Opening a new live trading account in Fullerton Markets is fairly simple and can be done in several easy steps. Read further to find out more.

To begin your trading journey, you'll need to first open a trading account with a brokerage company. There are loads of brokers these days that offer such service, so you need to make sure that you choose the right company to facilitate your trading based on your criteria.

Today, we're going to introduce you to Fullerton Markets, a forex broker company that has been in business since 2015. It offers trading on popular instruments such as forex and CFDs on metals, indices, and crude oil. You can trade using popular platforms such as MetaTrader 4 and 5, as well as a proprietary platform called PipProfit.

Becoming a client in Fullerton Markets is fairly easy. The registration process will only take about a few minutes of your time and everything is done online. Let's find out all the details in the article below.

Steps to Open an Account in Fullerton Markets

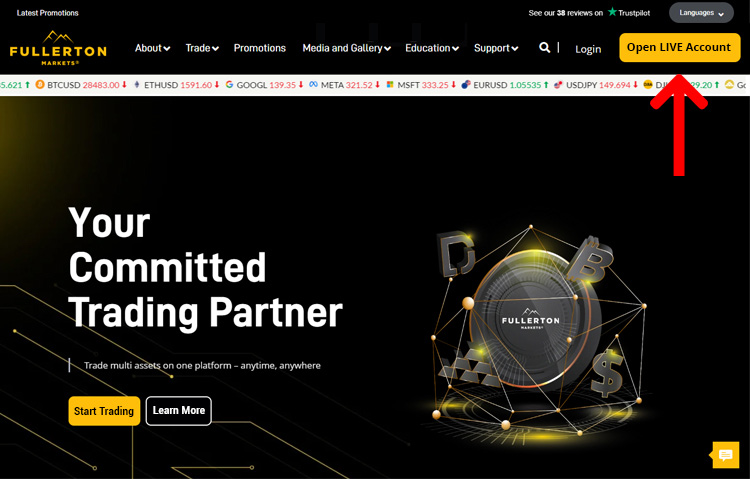

- Head over to the Fullerton Markets' official website and click the "Open Account" button at the top right corner of the screen.

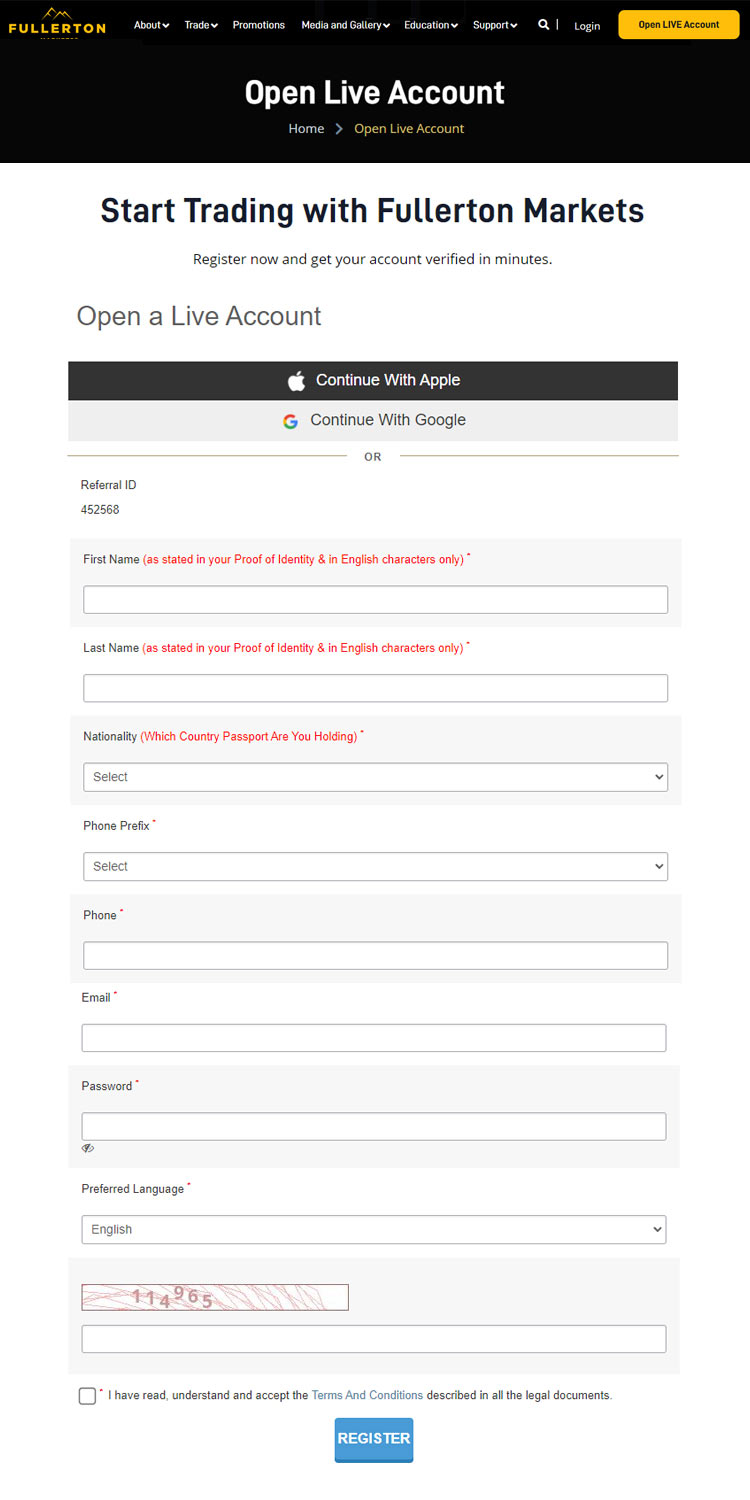

- Fill in the registration form with your personal information. Once you're done, click "Register".

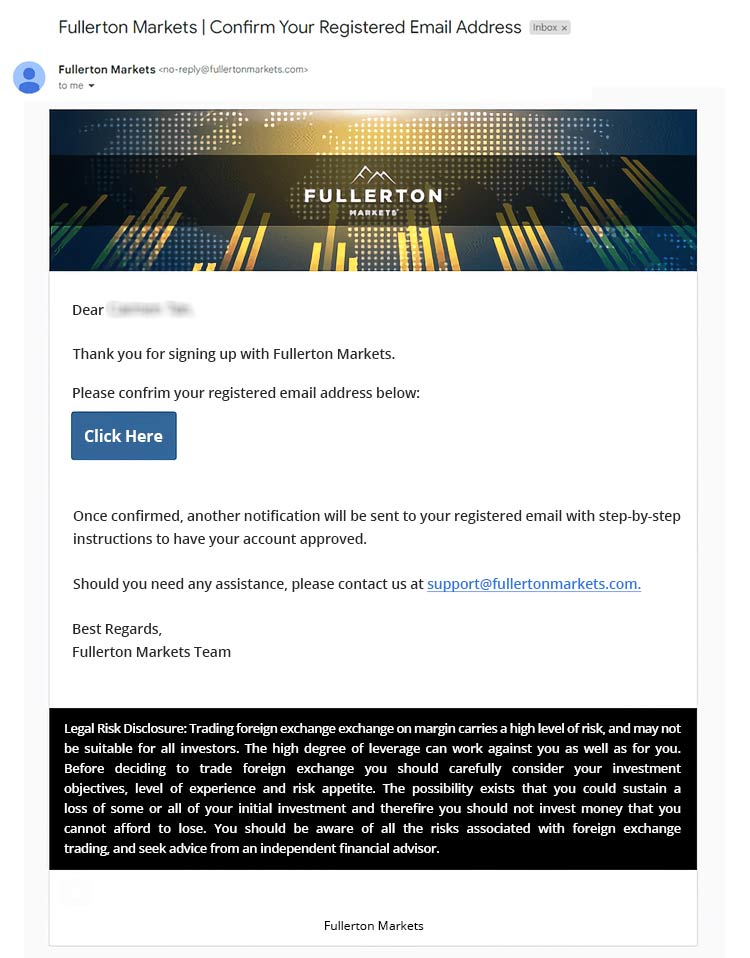

- You will receive a confirmation email on your registered email address. Click on the provided link to verify your email and activate your account.

- Once you verify your email, you will get another email containing your account credentials. Use it to log in to your Fullerton Suite.

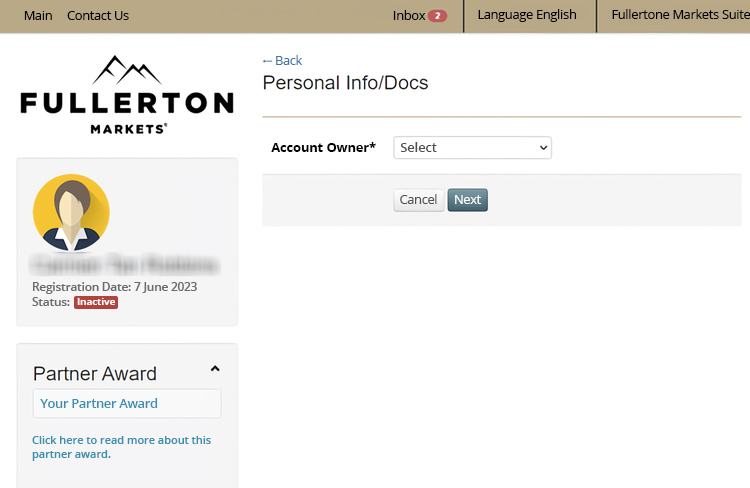

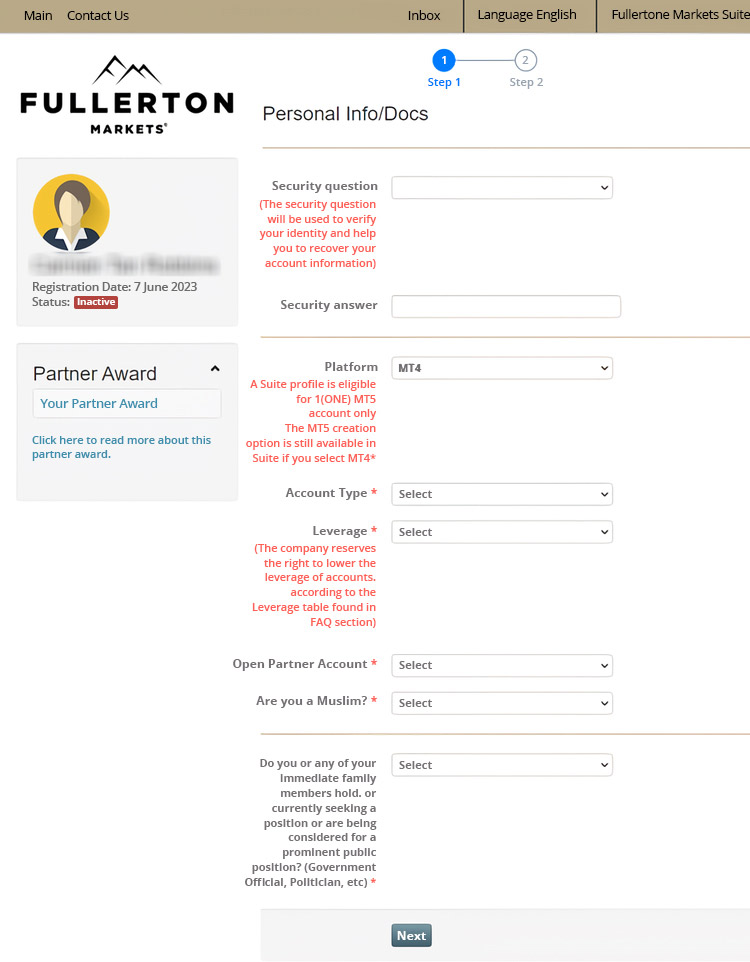

- After logging in, choose your account type. Decide whether it's a Personal or Company account.

- Specify your account details by answering the security question, trading platform, account type, etc.

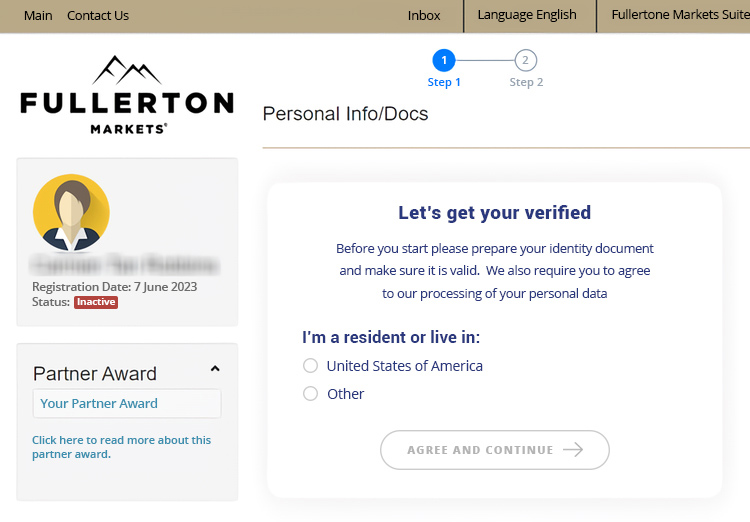

- For the last step, complete the account verification process by providing a digital copy of the requested documents. Note that it may take about 1 business day to process your submitted data.

- Congrats! You have successfully activated your account. The only thing left to do is to deposit some funds and start trading.

Fullerton Markets is a broker for online trading catering their services to traders worldwide. Established in 2015, CEO Mario Singh stated that the company's vision is to be a disruptive force in three areas of the trading industry: the safety of funds, speed of execution, and system of wealth creation. The "3S" principle was later realized by enforcing several features like segregated bank accounts, partnership with tier-one banks and Equinix, as well as analytical contents and partnership programs.

Fullerton Markets obtained Certificates of Registration by the New Zealand Intellectual Property Office, but the company was incorporated under the International Business Companies (IBC) of the revised laws of St. Vincent and the Grenadines. Thus, it can be safely concluded that Fullerton Markets is an offshore registered broker despite its initial founding in New Zealand territory.

Speaking of trading instruments, Fullerton Markets has provided traders with a variety of assets in Forex, Metals, Indices, and Crude Oil markets. Trading conditions for each instrument are described thoroughly in their dedicated pages at Fullerton Market's official website. This is important as it indicates the broker's transparency to provide the clearest information possible for prospective clients.

The only downside found in Fullerton Market's specs is their lack of ability to follow the latest trends to present alternative platforms; it still offers MetaTrader 4 as the sole trading platform for traders. Nonetheless, Fullerton Markets is quite lucrative in offering other ways for online trading. The company is, in fact, infamous for its proprietary copy trading system labeled as CopyPip. Besides, Fullerton Markets also provided an optional mirror trading through financial technology provider Tradency.

Leverage is set at 1:500 as the highest, while minimum trade volume can go as low as 0.01 lot. Trading in Fullerton Markets is also equipped with the ability to choose 4 base currency options (USD, EUR, NZD, & SGD) for their trading account.

As for fundings and withdrawals, Fullerton Markets opts to arrange them via various payment methods. From bank transfers to digital wallets, traders are free to choose their most preferred methods. Even better, this broker has accepted payments via Bitcoin, as well as local transfer in 6 different jurisdictions (Thailand, Malaysia, China, Indonesia, Vietnam, and the Philippines), signifying its commitment to expand further toward the Asian region.

To sum up, Fullerton Markets is a forex and CFD broker with a friendly trading environment for retail traders with high interest in low spreads. Furthermore, traders residing in South East Asian countries can process their deposits and withdrawals easier by this broker's special connection to enable Local Transfer in the region. Still, considering their offshore-based status, it is safer to learn how to manage the high-risk of trading in such broker prior to opening a live account in Fullerton Markets.

Document Requirements for Account Verification

Before you can get full access to the broker's services, you need to complete the account verification process either via the website or the mobile app PipProfit. There are two types of documents required in Fullerton Markets:

Proof of Identity (POI)

You can choose to upload one of the following documents:

- National Identification Card

- Driver's License

- Passport

- Armed Forces ID Card

- Known Employer ID Card

- Other card issued by the government

Proof of Residence (POR)

You can choose to upload one of the following documents:

- Utility Bill

- Bank Statement

- Council Tax Bill

- Mortgage Statement from a recognized leader

Please note that the document must be clear and eligible. You can scan or capture both sides of the document but do not crop. Make sure that the document is valid (not expired) and shows your photo, full name, date of birth, and address. Lastly, for the POR document, the issue date must not be older than 6 months from the date of application.

FAQs on Fullerton Markets Open Account

- Is Fullerton Markets a safe broker?

Fullerton Markets is an offshore broker registered in St. Vincent and the Grenadines and is self-regulated. According to the current registration, the company is allowed to provide currency trading services. - What types of accounts are offered by Fullerton Markets?

Fullerton Markets offers one live account type from which trades can be made in real market conditions. The minimum deposit to start trading with this account is 100 USD and the minimum trade size is 0.01 lots. Traders can get leverage of up to 1:500 and spread starting from 0.1 pip. - What is a Conditionally Approved Account in Fullerton Markets?

Conditionally Approved Account is an account with only POI verified. At this level, you may deposit and receive funds of up to 2000 USD and use it for trading. You can also withdraw after getting approval from the broker. However, there are certain limitations that you should know. First, you may not deposit or withdraw more than 2000 USD. Second, deposits via bank wire and credit/debit card are not available, as well as other features such as urgent deposits. If you wish to unlock all these features and benefits, please complete the verification process by uploading your POR document.

Fullerton Markets is a forex and CFD broker that prides itself on fund safety, quick execution, and a system of wealth creation. Founded by Mario Singh, Fullerton Markets is also supported by tier-one liquidity providers, 24-hour dedicated support, and offers negative balance protection as well as a number of in-house services like CopyPip, KryptoPips Loyalty Program, and EmpowerEarnings.

Accelerator Bonus: Receive up to USD10,000 Credits

Accelerator Bonus: Receive up to USD10,000 Credits Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest

5 Comments

Joong-jae

Oct 19 2023

Hello, so I just made my first ever trading account in Fullerton Markets. I did follow the instructions written on this post up to step 5 and I'm planning to complete the verification step this evening. The process has been smooth so far, I didn't find bug or delay on the website, which is great. However, I'm wondering why the status under my profile says "inactive"? Does that mean I'm not allowed to do any trading just yet? How can I activate it? Aside from that, I also want to know how to open a demo account in this broker. Thanks for the help

Sophie K.

Oct 19 2023

Oh you don't have to worry about the inactive status. It will be activated and automatically turned green once you get through all the process, including the verification. As stated in this article, it's best if you upload both the POI and POR documents. If you only verify your identity and not your address, you won't get full access to the broker's full feature. If you are a big trader, this can be quite troublesome, considering that you can only deposit up to 2000 USD. Therefore I highly suggest to do the account verification as soon as possible.

Sophie K.

Oct 19 2023

As for the demo account, you can easily open one from your Fullerton Suite. Specify your account details such as trading platform, leverage, etc, then start trading without risk. Obviously, it's a great option for beginners because it allows you to practice, but it can also be beneficial for experts who want to test their strategies and check out the trading platform. Do remember though that the demo account is only active for 30 days.

Chacha

Oct 20 2023

I've never heard of Fullerton Markets before, but now I'm really intrigued. Based on the reviews I found online, the broker seems legit even though it is an offshore broker. One thing that caught my attention was the proprietary platform! I believe it's called PipProfit, right? So, I want to know more about it if that's okay. What is the purpose of the app and does it support trade on the go via mobile phones? The thing is, I like to travel around, so I usually don't have much time on the screen. Therefore, mobile trading would be really helpful. Lastly, why is there only one type of account? Makes me wonder who is this broker best suited for? Thanks

Brett

Oct 21 2023

According to the app description, PipProfit allows traders to access information and manage their account. This includes regular market news, event info, trading data, live webinar, etc. I believe you can also make quick deposits and withdrawals. However, I don't think it's possible to make trades from the app. You'd still need MT4 or MT5 trading platforms.

As for your second question, I think the broker offers standard trading conditions that can benefit both active and passive traders. Did you know that the broker offers MAM accounts? It can be a great choice to get passive income with low risks.