Understanding the correlation between currencies can help you control your overall portfolio's exposure. Here's how the Correlation Matrix tool works at HF Markets.

Since the market is always moving, the relationship between currency pairs is also very dynamic. When one pair rises, it's common to expect another pair to fall.

To help you further, HF Markets offers a premium trading tool called Correlation Matrix. By using HF Markets Correlation Matrix, you can determine the relationship strength between different currency pairs on the market

Knowing the ins and outs of pair correlations can be useful, especially for you who want to do hedging. Plus, you'll be able to manage your overall portfolio's exposure.

But before that, let's take a look at how Correlation Matrix works in general.

Table of Contents

What is Correlation Matrix?

Correlation Matrix is basically a tool to summarize the correlation between different variables and it's available in HF Markets.

The data is displayed in a table that consists of rows and columns that represent the variables, and each cell of the table shows the correlation coefficient.

In other words, the matrix is a powerful tool that describes the correlation between all pairs and summarizes the results in a table. In forex trading, Correlation Matrix is used to see the relationship strength between different currency pairs on the market.

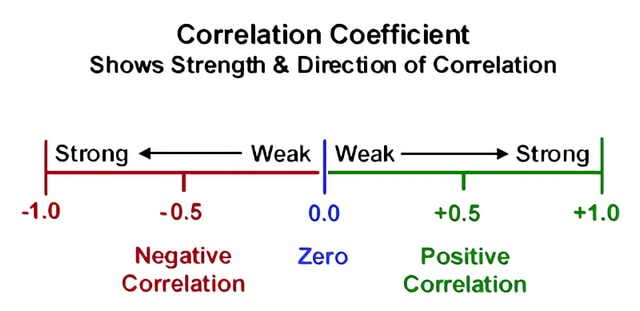

By looking at the matrix, we can see whether two currencies are moving in the same, opposite, or completely random direction over some period of time. The connection is calculated into what's known as the correlation efficient whose value usually ranges from -1 to +1.

There are two types of correlations in forex, namely:

- Positive correlation. If the correlation coefficient is positive, it indicates that the two currency pairs are moving in the same direction. For example, the EUR/USD and GBP/USD have a positive correlation, so if one rises, the other probably will too.

- Negative correlation. If the correlation coefficient is negative, it signals that the two pairs are moving in the opposite direction. For example, the EUR/USD and USD/JPY have a negative correlation, so if one pair rises, the other probably will fall instead.

From the image above, we can see that by using HF Markets Correlation Matrix, you can see how currency pairs respond to each other. The coefficient number can also tell you how strong or weak the correlation is. The bigger the number, the stronger the connection.

See Also:

How to Use HF Markets Correlation Matrix

HF Markets (formerly known as Hotforex) is a widely known forex broker that has clients from over 100 countries and is regulated by several top-tier financial authorities.

A recipient of multiple prestigious awards, this brokerage firm offers a wide number of assets, including currency pairs, equities, and cryptocurrencies. It also presents a bunch of trading tools that suit beginners and professionals.

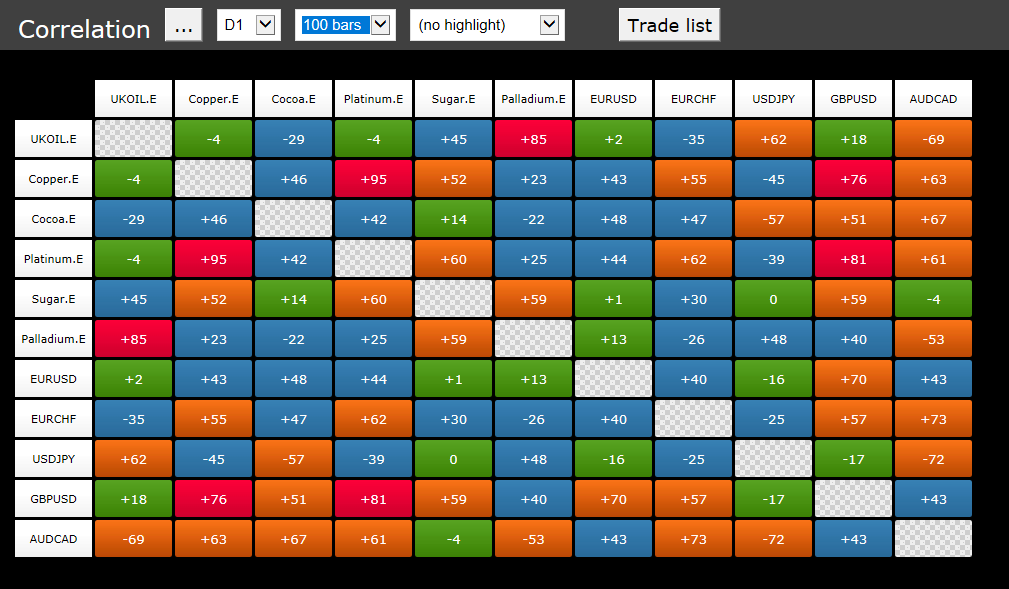

Particularly for forex traders, the broker's Correlation Matrix tool is definitely worth checking out. At HF Markets, the Correlation Matrix is displayed not only as numeric values (ranging from -100 to +100) but also as simple color-coding that allows you to easily identify strong and weak correlations at a glance.

You can also change the basis of the calculation, choose a time frame to work on and determine the number of historic bars depending on the time period you will be using.

Here's what the table looks like on the platform.

Based on the table, there are some details you can gather, such as:

- The Strength of the Correlation

The table consists of different-colored cells and numbers, allowing you to see how strong or weak the correlation is. Additionally, it also allows you to highlight sub-sections of the grid and choose to focus on specific forex correlations. - "What If" Scenarios

The Correlation Matrix tool allows you to calculate an average calculation between all of the currencies that you have open positions with. You can simply choose any number of currency pairs and calculate the average of the current correlations between them, allowing you to calculate the risk of your entire portfolio.

Forex Correlations Can Change

It is worth noting that correlations are not always the same. The high volatility of forex market sentiments and the global economy certainly affects the movements of currency pairs on the market.

As a result, the strong correlation that we see today may not reflect the longer-term link between pairs.

Correlations may change based on several causes, such as:

- The susceptibility of a certain currency pair to certain commodity prices.

- Specific political and economic factors.

- Divergence monetary policies.

The Bottom Line

If you are planning to stay in the forex market for a long, then you must be aware of forex correlations. This allows you to trade more effectively and reduce the risks of losing money.

However, it's important to know that forex market correlations can change due to high volatility. This is why it's important to keep track of the correlations from time to time.

The Correlation Matrix tool can certainly save your time, as you can just simply look at the table before deciding to take any action. In addition, HF Markets offers several other tools to help improve your trading performance, such as Trade Terminal, Connect, and Trading Calculator. For more information on the broker, you can refer to the description below:

HF Markets is an award-winning forex and commodities broker. Established since 2010, the company provides trading services and facilities to both retail and institutional clients. For more than 9 years in business, HF Markets has around 1,500,000 live accounts opened and 200 employees globally.

Based on its services, HF Markets can be regarded as middle-class category. Clients do not need to prepare a big deposit for joining to trade with this broker. Also, there are various account types, trading software, and tools to facilitate individuals and institutional customers to trade forex and CFD online.

HF Markets is a registered brand name of HF Markets (Europe). Based on the location, the company is regulated by various financial regulators. Here are the details:

- HF Markets (SV) Ltd, registered in St. Vincent & the Grenadine as an International Business Company with the registration number 22747 IBC 2015.

- HF Markets (Europe), authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with Licence Number 183/12.

- HF Markets SA (PTY), is authorized and regulated as a Financial Service Provider (FSP) by the Financial Sector Conduct Authority (FSCA) in South Africa, under license number 46632.

- HF Markets (Seychelles), incorporated under the laws of the Republic of Seychelles with registration number 8419176-1, regulated by the Seychelles Financial Services Authority (FSA) under Securities Dealer Licence number SD015.

- HF Markets (DIFC) Ltd, authorized and regulated by the Dubai Financial Services Authority (DFSA) under license number F004885.

- HF Markets (UK) Ltd, authorized and regulated by the Financial Conduct Authority (FCA) under firm reference number 801701.

If traders have more experienced, knowledgeable, and sophisticated trading environment, they can join to become Professional Clients, who can manage and assess their own risks. For that reason, these kinds of clients are granted access to more favorable rates but afforded lesser regulatory protections than retail clients.

Trading with HF Markets can enable traders to access a variety of trading instruments like CFDs on Forex, Cryptocurrencies, spot metals (gold, silver, and others), energies (oil and gas), commodities (such as coffee, copper, and sugar), indices, bonds, and popular shares such as Google, Apple, and Facebook.

HF Markets offers some of the tightest spreads in the market, starting from 0 pips in Zero Account. This broker quote major foreign exchange currency pairs to five decimal places. Therefore, traders have the opportunity to get more accurate pricing and the best possible spreads.

HF Markets receives numerous highly prestigious titles, including the huge honor of being ed to join the ranks of the World Finance Top 100 Global Companies. Others are Best Client Funds Security Global by Global Brands Magazine, Best Global Forex Copy Trading Platform by Global Forex Awards 2019, Fastest Growing Forex Broker Mena 2019 by International Business Magazine, and many more.

After opening an account in HF Markets, traders will obtain various forex trading platforms to accommodate all of their trading demands. Whether traders like to trade on desktop or prefer to trade on-the-go, they can use MetaTrader 4 on desktop (terminal, multi-terminal, and web terminal) and phone (iPhone, iPad, and Android).

Clients' funds are held in segregated accounts. Only major banks are used by Markets because they believe that successful traders have to give their full attention to their trading rather than worrying about the safety of their funds.

Traders do not need to worry about transaction fees when depositing and withdrawing. Transaction fees are not charged, and diversity of payment methods enable them to choose between Wire Transfer, Bank Card, and online payments (Neteller, iDeal, Sofort Banking, and Skrill). HF Markets ensures that traders make fast transactions 24/5 during the standard hours.

Traders can earn extra income by joining the affiliate program offered by Markets. Clients who join this program will get some advantages, such as 60% of Net Spreads based on the volume traded by sub-clients, up to $15 per a lot of net revenue, and many more. More information about HF Markets can be obtained on their official website which is supported in 27 languages.

From the review above, it can be concluded that HF Markets is one of the award-winning forex and commodities brokers. There are various account types traders can choose in HF Markets, and the broker itself becomes a favorite among traders for its low spreads. This condition is very suitable for traders with limited funds and a desire to get more opportunities to gain maximum profit.

HF Markets is a global Forex and Commodities broker that facilitates both retail and institutional clients. Previously known as HotForex in the brokerage industry, HFM has positioned itself as the forex broker of choice for traders worldwide through their various account types and trading tools. Furthermore, HF Markets allow scalpers and traders use Expert Advisors unrestricted.

Xbox Series Giveaway

Xbox Series Giveaway Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024

31 Comments

Manganiello

Oct 28 2022

Is there any disadvantage in using correlation matrix?

Louise

Feb 21 2023

Manganiello: The success of a trader can be judged by many parameters: profitable trades, account balance, or total deposit. However, I think that the professionalism of traders is determined by one very important indicator - the ability to calculate and analyze statistical indicators.

As a filter in calculating the total risk for all trades:

The correlations formed by forex pairs, whether positive or negative, offer opportunities to realize larger profits or to protect your trading positions. In addition, the value of some currencies is not only correlated with the value of other currencies but also correlated with commodity prices.

In conclusion, you should note that the correlation between financial instruments is not a constant factor. So it is advisable to use it not as an independent type of analysis when making decisions, but as a kind of filter.

Anganaa

Oct 31 2022

What makes forex correlations important?

Tristan

Feb 21 2023

Anganaa: When trading, it is important for traders to understand the price relationship of several currency pairs. This will allow you to gain a deeper understanding of how likely it is to develop a forex trading strategy.

Correlation is the relationship between currency pairs. It shows how far a currency moves in one direction. The stronger the correlation, the more correlated their price charts will be. There are two types of correlation, positive and negative.

A positive correlation means that both pairs are moving in the same direction. for example, a correlation of 1 indicates that two currency pairs move 100% in the same direction over time. A negative correlation or an inverse correlation means that the two pairs are moving in opposite directions. For example, a -1 correlation indicates that two currency pairs move 100% in opposite directions over time.

Knowledge of currency correlations can help reduce risk, increase coverage, and diversify trading instruments. In this article, we will introduce you to forex trading using market correlation.

Correlation can be a more powerful forex tool for analysis in conjunction with other forex indicators. For example, if a pair breaks out above or below the key technical levels of support or resistance, positively correlated pairs have a high probability of risk.

Grace

Feb 21 2023

Anganaa: At HFM Brokers have provided a Correlation Matrix which helps to reduce risk and trade with more confidence.

This trading tool is provided by HFM in its trading tool features even though it is still premium. This tool shows the correlation between pairs of trading symbols in a box. The Correlation Matrix shows the correlation between symbols over a configurable timeframe and the number of bars, for example, the last 100 H1 bars.

This tool allows traders to highlight subsections of the grid, for example isolating symbols that are strongly or weakly correlated with each other.

It is very important for every trader to monitor correlations in the Forex market. For example, a trader may subconsciously buy (long) USD/CAD and sell (short) EUR/JPY, thinking they have opened two different trades. However, on the contrary, the pair tends to move in the opposite direction as this currency pair has a strong negative correlation. In this case, they open almost identical trades. So, on the one hand, traders can get double profits, but on the other hand, traders can also experience double losses because USD/CAD and EUR/JPY are highly correlated.

If you are just starting out in trading, a demo account will be the perfect start as it will allow you to practice trading without any risk.

Ketlyn

Feb 21 2023

Grace: I completely agree with your explanation regarding the importance of forex correlation in trading, even though you have tried to choose the best broker. I think HFM has overcome this by providing a Correlation Matrix in its trading feature.

The correlations between symbols change over time, and the most recent correlations may not continue in the future. As a general rule, the settings you choose should be related to how long you want to keep your positions open. For example, if you expect a position to be open for 24 hours, you might want to look at the H1 correlation over the last 50 or 100 bars (2 or 4 days roughly).

I want to give an example regarding the importance of forex correlation in trading. For example, you open the NZD/USD chart and see two long signals, the pair breaks the lower Bollinger band and the candles form a pin bar. Now let's move on to the AUD/USD correlated currency pair. Good! It also shows a buy signal and the Stochastic Oscillator signal line crossing the dotted line from bottom to top. By using this signal you can get double the profit from NZD/USD and AUD/USD.

Drisana

Nov 4 2022

Can I use Correlation Matrix for assets other than forex?

Urashini

Feb 21 2023

Drisana: Not only correlated currency pairs, but also commodities, stocks, and stock indices. All of these assets can be related to each other, not just currency pairs. For example, gold (XAU/USD) tends to be inversely correlated with the US dollar and strongly positively correlated with a silver (XAG/USD).

Commodities correlated with currencies

Currency correlations change over time due to various economic and political factors. This could include divergences in monetary policy, commodity prices, changes in Central Bank policies, etc. A strong correlation does not guarantee it will stay the same in the future, which makes changes in the correlation more critical. We recommend that you check the long-term correlations to get a better perspective.

Donte

Nov 9 2022

Is the Correlation Matrix tool at HotForex free?

Bhatt

Mar 5 2023

Donte: Matrix Correlation helps you manage risk and trade with more confidence. This tool displays a correlation grid between pairs of trading symbols.

Correlation Matrix and Correlation Trader: These tools work together to show the correlation between pairs of trading symbols. This feature works with any symbol available on the trading platform, allowing the calculation of the correlation between several asset classes on Forex. The Correlation Trader will then allow a detailed examination of the correlation between any two instruments.

Access this premium trading tool, is actually free of charge or free. however, this is for all HFM clients with a minimum deposit of 200 USD. Premium Trader Tools gives traders access to institutional quality technology, including advanced trading tools, user-configurable news and information, and trading analysis. It also includes a suite of advanced alarm and messaging systems, and live sentiment and correlation tracking.

Other trading tools available at HFM include various trading calculators, which can be used to calculate pip values, swap fees, percentage risk, and support and resistance levels.

Annemieke

Nov 16 2022

Can forex pairs correlate with other assets as well?

Coinneach

Feb 21 2023

Annemieke: Currency correlation in forex trading is not only this but also occurs in other currency pairs that are widely traded on the forex market.

Not only are correlated currency pairs, but also commodities, stocks, and stock indices. all of these assets can be related to each other, not just currency pairs. For example, gold (XAU/USD) tends to be inversely correlated with the US dollar and strongly positively correlated with a silver (XAG/USD).

On the other hand, crude oil (XBR/USD and XTI/USD) is positively correlated with the Canadian dollar because Canada is the largest supplier of oil to the United States. Therefore, when oil prices rise, CAD/JPY tends to rise and USD/CAD tends to fall.

Also, US stock indexes such as S&P 500 (US500) and Nasdaq 100 (US100) show a strong positive correlation. Cryptocurrencies like Bitcoin and Ethereum have a high positive correlation. Speaking of stocks, when one large-cap stock goes up, so do all other similar stocks in the same sector.

Understanding financial market correlations can help traders better manage risk and provide useful skills for increasing profits.

Coinneach

Feb 21 2023

Annemieke: Currency correlation in forex trading is not only this but also occurs in other currency pairs that are widely traded on the forex market.

Not only are correlated currency pairs, but also commodities, stocks, and stock indices. all of these assets can be related to each other, not just currency pairs. For example, gold (XAU/USD) tends to be inversely correlated with the US dollar and strongly positively correlated with a silver (XAG/USD).

On the other hand, crude oil (XBR/USD and XTI/USD) is positively correlated with the Canadian dollar because Canada is the largest supplier of oil to the United States. Therefore, when oil prices rise, CAD/JPY tends to rise and USD/CAD tends to fall.

Also, US stock indexes such as S&P 500 (US500) and Nasdaq 100 (US100) show a strong positive correlation. Cryptocurrencies like Bitcoin and Ethereum have a high positive correlation. Speaking of stocks, when one large-cap stock goes up, so do all other similar stocks in the same sector.

Understanding financial market correlations can help traders better manage risk and provide useful skills for increasing profits.

Shabrina Cataleya

Jan 30 2023

What is the purpose of a correlation matrix in Forex trading and how can it help inform a trader's decisions when ing currency pairs to trade? To be able to access this feature on HF Markets, do traders need to meet special requirements (such as contacting CS or buying an additional package)?

Diego

Feb 21 2023

Shabrina Cataleya: Currency correlation is closely related to risk management, and traders will be helped to better understand the market when trading. By knowing currency correlations, traders can avoid excessive trading activity and are able to use the right margin for each trade.

Eliminate obstacles. If the strength of the correlation between two different currencies turns out to be strong, traders can avoid unnecessary hedging. One example is the negative correlation between EUR/USD and USD/CHF which prevents traders from taking positions in the same direction. The reason is, when one trade wins, the trader will lose another trade.

Notify high-risk signals. The correlation between different currencies can also provide information on the amount of risk that will be borne. For example, if you want to take a long position on EUR/USD and GBP/USD and both are positively correlated, it will signal double risk of the same position.

Eliminate some risks. Opening several highly correlated positions at the same time is not recommended because it opens up a lot of risks. With a high level of risk, the analysis carried out could be wrong because the market is so unpredictable. By knowing the level of correlation between different currencies, traders can get an idea of ​​how strong the correlation is.

Whalen

Mar 5 2023

Actually, I'm still new to the world of trading and yes, I rarely hear about brokers that provide trading instruments and platforms. You must have known FBS and OctaFx which always appear in several advertisements on social media. As for the HF Market broker, to be honest I have never heard of this broker.

And yes, I just found out in this article, and yes, what is being discussed here is related to the Correlation Matrix which is included in the premium trader tools. Actually, even after it was explained, I didn't really understand and actually just found out that there is also a broker called HF Market. As already explained, this broker has only been established since 2007, but I cannot say for sure whether this broker is good and safe. I ask friends for an explanation, is the IC Markets broker safe for trading and my funds? Is my personal data also safe here? If anyone knows, could you please explain...

Mikasa

Mar 5 2023

Whalen: HF Market was founded in 2010 as an online forex and commodities broker offering a wide range of account options, trading software, and trading tools to provide optimal trading conditions to individuals, Fund Managers, and institutional customers.

Before giving an assessment of the features and services provided, it is better for you to know about how this broker guarantees the safety of the funds that you deposit. This is very important, in my opinion, because you cannot trade with a calm mind if you are overthinking your trading funds. I want to provide an explanation regarding what security is guaranteed by HF Market.

Client deposits are protected. HFM goes the extra mile to protect its obligations to Clients and other third parties with a Civil Liability insurance program of up to EUR 5,000,000 which covers the best protection on the market against the risks of error, neglect, negligence, fraud, and various other risks that could result in financial wrongdoing.

Client funds are held in a separate bank account from Company funds. Client funds are not included in the company's balance sheet and cannot be used to pay debts to creditors if the company becomes bankrupt or defaults.

Negative Balance Protection. the client will not be held liable for paying negative balances if market conditions are highly volatile and margin calls and stop-outs do not work properly.

Saito

Mar 5 2023

Mikasa: I want to add to your explanation. HFM has won numerous awards for its services and offerings over the years, recent honors include:

Best Broker in Africa 2020 (AtoZ Forex),

Excellence in Global Customer Service 2020 (International Investor Awards),

With years of responsible operations, regulation by some of the strictest authorities in the world, and a long list of customer satisfaction awards, HFM is considered a reliable and safe Forex broker. Although HFM's Indonesian clients are not as well protected as their EU and UK clients, the FSA provides adequate security including ensuring that HFM segregates client accounts from its own funds and undergoes frequent audits.

Gara G

Mar 5 2023

Whalen: HF Market supports the MT4 and MT5 platforms – but unlike most other brokers, it does not offer its own web-based platform – and has some excellent trading tools to assist more experienced traders. Here are the regulators overseeing this broker. Even this broker can also get a license from the FCA.

all client funds are held in segregated accounts with top-tier banks and HFM undergoes frequent audits of its clients' financial operations and operations. In addition, all clients have negative balance protection, which means they can never lose more money than is stored in their trading account.

But be careful with countries that are monitored by the FSA regulator. Unlike other regulators, such as ASIC in Australia and FCA in the UK, FSA St Vincent and the Grenadines does not compel HFM to limit leverage or become a member of a client compensation scheme.

Yashiko

Mar 15 2023

I just learned a new method here today, but, how often should traders review the correlation matrix to ensure they are making the most informed trading decisions? I mean as a beginner, is it really necessary to look for this correlation matrix each time I'm about to make a trade?

Katya Hernandova

Mar 15 2023

@Yashiko:

Traders should review the correlation matrix on a regular basis to ensure they are making the most informed trading decisions. The frequency of the review can depend on several factors, such as market volatility, economic events, and changes in the currency market.

However, it is generally recommended that traders review the correlation matrix on a daily or weekly basis to stay updated on any changes in the correlation patterns between different currency pairs. This will help them to identify potential trading opportunities and avoid making uninformed decisions based on outdated information.

Additionally, traders should be aware that correlation coefficients can change over time, and a previously strong correlation may weaken or disappear altogether, so it is important to stay up-to-date on the latest market developments to make the best decisions possible.

Bruno

Mar 16 2023

@Yashiko: Hey! It's great that you're exploring new methods in trading. When it comes to reviewing the correlation matrix, the frequency may vary depending on your trading style, time frame, and personal preference.

As a beginner, it's helpful to understand the concept of correlation and its potential impact on your trades. While it's not necessary to check the correlation matrix for every single trade, it can be beneficial to have a general understanding of the correlations between different currency pairs or assets that you frequently trade.

Regularly reviewing the correlation matrix can provide valuable insights into how certain pairs or assets move in relation to each other. This information can help you make more informed trading decisions, particularly when it comes to diversifying your portfolio or managing risk.

You don't necessarily need to check the correlation matrix before every trade, but it's a good practice to periodically assess correlations, especially if market conditions or your trading strategy undergo significant changes. This can be done on a daily or weekly basis, depending on your trading frequency and the time commitment you're willing to allocate.

Peter

Mar 15 2023

neat, seems like I can use this method to hedge trading positions in multiple pairs that shares positive correlation...

Btw, what other factors besides correlation should traders consider when ing a trading pair?

DunkinDong

Mar 20 2023

@Peter:

Traders should consider several factors besides correlation when choosing a trading pair, including:

These are just the tip of the iceberg, imho, you simply need to look for more informations during your daily practices. The more you trade, the more you should learn and improve

Ashley

Jun 11 2023

How accurate is the correlation matrix tool provided by HF Markets and how can it be effectively utilized? As a renowned forex broker with a global clientele and multiple regulatory certifications, HF Markets offers a diverse range of trading assets and tools suitable for traders of all levels. One noteworthy tool is their Correlation Matrix, specifically designed for forex traders. It not only presents correlation values ranging from -100 to +100 but also employs a user-friendly color-coding system to quickly identify strong and weak correlations. Additionally, the tool allows customization options such as ing the calculation basis, time frame, and number of historic bars.

Considering the significance of accurate correlation analysis in forex trading, it would be helpful to understand the reliability and precision of HF Markets' Correlation Matrix. How does the broker ensure the accuracy of the correlation data provided? Are there any methodologies or algorithms implemented to update and maintain the correlation values in real-time? Moreover, what sources or data providers are used to generate the correlation information for different currency pairs?

Lionel

Nov 19 2023

Oh my goodness, there's one more thing I've got to dive into. It's all about checking out how different pairs are connected. It seems like understanding this correlation game can seriously boost our profits. You know, with that HF Correlation Matrix, we can easily spot if two pairs are buddies or not based on their positive or negative scores.

But here's the kicker that's got me intrigued – the negative correlations. Like, if it goes negative, does that mean those pairs are off-limits for trading? Can we actually trade pairs that have a bad correlation with each other? I'm curious if there's a way to navigate that negative correlation territory.

Fuad

Nov 22 2023

I'm not too savvy with the whole correlation thing, but from what I understand, the correlation matrix is just a tool to assist traders in making decisions, and it's not foolproof. Regarding negative correlation between currency pairs, it doesn't mean you can't trade them; it simply suggests that these pairs often move in opposite directions. If one goes up, the other tends to go down.

Trading pairs with negative correlation can be a bit challenging because you have to be aware of how they interact. If you grasp the relationship and have a solid strategy, you might seize opportunities from their divergent movements. It's like finding the right balance – knowing when to go long on one and short on the other. So, yeah you need back to your own interpretation about the correlation between those pairs.

Sonny

Dec 21 2023

According to the article, the correlation matrix diagram illustrates both positive and negative aspects. A positive correlation is indicated when the correlation value is positive, and a negative correlation is indicated when the value is negative. I would like to inquire about the scenario where the correlation value is zero. In such cases, how do we determine the pairs to consider? Is it advisable to trade in such pairs, or is it better to exchange them for others with more discernible correlations?

Memphis

Dec 25 2023

Hey there! As I know, when the correlation value is zero, it suggests a lack of linear relationship between the currency pairs. In such cases, traders often interpret this as an absence of a clear positive or negative correlation. The decision to trade or exchange the pairs depends on your specific trading strategy and risk tolerance.

Here are two considerations:

Trading in Pairs with Zero Correlation:

Exchanging for Pairs with Clearer Correlations:

So, it is depending on your preference! Happy Trading!

Pangeran

Feb 24 2024

Given the importance of precise correlation analysis in forex trading, it's valuable to delve into the dependability and exactitude of HF Markets' Correlation Matrix. How does the brokerage firm guarantee the precision of the correlation data it offers? Are there specific methodologies or algorithms in place to continuously update and uphold the accuracy of correlation values in real-time? Additionally, what channels or data sources does HF Markets utilize to compile correlation information for various currency pairs?

Ojin

Feb 27 2024

Dont worry about it! HF Markets ensures the accuracy of its Correlation Matrix data through a combination of methodologies and algorithms designed to continuously update and maintain correlation values in real-time. These algorithms are meticulously crafted to analyze vast amounts of market data and identify correlations between different currency pairs accurately. Additionally, HF Markets leverages various reputable data sources and providers to gather comprehensive information on currency pair correlations. These sources may include financial institutions, exchanges, central banks, and other trusted entities renowned for their reliable market data. By employing these robust methodologies and collaborating with reputable data providers, HF Markets strives to offer traders precise and up-to-date correlation analysis essential for informed decision-making in forex trading.