Opening a new trading account in TriumphFX is very easy. You only need to choose one account type that suits you and read further to see the complete guide.

In order to start trading, you need to open a live trading account in a broker. Most online brokers these days allow you to make a new account on their website or mobile apps, so the process is usually very easy to follow. However, there are several things that you need to consider before going headfirst into the business. The first thing to think about is choosing the right broker. There are many legit brokers out there, but not all of them are good for you.

In this article, we'll introduce you to a broker called TriumphFX and show you how to create a new trading account on the platform.

Introduction to TriumphFX

TriumphFX is a well-established broker that has been providing service for over 12 years now. It is a broker that aims to make forex trading available to everyone by providing direct access to the world's top liquidity providers using STP technology. This allows them to perform high-quality service and fast order execution. TriumphFX operates in Europe and internationally. The company's international division is regulated by the VFSC Vanuatu, whereas the European division of the company is regulated by CySEC Cyprus.

At TriumphFX, clients can choose to trade with 60 forex pairs and 4 precious metals. Aside from that, the company is also known for its reliable trading platform, competitive spreads, and easy account opening with various payment methods available. Customer support is also considered reliable and responsive, but the service is only available during working hours in Cyprus time.

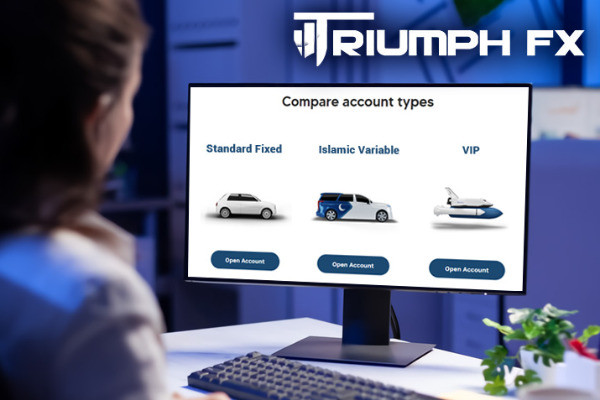

TriumphFX doesn't particularly focus on a specific type of trader, so the broker offers several types of accounts to accommodate the needs of both beginners and veteran traders:

- Standard Fixed/Standard Variable: The minimum deposit is 100 USD and the spread starts from 1.6 pips. If you choose fixed spread, then open a Standard Fixed Account, but if you choose floating spread, go for a Standard Variable Account. In addition, the maximum leverage is 1:500.

- Islamic Variable: As the name suggests, this account is designed for Muslim traders. This account type essentially has the same features as the Standard Account, but the difference lies in the swap charges. The Islamic Account has no swap charges as it is against the Sharia Law.

- Premium: The Premium Account has a minimum deposit of 500 USD, spreads starting from 0.6 pips, and a maximum leverage of 1:500. While the spread is lower, users have to pay a commission of 6 USD per trade.

- Islamic Platinum: This account type is suitable for professional Muslim traders. As an Islamic Account, this type charges no swap fees. Meanwhile, the minimum deposit is 2,000 USD, the spread starts from 0.6 pips, and the maximum leverage is 1:500.

- VIP: In this account type, the minimum deposit is 5,000 USD, the spread starts from 0.5 pips, and the maximum leverage is 1:500. There is no commission charged and the spread is variable.

Overall, here is a brief information to describe TriumphFX:

TriumphFX offers forex and CFD trading to retail and professional investors who have successfully opened live accounts with the broker. Regulated by FSA (Seychelles) SD080 and VFSC 17901, TriumphFX caters to traders from the EU to Cyprus, Great Britain, South Korea, Italy, Malaysia, Indonesia, Singapore, Australia, and Germany for trading forex and metals.

TriumphFX was founded in 2009 and has now opened offices in Malaysia, Hong Kong, Cyprus, and Australia. The company has a diverse client base, with opportunities for less experienced investors, as well as institutional traders.

MetaTrader 4 (MT4) is the main platform provided because. In addition to facilitating client navigation, the platform contains comprehensive educational material for beginners. Copy trading is also available, where users can copy other successful investors.

After you sign up, deposits can be made in the following currencies: USD, EUR, and GBP. Deposits and withdrawals through banks are usually completed within 2-5 days. TrimuphFX operates according to anti-money laundering guidelines, so document verification is required before a withdrawal can be approved.

The company offers a welcome bonus of 5% for the international division, however, this is not available to clients in the EU. TriumphFX offers one demo account and 4 different live accounts: Platinum, VIP, Premium, and Standard. The main difference between live accounts relates to the minimum deposit.

Clients can contact customer service via ticket, email, or telephone. The team will respond to any issues the client may have quickly and responsively.

Documents to Prepare

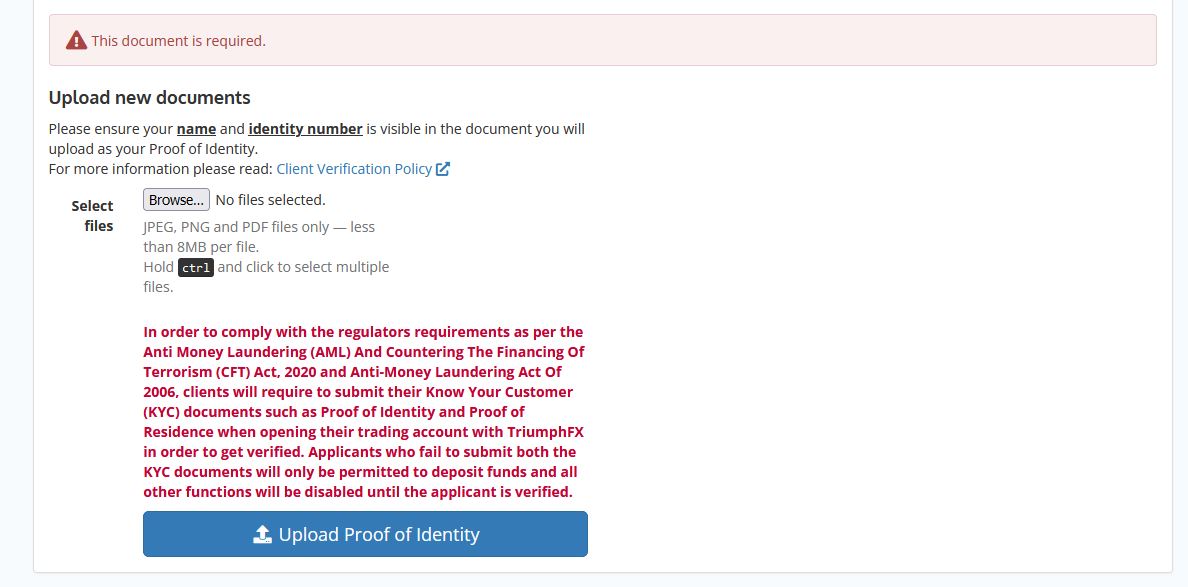

As a fully regulated broker, TriumphFX must comply with the rules set by the regulators, particularly for Anti-Money Laundering and Prevention of Funding of Terrorist Activities. In order to fulfill the requirements, all clients must go through the Know Your Customer (KYC) procedure when opening a new account to verify their identity, nationality, and residential address.

Before sending the required documents, please make sure that the documents meet all of the following criteria:

- Documents can only be uploaded in the following formats: JPEG, PNG, and/or PDF file extensions.

- The size of the file must not exceed 2 MB.

- Document resolution and clarity should be high enough to make sure the documents are clear and legible (scanner recommended).

- Documents must fill at least 50% of the file. Please crop your document properly.

- All four corners of the document must be clearly shown.

- Only documents scanned in color will be accepted.

- Documents with glare effects will not be accepted.

Documents that you need to provide when opening a new account are:

1. Proof of Identity and Nationality

Clients must verify their identity as well as their nationality by providing one of the following documents. Note that the document must be a government-issued photo identity document like:

- Valid Passport

- Valid National Identity Card

Other types of documents might be accepted, but it has to go through a proper inspection on a case-by-case basis by Triumph Int Limited Application Department.

Please make sure that the document contains all of the following information:

- Name must be comparable as in the Live Trading Account application.

- Photo Identity number must be comparable as in the Live Trading Account application.

- Date of Birth.

- Date of expiry of the document provided (not expired yet).

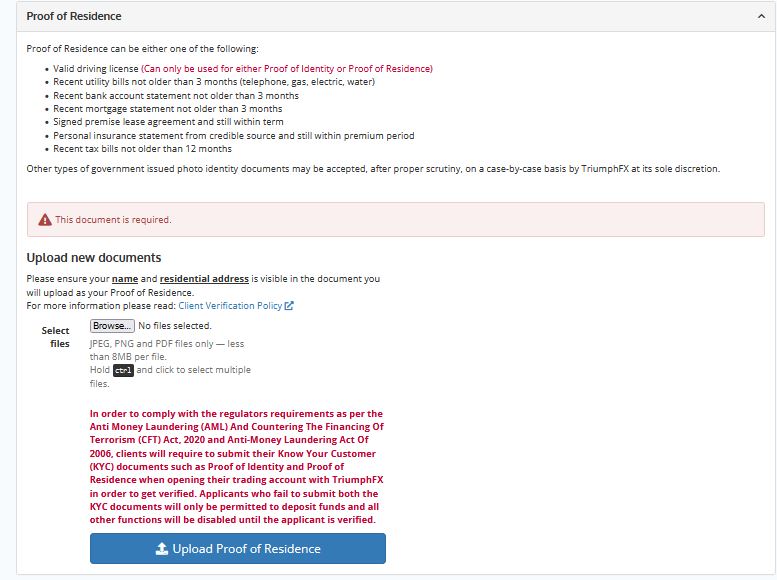

2. Proof of Residence

All clients must provide one of the following documents as Proof of Residence:

- Valid Driving License.

- Utility Bill i.e. Fixed Telephone Line, Gas, Electric, Water (within last three months).

- Bank Statement (within the last three months).

- Credit Card Statement (within the last three months).

- Mortgage Statement (within last three months).

- Current Premise Lease Agreement (within the last three months).

- Personal Insurance Statement issued by a trusted insurer and within the premium period.

- Personal Tax Bill (within the last 12 months).

The document must contain all of the following information:

- Name must be comparable as in the Live Trading Account application.

- Residential address must be comparable as in the Live Trading Account application.

- Date of expiry of the document provided (not expired).

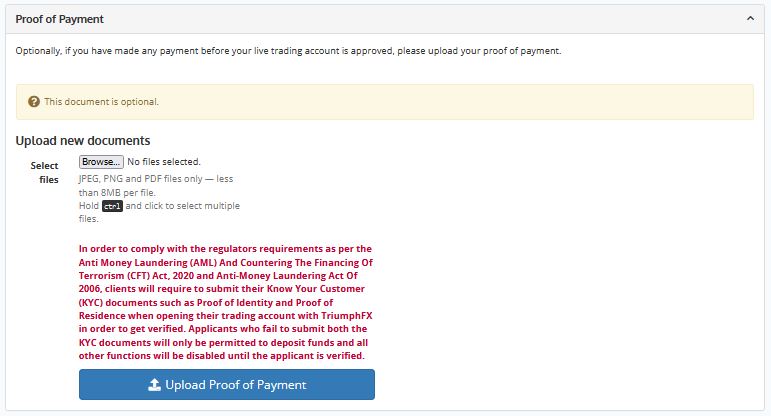

3. Proof of Payment

This is completely optional. You can upload a print screen of the Proof of Payment if you have made any payment before your live trading account is approved. This will allow the broker to immediately credit your account once it's activated. Considering that deposit via bank transfer is not always instant, early funding can give you a head start.

A Step-by-Step Guide to Open a Trading Account

1. Head over to TriumphFX official website and click the "Create Live Account" or "Open Account" button.

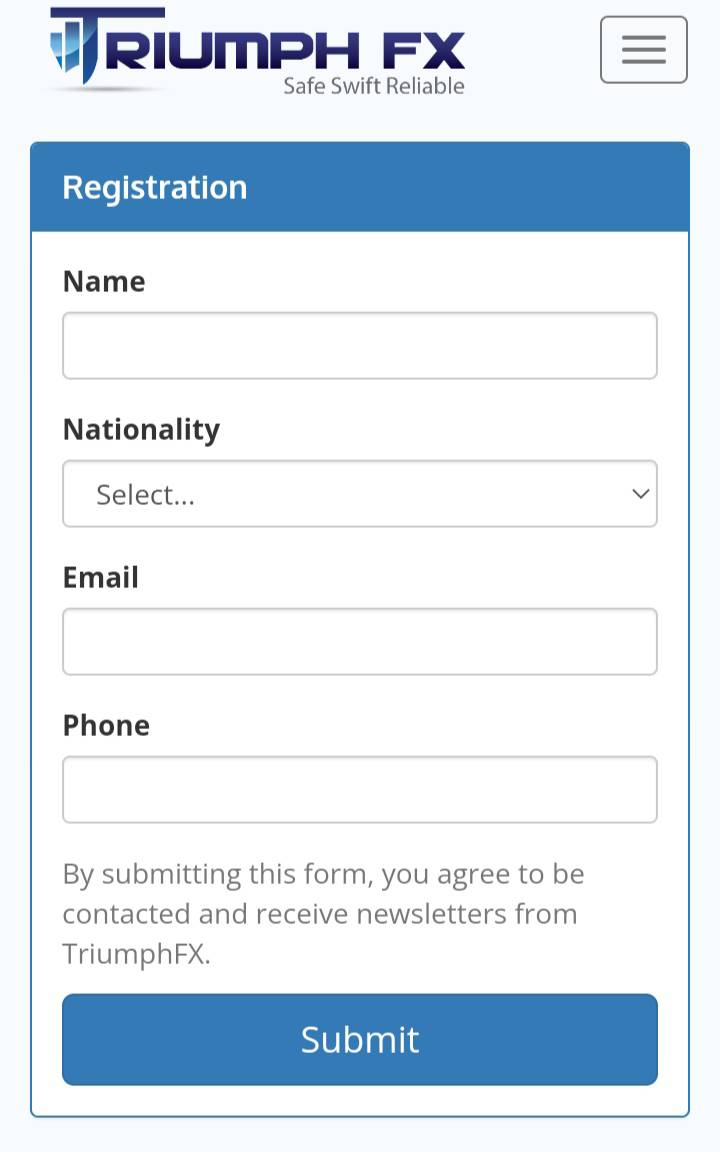

2. To start with, you'll need to provide some basic information about your identity. This includes your name, nationality, email address, and phone number. Click "Submit" once you're done.

3. After completing the initial registration, the system will direct you to a more in-depth questionnaire. There are several sections that you need to fill, such as:

- Personal Particulars. This contains your personal information, including name, identity, gender, nationality, and date of birth.

- Contact Method. Fill in your email address and phone number. Make sure that you use a valid email address and an active phone number with International Country Calling Codes.

- Residential Address. Fill in your full address, including the street name, city, postal code, state/province, and country of residence. Please note that the address must be comparable with the data shown in the Proof of Residence document.

- Referral. You can enter a referral code if you have one. If you're not referred to TriumphFX by anyone, you can just leave it blank.

- Trading. This contains information about your trading objective, which is necessary for the broker to know so that they can provide the best trading condition for you.

- Employment & Financial Information. Choose your employment status. If you're employed, you'll need to fill in your employer's details. Then, provide information about your financial condition, including your source of funds, approximate annual income before tax, approximate value of savings and investments, and approximate equity in home.

- Financial Experience. Understanding your trading expertise is also important for the broker as it can help them determine the most favorable protection and trading condition for you. It is important to understand that some financial instruments are not available to all traders due to the high risk, so you need to specify your trading skill beforehand and trade according to your capability.

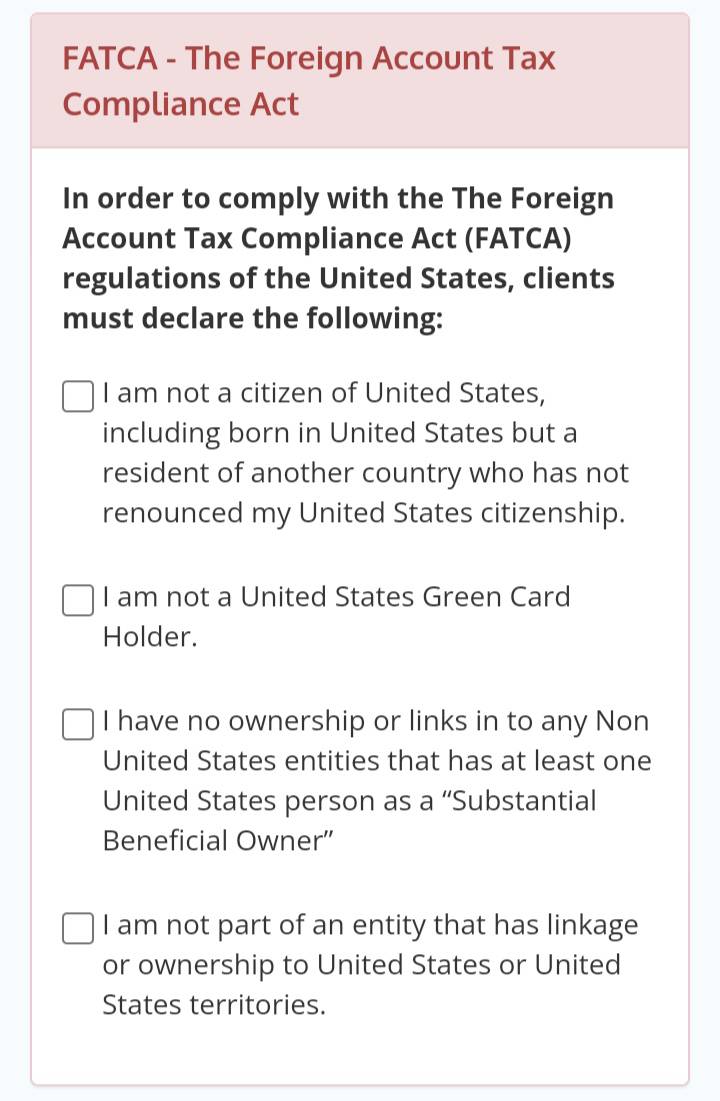

4. Next, you'll see the Foreign Account Tax Compliance Act (FATCA). There are several statements that you need to read and understand. This form basically confirms that you are not a US citizen, do not have a Green Card, and are not a US taxpayer. Tick all of the boxes if you agree.

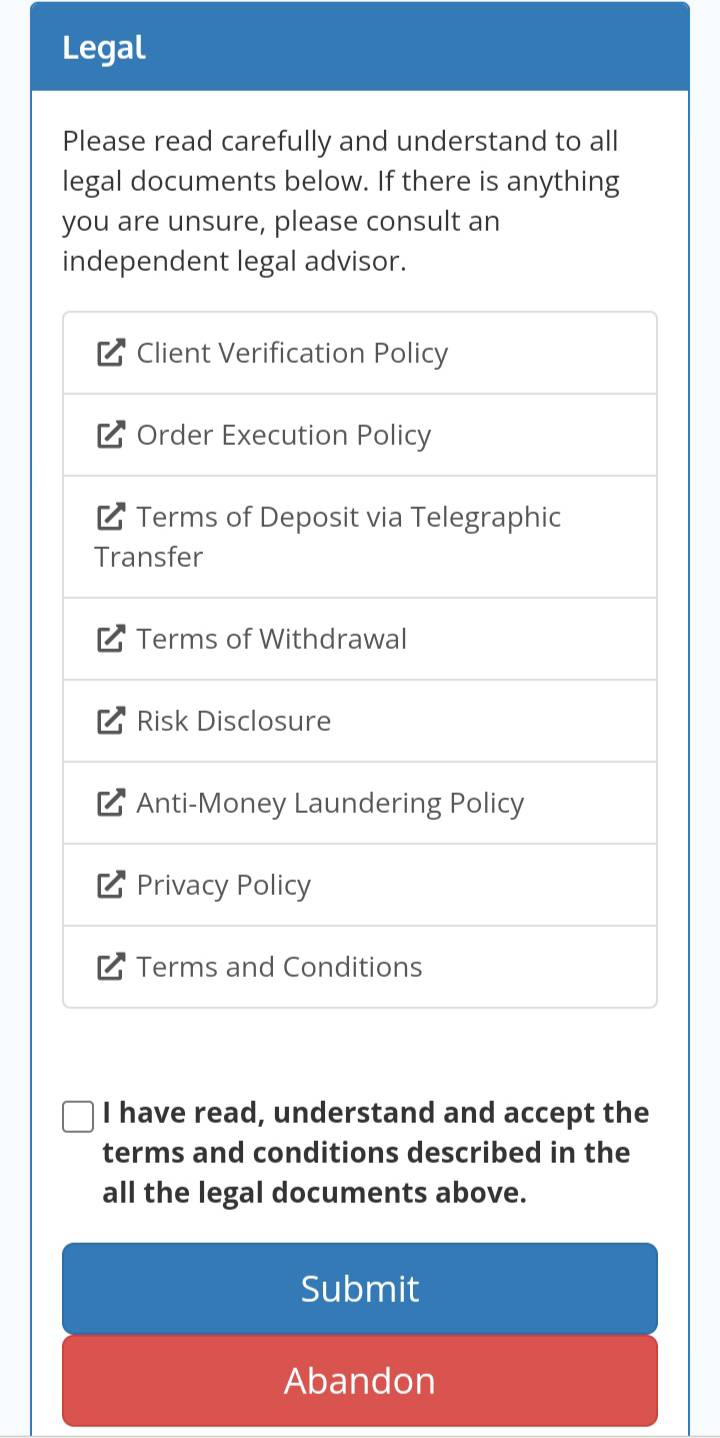

5. The Legal section provides all of the legal documents regarding the broker and account opening. Make sure to go through each document carefully before proceeding. If you have any questions, please consult an independent legal advisor.

6. Once you're done, tick the box that says "I have read, understand, and accept the terms and conditions described in all the legal documents above", and click the "Submit" button.

7. The next page is where you upload all of the documents to prove your identity, nationality, and residence. In order to upload a document, click "Browse" and choose the files that you want to upload. Then, upload the document by clicking "Upload Proof of Identity".

The second one is Proof of Residence. Upload the document and click "Upload Proof of Residence".

Lastly, you can upload your Proof of Payment and click "Upload Proof of Payment". Keep in mind that Proof of Payment is optional, so if you haven't made any payment, you can just leave it blank.

8. You're all set up! Click "Finish" to complete your registration.

All in all, here is a tutorial video that provides visual instruction on how to open an account in TriumphFX:

What Happens After Completing the Account Opening Procedures?

At this stage, your account status is still pending. You'll receive an email from TriumphFX once your submission is processed and ready to go. In the email, there are some important details that contain your access to Trader's Room as well as the trading platform. Save the information carefully so you can always access your account easily. Also, pay attention to keep it personal as data leak could lead to account breach that harms your account.

As TriumphFX is regulated both in CySEC and Vanuatu's regulatory agency, it can be said that this broker is a multi-licensed broker. Find out everything about it in A to Z on Forex Brokers with Multiple Licenses.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

23 Comments

Cristin Milburn

Nov 7 2022

Hmm....interesting, so TriumphFX has Islamic options available after all. And here I thought they didn't have anything like that at all. Is this option available as a wholly different account or is it an added feature in each trading account?

Smith

Feb 4 2023

Cristin Milburn: Yes, Islamic account option is available with option available as other account. Therefore, you must choose to open an Islamic account just like any other, but traders who qualify for an Islamic account must complete a physical account application before they can apply for an Islamic account. There may be certain documents, in addition to proof of identity and residential address, that TriumphFX may require prior to approving an Islamic account application. (Most important there is proof of ID that you are Muslim)

As information on both this website and the ThriumpFX website, accounts in ThriumpFX are divided into 5 types of accounts, which are:

Classic, Gold, Premium, Islamic Variable and Islamic Platinum Accounts.

Love Keefer

Nov 9 2022

So, I just created an account with TriumphFX by following the steps above. NGL I was confused at first but after reading your tutorial I realize that my document size is much larger than the maximum amount LOL.

Don't worry. Everything is peachy after I fixed it.

To all who wants to open a live account, y'all should check out the requirement for the documents first. Don't be like me.

Humberto Isaac

Nov 10 2022

Lemme get this straight. You can use LEASE as proof of residence???

That is good to know as I just move to another country (Thankfully still within TriumphFX reach).

Obviously, I haven't got any kind of ID. This is great news for real! I think I'm gonna apply for a live account soon.

Phil Howell

Nov 13 2022

Humberto Isaac: Some brokers allow that. But, you should consider asking about this thing to the customer service. Most of the time, they will provide you with good solutions. Don't just attach the documents without asking first. Especially considering it is a very sensitive document.

joao

Feb 4 2023

Humberto Isaac:

Yes, you can use the leasing agreement as proof of residency because the tenancy has everything to do with your identity as well as details about the place you are renting. You can even use your mortgage statement, credit card statement, or anything that can prove your address is real. Dude, I think you need to have an ID that can prove your identity and address.

In other words, the broker just wants to know that the address you entered is real and not fake. I have to admit that opening an account at ThriumpFX is easier compared to other brokers.

Sammy

Feb 4 2023

"In order to comply with the Foreign Account Tax Compiliance Act regulation of United States"

What is that called FACTA term anyway and why can't a citizen or any green holder of the US and anything related to US trading in ThrumpFX.

I mean from the Thriump term on that pictures it seems the "not possible" word mean forbidden. For what? And if a US citizen signs up to accept the full term in the ThriumpFX opening step, what penalties could this result in for traders and brokers?

Does this also apply to other brokers? ?

Leandro Molina

Feb 4 2023

Sammy: Dude, you mean FATCA right? It is not about brokers not being able to accept US clients. First, the US government needs to make sure that this FACTA law can help them supress tax evasion in the United States.

In other words, the US Treasury Department and the Internal Revenue Service (IRS), the tax agency of the US government, want Americans to be tax compliant and prevent them from using other banks and other financial institutions including forex brokers to avoid taxes.

Meanwhile, ThriumpFX is not regulated in the US, i.e. they cannot have an office and cannot operate in the US. And because of these factors, Thriump FX does not need to pay taxes to the US government. And as a result, US merchants are banned from doing business with them (US traders' money moves to another country, which is very likely to commit tax evasion.)

All terms on the article, are for Americans, including green card holders and US citizens.

Sammy

Feb 4 2023

Leandro Molina: So this FATCA law is only for US traders right? the first time I read these, I thought the brokers had a problem with the US, but in reality they don't. And also from what you explained to me, I think all brokers that are not regulated in the US will have this term as well.

In my opinion, why brokers cannot be regulated in the US, the reason is that the amount required is very high, as well as the operating costs to have an office there, also very expensive.

Anyway, thanks for the explanation! It is very useful !

Emilliano

Mar 13 2023

Some brokers have a time limit on the usage of their demo accounts. I am unsure if TriumphFX has such a policy, but it can be frustrating as the trading history or journal in the demo account will disappear once the account expires. As a beginner, I need sufficient time to learn about trading since there are many live trading accounts to choose from, and I don't want to make a wrong choice due to the limited time available for the demo account. Therefore, I would like to know if TriumphFX's demo account has a time limit. Thank you.

Darrel

Mar 13 2023

Regrettably, the demo account offered by TriumphFX is limited in terms of its usage. Upon visiting their website, I discovered that to activate the demo account, one must first have a live account with them. Furthermore, only 15 days are provided to use the demo account, after which it becomes inaccessible until a new live account is opened and a deposit is made. If you feel satisfied with TriumphFX but lack the funds to deposit $100, it is recommended that you copy your trading journal or take note of each trade made.

Tommy

Mar 13 2023

In essence, Triumph FX is an offshore broker, meaning that if you are not a European trader, you will be subject to the regulations of an offshore regulator, specifically the Vanuatu Regulator in this case.

I'm not implying that Triumph FX is an unsafe broker. However, offshore regulators, such as Vanuatu, are known to have weaker regulations. This means that they may not regularly monitor their brokers, and if a broker violates any laws, the offshore regulator may impose a weak penalty. Although I cannot confirm the specifics of Vanuatu Regulatory, it is important to exercise caution when dealing with offshore brokers. Thank you.

Bryce

Mar 13 2023

Yo dude, when it comes to the safety of Vanuatu regulatory, it all depends on a bunch of factors like their laws, how they enforce them, and what people think of them globally. The Vanuatu Financial Services Commission (VFSC) is the big cheese in charge of regulating all financial services in Vanuatu, including forex and binary options trading.

In the past, Vanuatu's regulators have been criticized for being too chill, but the VFSC has been making moves lately to beef up their oversight and make things more transparent. They've put in stricter licensing rules for financial service providers, made it mandatory for companies to do yearly audits, and have been working with regulators worldwide. So while there's still some work to be done, they're definitely heading in the right direction.

But hey, don't forget about CySEC! They're a pretty strict regulatory authority based in Cyprus, and they're known for implementing some solid rules and guidelines for brokers to follow. So all in all, it's safe to say that trading with Triumph FX is a pretty solid choice!

Tommy

Mar 13 2023

Thanks for the answer! When I first read about TriumphFX, I was impressed by its specifications and wondered if it was a trustworthy broker. However, after learning more about Vanuatu regulatory and CySEC, I feel more confident that TriumphFX is a safe choice for trading. The fact that the broker has received 3 out of 5 stars in this website's review also gives me some reassurance. Once again, thank you for the answer - it has really helped me understand the safety of different regulatory bodies and how they relate to TriumphFX.

Angga

Jun 30 2023

Just have some questions here.

Can presenting a Personal Insurance Statement issued by a trusted insurer and within the premium period help expedite the account opening process in Thriumpfx as a proof of residence? In what ways does Thriumpfx typically verify proof of residence for account opening? While the Personal Insurance Statement serves as proof of residence, are there any additional documents or requirements that need to be provided to establish residency? How does Thriumpfx ensure the authenticity and reliability of the Personal Insurance Statement as a valid proof of residence? Do they have specific guidelines or criteria for accepting insurance statements as proof of residence, such as the insurer's reputation or the type of insurance coverage? Are there any limitations or specific conditions regarding the acceptance of Personal Insurance Statements for proof of residence, such as the duration of the premium period or any specific insurance types? Lastly, what other options or alternatives does Thriumpfx offer for providing proof of residence, in case a Personal Insurance Statement is not available or does not meet their requirements?

Thank you!

Sandy

Jul 1 2023

@Angga: Hey, how's it going? When it comes to opening an account with Thriumpfx, having a Personal Insurance Statement from a trusted insurer within the premium period can help speed up the process as proof of residence. But, keep in mind that Thriumpfx might have other documents or requirements for establishing residency, like utility bills or government documents with your address on 'em.

To make sure the Personal Insurance Statement is legit, Thriumpfx probably has guidelines and criteria in place. They might consider the insurer's reputation and the type of coverage you have. But, hey, it's always best to double-check with Thriumpfx to get the full scoop on what they require.

If the Personal Insurance Statement doesn't cut it or you don't have one, no worries! Thriumpfx might have other options for proof of residence, like utility bills or bank statements. Just be prepared with alternative documents just in case

Aston

Jul 5 2023

I understand that we need to go through the KYC process when opening an account with TriumphFX, but even after completing the necessary steps, it states that our account status is still pending and we have to wait for approval. This waiting period can be a bit frustrating, so I'm curious to know why exactly this approval process is required. What factors or criteria are being evaluated during this time? Is it primarily for security purposes, verifying the authenticity of the submitted information, or ensuring compliance with regulatory requirements? Additionally, what measures does TriumphFX take to expedite this approval process and minimize the waiting time for traders? It would be helpful to have a better understanding of why we need to wait for approval and how it contributes to a secure and reliable trading environment.

Tailor Swift

Jul 10 2023

Hey, I have to say that I really dig TriumphFX as a trading platform. I mean, they have some killer features that I'm really tempted to, especially in terms of their leverage, which is actually higher than what's allowed in my own country, the US.

So after reading this article, I decided to give their demo account a try. I trained with him for several months and finally felt ready to open a live account. I followed all the steps outlined in the article, but when I tried to open a live account, it was rejected. I was disappointed and finally contacted TriumphFX customer support.

They explained to me that they do not accept US traders. I was a bit confused because they let me open a demo account in the first place, but didn't let me open a live account. Do you know why this is? What's the problem with TriumphFX not accepting US traders?

Billie Sam

Jul 11 2023

Hey bros! Too bad you have experience with TriumphFX. So here's the deal with Exness not accepting US traders. The thing is, TriumphFX is a global brokerage company, but they have certain regulatory and policy limitations. One of those limitations is that they do not accept clients from the United States.

Now, you may be wondering why they let you open a demo account. Well, demo accounts are often available to traders all over the world, regardless of their location. This is a way for traders to get a feel for the platform and test their strategies without risking real money. But when opening a live account, TriumphFX must comply with the regulations set by the authorities in the countries where they operate. TriumphFX has licenses in various international regions such as CySEC, FSC, and OJK. unfortunately, it's not all in the US territory, meaning they can't accept traders from the US.

Hedda Riel

Jul 12 2023

That's right, not many brokers accept US traders. According to the articles I read, it is known that getting a US license is very difficult because the requirements are quite strict. One of the main reasons why forex brokers do not accept US clients is because of the strict regulations imposed by the US government. The US government has implemented a number of regulations regarding forex brokers, including the Dodd-Frank Act which was introduced in 2010. This law requires forex brokers to register with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) which can be a lengthy and expensive process.

In addition, forex brokers are also required to meet a number of other requirements, including maintaining minimum capital requirements and submitting periodic financial reports to the authorities. These regulations can be difficult for forex brokers to comply with, which is why many prefer not to accept US clients.

Well despite the many rules in the US, it is important to remember that these regulations are designed to protect traders and ensure that the forex market operates fairly and transparently. As a result, it is important to choose a regulated and trustworthy forex broker, even if they do not accept US clients. Yeah, even though TriumphFX Broker can't penetrate the US market, it can't be denied that it is a good broker. TriumphFX is a highly regulated Broker with a good reputation. The company is recognized globally and offers good trading conditions for professional or regular traders. TriumphFX has one of the best and most good study and research materials for trading EAs.

However, you still need an account that has US regulations, you have to read this (Forex Brokers Offering Us Clients)

Hugo Olaus

Jul 13 2023

Actually, here I just want to add the reason why forex brokers don't accept US clients is because of the higher costs associated with doing business in the US. The US is known to have a higher cost of living and wages than many other countries, meaning forex brokers have to pay their employees more, resulting in higher operating costs.

In addition, forex brokers also have to pay higher taxes and fees to operate in the US, which can be a significant burden for smaller companies. As a result, many forex brokers choose to focus on other markets where the costs of doing business are lower.

Apart from these reasons, In the US, forex brokers are only allowed to offer a maximum leverage of 50:1 on major currency pairs and 20:1 on minor currency pairs. This is much lower than the leverage that is offered by brokers in other countries, such as Australia and Europe, where leverage of up to 500:1 is available. The restrictions on leverage in the US can make it difficult for traders to make a profit, as they are not able to take advantage of the same level of leverage that is available in other countries. As a result, many traders choose to use offshore forex brokers that offer higher leverage, which is why many US forex brokers do not accept US clients.

This is all done to protect traders from fraud and cybercrime.

Axel Gustav

Jul 25 2023

Hi! I just want to thank you for the article which gave me step-by-step instructions and a guide to verifying an account at TriumpFX. That really helped, especially while uploading my documents to complete the process. Now, I'm really looking forward to the verification being done! It's easy as pie, thanks to the article!

I have a question about the types of accounts that can be opened with KYC Markets. I want to know if it is possible to open multiple accounts and if it is possible to specify different specifications for these accounts. If so, I'm wondering if I need to go through the KYC process again for each account. Can you tell us a little about this?

Thanks again for the informative article! This has been a great resource for me and any additional advice regarding the KYC Markets account verification process would be greatly appreciated.

Siegfried

Jul 26 2023

Hi there, glad to hear that this article helped you in guiding you through the process of opening an account with Admiral Markets! It's great that you feel easy-peasy. Now, to answer your question about multiple accounts, yes, you can open multiple accounts with Admirals. The cool thing is, these accounts can indeed have different specifications, such as different base currencies, leverage levels, or even account types such as Trade.MT4 and Zero.MT4 accounts, Standard, Gold, and Premium. All accounts feature fairly competitive trading conditions and available services, while higher-class accounts will add extra profit to traders. Alike Gold account users can benefit from Webinars hosted by TriumphFX and Premium traders get 1 vs 1 Market Analysis etc. All in all, the TriumpFX account type offering is quite good, with a wide choice between suitable conditions.

But here's the deal with the KYC process. When you open an additional account with Admiral Markets, you usually don't need to go through the full KYC process again. After you complete KYC verification for your initial account, subsequent accounts usually go through a simplified verification process. This means you may only need to provide some basic information or documents to get those additional accounts up and running.