Forex swap may influence your trading costs if you often hold positions overnight. Let's learn how to calculate swap fees in this article.

In forex trading, there are many important terms that traders should know. The forex swap is one of the most underrated terms, yet it is one of the most important as it can affect your potential profits or losses.

In this post, we're going to talk about forex swaps in one of the leading forex brokers, Exness. Hopefully, by the end of this guide, you'll be able to calculate your swap fees and know how to use them to your advantage.

Contents

What is a Swap Fee?

Every country has a different interest rate for its national currency, and this rate often changes from time to time. This is why some interest rates are higher and others are smaller.

For example, let's say that the interest rate in Australia is 2% and the interest rate in the US is 0.25%. Traders who want to trade with the AUD/USD pair must either pay or receive the difference between the two currencies' interest rates.

Such difference is what is referred to as a swap.

Swaps can either be long or short depending on the type of position you've opened (Buy or Sell). Swaps can also either be positive or negative, so you can either pay a fee or you will be paid a fee for holding your position overnight.

If a Buy position is left open overnight, the trader will have to pay interest based on the USD interest rate and will receive interest based on the AUD rate.

In other words, the trader will obtain 2% (AUD rate) and pay 0.5% (USD rate), so the trader will get a 1.5% swap per lot. On the other hand, if the trader opens a Sell position and left it open overnight, then they will get a negative swap of -1.5% per lot.

See Also:

When Does Exness Charge Swaps?

The exact time at which the swap is charged to your live account depends on your broker. Most brokers charge swap fees at around midnight, but Exness applies the fees at 22:00 GMT+0 each day except for the weekends until the position is closed.

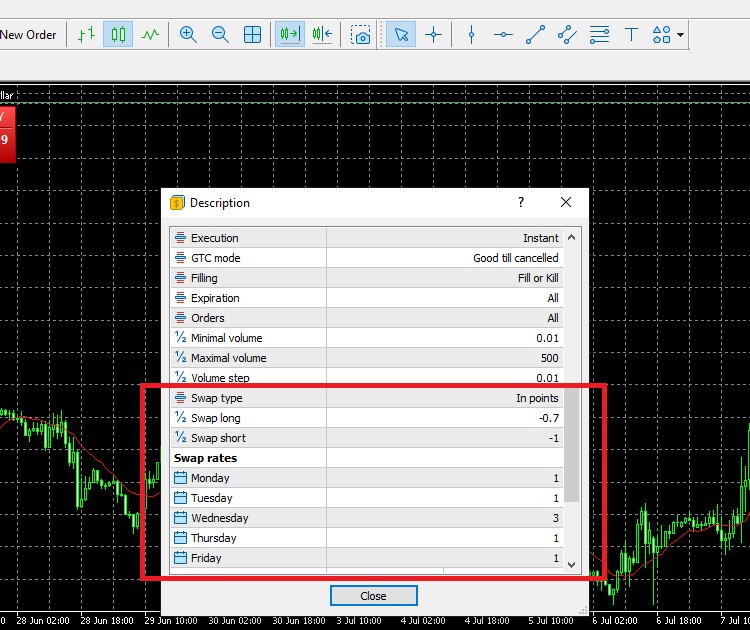

It is worth noting that sometimes the swap will be charged for opening a position over the weekend. In Exness, the amount of swap is charged on Wednesday (or Friday for Energies) at a triple rate after a few days to compensate for the next weekend, during which swap is not applied.

That being said, if you hold your position overnight on the day that weekend swaps are charged, you will get swaps three times bigger than the normal swap.

Finding Swap on Exness MetaTrader

If you trade with the MetaTrader trading terminal, you can see your swap amount at any time by following these steps:

1. Log in to MetaTrader with your trading account.

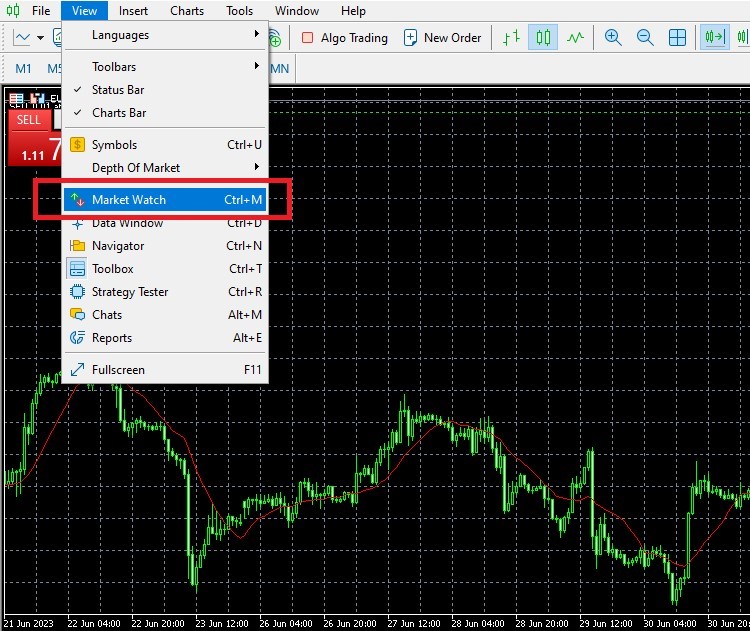

2. Open the View tab.

3. Open the Market Watch.

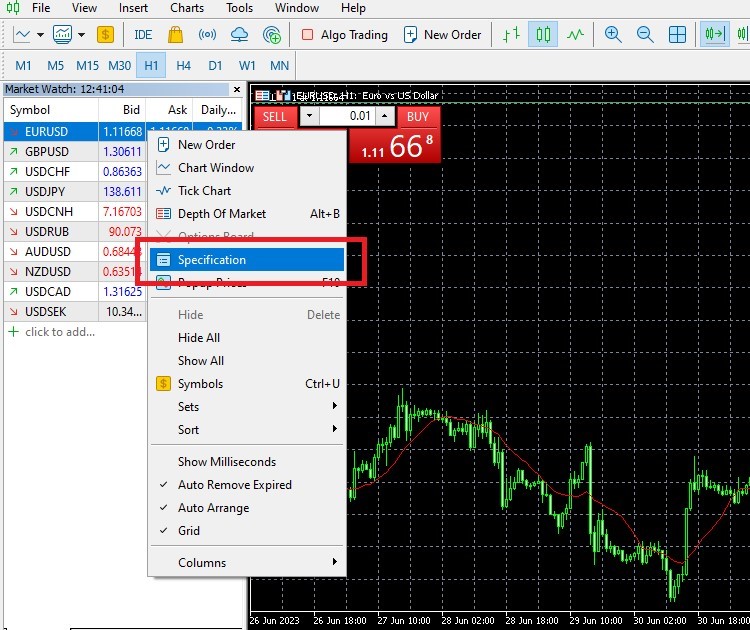

4. Choose one pair, right-click, and then click Specification.

5. Scroll down until you find the Swap section.

How to Calculate Swap Fee on Exness

Swap fee calculations can be quite complicated depending on the broker you use. If you trade with Exness, you can easily check your swap amount from your trading platform.

Simply open the platform, log in to your account, open the Trade tab, and look at the swap amount on the left side of the screen. However, keep in mind that this feature is only available on MetaTrader 4.

If you want to calculate your potential swap amount before opening a trade, you can use the Trader's Calculator on the broker's website or you can do it manually by using the following formula:

Lots x Contract Size x Pip Size x Swap Short or Swap Long x Number of Days

Case Study

Here's an example:

Let's say you used a Standard account to open a Buy position for 1 lot of EURUSDm on Tuesday at 15:00 and then closed the position on Thursday at 23:00.

Since it's a Buy position, then you'll need to use the swap long rate for calculation. You can check the broker's Contract Specifications for this. In this example, the swap rate is -0.86852.

Also, the position was held overnight from Tuesday to Wednesday, a total of 3 days. Each day uses a single swap, while on Wednesday the swap is tripled. So, in this example, the total swap charged is 5 days.

Now that we have every figure we need, we can input them into the formula.

1 x 100,000 x 0.0001 x (-9.86852) x 5 = -44.42 USD

Since it's a negative swap, then the amount will be deducted from your account.

Is It Possible to Make Money from Swaps?

As explained above, swaps can either be positive or negative. This means swaps can either make you pay interest or earn money from the trade.

In forex trading, there's actually a strategy that allows you to make profits by using swaps. This strategy is called carry trade.

Carry trade involves making a trade where you borrow in a currency with a low-interest rate and invest in a currency with a high-interest rate. In the previous example, this translates to borrowing USD and investing in AUD.

Since the strategy focuses on the difference between interest rates, it's important to choose two currencies that have a significant difference in rates.

Exness allows traders to carry trade and doesn't apply any restrictions for doing so. This makes it possible for Exness clients to gain profit from swap differences in their trading instruments.

Nevertheless, it's worth mentioning that the strategy is not free of risk because unexpected market movements might eliminate the profits made from collecting the daily swaps. This is why carry trading is more appropriate for big traders who like to hold positions for a long time.

Does Exness Provide Swap Free Account?

What if you want to eliminate swap fees altogether?

Some brokers have Islamic swap free accounts that do not charge forex swaps to positions held overnight, and yes, Exness is one of the brokers that provide swap free accounts.

This account is applied automatically and is only available for Muslim traders who live in Islamic countries. That is because according to Sharia law, lenders are not allowed to charge interest, so swaps are simply forbidden.

Keep in mind that if a client is found to have abused the swap-free status attached to their accounts, Exness may cancel the swap-free status on the account and start applying swap charges for any open orders as well as orders opened in the future.

For more information on Exness, please refer to the information below:

The choice of broker is adjusted to the needs of each trader. If you are a trader who only needs a basic platform and trading features with the best attributes, then Exness can be your best choice.

Exness covers its lack of feature variations with other advantages like low spreads starting from only 0.1 pip. This is very suitable for traders who use scalping strategies (Scalper). Spreads on major pairs in certain account types can also be as low as 0.0 pip, depending on market conditions.

Not only that, but traders can also enjoy other advantages such as automatic fund withdrawals. Exness processes the majority of client withdrawals instantly, without manual checks; however, withdrawals may be subject tos depending on the payment provider or method of choice.

The safety of traders' funds is also guaranteed as Exness is one of the European-based STP/ECN brokers. Exness's ability to become an official partner of the Real Madrid soccer team for 3 years, starting July 2017, also provides evidence that the company has high solidity.

Deposits and withdrawals may be made 24 hours a day, 7 days a week. However, it is important to note that the company shall not be liable fors in processing deposits and withdrawals if suchs are caused by the payment system.

Traders do not need to worry about transaction fees when depositing and withdrawing. Exness doesn't charge any transaction fees to traders even though some charges may be incurred depending on the payment provider of choice. A variety of payment methods are provided for traders, including Wire Transfer, Bank Card, Neteller, Skrill, and many others.

The financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the four largest public accounting firms globally.

Moreover, Exness is one of the mote transparent brokers in the online trading industry. Traders can find out all information about this company on the website, such as trading volume, number of active clients, client deposits, company funds, and many more.

The platforms provided by Exness vary in MetaTrader 4, MetaTrader 5, Web, and Mobile platforms. This makes it easy for traders when trading on Exness, as they can also access Exness platforms anywhere and anytime.

Over the years, Exness has developed into a broker that attracts traders. Trader's trust is further enhanced by its compliance with financial regulations like the FCA and CySEC.

One measure of client confidence can be put on the trading volume. By December 2018, their clients' monthly trading volume reached USD348.4 billion and active traders around the world surpassed 50,342.

Through the program offered by Exness, traders also have the opportunity to earn extra income by becoming their partners. From the Introducing Broker (IB) program, partners can earn up to 33% spread commission from every new client that registers with them.

Additional income can also be obtained from Exness Partners. Traders can get a spread commission of up to 25% per transaction made by traders who register through an affiliate link.

When trading with Exness, clients can also make use of its free VPS hosting services. A VPS (Virtual Private Server) offers increased reliability and stability for traders as they can maintain their trades and expert advisors without interruption in the event of unexpected technical issues, such as internet or electricity downtime.

From the review above, it can be concluded that Exness is a favorite broker for traders because of low spreads and flexible account types. This condition is very suitable for traders with limited funds but is in need of more opportunities to get maximum profit. This broker is also well known for its maximum support on both new and existing partners.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

54 Comments

Riri

Oct 17 2022

Is the carry trade strategy suitable for beginners?

Habib Sadidi

Mar 13 2023

@Riri:

The carry trade strategy can be risky and complex, and may not be suitable for beginners. The strategy involves borrowing money in a currency with low interest rates and investing it in a currency with higher interest rates, with the goal of profiting from the interest rate differential. However, the trade also involves foreign exchange risk, which can be volatile and unpredictable.

If you are a beginner in trading, it is recommended that you start with simpler strategies that involve less risk and require less expertise. It is important to gain a solid understanding of the basic principles of trading and risk management before attempting more advanced strategies like the carry trade.

Additionally, it is important to have a sound trading plan, sufficient capital, and a good understanding of the macroeconomic factors that can impact the currencies you are trading. It is always wise to do thorough research, practice with a demo account, and seek the guidance of an experienced mentor or financial advisor before attempting any complex trading strategies.

Farha

Oct 22 2022

What is the best currency pair to use in carry trade?

Hernandes

Feb 16 2023

Farha: The most popular carry trades involve buying currency pairs like the Australian dollar/Japanese yen and New Zealand dollar/Japanese yen because the interest rate spreads of these currency pairs are very high. The first step in putting together a carry trade is to find out which currency offers a high yield and which one offers a low yield.

Given that New Zealand and Australia have the highest yields while Japan has the lowest, it's no surprise that AUD/JPY is the best to do the carry trade. Currencies are traded in pairs, so all an investor needs to do to execute a carry trade is buy NZD/JPY or AUD/JPY through a forex trading platform with a forex broker.

Jonathan

Oct 27 2022

How can I view swap rates in MetaTrader 5?

Cucurela

Feb 16 2023

Jonathan: Swap rates can only be viewed on the broker's website. All information about swap rates can be found in the trading instrument details. Find swap information or there are words "long" and "short". swap rate numbers do not have a percent sign andc can show either positive and negative values. All brokers have swap information, swaps can change daily and are not the same as other brokers

MT5 or MT4, on the other hand, do not provide information about swaps, whether they are charged or not. It's like suddenly reducing profits or adding pending losses or vice versa.

Reese

Nov 1 2022

Does swap rate impact short-term traders?

Juan Don Sanchez

Feb 16 2023

Reese: This will have an impact if your transaction remains open until the server time change date. if you mean that short traders are style day traders, scalpers and day traders, then that won't affect the trade itself unless you trade close to the change of day.

However, if you mean short-term traders who trade for a few days, the swap fee rate will be calculated based on the time that has passed since you opened your position. And if your entry trade is opened on Wednesday, you will receive three times the swap rate fee. So be careful and keep an eye on the swap rates, and prepare extra deposits to accommodate potential floating losses

Reuben

Nov 6 2022

Are there swap fees in the futures markets?

Irwin

Feb 16 2023

Reuben: Yes, at the broker, all instrument trades will receive a swap fee. It could be Forex, trading metals, commodities, indices, cryptocurrencies, stocks or even futures. There is no way to avoid swap fees unless you open a swap free account or make short term trades for less than a day, scalping and day trading. But don't trade near the closing of the day because you can get swap fees if your trading position still opened.

To check detailed information about products that can receive exchange fees, you can visit the broker's website and search for detailed information on assets that can receive exchange fees.

Carl

Jan 16 2023

how can we possible to earn money if I trade with swing trading style. I mean if loss almost $50 for 5 days because of swap rate, I need to hold longer my position in order to hope can make my profit and it is hard for me to do that since my funds also limited. And i am curious about the swing trader, how can they profit from that if the swap rate also very expensive. And don't forget about the commissions and spreads too. I hope I have the answer because I still find trading style that suits to me.

Martin

Jan 16 2023

Dude, swing trading is harder than you think if you're funds are not enough to do the trade. In swing trading, the target number of pips a trader wants is a larger target than in day trading. If day trading requires 100 pips to 200 pips, swing trading needs more to get more profit. As usual, swing traders will look for trading accounts with fixed spreads and a small commission to minimize fees, especially swap rate fees.

Since his target is 200+ pips, the profits that he can get maybe more than $200 on standard account e.g., if they hold for 3 days, he can pay out only $24 if conditions are similar to the article's example.

Note: if you want to be a swing trader, you need more funds to cover your floating losses and avoid margin call. The more money, the better.

Carl

Jan 16 2023

Martin: If you said so about the swing trading`s condition and the funds that needed are high. What about the strategy itself? do you have any suggestions for a swing trading? And the technical indicator that i can use for swing trading as I think forex trading also needs technical analysis and fundamental analysis. If you have any examples, I would appreciate it! Thank you!

Martin

Jan 16 2023

Carl: Of course, you also need trading indicators and fundamental analysis! I have an indicator you can use! Below you can read some articles on swing trading strategies and indicators :

These indicators are most common used in trading. It is very to use and I think it is suuitable not only for swing trading but also other trading style but of course with different setting. And also don't forget about the fundamental analysis too! With the combination, you can predict the market more accurate!

Gerald

Jan 16 2023

For swap-free trading accounts, I believe there may be other fees beside spread and commission. Basically, swap rates are paid by brokers, it can't be avoided because all the currencies in the world have its own rate. So, because of that swap free traders won't receive swap rate fees, but have to pay more for trading spreads, commissions, and even registration fees. Whether you used a swap-free trading account or not, money management is really necessary if you want to trade swing trading style or position trading. Because these two types of trading require very large funds to do it on hold. than 100 pips. It also means that trading with this style of trading is riskier! (Read the details of swap-free account at here Islamic account)

Honoka

Mar 9 2023

What other fees or charges (including swap fee) should traders be aware of when trading on Exness, and how can they calculate the total cost of their trades including all fees?

Haston B

Mar 9 2023

@Honoka:

In addition to swap fees, traders on Exness should also be aware of other fees and charges that may impact the total cost of their trades. Some of these fees include commission charges, deposit and withdrawal fees, and inactivity fees (fortunately, Exness doesn't charge inactivity fees, like Oanda)

Exness offers commission-free trading for most account types, but some accounts may charge a commission per lot traded. Traders should check the specific terms of their account type to understand any commission charges that may apply.

Deposit and withdrawal fees vary depending on the payment method used, and traders should check the Exness website for the latest fee schedule. Inactivity fees may also apply for accounts that have been inactive for a certain period of time.

To calculate the total cost of their trades, traders can use the Exness calculator tool, which takes into account the spread, swap fee, and any other applicable fees. This tool can be accessed through the Exness trading platform or on the company's website.

It's important for traders to factor in all fees and charges when calculating the total cost of their trades, as these costs can impact their profitability and overall trading performance. By understanding the various fees and charges associated with trading on Exness, traders can make more informed trading decisions and manage their risk more effectively.

Sam

Mar 16 2023

Regarding the swap account offered by Exness, do we need to contact customer service to open it? I have read about how to open Islamic accounts with other brokers, but I am not sure about the steps required for Exness.

Furthermore, I have heard that swap-free accounts or Islamic accounts may not always be completely free of fees. Some brokers may charge higher spreads or commissions for trading with such accounts. In the case of Exness, what are the exchange fees if I activate a swap-free account? Thank you! Wait for the explanation!

Boris

Mar 16 2023

To get an Islamic or swap-free account with Exness, you just need to reach out to their customer support team and ask for it. They'll walk you through the process of converting your account.

As for fees, Exness doesn't charge extra fees or commissions for their swap-free accounts. However, the spreads (the difference between buying and selling prices) might be a little higher on swap-free accounts. This is because the broker has to cover their costs of financing positions that are held open overnight without charging interest.

Just keep in mind that the difference in spreads can vary depending on the currency pair you're trading and other factors, so it's always a good idea to check the current spreads and fees for your specific account type and currency pair before making any trades.

Herry

Mar 16 2023

About the sap fees itself. Actually I understand little bit. If the long swap is at -5, and the short swap is af 2, if you trade with long position, you will get charged by -5 point and with short position, you will get 2 point. I mean, all of this swap can be occured if we still have active position overnight. As the article said, how to count and so on explained very well. BUt I still dont understand one thing. The example of the count in the article showed us 1 lot trading. How about trading at 0.01 lot with the same rate at -0.86852 and opened at Tuesday clsoed at Thursday. What ammount that I needed to paid?

John

Mar 16 2023

I can help clarify your question about swap fees. If the long swap rate is -5 and the short swap rate is 2, this means that if you hold a long position overnight, you will be charged -5 points and if you hold a short position, you will receive 2 points. The swap fees only apply if you hold an active position overnight. If you trade with 1 lot, you will paid $5 or get $2. But if you trade with 0.01 lot, the swap that you will paid is at $0.05 and you will get $0.02 if you open the short position.

Regarding your specific example of trading 0.01 lot with a swap rate of -0.86852 and opening on Tuesday and closing on Thursday, to calculate the swap fee, just follow the article instructions.

Assuming a lot size of 0.01 and a swap rate of -0.86852, you can use the following formula to calculate the swap fee for a currency pair:

Swap Fee = Lot Size × contract size x pip size × swap rate x Number of Nights

In your example, you held the position overnight from Tuesday to Thursday, which is a total of 5 nights. Plugging in the values, we get:

Swap Fee =1000 x 0.0001 x -0.86852 x 5 = -$0.43

Herry

Mar 16 2023

Now I understand why the lot size in the formula mentioned in the article is 100,000. It's because of the trading volume size. The swap fee charged is based on the pip value of the currency pair. Therefore, the larger the trading volume, the higher the swap fees will be. However, if we trade with a smaller volume like 0.01 lot, the swap fee charged will also be lower since it's based on the trading volume entered. In other words, the calculation of the pip value for the swap rate is similar to how we calculate the spread amount. Thank you for providing an example and explaining it to me.

Jerry

Apr 14 2023

Some brokers, including Exness, have Islamic swap-free accounts that do not charge forex swaps to positions held overnight. This account is applied automatically and is only available for Muslim traders who live in Islamic countries.

Hey, I just realized that we can't use the swap-free account on Exness if we're not domiciled in an Islamic country. What about other Muslim traders who are not in Islamic countries? Is there any solution other than not using Exness? I mean, Exness is a really good broker and it's regulated by a top-tier regulator in Australia. The conditions and terms offered are also fair, in my opinion.

Liam

Apr 14 2023

@Jerry: Yes, it is true that Exness only offers a swap-free account option for traders who are domiciled in Islamic countries. This is because the swap-free account follows the Islamic principles of finance, which prohibits the charging or earning of interest. However, for Muslim traders who are not domiciled in Islamic countries, there are still other options available.

The only option that can be used is to use regular trading accounts and simply avoid trades that involve interest, known as "Riba" in Islamic finance. Some brokers also offer educational resources to help traders who wish to avoid interest-based trading. The trading such as short-term trading may help them to avoid Riba because the trading be done before changing day.

Urashini

Jun 9 2023

When it comes to opening an Islamic or swap-free trading account, it's important to consider the fees and charges associated with such accounts. While these accounts do not involve swaps, there may be other fees in place. In the case of Exness Markets, they offer an Islamic account option called Exness Islamic. However, I'm curious to know more about the fees involved.

Could you provide details about the fees associated with the Admiral Islamic account? Specifically, I'm interested in understanding if the fees for this account are higher compared to their regular accounts. Are there additional fees such as administration fees and financial fees that apply to all Exness accounts? It would also be great to know the starting point of these fees and if they are advantageous for traders.

Gabriella

Jun 10 2023

Hey there! When it comes to the Islamic account offered by Exness, you won't have to worry about those pesky swap fees. Instead, they've got this thing called administration fees in place. These fees are there to keep things in line with the whole interest-free concept in Islamic trading.

So, here's the deal. The administration fees in the Islamic account are based on a fixed percentage that's applied to any open positions you hold overnight. The exact fees might vary depending on what you're trading and what the market conditions are like at the time.

But hey, remember that there are other regular trading costs to keep in mind too. Things like spreads, commissions, and any possible deposit or withdrawal fees. These expenses are pretty much similar to what you'd find in any other trading account.

Ivan

Jun 11 2023

"Instead of swaps, there is a fixed administration fee for any position that`s held open for more than three consecutive nights."

What we can conclude from the above sentence is that swap or rollover fees may be charged as an extra charge if the trade is opened for his 3 nights in a row. Why would a broker charge us for this kind of swap? As I know, the swap fees itself sometimes can be very high fees too and sometimes it is hard to gain profit from the swap.

Ruud

Jun 12 2023

This is because the swap rate calculates Wednesday's triple times. As stated in the first paragraph of the article, brokers must request swaps to maintain overnight positions.

In fact, the condition for opening trading on the forex spot market is two days before the actual settlement date. Deals closed on Thursday have a value of Monday. Transactions made on Friday will be applied on Tuesday. On Wednesdays, the rollover amounts are tripled to balance out the upcoming weekend (due to trading breaks on weekends, rollovers are not calculated during this period).

and in the swap-free account, Wednesday will be the day that they charge 3 times fee too

Victory

Jun 13 2023

How to calculate swap ? For example, I sell XAUUSD from the table at 1.01 dollars for 1 lot, if I keep the position open for up to 4 days, will the fee be 4.04 dollars?

On the other hand, if I Buy XAUUSD from the table it says -10.01 dollars for 1 lot. if i keep the position open for 4 days, it will be -40.04 dollars? Does this mean that when I sold I made a profit of 4.04 dollars, when I bought I lost -40.04 dollars?

That's my confusion. I am a day trader who never trades for more than 4 hours, if I trade overnight, are my calculations correct? Please correct me if I'm wrong. Thank You

Ukrain

Jun 14 2023

Swap fees for each currency pair at each broker may be different. However, you can find out how much swap there is in each currency pair by looking at the detailed contract specifications. If you see a positive swap rate for a currency pair, then you will gain additional profit from the positive swap that has been set. However, if you see a negative swap rate, it means that you have to pay the negative swap that has been set.

According to me, your calculations are correct. and Yes it is if deposited after broker closing hours. In addition, most brokers implement 3-day swaps on Wednesdays. This means that interest on Wednesday-Thursday is calculated 3 times because Saturday and Sunday there is no interest anymore, so the total in a week is 7 times interest.

Kise Ryota

Sep 8 2023

What I learned in this article is that there is a way to make a profit from swaps by carrying out trades. How can Carry traders be profitable? Can you explain it in a discussion that is easy to understand because I am still too cloudy about the world of trading? Another question, is there no risk in applying this method in trading? thankyou

Sammuel

Sep 9 2023

First, the easy part - to do a carry trade, you borrow in a country that offers low-interest rates (for the past few decades Japan has been a favourite) and invest in a country that has high interest rates (like Australia currently). You collect a higher interest rate and pay a lower interest rate, so you earn the difference. However, at that time, currency exchange rates may change and you may lose money.

If we think about this in a different way, if things were running efficiently, the interest rate differential would actually be a market price against the future exchange rate. So, if the interest rate in Australia is 4% and in Japan it is 0.1%, then the value of the Australian dollar vs. the Yen will fall by 3.9% in the next year. In fact, there is a market called the bank forward market that determines the price of future exchange rates, and this is indeed the price you are seeing. If the forward market price were anything else, then there would be strict arbitrage, which a carry trade is not. A carry trade is probably best thought of as a trade that bets against this 3.9% drop actually happening. Historically, this has worked quite well. I offer several theories about why.

Read : The Best Brokers for Carry Trade

First, the cash savings market is dominated by people and companies who hold cash in their local currency, not because that currency pays them the most interest, but because it is more convenient because their liabilities tend to also be in their local currency. Merchant carry is just a small drop in the ocean of bank deposits. So, if no one is chasing a higher exchange rate, this could be out of sync with the exchange rate they predicted.

Second, central banks change interest rates artificially, and this is largely based on domestic economic pressures. These interest rates are not determined by the borrowers and lenders who need the currency now or in the future - those players are just playing along, and making some money from pricing errors is not difficult. Central banks move interest rates in ways that suit their domestic objectives but allow currency forward pricing to be imprecise, and currency markets are large enough that such pricing persists over long periods of time.

The problem with the loss might be due to the uncertainty of the exchange rate, in my opinion, it's not too much of a problem. The benefits are also more.

Ali Gatie

Sep 10 2023

I just want to add an explanation regarding the risks that traders who use the Carry Trade method will face because this cannot be considered easy in my opinion. The problem with carrying trades is exchange rate uncertainty. Rapidly changing forex exchange rates make it important for a trader to consider more than just interest rates in carry trades. The directional trend of the pair should also be considered as a move in the wrong direction can easily wipe out profits made from interest rate differentials in a carry trade. That means big losses can occur even when traders make money from interest rate differences.

In my opinion, this is quite a big risk because we cannot prevent currency fluctuations. The high level of leverage used in carry trades means that even small exchange rate movements can result in large losses if the trader fails to hedge his position appropriately.

Negative market sentiment among traders can have a quick and severe impact on carry pairs. Without adequate risk management, a trader's account can be wiped out suddenly and brutally. The best time to enter a carry trade is when fundamentals and market sentiment support it. For this reason, carry trading is only a good option for traders with a high-risk appetite.

Maggie

Sep 13 2023

This account appeals to traders who avoid interest fees and hold positions overnight, but some may find its limited instrument options unsatisfactory. Exness offers both swap-free and Standard accounts, which are similar in fee structures.

Which one do you think is better? Any insights on their differences?

Janne Medusa

Sep 14 2023

Swaps occur when trading positions are held past midnight, with fees calculated from bank interest rates. Swap-free accounts waive these charges, making them preferable for some Muslim traders due to religious beliefs.

However, others may avoid them to prevent potential profit loss. Exness offers both swap-free and standard accounts, with commission-free trading and identical lot order sizes. While swap-free accounts are suited for those averse to interest-based fees, standard accounts offer a wider range of trading instruments and a comprehensive platform.

Kushina Till

Sep 20 2023

I have been interested in cryptocurrencies for a while and coincidentally, I read this article and found that both Exness Markets offer interesting features. However, both of them are actually forex brokers, right?

When talking about brokers, it usually means there are swap fees if I'm not mistaken. The article didn't mention the swap fees that may occur in CFD assets. I mean, I have encountered many CFD assets such as forex, metals, and even indices that have swap fees. If possible, could you let me know if cryptocurrency CFDs have swap fees too?

Also, can crypto swaps have their own interest rates? Additionally, regarding the charts, do cryptocurrency CFD charts and cryptocurrency exchange charts have the same graphics and chart formats?

Akashi Joi

Sep 21 2023

when it comes to trading cryptocurrencies with brokers like Exness, it's important to keep in mind that these guys are primarily forex brokers. That means that when you're trading crypto through CFDs, there could be swap fees involved.

Now, as for cryptocurrency CFDs specifically, swap fees can vary depending on the broker and the specific asset you're trading. Some brokers might offer better swaps for long positions, while others might be more favourable for short positions.

Oh, and speaking of interest rates, the swap rates for cryptocurrency CFDs can be influenced by things like supply and demand, market sentiment, and interest rate differentials.

Now, when it comes to charts, you might notice that the graphics and formats for cryptocurrency CFD charts and cryptocurrency exchange charts can be a bit different. While they both show things like price and volume, they might have different designs and layouts depending on which platform you're using, but the source is the same after all.

Barack

Sep 22 2023

You are correct that Exness is primarily a forex broker, but they also offer trading in a variety of other assets, including cryptocurrencies, through CFDs (Contracts for Difference). When it comes to trading cryptocurrencies through CFDs, it's important to note that some brokers do charge swap fees, which are essentially the cost of holding a position overnight.

In the case of Exness, it's best to check their individual websites or speak with a customer service representative to get the most up-to-date information on their swap fees for cryptocurrency CFDs.

Regarding interest rates for crypto swaps, it's possible for different cryptocurrencies to have their own interest rates, just like with traditional currencies. This can be influenced by a variety of factors, such as supply and demand, market sentiment, and overall market conditions.

As for charts, the graphics and chart formats for cryptocurrency CFDs and cryptocurrency exchanges can vary depending on the specific platform being used. However, both types of charts generally display similar information, such as price data and technical indicators, to help traders make informed trading decisions.

Axel Gustav

Sep 24 2023

What are the specific terms and conditions of an Exness Swap Free Account, and how does it differ from their standard trading accounts

What are the potential benefits and drawbacks of choosing a swap free account, and how might this impact traders' overall trading costs and profitability?

How might traders with different trading styles, such as long-term investors or high-frequency traders, be affected by the limitations of a swap-free account?

Sangsoo Lee

Sep 25 2023

Interested in the Exness Swap Free Account? Here's the lowdown: tailored for traders adhering to religious practices prohibiting interest transactions, it waives swap fees on overnight positions. While it's fee-free, note its wider spread, affecting overall trading costs. Also, not all instruments are available, so check availability. Depending on your style, it may suit long-term investors or those relying on overnight strategies, but not high-frequency traders.

Lince

Nov 18 2023

It gets pretty intriguing in this article that delves into the swap fee guide provided by Exness. The article breaks down the ins and outs of swap fees, offering a comprehensive A-to-Z explanation. It not only shows us how to calculate these fees but also reveals opportunities to benefit from them.

One particularly interesting term highlighted is "carry trade," which the article suggests is a way to gain benefits from swap fees. Notably, Exness allows traders to engage in carry trade without imposing any restrictions. This opens up the possibility for Exness clients to profit from differences in swap rates across their trading instruments. Now, I've got a couple of questions: What exactly is carry trade? Is it as straightforward as reaping benefits from swap fees? And on a final note, what are the risks associated with carry trade? Appreciate the insights!

Joyce

Nov 22 2023

Let me answer your question! Carry trade is a trading strategy where an investor takes advantage of the interest rate differential between two currencies. In the context of swap fees, carry trade involves borrowing money in a currency with a lower interest rate and using it to invest in a currency with a higher interest rate. Traders aim to profit from the interest rate differential and the associated swap fees.

In simpler terms, carry trade is not just about gaining benefits from swap fees; it's a strategy that capitalizes on the interest rate variations between currencies.

As for the risks of carry trade, they primarily revolve around currency exchange rate fluctuations. If the exchange rates move unfavorably, it can offset the gains from the interest rate differentials, leading to potential losses. Additionally, economic and geopolitical factors can influence currency values, introducing an element of risk to carry trade strategies. Traders engaging in carry trade should carefully monitor market conditions and be aware of potential risks associated with this approach. (read more about carry trade : Carry Trade In Forex Trading)

Galuh

Nov 29 2023

The information indicates that Exness permits traders to engage in carry trading without imposing any restrictions. This enables Exness clients to potentially profit from differences in swaps related to their trading instruments. I have a clear understanding of what carry trade involves, emphasizing the pursuit of profit through swap differences. My question is, how effective is carry trading compared to conventional trading in terms of gaining profit? Additionally, is it suitable for beginners to adopt a carry trade approach?

Haytam

Dec 2 2023

Engaging in carry trading on Exness, where there are no restrictions on such practices, can offer opportunities for traders to capitalize on swap differences in their trading instruments. Carry trading involves seeking profits from variations in swap rates. The effectiveness of carry trading compared to normal trading depends on various factors, including market conditions, the specific instruments traded, and the trader's risk tolerance.

Carry trading can be effective in certain market environments, especially when there are clear interest rate differentials between currency pairs. However, it comes with its own set of risks, including market volatility and unforeseen events impacting currency values.

For beginners, it's important to approach carry trading with caution. While it can be a profitable strategy, it requires a good understanding of market dynamics and risk management. Beginners should thoroughly educate themselves on carry trading principles, monitor market conditions closely, and start with small positions to gain experience without exposing themselves to excessive risk.

Alex

Dec 21 2023

It's mentioned that Exness permits traders to engage in carry trading without imposing any restrictions. This enables Exness clients to potentially profit from the differences in swaps within their trading instruments.

Hey, I have a question regarding carry trading. Firstly, is it applicable in the Free Swap Account? Additionally, is carry trading considered forbidden (haram) for Muslim traders? Secondly, are there brokers that prohibit carry trading, and if so, what are the reasons behind such restrictions? Thanks!

Ospina

Dec 24 2023

Regarding your questions:

Free Swap Account: The suitability of carry trading in a Free Swap Account would depend on the specific policies of Exness. You may want to refer to their terms and conditions or reach out to their customer support for detailed information on the use of carry trade in such accounts.

Consideration for Muslim Traders: Whether carry trading is considered haram for Muslim traders depends on individual interpretations of Islamic finance principles. It is advisable for Muslim traders to consult with a qualified Islamic scholar or financial advisor who can provide guidance based on their personal circumstances and beliefs. But in general, any trade or activities that involved with "rate" considered haram. (read : Introduction to Islamic Account in Forex Brokers)

Prohibition by Brokers: While Exness allows carry trading, some brokers may have restrictions or prohibitions based on their own policies. The reasons behind such restrictions can vary and may include risk management considerations, compliance with regulatory requirements, or the broker's business model. It's recommended to review the terms and conditions of specific brokers or contact their customer support for detailed information on any restrictions related to carry trading.

Hope it can help!

Herman

Dec 26 2023

Hello! I'm curious to learn more about Exness' swap-free account mentioned in the article. It's mentioned that if a client is found to have abused the swap-free status, Exness has the right to cancel it and apply swap charges for current and future orders. I'd like to understand what specific activities or behaviors could lead to the cancellation of swap-free status by the broker. Ensuring that I trade fairly and comply with the broker's rules is important to me, so any insights on this matter would be appreciated!

Hans

Dec 30 2023

To maintain the swap-free status on your Exness account, it's crucial to adhere to the broker's terms and conditions meticulously. Exness reserves the right to cancel the swap-free status if any abuse or misuse is detected. Activities that might lead to the cancellation include engaging in arbitrage, which exploits price differences between different brokers or markets, or implementing hedging strategies specifically designed to take advantage of the swap-free status. Any violation of the broker's policies, intentional or not, could trigger the removal of swap-free benefits. It's advisable to thoroughly understand and comply with Exness' rules governing swap-free accounts to ensure fair and transparent trading practices. If there are any uncertainties about specific activities, seeking clarification from Exness' customer support is a prudent course of action to avoid inadvertent rule violations.

Anna

Jan 18 2024

The article mentions that the specific timing for the swap fee application to your live account varies among brokers. While many brokers typically apply swap fees around midnight, Exness, in contrast, imposes these fees at 22:00 GMT+0 daily except for weekends, continuing until the position is closed.

I have a couple of queries in this regard. Firstly, for brokers that commonly impose swap fees around midnight, is it preferable, or are there potential advantages to selecting a broker that charges before midnight? Secondly, concerning weekends, does the swap fee still apply during this period?

Phil

Jan 22 2024

Bellison

Feb 24 2024

Can you explain to me more about this.

In the article, it stated that we need to keep in mind that if a client is found to have abused the swap-free status attached to their accounts, Exness may cancel the swap-free status on the account and start applying swap charges for any open orders as well as orders opened in the future.

I want to know the example of the action that makes us canceled in swap free account.

Imelda

Feb 27 2024

I'd be glad to provide further clarification on the circumstances that could lead to the cancellation of a swap-free account status. Essentially, Exness stipulates that if a client is discovered to be exploiting or misusing the swap-free status associated with their account, the company reserves the right to revoke this privilege. Such exploitation or misuse could encompass actions such as engaging in excessive trading solely to avoid swap charges, or deliberately holding positions for extended periods under the guise of adhering to Islamic finance principles while actually seeking to circumvent swap fees. Additionally, if a client is found to be conducting activities inconsistent with the intended purpose of a swap-free account, such as using it for speculative purposes rather than genuine adherence to religious beliefs, Exness may opt to terminate the swap-free status on the account. In such cases, the company would then commence applying swap charges for any existing open orders, as well as for future orders. Therefore, it's imperative for clients to utilize swap-free accounts in a manner consistent with the principles of Islamic finance and in good faith, avoiding any actions that could be perceived as exploiting or abusing the privilege of having a swap-free account. Hope you can understand about that!

Jordi

Apr 25 2024

It's mentioned that occasionally, swaps are charged for holding positions over the weekend. With Exness, the swap amount is tripled on Wednesdays (or Fridays for Energies) after a few days, aiming to compensate for the upcoming weekend when swaps aren't applied.

I'm curious about the rationale behind this tripling of swap rates. It seems like a hefty fee, especially for traders with positions open during that time.

Vito

Apr 27 2024

The reason behind tripling the swap rates on certain days, like Wednesdays or Fridays for Energies, by brokers like Exness is to account for the upcoming weekend when swap fees aren't typically applied. This adjustment aims to ensure fairness and balance in the charging of swap fees over extended periods, including weekends, when market activity may differ.

While it may seem like a significant increase in fees, especially for traders with open positions during those times, it's important to consider the rationale behind it. Ultimately, it's part of the broker's policy to manage and compensate for the lack of swap fees over weekends, ensuring consistency and fairness in their trading conditions.