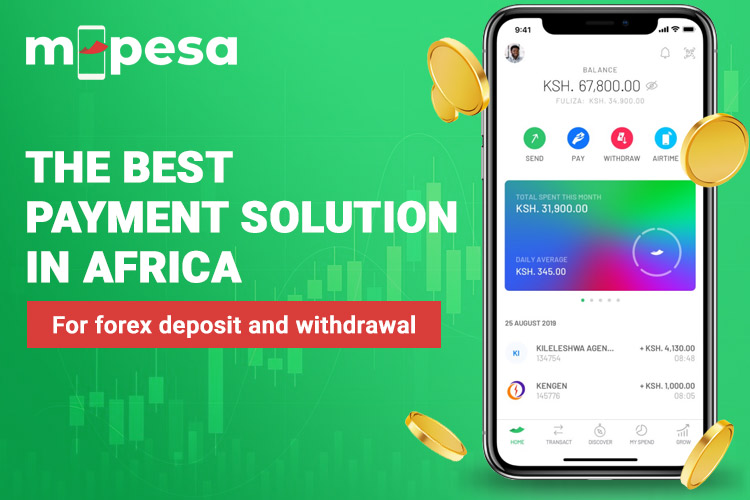

More than just a mobile payment system, M-Pesa has made forex trading more accessible in areas where financial inclusion is still an issue.

In the ever-evolving world of global finance, technology has become a beacon of hope, opening doors to financial instruments that were once exclusive. One such technological marvel making waves in the realm of financial inclusion, especially in forex trading, is M-Pesa.

M-Pesa is a revolutionary mobile payment platform originating from Kenya. It reshapes financial landscapes not only in Sub-Saharan Africa but also far beyond.

As a deposit and withdrawal method in forex brokers, M-Pesa makes forex trading more accessible to many traders in Africa. It eliminates the need for a bank account and high transaction costs.

Understanding M-Pesa

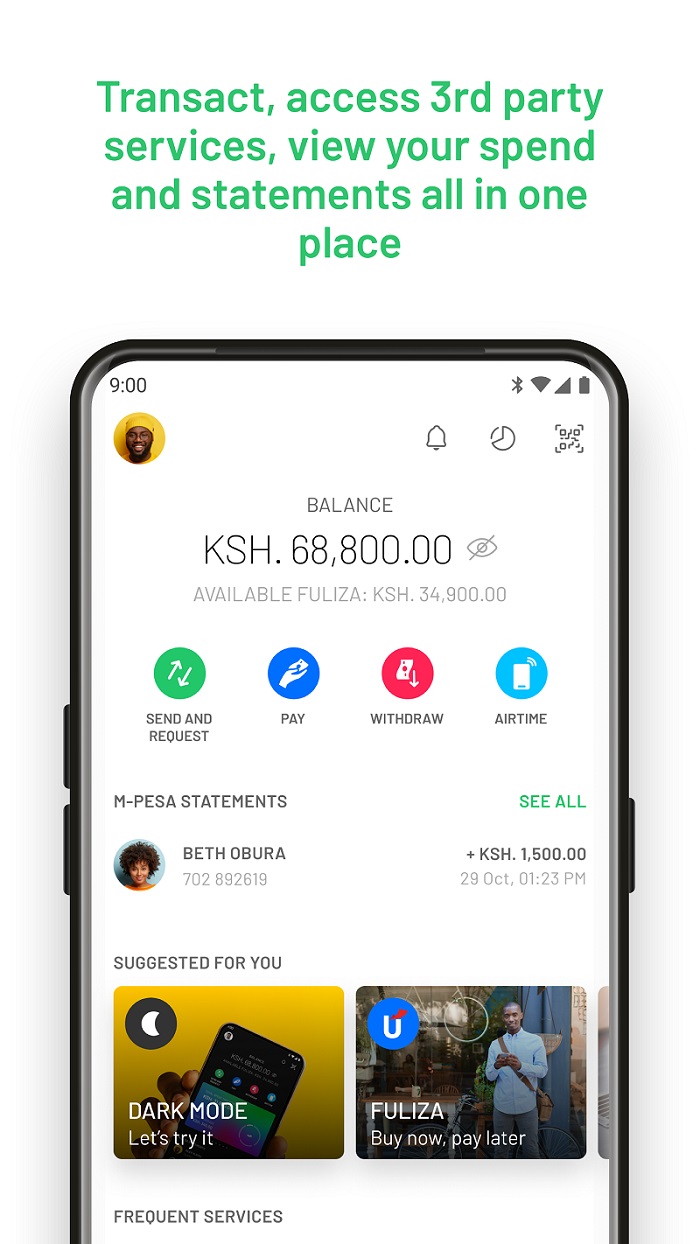

Imagine a world where mobile phones become the gateway to financial freedom — this is the essence of M-Pesa. Conceived by Safaricom in Kenya in 2007, M-Pesa, a fusion of Swahili words for "mobile" and "money," started as a simple platform for mobile transactions.

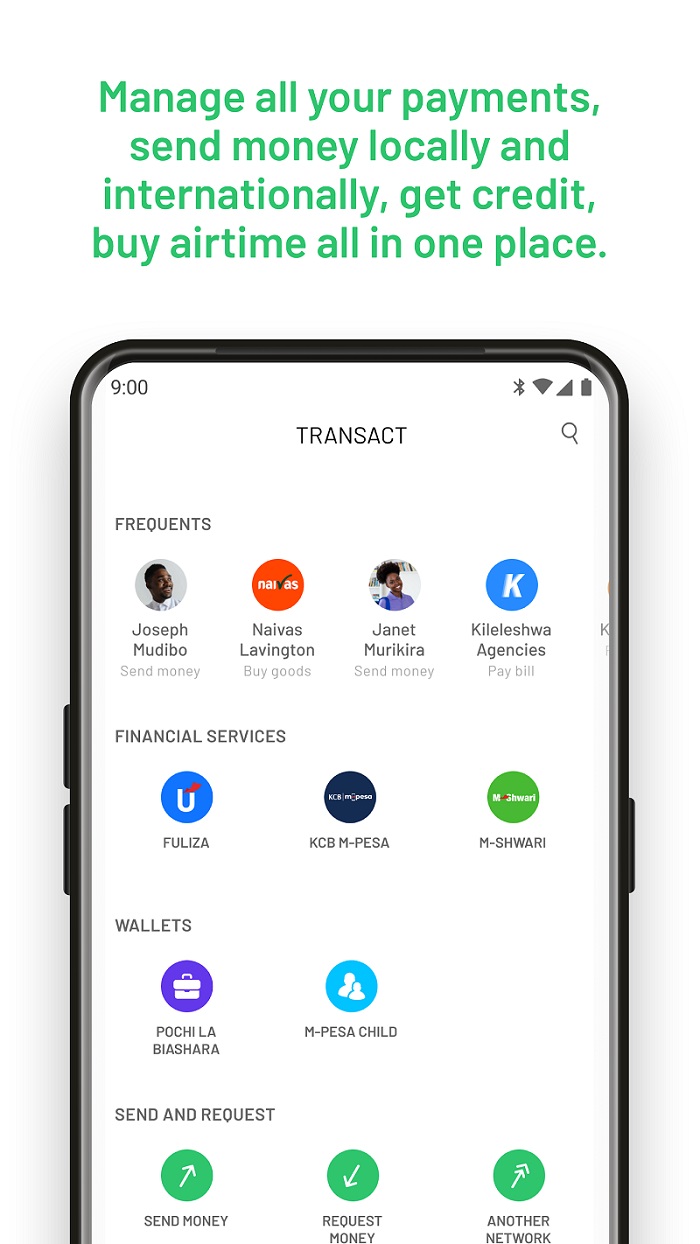

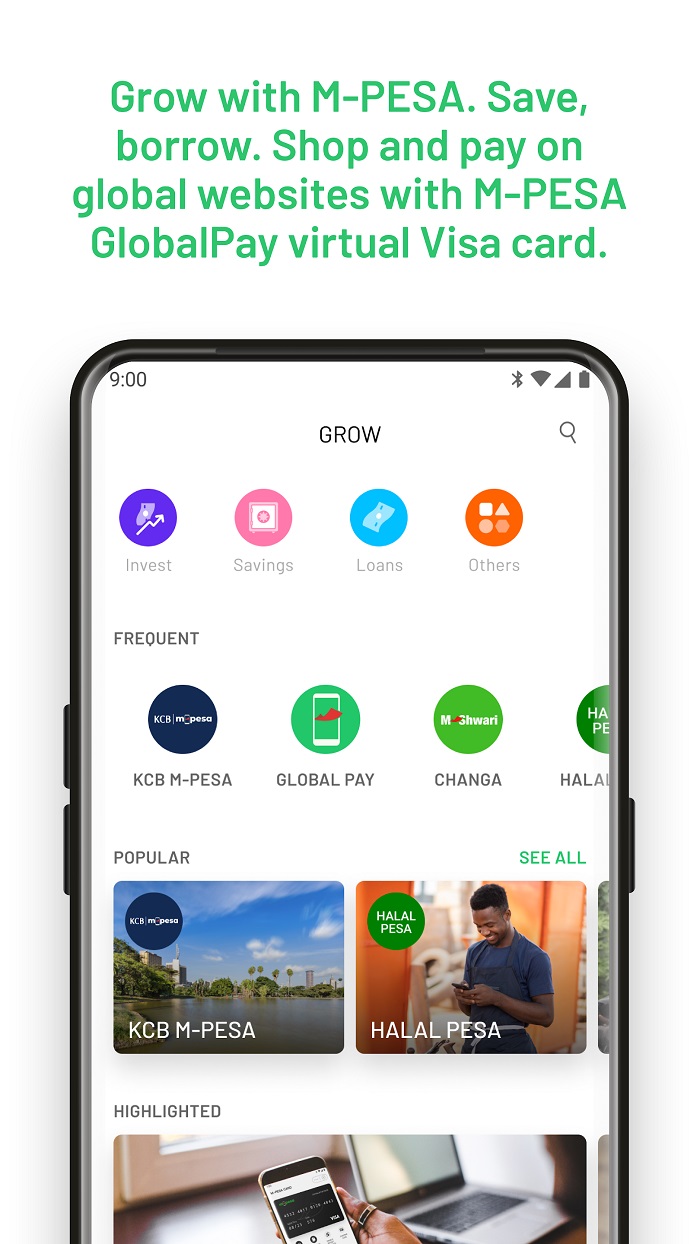

Over time, the M-Pesa mobile app has blossomed into a comprehensive financial ecosystem, allowing users to deposit, withdraw, transfer money, and settle bills using their mobile phones. This simplicity and accessibility have been instrumental in helping financial services such as forex trading reach a wider audience in Africa.

How M-Pesa Supports Traders in Africa

Thanks to M-Pesa, forex trading, once reserved for institutional investors and high-net-worth individuals in Africa, has witnessed a big change. This transformative mobile money platform has enabled more people in Africa to participate as forex traders.

Easy Access for Deposits and Withdrawals

Having a traditional bank account is a challenge in Africa, as not many individuals can have access to formal banking services. Nearly 90% of people with no bank accounts in Africa store their money at home or with a community member, so it's nearly impossible for them to trade in forex brokers who process each transaction online.

However, since M-Pesa can seamlessly integrate with forex brokers, any of its users are no longer required to rely on bank accounts for deposits and withdrawals.

Operating in 10 countries, M-Pesa shines most brightly in Kenya, where it fuels a surge in trading apps. This innovative use of trading apps in Kenya using M-Pesa has made it possible for African traders to easily deposit and withdraw in forex brokers.

After all, many popular brokers who extend their service in Africa have long accepted M-Pesa as one of their payment methods. Here are some examples:

*Data as of February 2024

See Also:

Low Transaction Costs

High fees associated with traditional banking transactions have long discouraged small-scale investors from venturing into financial markets. M-Pesa disrupts this norm with a more favorable fee structure, offering lower transaction costs.

| ⏬Minimum Transaction (in KES) | ⏫Maximum Transaction (in KES) | 💸Fees (in KES) |

| 1 | 49 | Free |

| 50 | 100 | Free |

| 101 | 500 | 7 |

| 501 | 1000 | 13 |

| 10,001 | 15,000 | 100 |

| 20,001 | 35,000 and above | 108 |

Now, let's compare the payment fees between traditional banking methods between KCB (Kenya Commercial Bank) to M-Pesa. Any amount between KES 15,001 and KES 20,000 requires a KES 113 fee, while transactions from KES 20,000 to KES 25,000 would be charged KES 178.

So if you make a transaction of KES 21,000, the fee comparison would be:

- M-Pesa: KES 108

- Traditional banking: KES 178

From the example above, it is clear how mobile payments offer transactions at a lower cost, contributing to the success and popularity of M-Pesa.

This affordability empowers individuals with limited financial resources to participate in the forex market without the burden of excessive fees.

Challenges and Opportunities

Although the mobile platform has served as a reliable payment system in African countries, there are still many challenges to consider. In this case, regulatory frameworks, technological literacy, and network infrastructure can influence M-Pesa's future use in Africa.

Looking ahead, the continued evolution of M-Pesa and similar mobile money services presents opportunities for further innovation. Imagine a future where these platforms seamlessly integrate advanced financial tools, educational resources, and enhanced security features. This evolution can empower traders by allowing them to make cheap and easy deposits and withdrawals with international forex brokers.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance