Triple candlestick patterns could be a little complex to learn especially for beginners. Therefore, these patterns could serve as a good introduction to trading with tiple candlesticks.

Triple candlestick patterns involve a combination of three candles that are recognized together. They are useful for performing a technical analysis of the market so that traders can predict the direction of price movement for an asset in the market. They constitute crucial tools for technical analysts to pinpoint potential reversals or continuation of a trend.

While identifying and reading triple candlestick patterns takes triple the effort, it also results in tripled rewards as traders can use it to determine optimum periods for entering and exiting trades. As such, triple candlestick patterns are often regarded as the most accurate compared to single and double patterns.

Below are the best triple candlestick patterns for beginners.

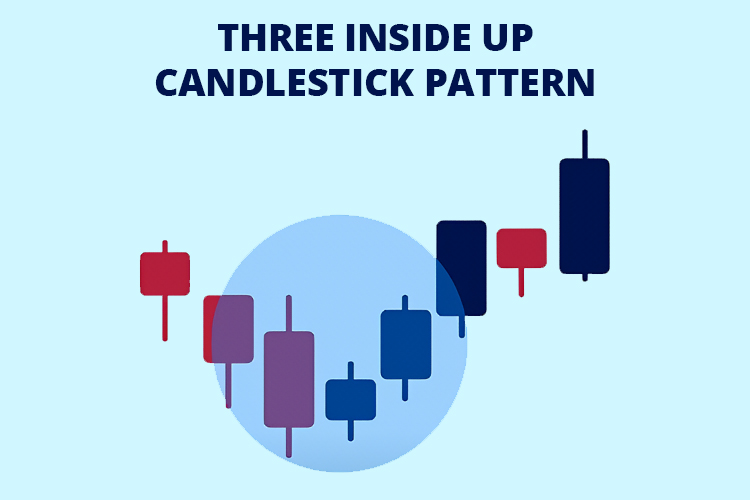

Three Inside Up

This is a triple candlestick pattern that has a bullish reversal setup and is seen at the end of a bearish trend to indicate the start of a possible reversal and a new market trend. Its three candles are set up in such a way that the first two candles form an inside bar while the third forms a long bullish candlestick behind the first two.

The process of forming this type of triple candlestick pattern starts with the first candle being long and bearish which shows that the market is experiencing an extended downtrend. The second candle is bullish and should normally close at the halfway point of the first candle. The third candle, which is also bullish, then closes ahead of the first candle's opening and preferably above the high of the second candle. Thus, the setup adequately depicts the start of a new uptrend.

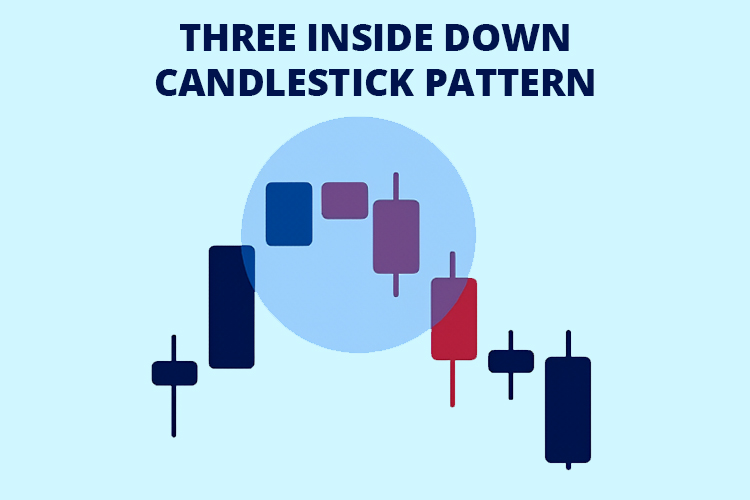

Three Inside Down

This triple candlestick pattern is in contrast to the three inside up pattern as it is a bearish candlestick that can be found at the end of an uptrend. Hence, three inside down signals a change in the direction of the bullish trend. The pattern is made up of a bullish candle that is followed by an inside Doji bar after which the third candlestick displays a price that breaks down below the opening of the first candle.

The setup begins with the first candlestick being long and bullish which is a sign that the market is still maintaining its uptrend. The second candlestick is bearish and tends to have a small body in the shape of a Doji candle; it should preferably close at the halfway portion of the first candlestick. The third candlestick is also bearish with its closing point beyond the opening of the first candlestick, preferably below the low of the second candle.

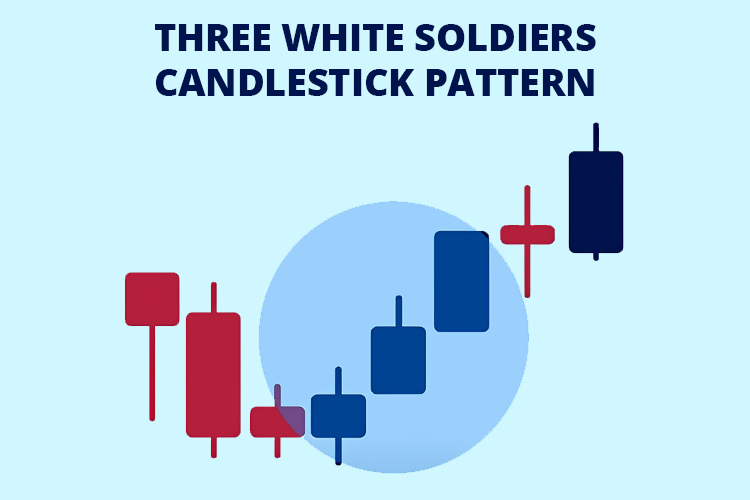

Three White Soldiers

Three white soldiers are a form of triple candlestick pattern that is formed when three consecutive bullish candlesticks appear alongside higher close prices. Serving as an indication of a strong upward trend, their setup is a bullish reversal and is found when a downtrend comes to an end.

For the setup to be valid as three white soldiers, the three candles must feature a long body with very small upper (wicks) shadows that are almost non-existent. Also, the opening of all three candlesticks must be within the real body of the previous candle, while the closing must exceed the previous high to show that the bulls are causing the price to rise.

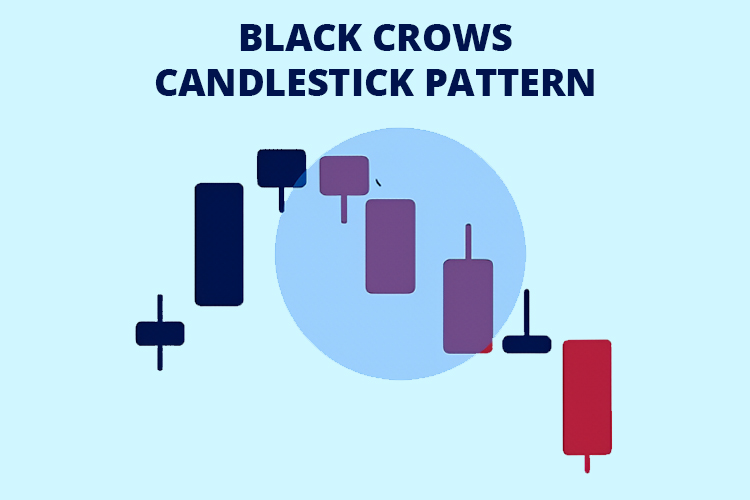

Three Black Crows

Three black crows are the opposite of the three white soldiers and as a result, their setup is considered to be bearish. Therefore, they are only formed when an uptrend comes to an end with three consecutive bearish candlesticks opening within the real body of the previous candle while also forming lower closing prices. This is a sign of a strong downward trend and to confirm this pattern, each of the candlesticks must have a long body with negligible or non-existent lower shadows (wicks) to indicate that the bears are causing the price to fall.

Overall, those are the best triple candlestick patterns for beginners that are new to trading and just learning about forex charts. They are quite straightforward and with a little bit of practice, beginner traders should be able to grasp the basics. The more they familiarize themselves with them, the better they will get at using these triple candlestick patterns.

Even then, it is necessary to point out that these triple candlestick patterns should be used together with other tools for technical analysis so that traders can obtain optimal results. These results are in the form of confirming whether a trend will continue or experience a reversal in relation to broader market conditions.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance