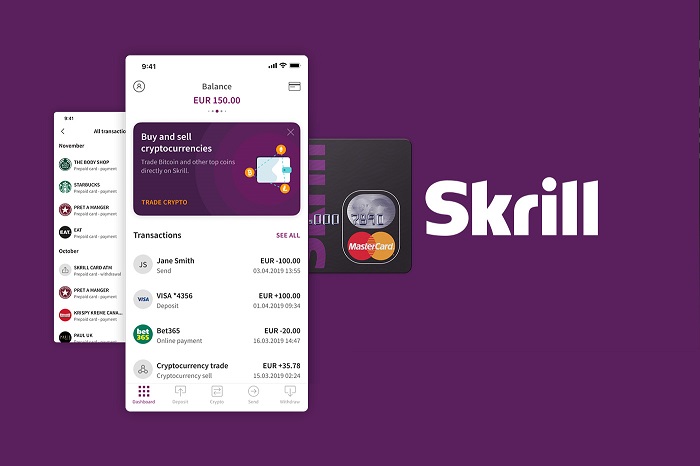

There are many benefits of using Skrill as a payment method for deposit and withdrawal. Here is the complete guide of Skrill forex brokers that you can choose from.

Skrill is a popular digital payment system previously known as Moneybookers. Despite the rebranding, Skrill's policy and service remain the same. Even better, the new name leads this e-payment's popularity to reach new heights.

Skrill is also used by forex traders from many countries. Every trader, of course, needs a quick and safe transaction, especially if it deals with a big amount of money. Accommodating the need, Skrill is managed and operated by the best accounting specialists and financial leaders so it won't put you at high risk.

5 Benefits of Using Skrill in Forex Brokers

Highly recommended among its peers, Skrill is a secure and simple online payment system. It has been approved by many brokers and traders worldwide. The followings are the advantages of Skrill for forex traders:

- Very fast. The point of having a profit is you can withdraw it quickly and enjoy it. Using Skrill won't spend much time because every transaction is processed instantly. You cannot do that through a bank wire transfer that usually takes 3-5 business days.

- Transparent. All financial clients always need transparency from their payment partners. Don't worry, Skrill offers a transparent report that is published weekly or monthly. They report all of your transaction records. It is good for the advanced analysis of your funding activity as you will know your deposit and withdrawal history.

- Accepted by many brokers. The old clients of Moneybookers still use Skrill until now. So, it won't be difficult for you to find a decent broker that accepts deposit and withdrawal via Skrill. You can also choose Skrill forex brokers based on their reliability and credibility.

- Free service. Don't worry, no extra fees for you whether you make deposits or withdrawals. No matter the amount or the time you make the transactions, there won't be any fees charged.

- Special privileges. Many brokers have partnerships with Skrill and there are extra advantages that come with it. A broker can give special perks for clients who use the payment system. The rewards can be free credits, bonuses, or interesting trading features. All you need to do is making sure to use Skrill as your gateway to deposit and withdrawal transactions.

Forex Brokers that Provide Skrill Payment

Skrill forex brokers are essentially brokers with standard features and tools for trading. They also offer forex bonuses and other common things on trading platforms. What's different is the brokers support Skrill as a payment method among others.

If you choose a trusted broker with Skrill as its payment method, all of your financial transactions will be much more protected. First, the broker itself protects your account, and second, Skrill also protects your transaction. The good thing is you can deposit and withdraw your money through the Skrill payment system, so it will minimize your time and cost.

Skrill has been used by many brokers because of its excellent service. Below are some recommended brokers who accept Skrill as their payment method.

IC Markets

IC Markets is a brokerage in Australia that was established in 2007. It is regulated under the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), and the Cyprus Securities and Exchange Commission (CySEC).

Its trading accounts vary from Raw Spread (cTrader or MetaTrader) and Standard (MetaTrader). The spreads begin from zero pips on the Raw Spread account. The standard account usually is free from commissions with spreads starting from 1 pip.

If you fund your capital using Skrill on IC Markets, it will be processed instantly, but they only accept AUD, USD, JPY, EUR, SGD, and GBP currencies.

IC Markets is an online forex broker operating under the company of International Capital Markets Pty Ltd. Traders under the Australian jurisdiction are provided with the trading service of IC Markets AU that is headquartered in Australia and licensed by the Australian Securities and Investments Commission (ASIC).

On the other hand, non-Australian traders who open an account in this broker are registered under IC Markets SEY that is based in Seychelles, and regulated under the Seychelles Financial Services Authority (SFSA). The dual operation is a result of the relatively new rules from ASIC that prohibit their regulated broker to offer trading services outside Australia.

Classified as an ECN broker, IC Markets provide clients with MetaTrader 4, MetaTrader 5, cTrader as platform trading options. This broker also follows market trends to include Cryptocurrencies as one of its products, enriching its already wide selection of trading assets that include Currencies, Indices, Metals, Energies, Softs, Stocks, as well as Bonds.

The minimum deposit in IC Markets is in the middle range compared to other ASIC-regulated brokers, as it reaches $200 for every client. Market analysis materials are also prepared regularly for trading insights on IC Markets's official website, proving their competence to serve their traders with important contents created by market experts that work specifically for them.

For payment methods, IC Markets allows funding and withdrawal via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, as well as Bitcoin via BitPay. The more interesting aspect from this broker is its multi-base currencies that include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

As the trading technology in IC Markets is highly equipped with co-located servers and extremely low latency (especially on cTrader), the broker is widely known for its capability in hosting traders with the special needs for high-frequency trading as well as scalping.

To sum up, IC Markets is a fitting destination for active traders looking for a well-regulated broker. IC Markets is also flexible in terms of base currency and payment methods, signaling their commitment to welcome traders beyond their home country. As of late 2019, IC Markets provided their website in 18 international languages including English, Korean, Indonesian, French, Spanish, Italian, Malay, German, and Chinese.

FP Markets

It is a brokerage from Australia and is a brand of the First Prudential Markets Pty Ltd. FP Markets operates for more than 14 years and becomes quite well-known due to its excellent service, trade execution, and trading education.

If you deposit using Skrill on FP Markets, it will be processed instantly if you are an MT4/MT5 user and one day if you are an IRESS user. In FP Markets, Skrill payments only accept USD, EUR, and GBP currencies.

Keeping positions open overnight won't result in the overnight/rollover fee reducing your earnings, so you don't have to worry about it. FP Markets offers the most competitive swap rates in the industry by introducing Swaps Points in the form of a live swap rates list on the MT4 and MT5 platforms. Here are some examples:

- ACWI: -5.00 for long positions and -2.50 for short positions.

- ADAUSD: -20.00 for long positions and -20.00 for short positions.

- AGG: -5.00 for long positions and -2.50 for short positions.

FBS

FBS is a global CFD broker offering competitive fees for stock and stock index CFDs. They do not charge an inactivity fee and provide a fast and simple account opening process. In this broker, Skrill deposits are free, but there's a 1% commission for withdrawals.

Since 2009, the action of FBS Holding Inc. or known as FBS in the world of forex trading has been recognized by various international institutions. With clients reaching 14 million as of 2019, FBS has received the title of Most Transparent Forex Broker 2018, Best Investor Education 2017, Best Customer Service Broker Asia 2016, IB FX Program, and many others.

FBS is regulated by FSC Belize and CySEC Cyprus. This broker has been trusted by millions of traders and 370 thousand partners from various countries. Based on their data, FBS garners about 7,000 new traders and partner accounts every day. And, 80% of the clients stay in the FBS for a long time. No wonder the broker is growing rapidly due to the incredible growth in the number of clients.

Trading products offered by FBS range from forex, CFD, precious metal, and stock. For forex trading, CySEC-regulated FBS offers leverage up to 1:30 on Cent and Standard Accounts. Clients who want to try higher leverage than that can alternatively register an account under FBS Belize.

FBS spread begins from 0.5 pips for Pro account type and from 0.7 pips for Standard and Cent accounts. On a standard account, volume orders can be made from 0.01 to 500 lots. Therefore, this account is recommended for experienced traders.

Whereas on Cent Accounts, volume orders can be carried out with a maximum of 500 cent lots or the equivalent of 5 standard lots. Cent Accounts involve a different level of risk. FBS recommends Cent Accounts for beginner traders. All account types support the following trading instruments: 36 Forex pairs, 8 metals, 3 energies, 11 indices, 127 stocks, 5 crypto pairs.

Before plunging into the real forex market, traders can practice with FBS Demo Account which consists of two types, i.e Standard and Cent.

FBS uses the MetaTrader 4 and MetaTrader 5 platforms. They offer them on Windows and Mac as well as Android and iOS mobile. These platforms provide a trading experience at traders' fingertips, allowing traders to progress as a trader anywhere at any time.

MetaTrader platforms also have a variety of mainstay features, including the possibility to create, buy, and use expert advisors (EA) and scripts, One-click trading and embedded news, technical analysis tools, the possibility to copy deals from other traders, hedging positions, and VPS service support.

Another advantage provided by FBS is a deposit bonus of 100% for clients who fulfill certain requirements. The process of FSCing and withdrawing funds can be run easily and quickly. Based on clients' testimonies, each process usually takes no more than 3-4 hours, except on holidays.

Traders also have the opportunity to develop a side business when trading with FBS, namely as an Introducing Broker (IB) or Affiliate. The FBS partnership system provides partner commissions that are already in 3 level positions. Only by introducing new clients to FBS according to certain procedures, traders can earn extra income.

Traders will also get trading education experience at FBS. They have prepared a comprehensive forex course. The course consists of 4 levels: beginner, elementary, intermediate, and experienced. Traders can take courses that will turn them from newbies to professionals. All materials are well-structured. Besides, FBS provides various forex analyzes, webinars, forex news, and daily market analysis that can be accessed easily on their site.

Traders can access the FBS website with many language choices. Of course, this will increasingly provide comfort for traders. Available languages include English, Italian, French, Portuguese, Indonesian, Spanish, and others. Live chat support is also provided 24 hours 7 days a week.

In conclusion, FBS is a widely known broker among retail traders around the world. It continually grows to become a preferred broker because of flexible trading conditions that enable its clients to trade with various instruments, low deposit, and other trading advantages.

HF Markets

HF Markets is a broker offering diverse account types and an extensive selection of trading assets. They provide high-quality software and favorable trading conditions, ensuring instant order execution. With a comprehensive list of tools and services, traders can choose the options that suit them best.

For payment, if you use Skrill, the minimum deposit is $10 and will be processed within 10 minutes with no fee. However, the minimum amount to withdraw is $5.

HF Markets is an award-winning forex and commodities broker. Established since 2010, the company provides trading services and facilities to both retail and institutional clients. For more than 9 years in business, HF Markets has around 1,500,000 live accounts opened and 200 employees globally.

Based on its services, HF Markets can be regarded as middle-class category. Clients do not need to prepare a big deposit for joining to trade with this broker. Also, there are various account types, trading software, and tools to facilitate individuals and institutional customers to trade forex and CFD online.

HF Markets is a registered brand name of HF Markets (Europe). Based on the location, the company is regulated by various financial regulators. Here are the details:

- HF Markets (SV) Ltd, registered in St. Vincent & the Grenadine as an International Business Company with the registration number 22747 IBC 2015.

- HF Markets (Europe), authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with Licence Number 183/12.

- HF Markets SA (PTY), is authorized and regulated as a Financial Service Provider (FSP) by the Financial Sector Conduct Authority (FSCA) in South Africa, under license number 46632.

- HF Markets (Seychelles), incorporated under the laws of the Republic of Seychelles with registration number 8419176-1, regulated by the Seychelles Financial Services Authority (FSA) under Securities Dealer Licence number SD015.

- HF Markets (DIFC) Ltd, authorized and regulated by the Dubai Financial Services Authority (DFSA) under license number F004885.

- HF Markets (UK) Ltd, authorized and regulated by the Financial Conduct Authority (FCA) under firm reference number 801701.

If traders have more experienced, knowledgeable, and sophisticated trading environment, they can join to become Professional Clients, who can manage and assess their own risks. For that reason, these kinds of clients are granted access to more favorable rates but afforded lesser regulatory protections than retail clients.

Trading with HF Markets can enable traders to access a variety of trading instruments like CFDs on Forex, Cryptocurrencies, spot metals (gold, silver, and others), energies (oil and gas), commodities (such as coffee, copper, and sugar), indices, bonds, and popular shares such as Google, Apple, and Facebook.

HF Markets offers some of the tightest spreads in the market, starting from 0 pips in Zero Account. This broker quote major foreign exchange currency pairs to five decimal places. Therefore, traders have the opportunity to get more accurate pricing and the best possible spreads.

HF Markets receives numerous highly prestigious titles, including the huge honor of being ed to join the ranks of the World Finance Top 100 Global Companies. Others are Best Client Funds Security Global by Global Brands Magazine, Best Global Forex Copy Trading Platform by Global Forex Awards 2019, Fastest Growing Forex Broker Mena 2019 by International Business Magazine, and many more.

After opening an account in HF Markets, traders will obtain various forex trading platforms to accommodate all of their trading demands. Whether traders like to trade on desktop or prefer to trade on-the-go, they can use MetaTrader 4 on desktop (terminal, multi-terminal, and web terminal) and phone (iPhone, iPad, and Android).

Clients' funds are held in segregated accounts. Only major banks are used by Markets because they believe that successful traders have to give their full attention to their trading rather than worrying about the safety of their funds.

Traders do not need to worry about transaction fees when depositing and withdrawing. Transaction fees are not charged, and diversity of payment methods enable them to choose between Wire Transfer, Bank Card, and online payments (Neteller, iDeal, Sofort Banking, and Skrill). HF Markets ensures that traders make fast transactions 24/5 during the standard hours.

