Are you trading in eToro or still planning to trade with the broker? Aside from the quality of the platform, eToro withdrawal is an important thing that you need to learn.

You may have heard that trading in the retail forex market is high risk. Using the right broker may not completely eliminate the risks, but it can definitely save you from unnecessary issues and dramas. That is why choosing a broker is arguably the most crucial step that every trader should do in their early trading journey.

One of the easiest ways of knowing the quality of the broker is by checking their withdrawal service. If we take a look at various broker reviews or forums, we may stumble upon complaints about withdrawal issues. Some of them claimed that they've been dealing with the broker for a long time and nothing bad has happened, but suddenly, they couldn't withdraw their funds for some reason. Even though they've tried, they haven't got any response from the company.

Withdrawal issues are the most common problems with brokerage companies. On the other hand, making deposits usually comes smoothly because no one will deny taking your money. That is why it is crucial to check a broker's withdrawal and read the user reviews on that matter before opening an account. Today we will discuss everything you need to know about the withdrawal feature in one of the leading multi-asset platforms, eToro.

In eToro, you're allowed to withdraw from your trading account up to the value of the balance in your account minus the margin used. Please make sure that your available balance is greater than the requested withdrawal amount. If you happen to have some funds invested in open positions, you can free up more funds by closing the positions.

Once they're closed, the company will send the invested amount of the profit directly back to your balance. In addition, eToro doesn't require you to hold any specific amount of money in your account, so it's possible to withdraw the whole balance if you need to.

Keep in mind that the funds should be withdrawn using the same method as your deposit. That means the money will also be sent to the same account that you used to make a deposit. So for example, if you made a deposit via credit card, then your money will be sent back to your card. Also, note that eToro has certain priorities regarding the withdrawal methods. The priority is in the following order:

- Credit card

- PayPal

- Bank transfer

- Crypto payment

So if you are withdrawing via credit card, then eToro will prioritize the process of your request first before PayPal and bank transfers. If you have changed your details since you deposited the funds, then you will have to provide an alternative withdrawal method.

See Also:

How Long Does It Take to Withdraw from eToro?

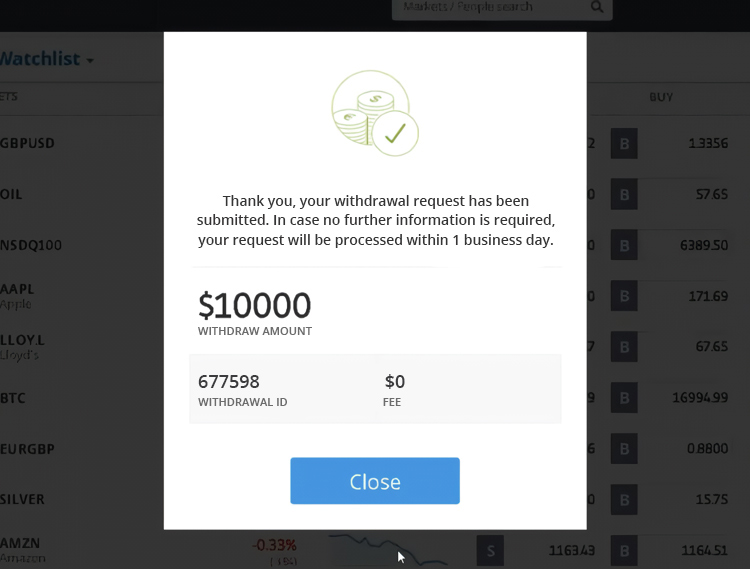

Withdrawal requests usually take up to one business day to be processed, assuming that all of the details on your eToro account are correct and the company has all the necessary information needed. Once the withdrawal is processed, the overall estimated time to receive the funds depends entirely on the payment method you use.

The table below shows the estimated time for each payment method:

| Payment Provider | Timeframe |

| Credit/Debit card | 3-8 working days |

| PayPal | 1-2 business days |

| China Union Pay | 1-2 working days |

| Neteller | 1-2 working days |

| Skrill Limited UK | 1-2 working days |

| WebMoney | 1-2 working days |

| Bank Transfer/Wire Transfer | 3-8 working days |

In case you're withdrawing via bank transfer, it's important to know that large withdrawals may be put on security hold that could cause furthers. Therefore, contact your bank before you make such withdrawal requests.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

Are there any Withdrawal Fees?

Yes, withdrawing requests are subject to withdrawal processing fees. eToro charges a flat fee of $5 for all withdrawals and the minimum amount of withdrawal is $30. You will see the actual fee in a pop-up window after you enter the amount you want to withdraw. Note that you may also be charged extra fees by the funding provider involved in the process (intermediary, receiving bank, or credit card provider). Also, if you wish to withdraw in currencies other than USD, you will be charged a conversion fee. The conversion fee will depend on your chosen currency.

How to Withdraw your Funds from eToro?

In order to take your money from your account, you will need to make a withdrawal request by doing the following steps:

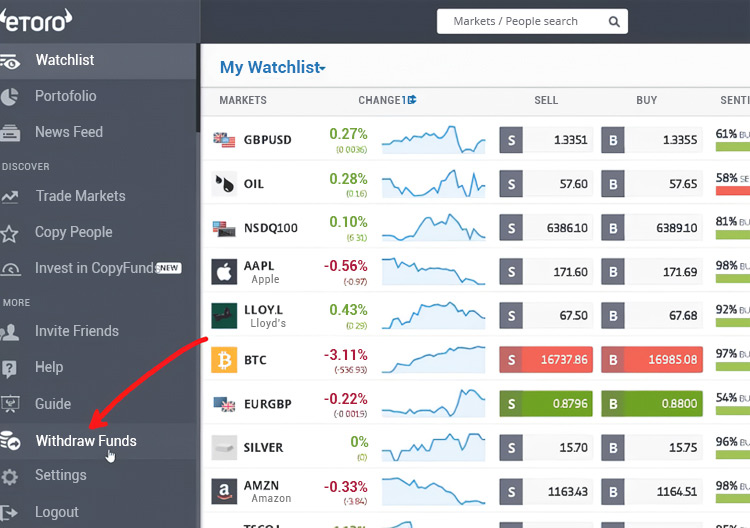

1. Open your eToro account and click "Withdraw Funds" on the left side of the side menu.

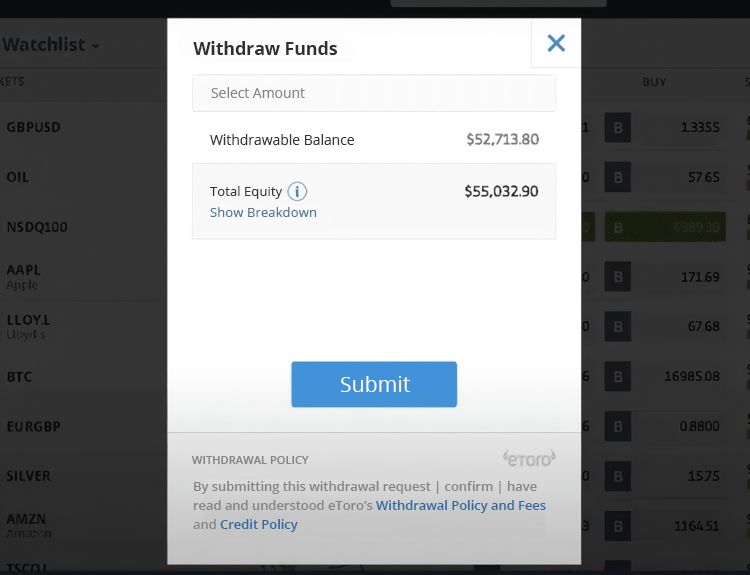

2. A pop-up window will show up, viewing your total balance and the amount of funds that you're allowed to withdraw.

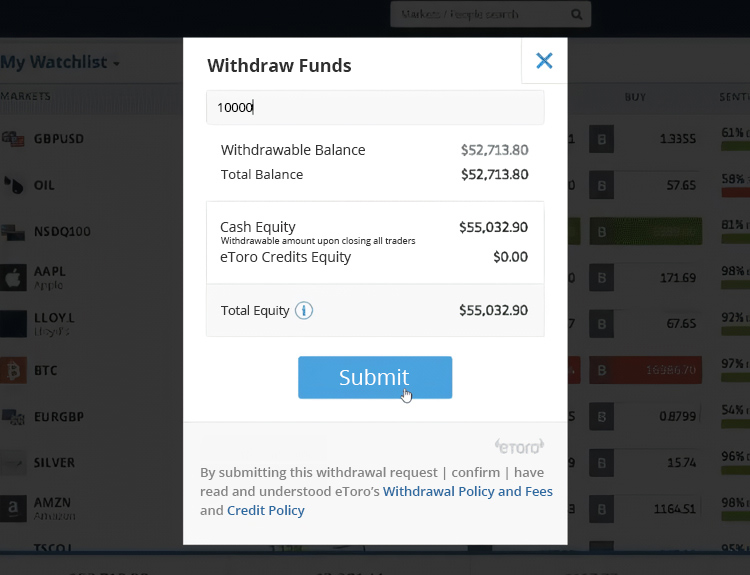

3. Enter the amount that you wish to withdraw (in USD) from eToro and click "Submit".

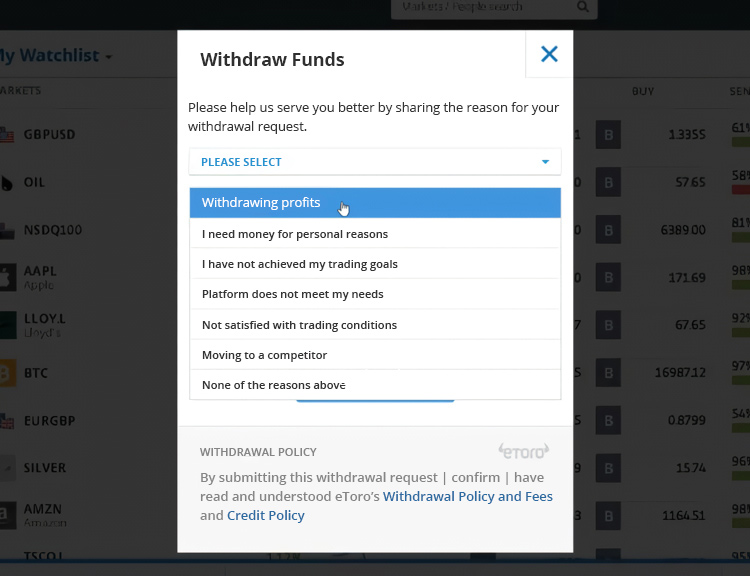

4. Specify the withdrawal reason and click "Continue".

5. Lastly, choose the withdrawal method provided by eToro and click "Submit".

You can stay updated with the status of your withdrawal in the "Portfolio" tab. Once the processing is in order, you will receive a confirmation email with the details of your payment method used to send your money. It's essential to note that eToro fees are subject to change at any time, depending on market conditions.

Is Canceling a Withdrawal Request Possible on eToro?

Yes, you can still change your mind and your withdrawal requests can be canceled when it's still being reviewed by the company (the withdrawal status is "Under Review"). You can cancel the withdrawal request by following these steps:

- Log into your trading account and click the "Withdraw Funds" tab on the side menu.

- A pop-up message will appear. Press the "Click Here" link to see your withdrawal history.

- Click the Reverse button on the withdrawal that you wish to cancel.

- Confirm the cancellation.

Once you successfully cancel the request, your funds and any charged fees will be immediately returned to your account. However, if the withdrawal status is already "In Process", then it won't be possible to cancel the request. If this happens, you would need to directly contact eToro for help.

Withdrawal Delays and Issues

If you haven't received the funds in your account even after the withdrawal request has been processed, then you should take into consideration the processing and payment times. The reason is that each payment method has a different processing time; some can take a total of up to 8 business days. Also, don't forget that eToro needs at least one business day to process your withdrawal request.

If you are still worried, you can check the status of your withdrawal by following these steps:

- Click on the Portfolio tab.

- Click on the History tab.

- Check to see which payment method your funds were sent.

Alternatively, you can also check your email inbox for a confirmation message that eToro would send when your request is in process. Other than that, keep in mind that public holidays can also cause a in your payment, so make sure to check your calendar to make sure that your withdrawal request won't happen during one of these dates.

eToro Withdrawal Checklist

All in all, before you proceed with the withdrawal in eToro, make sure to follow these rules:

- Your account must be verified and in good standing with eToro. Verified accounts will have a green tick on the user profile.

- The withdrawal fee for all withdrawals from eToro is $5.

- The minimum amount of withdrawal is $30 and there is no maximum limit.

- You will receive a confirmation email once your withdrawal request is in process.

- It's possible to cancel your withdrawal request as long as it's still "Under Review". You can check the withdrawal status via your Portfolio by clicking on the blue "History" icon and then use the "Reverse" button on the request you want to cancel.

- Funds deposited via online banking cannot be withdrawn until 7 days after the deposit was made.

All in all, eToro provides an easy yet effective way of withdrawing your funds straight from your trading account. With its long track history in the industry, eToro is widely known as a great platform both for rookie traders and professionals because the fully regulated company offers many interesting features that can improve one's trading performance.

The withdrawal service in eToro is working great with minimum issues regarding withdrawal difficulties ands. However, always make sure to read the requirements needed and follow the rules before deciding to make a withdrawal request.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Bruno

Feb 2 2023

Thank you very much. I think we need to know the concept of brokers. That way, we traders can have some peace of mind and not have to constantly think negatively about the multi-day withdrawal process. We as trader need to know and read this article.

Another important thing to know as a trader is when is the best time to withdraw. As the steps mentioned in the article that you need to know about holidays, making a withdrawal close to a holiday will the withdrawal process and the broker will process this on the first business day. For example, if you withdraw on Friday, the broker will process it on Monday. For example, with a bank transfer, it will be ready in almost 14 days, because the broker does not work because Saturday and Sunday are also holidays. at this point...

Willy

Feb 2 2023

Bruno: That is the question, why do brokers have to process withdrawals on business days? I mean, it doesn't matter if the broker doesn't work on public holidays, but I think it's very important to always process withdrawals. Why do brokers not process withdrawals on public holidays? I need to know why. Indeed, I noticed that brokers operate like banks, with limited opening hours and business days until Friday. I will know if the broker's working days follow the forex market. However, the negotiation process could take him 24 hours and 5 days. Why are brokers, especially customer service, not working 24/7?

What about eToro? Is customer service available to respond to dealer complaints 24 hours a day?

Emil Smith

Feb 2 2023

Willy: Yes, eToro customer support is available 24/7, but only Monday through Friday. With a ticket or with a customer service chat. I think eToro's customer service is not bad, but you have to wait patiently as they will use the quote system. But before submitting a ticket, I think you should read its FAQ first as it contains information about problems that traders often face. Based on my experience, I found a solution to my problem using the FAQ. It's faster and more efficient than submitting a ticket which will waste a lot of your time.

Tuchel

Feb 2 2023

Bruno: Why are brokers still not working on holidays or weekends? Because financial institutions like banks were not active at that time. This means that it is not possible to handle all processes including bank transfers. Also, during this time, brokers do not offer any trading services as they follow the forex market calendar.

But if the brokers also offer crypto trading, the brokers could be up and running by the end of this week. But again, withdrawals at this time cannot be processed. I mean all processes including money will not be processed. It is best to withdraw your funds before Saturday or public holidays for faster processing of your funds.

Sandy

Feb 2 2023

Thanks for the information! First of all, I really don't understand why I can't withdraw from eToro, I almost want to blame the eToro review on this site and am extremely angry.

But after reading the article, I realized that I am not allowed to withdraw my money because my balance is lower than the requested withdrawal amount and it is all because of my floating loss in trading and not because eToro wants the money mine! This means that I did not close the trading position. At least I know what is going on there, and if I want to get withdraw, I must at least close all trading positions first or stop trading also check all the trading position.