Before it became one of the analytical methods relied on by many traders, there were important people who played an important role in pioneering technical analysis.

Technical analysis is a method of analysis that is popular among many traders. Thanks to its convenience and simplicity, it's no wonder this analysis is still a favorite today. Its popularity is a notch higher than the fundamental analysis model.

However, has it ever crossed your mind how technical analysis was first used and popularized? Five important people oversee the history of the creation of technical analysis. Apart from the myths of technical analysis that often arise, technical analysis can still improve traders' daily activities thanks to its convenience. Then, who are they?

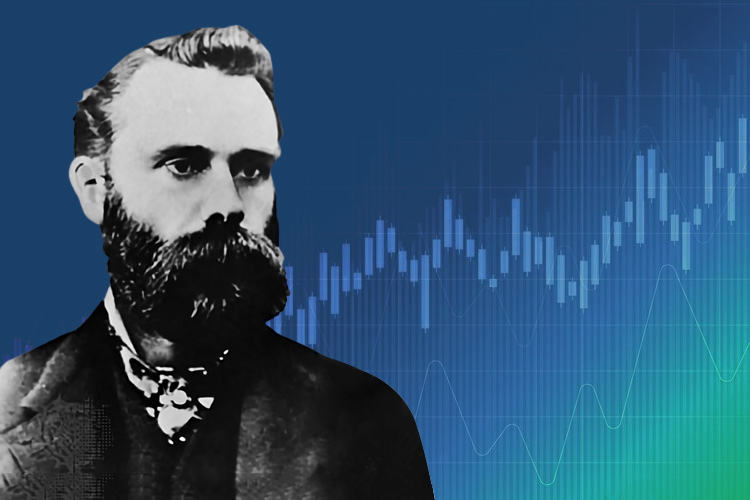

1. Charles Dow

The most important analytical technique began at the end of the 19th century. At that time, Charles Henry Dow, a financial magazine reporter in New York, issued several price prediction guides using historical stock movements in the past. Dow records all stock price movements, whether daily, weekly, or monthly.

Furthermore, he associated it with the market trend. From there, the Dow could then state that the price patterns that form in the market tend to repeat and can be predicted from previous events. Dow was eventually known as the Father of Technical Analysis and the first important analyst thanks to these discoveries.

Before being known as the first pioneer of technical analysis, Dow learned a lot about the world of finance and stocks. After a three-year career as a financial reporter, in 1882, Dow founded his magazine business with Edward D. Jones.

Starting in 1884, Dow's interest in stocks was strengthened after introducing the first stock market index, the Railroad Average. Then, in 1896, he published a new index called the Industrial Average, which consisted of the most speculative stocks on the exchange. The index became known as the Dow Jones Industrial Average (DJIA).

2. William Hamilton

William Peter Hamilton is the second most important analyst after Charles Dow. He completes the Dow Theory, the theory of technical analysis popularized by Charles Dow in the 19th century. In short, the Dow Theory itself is a theory that explains that trends serve as indicators of overall market conditions, especially in the stock market.

However, because Dow could not explain trend indications in detail, William Hamilton tried applying the Dow Theory to stock indexes. As a result, the terms bullish (uptrend) and bearish (downtrend) are created.

See Also:

According to Hamilton, the Dow Theory only describes a set of trends in the market that are not clear about their use, so they are not yet considered effective in "beating" the market. However, Hamilton himself has not been able to find "what" to use to read trend movements. Hamilton only conveyed an important note: trading activity should not be influenced by emotions but must be accompanied by an objective attitude. See what is there, not what you want to see.

3. Robert Rhea

The third most important analyst and the pioneer "practitioner" is Robert Rhea. In contrast to William Hamilton, who was still at the limit of studying the Dow Theory, Rhea created an innovation, namely turning the Dow Theory into a practical indicator to help traders when entering. In practice, Rhea successfully used this theory to identify Tops and Bottoms and finally made an advantage.

Rhea, the practitioner, succeeded in predicting the bottom level of the market in 1932, while the top level was successfully analyzed in 1937. The news about his innovation in updating the Dow Theory ultimately influenced the number of subscribers to his investment newsletter, Dow Theory Comments. Unfortunately, Robert Rhea breathed his last two years after successfully identifying with Top.

4. John Magee

The next most important analyst is John Magee. He was the only technical analysis pioneer determined to trade only by relying on stock price movements and price patterns. Magee doesn't read newspapers at all, aka ignoring fundamental analysis. For Magee, this can help him avoid a series of news that can spoil the analysis.

Although only armed with charts and chart patterns, Magee proved his success as a technical trader for four decades. As time passed, the trading strategy carried out by Magee became known as Naked Trading.

Besides being known as one of the most important technical analysts, Magee is also a chartist. He pioneered trading using chart patterns which were the results of his findings. The John Magee chart patterns are distinguished in shapes, such as triangles, flags, shoulders, bodies, and so on.

The shapes created by Magee seem to be the basis of the Triangle pattern, Flag pattern, and Head and Shoulders. So that the analysis results can be read by many other traders, Magee and Robert D. Edwards put it in the form of a book entitled Technical Analysis of Stock Trends, published in 1948.

5. Edson Gould

Edson Gould is the last most important technical analyst and the longest-lived one. He is listed as a pioneer of technical analysis with the longest track record and a trend forecaster with a high degree of accuracy.

At that time, he could predict a rise in the Dow Jones stock index of up to 400 points in a bull market in the next 20 years. He also said the Dow Jones could pass the 1.040 mark in 1973 and beyond. Gould can present a fairly accurate analysis because he uses charts, market psychology, and the help of technical indicators. From this, you can conclude that the technical analysis component was created during the analysis of Edson Gould.

During his 81 years, Gould never stopped analyzing to support his trading activities. Apart from that, he is also active in his profession as a newsletter writer. Reportedly, Gould's writings were sold for USD 500 in 1930.

Current Technical Analysis

This analysis's appearance is confusing, not to mention the candlestick charts with various patterns. There are also many kinds of technical analysis indicators. Currently, there are technical indicators called Moving Average (MA), Moving Average Convergence Divergence (MACD), Bollinger Bands (BB), and Stochastic.

MA is used to analyze the average price movement in several previous periods. MACD is used to determine to buy or sell signals obtained by looking at the long and short-term MA relationship. BB is an indicator that involves calculating price volatility. This indicator is used to analyze whether the market is busy or calm. So you can determine the strategy to be used in the market. Stochastic can be used to compare the last closing price point with the lowest or highest price range for a certain period.

For most traders, technical indicators are considered to be able to provide more realistic information on forex price movements. This is because prices are displayed in various chart models with indications. Plus, additional technical indicators are considered to be used as a complement to charts so that analysis can be considered more accurate.

Even so, you can not exalt technical analysis too much. There are several points that you should be aware of, including:

- First, because it is considered easy and simple, many traders use this analysis "without additional weapons". Forex trading success is not enough if you rely only on technical analysis.

- Second, you also have to consider market movements when trading. The market movement itself is a description of market conditions caused by several factors. For example, natural disasters, politics, the economy, and market psychological conditions. Market considerations like this are known as fundamental analysis.

Technical analysis sure has a lot of benefits for traders. After all, it is still one of the most popular market analysis methods. To successfully use this method, traders should first understand the basis of Technical Analysis.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance