Not like any candlestick pattern, an order block is a group of candles moving in a range accumulated from big positions in the market. The pattern serves an opportunity from a pullback.

Forex trading is an industry where you will always learn something new. Every day you will discover new trading tips and strategies. Today we're going to be diving into order block candlesticks and everything you need to know about them:

Where Does Order Block Candlestick Come From?

When discussing foreign exchange, the term order blocks refers to the aggregation of trades made by major financial organizations and banks. It's not as simple as opening a buy/sell order for large banks. They break up a single order into several different chunks in order to make the most of the earning possibilities.

In trading, these individual orders are grouped together into order blocks, and finding those order blocks on the candlestick charts is our primary emphasis here. This is done with the intention of making a profit from a breakout market.

Types of Order Block Candlesticks

Now that we've got the basics covered, let's move on to the technical stuff. There are two types of order block candlesticks. They are as follows:

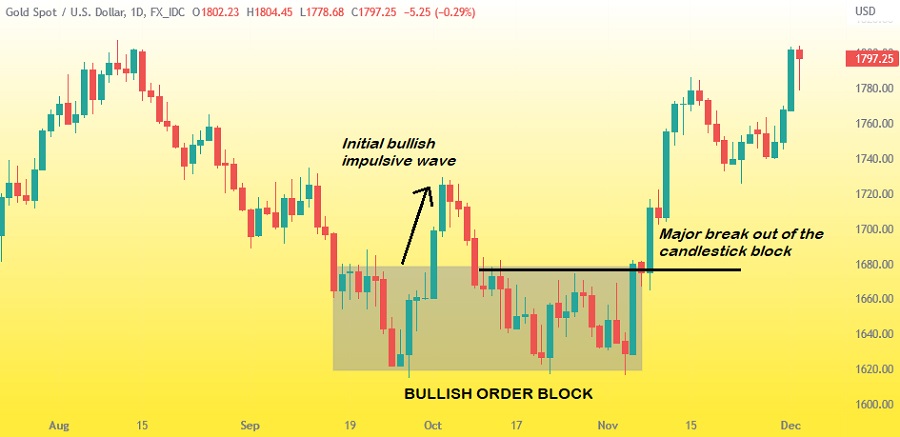

Bullish Order Block

A bullish order block is formed when a bullish impulsive wave occurs after the break of a range market structure or block. This signals that a bullish order block is about to form. When the price reaches the order block zone again, we will initiate trades with institutional buyers by opening purchase orders. It is usually found at the bottom of a downtrend.

Bearish Order Block

Bearish order blocks come into being whenever a bearish impulsive wave emerges in the wake of the rupture of a price range or block. If and when the price moves back into the bearish order block zone in the future, we will initiate sell orders from that location. The pattern is usually located at the top of an uptrend.

Order Block Candlesticks Trading Tips

If you're interested in incorporating order block candlesticks into your trading, there are two main tips we can give you to guide you in the right direction. They are as follows:

Not a Trading Strategy

Finding order blocks in the markets is not something you can look for or add to your forex trading strategy, as you can probably guess. Instead, you will need to use a different approach. No one knows when big players or central banks will enter a market.

You most certainly will not be informed in any way that it is getting closer to arriving. In addition, order blocks are not a common occurrence but are sometimes unusual. Because of this, you should not base your trading approach on order blocks.

Wait for Long Range

As soon as a pile-up is cleared, the markets have a tendency to trade sideways before moving in a particular direction. When anything like this occurs, there is one guideline that must be remembered: The tighter and longer the range, the more powerful the next trend will be.

Keep in mind that in many instances, central banks and other large institutions desire the range time to be extended in order to make it simpler for them to complete their acquisition at almost the same level of pricing. They do this in order to avoid having to cope with markets that are very volatile and changing.

Final Verdict

Order block candlesticks may seem slightly technical initially, but once you use them with your trading, you'll realize it's a piece of cake. The key is noticing when the price moves out of the range. To anticipate the risks, always incorporate proper money management techniques so you don't blow your trading account.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance