and focusing on the Annual Percentage Rate (APR). I would appreciate further insights into why avoiding compound interest and considering APR is beneficial when it comes to various types of loans, such as personal loans, credit card debt, and even crypto loans.

Understanding the distinction between compound interest and APR would be helpful in comprehending why borrowers are encouraged to steer clear of compound interest. Could you provide a detailed explanation of the differences between these two concepts? How does compound interest accumulate and impact the overall amount that borrowers have to repay? On the other hand, how does APR function, and what advantages does it offer in terms of reducing interest expenses?

Anthony Dion Lay

May 31 2023

@Silva: Hey there! Let me explain to you! When it comes to managing different types of loans, like personal loans, credit card debt, or even crypto loans, avoiding compound interest and considering the Annual Percentage Rate (APR) can be a real game-changer.

Let's talk about compound interest first. It's like interest on steroids! Not only do you pay interest on the initial loan amount, but it also piles up on any interest that's already accrued. That means your debt grows faster than a cheetah on a caffeine rush! To avoid this, it's best to pay off your balances gradually and avoid getting trapped in the vicious cycle of increasing debt.

Now, APR is your secret weapon in finding the best loan deal. It gives you the full picture of the borrowing cost, including the interest rate and any extra charges. By comparing APRs, you can see which loans are the most wallet-friendly. A lower APR means less money flying out of your pocket in interest payments.

So, remember, paying attention to compound interest and keeping an eye on APR can save you big bucks in the long run. Make gradual repayments, choose loans with lower APRs, and stay on top of your financial game. You got this!

Bernardo

May 18 2023

Okay, so basically, I have a little understanding of APY and APR. In short, APY stands for Annual Percentage Yield, which represents the money you can earn from an investment expressed as a rate. On the other hand, APR stands for Annual Percentage Rate, which represents the money you would need to pay for a loan expressed as a rate.

Now, I'm not sure if there are any specific investments or loans within the cryptocurrency world that use these terms, as they are typically associated with traditional financial systems. However, it's possible that there are similar concepts in the crypto space, involving investments or loans within the cryptocurrency realm

Torino

May 19 2023

@Bernardo: So, in my opinion, APY and APR are terms commonly used in traditional finance. When it comes to the world of cryptocurrency, they may not use these exact terms, but there are similar concepts. For example, in the crypto space, you can earn rewards by staking your coins. It's a bit like earning interest on your investment, which you could compare to APY.

Similarly, in decentralized finance (DeFi), you can provide liquidity to exchanges or liquidity pools and get rewards in return. Think of it as making money by letting others use your crypto. That's kind of similar to APY too. And when it comes to borrowing or lending cryptocurrencies, there are platforms where you can pay or earn interest. So, if you borrow crypto, you'll have to pay interest, and if you lend it out, you'll earn interest. It's kind of like APR in traditional finance, where you have to pay interest on a loan.

So, even though they might not use the exact same terms, there are similar ideas in the crypto world.

Saiko

May 27 2023

Based on my understanding of APY and APR, I know that APY represents the annual percentage yield, which signifies the earnings one can generate from an investment expressed as a rate. On the other hand, APR represents the annual percentage rate, indicating the cost of borrowing funds expressed as a rate.

Considering the compounding effect in APY, which is considered more profitable due to its ability to provide a higher yield, I'm interested to learn how this principle can be applied in the crypto space. Are there specific strategies or platforms that allow investors or lenders to benefit from compounding interest in the cryptocurrency market? How can investors or lenders utilize this compounding effect to potentially increase their profits and make the most out of their investments or lending activities within the crypto industry?

Corry

May 28 2023

@Saiko: In the crypto space, there are actually some cool ways to make the most out of your investments and earn some extra crypto along the way.

One popular method is through decentralized finance (DeFi) platforms. These platforms allow you to lend your crypto to others and earn interest on your holdings. The cool thing is, the interest you earn can be compounded, which means it's added to your original investment. So, as time goes on, you'll be earning interest on a bigger and bigger pile of crypto. It's like a snowball effect for your earnings!

With compounding interest in DeFi lending platforms, you can potentially see your profits grow exponentially. Just imagine, your initial investment is earning interest, and then that interest starts earning interest too. It's like a money-making machine!

Some DeFi platforms even offer additional strategies like yield farming or liquidity mining. These involve providing liquidity to specific pools and earning extra tokens as rewards. These rewards can be reinvested to compound your earnings even further. It's a way to put your crypto to work and make it multiply!

You can also read about lending crytpo system here : Traditional Lending vs Crypto Lending Explained

Thomas

Jun 1 2023

Hey there! I want to ask more about APR in crypto furthermore. So, what are the key differences in the calculation of APR (Annual Percentage Rate) between crypto lending programs and other traditional lending options? Are there any unique factors or considerations specific to crypto lending that borrowers and lenders should be aware of? Furthermore, with the availability of various lending platforms each offering different interest rates, is it common practice for participants in crypto lending to diversify their holdings across multiple platforms in order to maximize their potential APR?