Traders can earn extra income by joining the affiliate program offered by Markets. Clients who join this program will get some advantages, such as 60% of Net Spreads based on the volume traded by sub-clients, up to $15 per a lot of net revenue, and many more. More information about HF Markets can be obtained on their official website which is supported in 27 languages.

From the review above, it can be concluded that HF Markets is one of the award-winning forex and commodities brokers. There are various account types traders can choose in HF Markets, and the broker itself becomes a favorite among traders for its low spreads. This condition is very suitable for traders with limited funds and a desire to get more opportunities to gain maximum profit.

OctaFX

OctaFX is a globally recognized broker that caters to investors worldwide seeking favorable conditions for trading CFDs. With lower entry thresholds and support for short to medium-term trading strategies, OctaFX stands at the forefront of the industry. Since its establishment in 2011, OctaFX has experienced remarkable growth in fulfilling clients' demands. One of them is by offering fast deposits and withdrawals.

If you keep your funds in your Skrill account in Euro, depositing the OctaFX Euro account requires no conversion. You can also withdraw your funds with no commission.

Vantage

With favorable non-trading fees, such as the absence of inactivity fees, Vantage provides a cost-effective trading experience. Opening an account is seamless, taking less than 5 minutes through a fully digital process. The broker offers a wide range of deposit and withdrawal options, most of which are free.

Payment using Skrill in this broker only accepts USD, EUR, GBP, and CAD currencies that will be processed within 24 business hours.

Vantage Markets was founded in 2009 in Australia. It is the brand name of the Vantage International Group which is regulated by the Cayman Islands Monetary Authority (CIMA). Before it is known as Vantage Markets as today, they used to be MXT Global in 2009 and Vantage Markets Pty LTD in 2015. The Vantage Group also operates other companies such as Vantage Global Prime, which is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA).

According to the broker's website, Vantage Markets adds further protection to clients by segregating client funds and holding their funds with Australia's National Australia Bank (NAB). NAB is one of the 4 largest financial institutions in Australia as well as the Top 20 safest banks in the world. Thus, clients don't need to worry about saving their funds at Vantage Markets.

With Vantage Markets, traders will experience super-fast trade execution, as well as interbank grade and RAW ECN spreads. When combined, these elements offer clients a true institutional trading experience, across a wide range of trading instruments. They also offer services designed for both beginners and professionals with access to Forex ECN trading, as well as CFD trading on Indices, Commodities, and U.S & Hong Kong Shares. Those instruments are available to trade on MetaTrader 4, MetaTrader 5, MetaTrader WebTrader, CHARTS by TradingView, Mobile Apps, either for Mac, PC, iOS, or Android. There are also social trading platforms such as MyFXbook and Zulutrade.

By registering in Vantage Markets, traders will have access to an impressive range of educational materials and research tools including MT4 SmartTrader Tools, a wide variety of promotional trading offers and rebate programs, as well as access to accounts with up to 500:1 leverage. However, the leverage for ASIC and FCA clients is 30:1, and normally no promotion for AU and UK clients because of the compliance policy.

Vantage Markets provides research in the form of technical and fundamental analysis on its blog from in-house staff as well as guest writers. There is also an economic calendar powered by MQL5 from MetaQuotes. For clients who deposit at least $1,000, Vantage Markets offers a suite of plugins for MT4 branded as MT4 SmartTrader Tools, developed by FX Blue LLP.

As an authorized representative of Vantage Global Prime, the broker caters to retail traders under the Vantage Markets brand and offers access to the following instruments:

- 44 currency pairs, which are the most liquid global forex market currencies.

- 16 most liquid Indices from across the globe, including the S&P 500, DAX, FTSE, DJ30, and more.

- 16 commodities, either soft commodities or precious metals.

- 5 indices futures such as DJ30ft, DAX4ft, and NAS100ft.

- 600+ US, UK, and HK shares from large companies, such as Apple, Google, Coca-Cola, and big corporations listed on the Hong Kong Stock Exchange.

Clients can open accounts in Vantage Markets and deposit funds in 8 base currencies: USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, and JPY. They also provide clients with convenient deposit and withdrawal methods through local and international bank transfers, credit/debit cards, and e-payment.

Overall, Vantage Markets is valued to be proper for retail traders with small deposits who like the max leverage thresholds. In terms of pricing, the broker's commission-based Raw ECN account is the clear choice for cost-sensitive traders as it features a lower all-in cost compared to its Standard account offering.

The most important thing in trading is choosing a very efficient and free-of-charge payment method for your trading activities. Skrill comes with those advantages but they will become futile if your chosen broker is not reliable. But you can also consider other payment methods like Neteller.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance