Unlock success in UK trading with top strategies like the London breakout and BoE decisions. This is also useful for any trader in the world who trade UK financial instruments.

Having an effective trading strategy is super important for traders who want to make consistent profits. Fortunately, there are many profitable strategies for trading the market.

In this article, we will explore some of the top strategies special for UK forex traders. By learning these different trading strategies, UK-based traders can build a strong foundation to handle tricky market situations and get better at being successful traders.

London Breakout Strategy

The London breakout strategy is a day trading method designed to take advantage of the breakout of the day's trading range, formed before the London session starts. Typically occurring within the first three hours of the London session, this breakout is sought after due to the session's high liquidity and significant price movements, which often set the tone for the day's trend.

To implement the strategy, identify the range during the Asian trading session and wait for a breakout during the London session. Traders go long if the breakout is upward and short if it's downward.

This strategy works well with GBP currency pairs like GBP/USD, GBP/JPY, EUR/GBP, GBPAUD, GBPCHF, and GBPNZD. It's particularly suitable for UK traders because of its clear rules and occurrence during the morning working hours when banks open. Additionally, the strategy offers a potential risk/reward ratio exceeding 1:2.

For a clearer understanding, look at the GBP/USD chart on the M15 time frame below.

In the chart, notice the price forming a range during the Asian trading session, marked by horizontal support and resistance lines. With the London session's opening, there's a breakout above the resistance, triggering a buy entry.

Set the stop-loss below the previous low and the profit 2.5x the stop-loss. Later movement proves that the price continues to rise and touches the take-profit level.

BoE Decisions Strategy

Key elements of this strategy involve forecasting adjustments in interest rates and the implementation of monetary measures by the UK's central bank, the Bank of England (BoE). As a matter of fact, policy decisions made by central banks can exert profound and wide-ranging effects on financial markets.

This strategy is particularly well-suited for assets such as currency pairs involving GBP and UK government bonds. Additionally, stocks listed on the FTSE, especially those within the financial sector, are sensitive to interest rate adjustments and can be impacted by central banks' decisions like the BoE.

Raising interest rates typically strengthens the GBP. On the flip side, lowering interest rates may lift stock markets by lowering borrowing expenses for companies, but it might also weaken the GBP.

To get a better grasp, check out the example chart of GBP/USD on the H1 time frame below.

The provided chart covers the period from August 1-3, 2023. On August 3, 2023, the Bank of England (BoE) increased the interest rate by 0.25%, shifting it from 5.00% to 5.25%.

Following the BoE's announcement, the market responded positively. This is evident in the GBP/USD price, which had previously been on a downward trend, showing resistance and putting an end to its decline. After stabilizing around 1.2640, the price promptly started to rise, surpassing the 1.2720 mark.

To execute this trading strategy with precision, consider these measures too:

- Monitor central bank actions: Stay vigilant about the Bank of England's meeting schedule and official communications to proactively anticipate potential shifts in monetary policy. This step is essential for timely decision-making and capitalizing on emerging opportunities. You can bookmark an economic calendar to monitor the schedule.

- Consider the global economic context: Acknowledge the interconnected nature of global economic conditions with the central bank's policy stance. Factors such as international economic trends and geopolitical events can significantly influence the decisions made by central banks.

- Evaluate immediate and long-term impacts: Assess both the immediate market reactions and the longer-term consequences of central bank policy decisions. This nuanced approach is crucial for formulating a comprehensive strategy that adapts to evolving market dynamics over an extended period.

Interest Rate Differential Strategy

This strategy aims to capitalize on the differences in interest rates between two countries to profit from fluctuations in currency pairs. Traders strategically focus on the interest rate variance, utilizing it as a key factor to capture gains through currency market movements.

This strategy operates on the fundamental principle that disparities in interest rates between the UK and other major economies can be leveraged for financial gain.

The primary assets targeted in this strategy are currency pairs involving GBP like GBP/USD, EUR/GBP, and GBP/JPY. As such, the central banks in focus would be the BoE, the Federal Reserve (the Fed), the European Central Bank (ECB), and the Bank of Japan (BoJ).

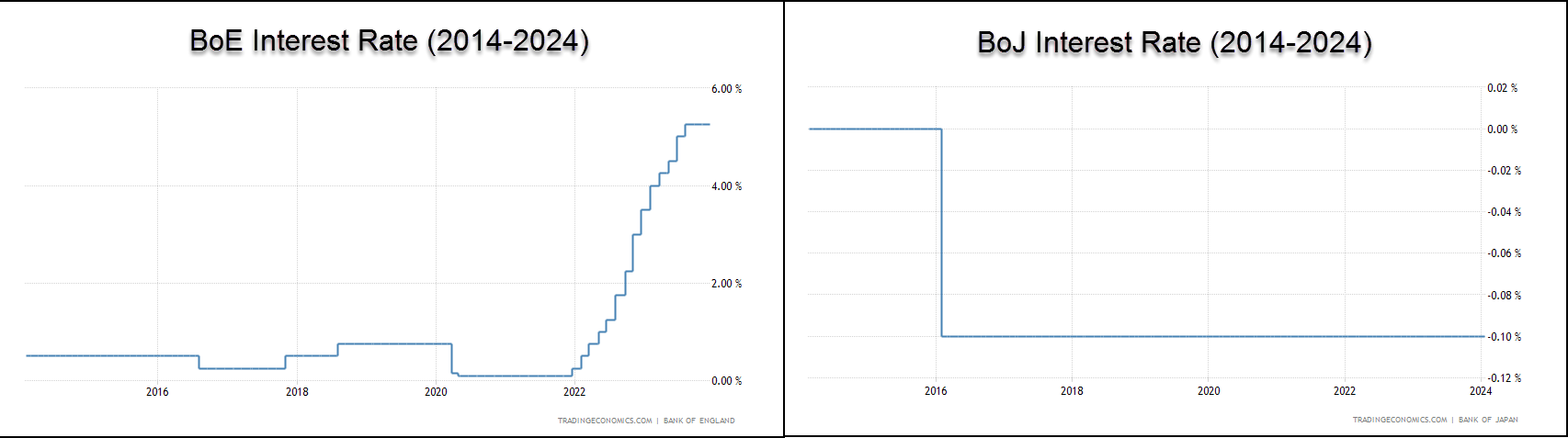

For a clearer understanding, let's take an example using the GBP/JPY currency pair. Check out the chart comparing the interest rates of the UK and Japan over the last 10 years (2014-2024).

As you can see, the UK began raising its interest rates from approximately 0.00% at the start of 2022, reaching 5.25% currently. In contrast, Japan has kept its interest rate at -0.10% since 2016.

In the Monthly chart of GBP/JPY above, you can see that the price consistently goes up after the Bank of England (BoE) increased interest rates in early 2022, continuing until the present.

To effectively employ the interest rate differential srategy, here are some extra steps to pursue:

- Monitor global central bank decisions: Traders need to consistently track central bank decisions on a global scale, extending beyond the Bank of England. Understanding interest rate movements in various countries especially Japan and the EU provides crucial insights for informed decision-making.

- Evaluate macroeconomic stability: Consider the macroeconomic stability of the involved countries. This step involves assessing economic indicators and projections for future interest rate changes, providing a comprehensive understanding of the potential impacts on currency pairs.

- Implement hedging: Particularly in volatile environments, adopting hedging techniques becomes essential to mitigate potential losses resulting from unexpected alterations in interest rates.

UK Earnings Play (for Stock Traders Only)

The UK earnings play constitutes a strategic trading approach centered around analyzing and exploiting financial results that companies in the United Kingdom release regularly, typically every quarter.

Traders employing this strategy aim to anticipate and capitalize on the market's reaction to a company's earnings report, depending on whether the company exceeds, meets, or falls short of analysts' expectations.

When a company consistently outperforms analysts' expectations, it signals strong management and favorable business conditions, often resulting in a bullish market response. Conversely, failing to meet earnings expectations may suggest underlying issues within the company, potentially leading to bearish market reactions.

This strategy is particularly suitable for assets such as UK stocks, with a specific focus on blue-chip companies listed on the FTSE 100 and promising candidates from the FTSE 250.

To grasp the strategy better, check out the H1 chart of 3I Group PLC below.

On November 10, 2022, 3I Group PLC unveiled an earnings report, revealing actual results of 182.50, which significantly exceeded the anticipated 142.70. This led to a bullish reaction in its stock price.

Consequently, within a few hours, the stock price of 3I Group PLC climbed from approximately 1250 to 1300.

To implement the UK earnings play strategy effectively, make sure to follow these standards:

- Stay informed: Utilize an up-to-date earnings calendar to remain ahead of upcoming announcements. This ensures timely awareness of companies' reporting schedules.

- Monitor analysts' forecasts: Pre-announcement, track analysts' forecasts, and consensus estimates. These predictions serve as benchmarks for market expectations, guiding traders in assessing whether a company is likely to surpass or fall short of projections.

- Exercise caution post-announcement: Immediately following the earnings announcement, exercise caution in trading decisions. Stocks can experience heightened volatility, often influenced by knee-jerk reactions from retail investors or automated trading systems.

- Consider long-term prospects: While immediate post-announcement movements are critical, traders should maintain a focus on the long-term prospects of the company. Volatility in the short term may not necessarily reflect the company's overall health or future potential.

Final Tips for UK Traders

In summary, the top UK trading strategies in this article give traders in the UK a different way of looking at things and some tools to handle the tricky parts of financial markets.

For traders in the UK, dealing with the relatively high volatility of the market suggests using the London breakout and earnings play strategies. These approaches are suitable for day trading, offer clear trend signals, and come with good risk/reward ratios.

Conversely, strategies like the BoE decision and interest rate differentials require a higher time frame, ideally on the daily chart, thus making them less suitable for day traders.

Before implementing the London breakout and earnings play strategies, it's crucial to start monitoring prices an hour before the London session begins. Also, check the economic news calendar for the day, as significant news releases can disrupt the London breakout strategy if results don't align.

Concerning stop-loss, it's wise to tighten it for an improved risk/reward ratio and be ready for sudden price reversals. ATR (Average True range) on the H1 chart is often used to determine stop-loss, typically set at 2 times the ATR range.

Lastly, maintaining disciplined risk management is crucial. Stick to a maximum of 1% risk per transaction, avoid overtrading, and take a break for evaluation if the market isn't favorable. Stay calm and resist entering the market impulsively, even if all your positions are currently profitable.

Whatever strategy you choose, it's a good idea to practice it with a demo account so you can avoid the risk of losing real money.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance