Exness Tick History Report is a valuable tool to access historical tick data across diverse financial instruments. Here's how to use it.

Exness is one of the most trusted brokerage companies that provide online trading services for several instruments, including currencies, commodities, stocks, and indices. The multi-regulated broker provides various features that uphold the principle of transparency, one of which is the Tick History feature.

In financial markets, a tick represents the smallest possible price change for a given asset. Tick data typically includes the price at which a trade was executed (bid and ask), the time of the trade (timestamp), and sometimes additional information such as the trade volume.

As such, Exness Tick History is an archive of tick movements for a selected trading instrument during a specified time period. Exness clients can use this data to perform detailed analysis, backtest trading strategies, and make more informed trading decisions. Furthermore, comparing the tick history to trading history can assure that there were no hidden costs and that orders were executed at the expected price.

This article provides a tutorial on how to get and use Exness Tick History. Let's take a look!

How to Download Exness Tick History Report

The Exness Tick History Report can be easily accessed on the Exness official website. Traders can download tick history for a specific time period and read it on their personal computers or smartphones. The following steps will guide you on how to download the tool:

- Ensure you have a real account with Exness. If you don't have one, you can easily register for an Exness account.

- Log in to your Exness account.

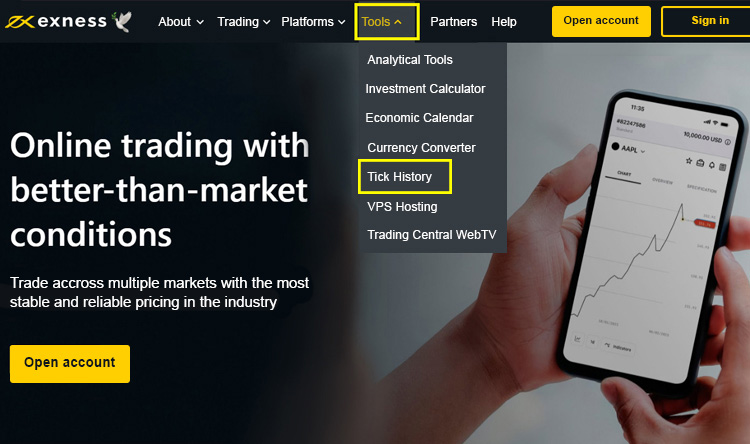

- Locate the Tools option in the header section and click on Tick History.

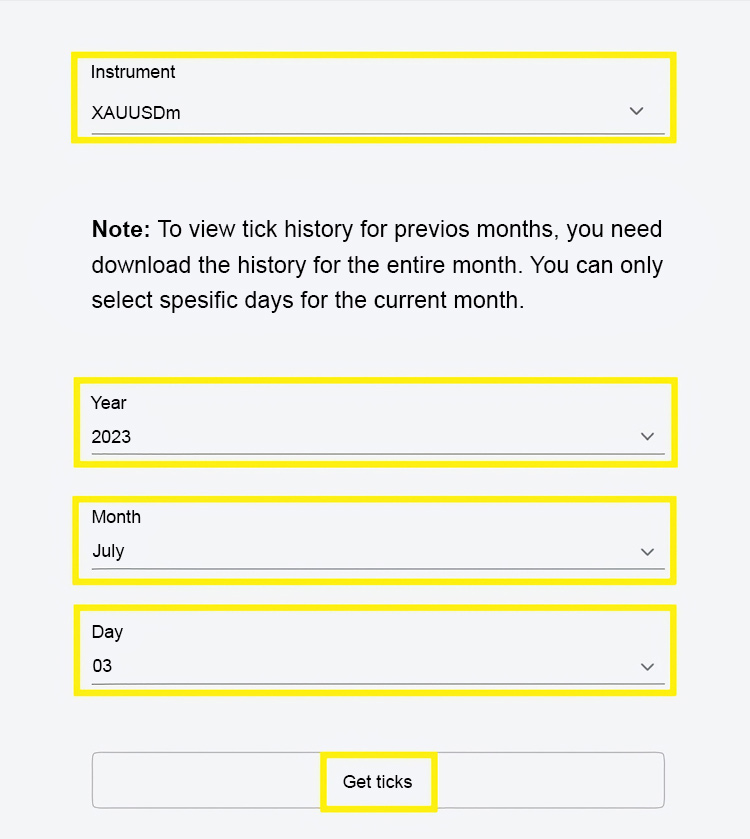

- Choose the specific instrument for which you want to download the tick history.

- Set the desired year, month, and day for the data you wish to download, then click on the Get ticks option.

- Your browser will initiate the download of the tick history file in either .zip or .rar format.

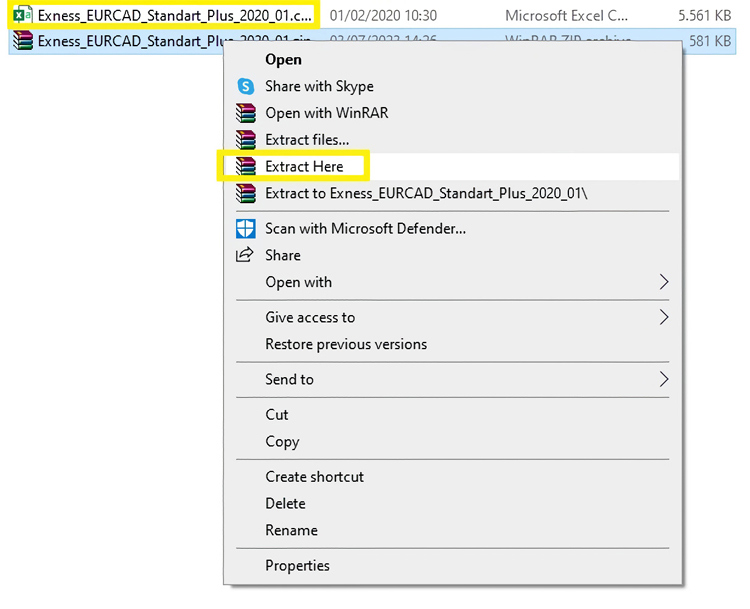

- To access the tick history report, you need to extract the file. Right-click on the downloaded file and select "Extract Here."

- A CSV file will be generated, and you can view the tick history data using Microsoft Excel (Windows) or Numbers (Mac).

How to Read Exness Tick History Report

After successfully downloading and opening the file, it's time to read the data. A tick history file contains all ticks for a specified time period in the format "Exness", "Symbol", "Timestamp", "Bid", and "Ask". Here's an explanation of each format:

- The "Exness" label indicates the source or platform from which the tick data was obtained.

- The "Symbol" field specifies the trading instrument or currency pair for which the ticks were recorded, such as EUR/USD or GBP/JPY.

- The "Timestamp" column denotes the precise time at which each tick occurred, allowing you to observe the chronological order of market events.

- The "Bid" and "Ask" columns represent the bid and ask prices at each timestamp, respectively. The "bid" price indicates the maximum price a buyer is willing to pay for the instrument, while the "ask" price represents the minimum price at which a seller is willing to sell.

Example:

exness,"EURCAD_Standart_Plus","2020-01-29 00:00:04.259Z",1.45085,1.45114

From the tick history data above, the following are the identification results and the breakdowns:

- Symbol: EURCAD_Standart_Plus

- Timestamp: 2020-01-29 00:00:04.259Z

- Bid: 1.45085

- Ask: 1.45114

If you want to search for a certain tick or order, it is advised to look at the timestamp, which provides the exact date and time, and compare it to your trading history.

Who Could Use the Exness Tick History Report?

This data can be useful for a variety of individuals and entities involved in financial markets. Here are some examples of who should find value in using Exness Tick History Report:

- Traders and investors: They can utilize the report to analyze past price movements, market trends, and liquidity conditions. By studying the tick data, they can gain insights into the behavior of specific trading instruments, identify patterns, and make more informed trading decisions.

- Algorithmic traders: Algorithmic or quantitative traders who develop strategies on historical data can use the Exness Tick History to backtest and optimize their algorithms, fine-tune parameters, and assess the performance of their strategies under various market conditions.

- Market researchers: Professionals involved in market research, financial analysis, or academic research can use the tick history report to study price dynamics, market microstructure, and the impact of economic events on various instruments.

- Regulators: Regulatory bodies and compliance officers may require access to tick history data for market surveillance, monitoring, and enforcement purposes. Tick data can be used to investigate market manipulation, identify irregularities, and ensure fair and transparent trading practices.

Final Words

The Exness Tick History Report is a valuable tool that aligns with Exness' commitment to transparency as a trusted broker. This feature enables traders, investors, market researchers, and regulatory officers to effortlessly access and analyze comprehensive historical tick data across diverse financial instruments.

By utilizing the tick history report, users can gain valuable insights into price movements, market trends, and liquidity conditions within a specified time frame. This information empowers them to make well-informed trading decisions, develop effective strategies, and conduct thorough market research.

Exness is a forex and CFD brokerage that serves clients to trade across multiple markets with the most stable and reliable pricing in the industry. Their features include spreads as low as 0 pips and maximum leverage of 1:unlimited.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

10 Comments

Milner

Jul 17 2023

Hey there! So, I stumbled upon this interesting article about Exness Tick History, and I couldn't help but wonder how it could actually benefit me as a trader. Have you heard of it? Apparently, it's an archive that keeps track of the smallest price changes for various trading instruments.

According to the article, tick data not only includes details like the bid and ask prices, but also the trade execution time and even trade volume. It got me thinking, how can this information from Exness Tick History enhance my trading strategies? Can I use it to perform detailed analysis and fine-tune my approach?

Pandu Suryo

Jul 18 2023

Exness Tick History is pretty cool, dude! It's like an archive that keeps track of even the tiniest price changes for different trading instruments. So, it's not just about bid and ask prices, but it also includes details like when the trades happened and how much volume was involved.

Now, here's the exciting part: all this information can actually boost our trading strategies! With Exness Tick History, we can dive deep into analyzing the market movements. By studying those tiny tick-by-tick changes, we can spot patterns, trends, and find the perfect moments to enter or exit trades. It's like fine-tuning our approach to trading, making it more precise and calculated.

But wait, there's more! The trade execution time and volume data in Exness Tick History are total game-changers. We can use the timestamps to figure out the best times to trade, when the market is buzzing with action or when it's a bit more chilled out. And the trade volume? It gives us a sneak peek into market liquidity and how intense the trading activity is. It's like having insider knowledge, man!

So, by tapping into Exness Tick History, we can take our trading skills to the next level. We can analyze the market in a more detailed way, make smarter decisions, and hopefully, improve our overall performance. It's like having a secret weapon in our trading arsenal, dude. Totally worth checking out and incorporating into our trading routine! Just follow the step in the article to get the Tick History!

Vincentius

Jul 19 2023

I disagree with you, bro! Sure, Exness Tick History gives us all these nitty-gritty details about price changes, execution time, and volume. But here's the thing: trading is a complex game, my friend. It's influenced by a bunch of factors like market sentiment, economic news, and good ol' gut instincts. Relying solely on tick data won't give us the full story.

Those tick-by-tick price movements? Sometimes they're just random noise, man. They can make it tough to make any sense out of 'em. And hey, even if we have all this data, the markets can still throw curveballs at us. Tick data won't magically give us the upper hand or predict the future, ya dig?

To make smart moves, we gotta take a broader approach, bro. Consider market trends, do some fundamental analysis, and use technical indicators. It's all about finding that balance, mixing different strategies, and learning to adapt to whatever the market throws at us.

So, while Exness Tick History can give us some insights, we shouldn't put all our faith in it. It's just one piece of the puzzle, man. We gotta use it alongside other tools and approaches to get a well-rounded view of the market and make informed decisions.

Luminto

Jul 17 2023

Hey there! Absolutely, it's mind-blowing how regulators and compliance officers can tap into the power of tick history data for market surveillance and fairness in trading practices. So, with this data at their fingertips, how exactly does it help regulators investigate market manipulation, spot irregularities, and maintain transparency in the trading environment? Can you provide some examples of how tick data empowers regulators to keep a watchful eye on the market and ensure a level playing field for all traders? Thank you!

James

Jul 19 2023

G'day, mate! It's bloody bonza how regulators and compliance officers can use tick history data to suss out any shonky stuff and keep the trading scene fair dinkum. With this ripper data at their disposal, they can really crack down on market manipulation and spot any dodgy business in action. It's like giving them a fair go at keeping things above board, ya know?

For example, regulators can dive into the tiniest price changes, the timing of trades, and even the volume involved. This helps them sniff out any fishy activities and put an end to market manipulation faster than you can say "fair suck of the sauce bottle." They can catch those cheeky buggers trying to pull a swift one and make sure the playing field is level for all traders.

But it's not just about catching out the bad apples, mate. Tick data also helps regulators keep things transparent. They can use it to make sure trades are fair dinkum, the prices are fair as a snag on the barbie, and there's no funny business going on. It's all about giving every trader a fair shake of the sauce bottle, so no one gets left behind.

So, tick data gives regulators the upper hand, mate. It helps them keep a keen eye on the market, give those rule-breakers a boot up the backside, and ensure a fair go for all traders. It's a real ripper of a tool, if you ask me. Cheers, mate!

Andrew

Aug 1 2023

The article mentions that the Exness Tick History Report can be utilized by various individuals and entities involved in financial markets. The data provided can be valuable for traders, investors, and algorithmic traders as they can analyze past price movements, market trends, and liquidity conditions to make more informed trading decisions and optimize their trading strategies. Additionally, market researchers can benefit from studying price dynamics and market microstructure, while regulators and compliance officers may use the tick history data for market surveillance and to investigate potential market manipulation, irregularities, and ensure fair and transparent trading practices.

I am a little bit curious about the market manipulation that was mentioned. So, what are some types of market manipulation that can be investigated using tick data?

Josh

Aug 2 2023

Let me answer your question with simple terms! Market manipulation is when people try to unfairly influence the price or volume of financial instruments in the market. You know, it's like artificially inflating or deflating the price, creating fake trading volume, or using insider information to gain an advantage. In the article, they mentioned that the Exness Tick History Report can be useful for regulators and compliance officers to investigate and prevent market manipulation. By analyzing tick data, they can detect unusual trading patterns, like spoofing or front running, and take action to ensure fair trading practices. It's essential for maintaining market integrity and protecting investors from fraudulent activities.

George

Aug 3 2023

Hey there! Market manipulation refers to illegal practices aimed at artificially influencing the price or trading volume of financial instruments to gain an unfair advantage in the market. Some types of market manipulation that can be investigated using tick data include:

By analyzing tick data, regulatory bodies and compliance officers can detect unusual trading patterns, identify potential instances of market manipulation, and take appropriate measures to ensure fair and transparent trading practices. Monitoring tick data is crucial for maintaining market integrity and protecting investors from fraudulent activities.

Brian

Aug 1 2023

Hey, I trade from an old computer and just realized there is a tick history feature in Exness. Based on the article I have read, we need to download the file and do the extraction process on the computer. I found that the tick history report uses CSV files instead of Excel files. I mean, what if I want to read the CSV file? Can I do it on Microsoft Excel 2003 since I don't have any updates? Will Excel 2003 be able to handle the CSV format, and how can I open the tick history data in Excel?

Hyuga

Aug 2 2023

Hey, no worries! If you're trading from an older computer and have just discovered the tick history feature in Exness, you might be wondering if you can read the CSV file in Microsoft Excel 2003, especially since you haven't performed any updates. Well, the good news is that Microsoft Excel 2003 should be able to read CSV files without any issues! CSV stands for Comma-Separated Values, and it's a simple and widely used file format that Excel has been able to handle for a long time. When you download the tick history file from Exness, it will most likely be in CSV format, and you should be able to open it directly in your Excel 2003 without needing any updates. Just double-click the downloaded CSV file, and it should open up in Excel, displaying the tick history data in a neat table. So, go ahead and explore the tick history report on your trusty old Excel 2003 – happy trading!