When you are researching for brokers to sign up with, you might have observed that there are brokers who allow hedging, and those who don't. What is hedging?

Hedging refers to strategies to limit risks that might appear from an unadvantageous price movement while there are open board positions. Normally, a trader's losses will stop when the stop loss is touched or Margin Call occurs. However, hedging enables forex traders to minimize loss or reach the break-even point. There are some methods how to hedge against unfortunate price fluctuation that might harm you.

Forex Hedging in the Same Currency Pair

As the name suggests, hedging in the same pair is done by opening a new position in the same pair you have already opened before. This is the simplest form of forex hedging strategy, sometimes called direct hedging.

Say, you expected the USD/JPY to go down from 103.75 to 103.49, so you sell the pair. After a while, the price moves upward, even breaking the previous resistance of 103.87. Still, you are unsure whether the move is real or the price will revert downward later. You opened a buy position in the same currency pair to hedge your way. That is hedging. In addition to opening a new position to the opposing direction, you could add a stop loss to both orders up to a certain level to consider whether the direction is confirmed up or down.

But this is a risky move. If the price moves erratically and you don't see any confirmation until it is too late, both stop loss might be touched, and you might gain double loss compared to if you did not hedge, as much as the gap between both positions. I have never been able to do this successfully, so I don't suggest it to you.

See Also:

Forex Hedging in Different Currency Pairs

The second method in the forex hedging strategy is hedging through different currency pairs that have a high correlation with one another, either negatively or positively. Some brokers forbid forex hedging in the same currency pair but allow it if it is in different currency pairs.

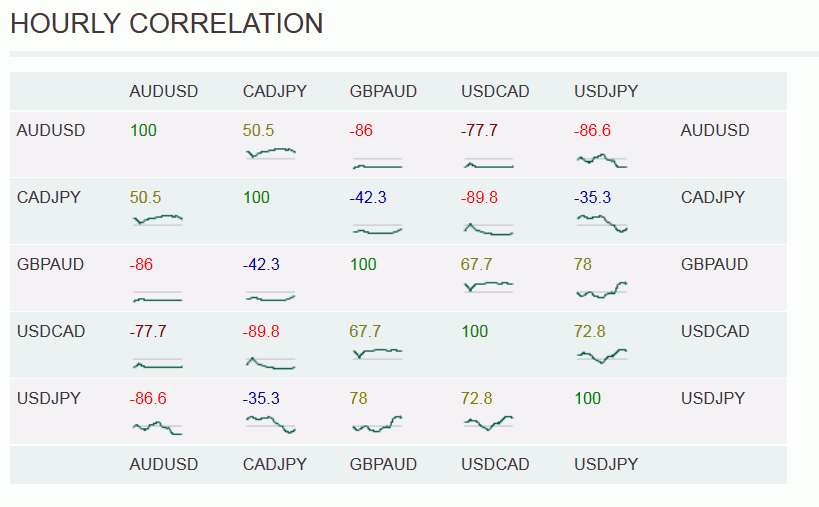

As you might have noticed in your trading platform, some pairs often move in different directions or, conversely, move in the same direction up to a certain degree. In the following graph, several pairs have more than -80 hourly correlations. That means they are negatively correlated; when one pair moves upward, the other one tends to move downward, and so on.

Hourly Correlation of Several Currency Pairs

Hourly Correlation of Several Currency Pairs

As you can see on the chart, USD/JPY and AUD/USD have a -86.6 correlation; that means you can hedge the USD/JPY position by using AUD/USD or vice versa. In the USD/JPY case before, instead of opening another position on the same pair when USD/JPY goes up, you could opt to hedge with AUD/USD. Open a long position in the AUD/USD pair, which probably would profit in the next few moments, closing up the losses you have suffered at the hands of USD/JPY.

The trouble with this method is that inter-pair correlation changes occasionally. When I wrote this article, USD/JPY and AUD/USD had a high negative correlation, but they might change in the next day or week. The correlation might weaken or turn fifty-fifty. Nevertheless, I consider this forex hedging strategy better than the first one.

To make it, consider hedging between currency pairs famous for being negatively correlated, like the GBP/USD and USD/CHF, or between pairs famous for having a highly positive correlation, such as GBP/USD and EUR/USD. Remember that if you hedge in positively correlated pairs, you should open two different positions (long and short). But if you hedge using negatively correlated pairs, you should open two positions in the same direction (long and long or short and short).

Pros and Cons Forex Hedging

Forex hedging is a strategy used to reduce the risk of losses due to fluctuations in currency exchange rates. Individuals, businesses, and investors can use it to protect their assets from the effects of currency volatility. There are several pros and cons to consider when using forex hedging.

Pros of forex hedging:

- Reduces risk of losses: Hedging can help to reduce the risk of losses due to unfavorable currency movements. This can be especially important for businesses operating in multiple countries or investors with assets denominated in foreign currencies.

- Provides certainty: Hedging can provide certainty about the future value of an asset. This can be helpful for businesses that need to make future payments in foreign currencies or for investors who want to lock in a profit on an investment.

- Can be used to protect against inflation: Hedging can be used to protect against inflation by locking in the current exchange rate. This can be helpful for businesses that need to import goods or investors who want to preserve the value of their assets.

Cons of forex hedging:

- Can increase costs: Hedging can increase the cost of doing business or investing. This is because hedging typically involves paying a premium to a financial institution.

- Can reduce returns: Hedging can reduce the potential returns on investment. This is because hedging locks in the current exchange rate, which may not be the most favorable in the future.

- It can be complex: Hedging can be difficult, and it is essential to understand the risks and costs involved before using it.

Forex hedging can be a valuable tool for reducing the risk of losses due to currency volatility. However, weighing the pros and cons carefully before using it is essential.

Here are some other things to consider when deciding whether or not to use forex hedging:

- Your risk tolerance: If you are risk-averse, you may want to consider hedging to reduce the risk of losses.

- Your investment horizon: If you are investing for the long term, you may not need to hedge as much as if you are investing for the short term.

- The type of assets you hold: Some investments, such as stocks and bonds, are more sensitive to currency fluctuations than others. You may want to consider hedging if you have assets sensitive to currency fluctuations.

- The cost of hedging: Hedging can be expensive, so you must ensure that the benefits outweigh the costs.

If you consider using forex hedging, speaking with a financial advisor to get personalized advice is essential.

See Also:

Forex Brokers for Hedging

Choosing a forex broker can be time-consuming, but it is important to research and find a broker that is right for you. One of the most important factors to consider is your trading strategy. If you use hedging, you must find a broker that offers the best hedging conditions.

Here are some things to look for when choosing a forex broker for hedging:

- Low spreads: Spreads are the difference between a currency pair's buy and sell price. Low spreads are important for hedging because they will minimize your losses.

- High leverage: Leverage is the amount of money you can borrow from a broker to trade. High leverage can help you to increase your profits, but it also increases your risk.

- Good execution: Execution is the speed and accuracy with which a broker executes your trades. Good execution is important for hedging because it will help minimize your losses.

- Competitive fees: Fees are a broker's charges for providing services. Competitive fees will help you to save money on your trading costs.

Once you have considered these factors, you can narrow your choices and find the best forex brokers for hedging.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

Steven

Apr 21 2024

I dont really understand about the Hedging and what makes me confused here is the article mentioned some cons in the Hedging trading and one of them is : Hedging can increase the cost of doing business or investing. This is because hedging typically involves paying a premium to a financial institution. Meanwhile the pros doing hedging is reducing the risk of trading.

The question here, what kind of cost that we face if we do the hedging and why needed to paying premium to the brokers to do the Hedging too?

Mira

Apr 24 2024

So, why do we have to pay these premiums? Well, think of it as paying for peace of mind. You're essentially buying protection against potential losses in your primary investments. But hey, nothing's free in this world, right?

On top of that, there are other costs to consider too, like transaction fees or commissions when you're opening or closing positions for your hedging strategy. These costs can add up, but many investors see them as a worthwhile expense to reduce the overall risk in their investment portfolios.

In a nutshell, hedging might cost you some dough upfront, but it's like paying for insurance – it helps protect your investments from getting slammed by unexpected market moves.