One of the most crucial steps in copy trading is finding the expert trader to copy. Here are 10 ways to find the best trader if you join eToro, one of the best platforms for copy trading.

Copy trading is one of the top trading strategies often recommended for novice traders. The strategy basically allows you to connect your portfolio with other traders. It is as simple as copying the whole portfolio of an experienced trader and applying it to your own trade. The amount of profit will be calculated based on how much you decide to invest in the trade. There are many brokers offering this service, including eToro broker.

This strategy is particularly helpful for traders with limited knowledge and experience in the field. Not only does it enable you to gain profit in the simplest way possible, but it also gives you the opportunity to keep up with the market trend without having to watch the screen all the time.

eToro is well-known to be the leading copy trading provider with its beginner-friendly trading platform that has gathered more than 4.5 million reliable and experienced investors to copy. You can browse, discuss, and learn more about copy trading by using various features provided on the platform. Not only that, but the platform also supports social trading and lets you connect with other traders from all around the world.

Since you're copying and using someone else's strategy, that means your trade's success depends heavily on the portfolio you choose. The basic principle is that if they win, you win. If they lose, you lose. Therefore, the most crucial part of copy trading is finding the most profitable trader for your portfolio.

It can be challenging indeed, as there are so many traders to choose from and so many factors to be considered. But don't worry, this article will show you the complete guide on how to separate traders who are really worth copying and those who just got a piece of short-term luck.

Contents

- Start with Risk Management

- Review the Trader's Profile and Stats

- Some Numbers are "Too Good to be True"

- Check the "Editor's Choice"

- Watch Out for New Accounts

- Understand the Terms and Conditions for Popular Investors

- Be Careful with Scaled-out Traders

- Protect Your Money with Copy Stop-Loss Feature

- Be Careful with Traders Who Recommends Copy Stop-Loss at 95%

- Take Suggestions from Other Traders

- Conclusion

1. Start with Risk Management

All successful trading begins with solid risk management. In copy trading, the biggest risk of losing money comes from building a bad portfolio. Trading can be highly unpredictable, especially if you use a volatile asset such as currency. But in this case, you can minimalize the risk by diversifying your portfolio, which means choosing several traders and using several assets at once.

To put it simply, if you are trading with a wide range of strategies and assets, then you can reduce the possibility of losing. Even if you lose on one of those trades, you can still rely on the rest of the portfolio to save your overall performance and earn profit.

It's always better to not put all of your eggs in just one basket. This way, you can manage your risk better and still gain money even if you lose some of the trades. For this reason, narrow down the options of popular investors to the ones that have diversified portfolios themselves.

Or, you can choose several traders who trade with different assets in eToro broker, such as commodities, stocks, and ETFs. After all, diversifying your portfolio should be your priority because even a small number of carefully chosen investors can make a huge impact on your trade.

2. Review the Trader's Profile and Stats

Now that you can narrow down the options, it is vital to check each trader's profile. Unlike other trading platforms, eToro actually provides a complete public profile that shows the trader's real name, display picture, and other essential stats regarding their trading experience. It will not, however, show any sensitive information such as account balance and personal details.

So before you decide to copy someone, make sure to check their profiles and stats properly. Some aspects that you need to consider are as follows:

- Time on the platform – to keep the risk minimum, it would be better to avoid young accounts. That means the trader's real skill hasn't been proven yet.

- The number of copiers – if there is a huge number of copiers, then it may be a good sign. This won't guarantee 100% safety though.

- Personal portfolio – is it diversified or specialized? See if their portfolio matches your criteria.

- Risk level – on the platform, eToro provides a feature called Risk Score to show the risk level for each trader. Avoid traders with big risk scores (6+) unless you're so sure about the trader.

- Stats – avoid traders with red open trades.

- Feed activity – some expert traders may just be bluffing about their skills, when in fact they're just lucky. By looking at how active they are at sharing valuable insights and participate in discussion forums, you can see if the trader really knows what he's doing or not.

See Also:

3. Some Numbers are "Too Good to be True"

When you check the stats on the trader's profile, you may see an incredible number of winning rates. While it may look tempting at the beginning, it is actually unrealistic. Be cautious with these numbers because if it sounds too good to be true, then it probably is.

Remember that there is no perfect trading strategy with 100% accuracy. Getting loss here and there is somewhat common and inevitable to almost every investment.

Even George Soros, one of the world's greatest investors, admitted that he made a lot of wrong calls throughout his career. So, trading is never completely separated from losing, even for the best traders. That is why, instead of focusing on spectacular numbers on the trader's profile, you should pay attention to their strategy and how effective it is for long-term profitability.

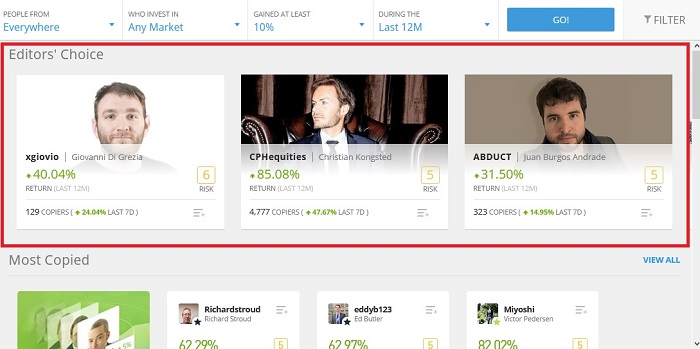

4. Check the "Editor's Choice"

Editor's choice is one of the best features offered by eToro. In this section, you can see a weekly ion of top popular investors who are considered worthy from the eye of eToro's own trading experts. Each popular investor has a short profile that contains a summary of their strategy and trading experience. This feature is a great way of choosing the best investors who are currently high rated and widely discussed on the platform.

From the list, you can directly add these popular investors to your Watchlist with only a single click, or you can straight up ask them questions and talk to them via their Feed. The Editor's Choice is especially useful if you're new on the platform and want to get a fast and reliable recommendation.

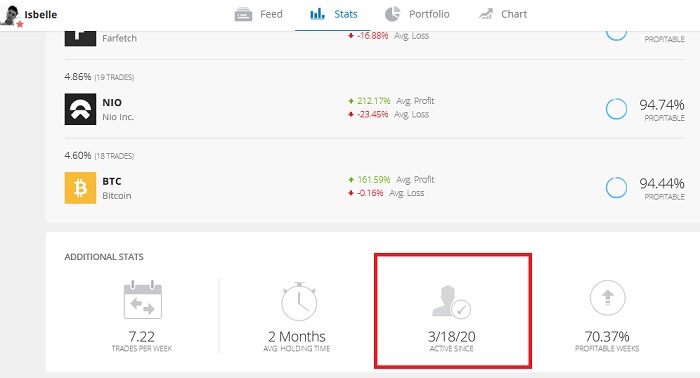

5. Watch Out for New Accounts

As we have mentioned before, young accounts are risky. It's hard to tell if the trader's to be trusted or not if their profile is still new. Many popular investors recommend that you should only copy those with at least six months of activity on the eToro trading platforms. According to them, half a year would be the proper minimum of time to measure if someone's consistently successful and not just lucky.

In trading, it is possible to get a lucky streak or find certain market conditions that are so great it could give them easy wins. But only truly skilled investors can maintain the consistency of good trades. That is why it is important to check the trader's past performance in the last months and even years.

Don't be instantly discouraged if you see some losses and red months on the stats, because as a trader you should know that loss is inevitable sometimes. Instead, try to see the bigger picture and see the pattern for the overall gains.

6. Understand the Terms and Conditions for Popular Investors

Previously, eToro paid the popular investors based on the number of copiers without checking the copiers' quality. As a result, some traders would manipulate the system by creating fake accounts with virtual money in order to raise the number of followers and copiers they have. This tactic is somewhat still around to this day even though eToro already updated its system.

Now, the platform uses the Popular Investor (PI) Program which is more advanced and better in ing the investors. That is why, make sure to stay updated with the company's terms and conditions to understand how the system works and avoid fraudulent traders.

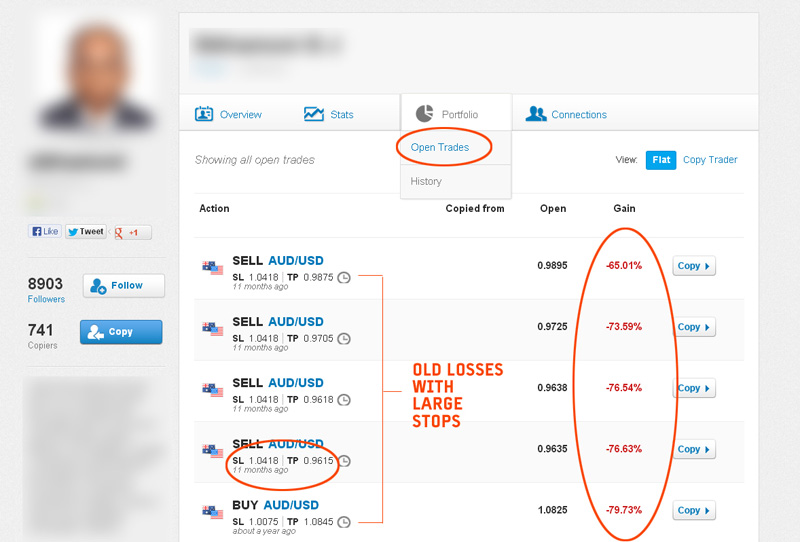

7. Be Careful with Scaled-out Traders

In order to keep the trade profitable, some traders would refuse to close their losing trades because it could damage their profit statistics. So they just expand the Stop Loss and leave the losing trade going. Such conditions mean that the profit statistics are not always accurate in representing the trader's performances.

Hence, look in their Portfolio tab and check the open dates under each individual position. If you find several losing positions that have been opened for a long time and accompanied by large stops, that is not a good sign.

8. Protect Your Money with Copy Stop-Loss Feature

Copy trading is a long-term investment. Some traders can let their copies run for months or even years. However, it is unlikely for beginners that just opened their first copy trades to monitor them on a full-time basis, even for mobile traders that can log in regularly on their phones, because it is not practical.

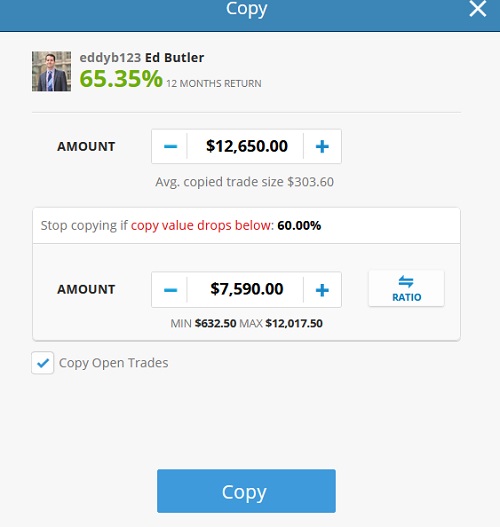

The solution to this issue is to set a Copy Stop-Loss right after you open a copy trade. The aim is to protect your money when the popular investor you're copying suddenly loses the trade due to unpredictable market changes. The Copy Stop-Loss will then automatically close the order once it reaches a certain point, even in eToro copy trading platform. This would be particularly useful if you have a diversified portfolio because then you can cut your losses and continue to profit from your other trades.

9. Be Careful with Traders Who Recommends Copy Stop-Loss at 95%

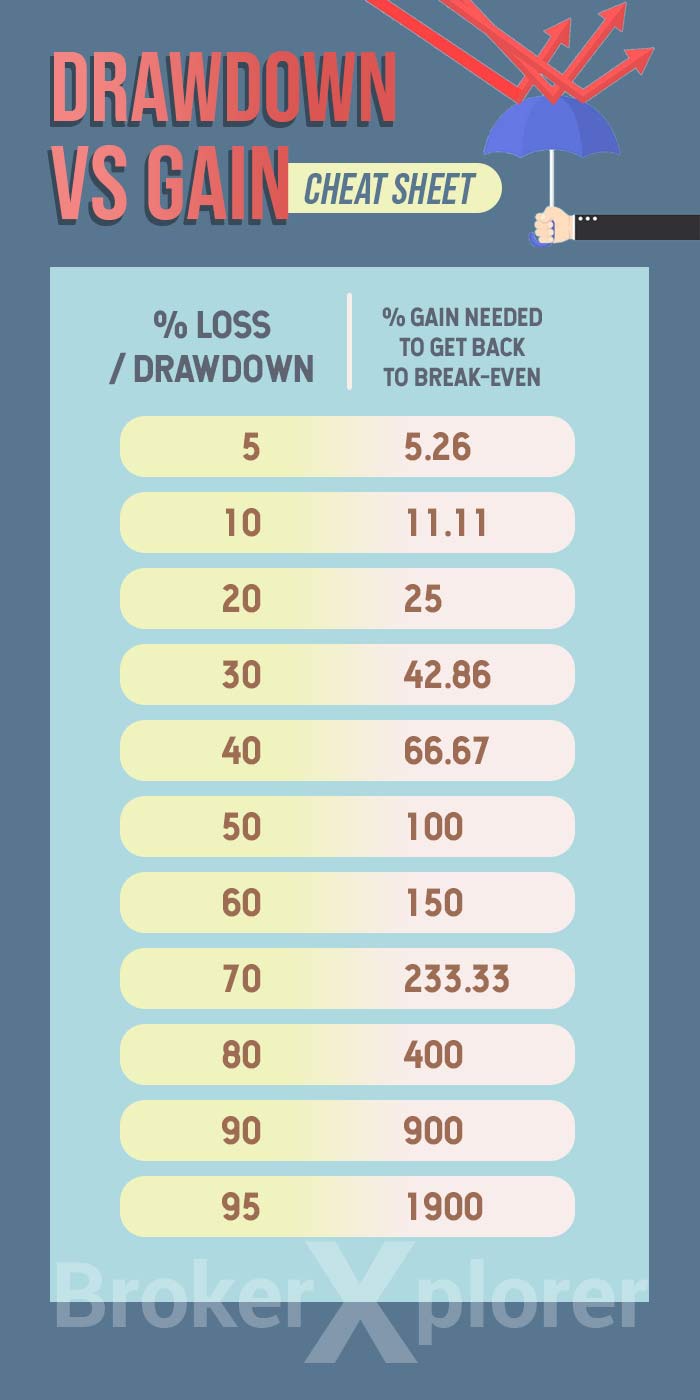

Kenneth Mowat, a.k.a Simple-Stock-Mkt, introduced this tip. He is an elite popular investor with more than 2,000 copiers and has more than $300,000 of copy assets under his management. He stated that some traders ask their copiers to set the Copy Stop-Loss to 95% and that is not a good idea.

According to his calculation, by incurring a 95% drawdown, you will need to get a 1900% gain in order to get a break-even before you even start making any money. So it is best to just stick with a realistic Copy Stop-Loss.

10. Take Suggestions from Other Traders

Lastly, you can also ask for advice and recommendations from other traders. Unlike other platforms that are full of anonymous "expert traders" with fake names and no pictures, eToro's popular investors are mostly verified and use their real photos. It is recommended to maximize the use of social trading on the platform by connecting with other traders and participate in various discussions.

With more and more traders starting to join eToro and share their knowledge with their followers, it's now easier to learn from the online community. You don't have to purchase expensive books or attend seminars abroad to gain knowledge about trading. Keep in mind that a good popular investor would likely interact with other traders and share their experience. That means they really do know what they're doing and are not hesitant to share it.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

Conclusion

A social trading platform like eToro may be the best option if you want to try copy trading. It provides all of the essential features to copy trade and definitely easy enough to follow even for those who just started to trade.

While you earn money from the trade, you can also learn from experts traders with various backgrounds and specialties. After all, that is the reason why copy trading is best suited for beginners. But remember that building a balanced and diversified portfolio is the key to successful copy trading with long-term profits. And in order to do that, you should pick the best traders possible so you can minimize the risk of losing. It is not an easy step, but it is one of the most crucial parts of copy trading.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance