Understanding currency strength is crucial if you want to become a skilled trader in market analysis. However, there are several variables you should know beforehand.

Currency strength refers to a country's relative purchasing power when trading for goods or against other currencies. We measure a country's currency strength by the amount of goods and services purchased, and the total amount of foreign currency received in return for one unit of the local currency. As a certain currency's strength increases, its users will be able to buy larger quantities of goods and experience greater financial empowerment.

In the financial market, currency strength is usually observed by investors and traders through historical price charts and/or Currency Strength Meters. Both are widely available on the net, but how to use currency strength for market analysis? First of all, you should learn what influences currency strength and how it is measured.

What Determines the Strength of a Currency?

Numerous factors can affect a currency's strength. A number of national and international variables are at work, including forex market demand and supply, central bank interest rates, domestic economy inflation and growth, as well as the country's trade balance and current account.

Currently, the US dollar is regarded as the world's strongest currency. Why? First, the greatest consumer market is in the US. Second, the USD is the main reserve and trade currency used internationally.

Around 40% of the world's debt, 60% of central bank reserves, 90% of trade, and 80% of all transactions are made in dollars. Investors also tend to seek safety from threats to the US dollar during times of global crises. This is an example of how market demand determines currency strength.

How is Currency Strength Measured?

A currency's strength is typically evaluated in comparison to other currencies. It can also be measured against additional benchmarks, such as precious metals and other commodities.

For instance, the EUR/USD is comprised of the US Dollar and the Euro. When EUR/USD increases by 0.5%, it means EUR is stronger by 0.5% against USD. On the contrary, when EUR/USD is down 0.3%, it means EUR is weaker by 0.3% against USD.

It should also be noted that the relative strength of a currency is seen over a substantial amount of time. Different time frames may result in different evaluations.

An interesting example: the yen has been steadily strengthening over time against the US dollar, going from an exchange rate of 300 yen to 1 USD in the early 1970s to the present exchange rate of over 130 yen to 1 USD. But we can also say that the yen has weakened significantly this year, going from 115 yen to 1 USD in January to the present exchange rate of over 130 yen to 1 USD.

Additionally, there are currency strength indicators that determine a currency's overall strength in the world's financial markets. Most notably, the US Dollar Index (also known as "Dixie").

The US Dollar Index evaluates the US Dollar's strength in relation to the currencies of the US's main trading partners. It sets a weighted average exchange rate for the US dollar against the British pound, the euro, the Japanese yen, the Canadian dollar, the Swedish krona, and the Swiss franc. The Swiss Franc has the lowest weight in the index (3.7 percent), while the Euro is the heaviest with a weight of 57 percent.

How to Trade with Currency Strength?

There is a huge misunderstanding among traders related to currency strength. Most beginners think that they can simply buy stronger currency and sell weaker currency, as shown in historical price charts and Currency Strength Meters. But this will be a big mistake because both historical price charts and Currency Strength Meters only show past and current values—they won't show future currency strength.

There are also traders who bet in the opposite direction, under the assumption that as a currency's strength peaks, the market will take profit and trigger a sell-off. They may succeed, but it is an extremely risky strategy. During a strong bullish market, for example, a strong currency will only get stronger instead of falling down.

Understanding currency strength is crucial if you want to become a skilled trader. However, we should be aware that forex charts and strength meters aren't as simple and obvious as we'd like. The correct use of both tools is as follows:

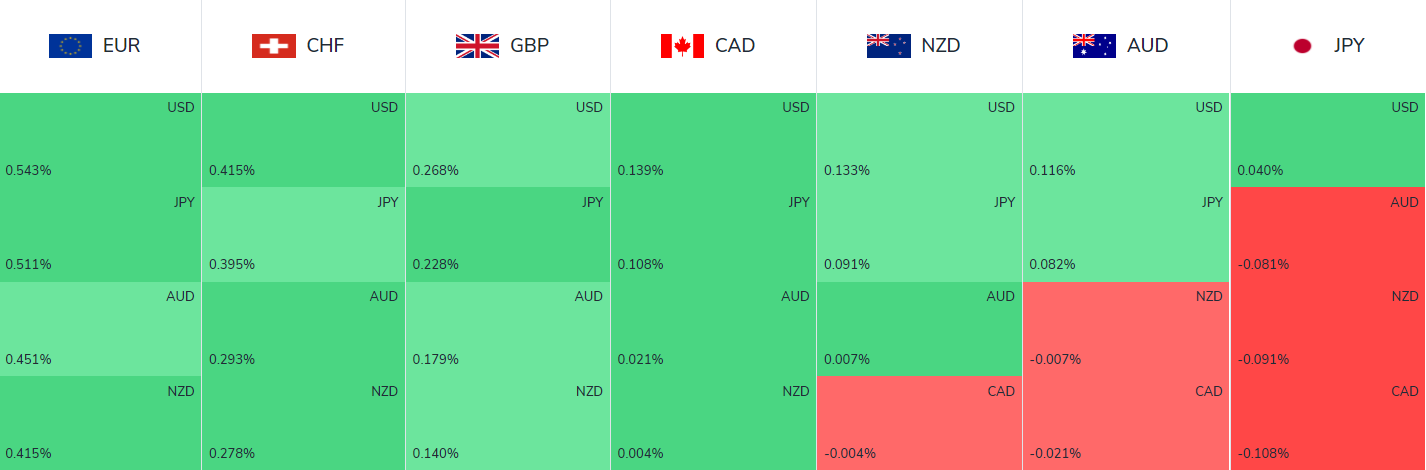

- To help us identify which forex pairs have moved the most and the fewest in different time frames. For example, the USD today has risen by 1% against the Japanese yen, 0.3% against the EUR, and 0.1% against the pound. It means that the market is currently most bullish on the USD against the yen, and the USD/JPY is the most likely to move significantly (either breakout or bounce).

- To assist us in recognizing broad market trends at a glance. For example, the EUR today is strong if its currency strength meter shows all green against most major currencies in different time frames.

The readings may help us choose which forex pairs to trade and determine the possible direction of future price movements. But wise traders will not make instant trading decisions based on this information alone. We should still examine the fundamental factors that cause currency strength changes, as well as make use of technical analysis to find the best entry and exit points.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

4 Comments

Melinda

Jun 29 2022

I completely concur with the statement that currencies, and the US Dollar in particular, have a significant impact on all aspects of trade, and as a result, they can serve as useful guidance while conducting market analysis.

Jemma

Jun 29 2022

However, it is important to keep in mind that currency is not the only thing that plays a role in trading. The price of gold and several other commodities are two examples of the many other factors that have the potential to influence it.

Mockingbird

Jun 29 2022

I also trade currencies, and in order to determine the relative value of one currency compared to another within the context of the financial markets, I consult historical price charts and currency strength gauges. Therefore, I am able to choose which currency to buy and which currency to sell in order to maximize my profit.

Sharon Carter

Jun 29 2022

The use of historical price charts and currency strength gauges is not guaranteed to produce accurate results. This is due to the fact that historical price charts and currency strength gauges only display values from the recent past and the present; they do not indicate how robust a currency will be in the foreseeable future.