Are you a news enthusiast and following global market updates regularly? If so, macro trading might just be the one for you.

A macro trader is a term used for traders who use the macro trading system. Instead of getting stuck in objective mathematical algorithms, macro traders focus more on subjective predictions. This is because macro trading uses big-picture fundamental analysis.

What is Macro Trading?

Macro Trading is a trading strategy in which a trader will build a picture and direction of a country's economy based on the country's macroeconomic prospects. These macroeconomic factors include GDP, employment levels, sectoral growth, and geopolitical climate in a country.

For example, a macro trader will analyze India's macroeconomic prospects before deciding to invest in the country's currency, stocks, or other financial assets related to the country. From GDP to India's geopolitics, it will be the basis for their analysis. However, there are also some macro traders who take a global approach and do not limit their investment to just one country.

A notable illustration of global macro analysis is performed by Quantum Funds, a private investment management firm established by George Soros and Jim Rogers back in 1973. Quantum Funds operates based on a global macro strategy, engaging in significant speculations on the price fluctuations of currencies, stocks, bonds, commodities, derivatives, and other asset classes, aligning with its macroeconomic analysis.

Due to the wide perspective, not only can macro traders trade forex, but they can also trade stocks, bonds, commodities, and ETFs in several countries. For instance, a macro trader who studies economic indicators believes that the US economy will fall into a recession and stocks will decline. Based on this, they can sell US stocks and invest in gold.

Example of Macro Trading Strategy

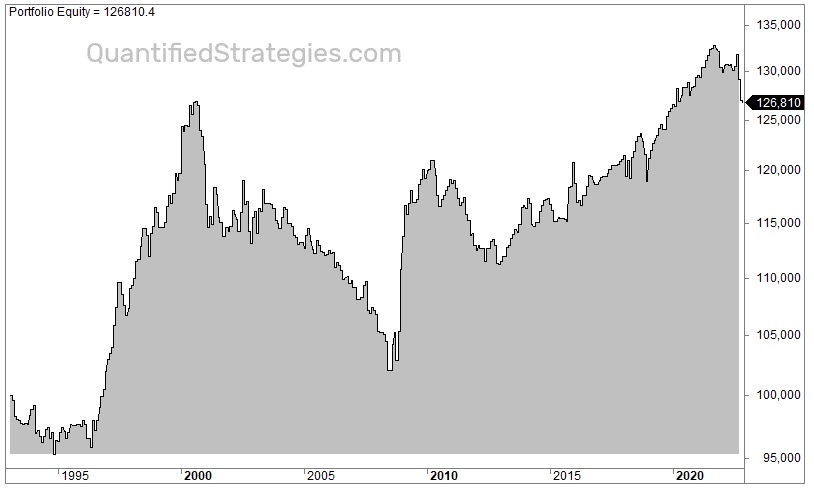

Quantified Strategies once backtested a macro trading strategy focusing on the US Friday job report. It is a crucial macroeconomic indicator published monthly by the US Department of Labor, typically on the first Friday of the month. The data contains key figures such as nonfarm payroll employment and the overall unemployment rate.

Despite being a comprehensive report with multiple pages of data, researchers at Quantified Strategies conducted a backtest on the S&P 500 (SPX) using a macro trading strategy. In this backtest, they entered trades at the market open and exited at the market close on the day of the job report release. The resulting equity curve is depicted as follows:

According to the statistics, there were 343 trades made, and the average gain per trade amounted to 0.07%. While this gain may appear modest, it is still considerably higher than the performance statistics observed on random trading days. By implementing an additional filter in their analysis, Quantified Strategies had proven that this strategy can become viable for trading purposes.

Key Aspects in Macro Trading

The main strategy in macro trading is to analyze a country's economic indicators. These indicators are not growth indicators for just one individual company or instrument, but rather indicators with longer-term prospects. For example, GDP and CPI are indicators with longer-term impacts than ROI (Return of Investment) and ROA (Return of Assets), right? These economic indicators are what macro traders use for trading.

Overall, fundamental analysis is the primary approach used for macro trading. However, there is still room for technical analysis as a tool for making certain trading decisions. For example, using technical analysis to study the price trend and locate potential entry and exit points.

In general, here are what makes the macro trading strategy:

Economic Indicators

Some things that are considered are GDP, inflation data, price indexes, employment rates, housing markets, and manufacturing indexes.

Macro traders look at all of this data on a country-wide scale and compare it to other countries. No single indicator is considered in isolation. Instead, macro traders look at all data points to develop an overall picture of the future economy of a company or country.

Monetary and Fiscal Policies

Next, macro trading will also require an overview of a country's monetary and fiscal policies. Monetary policy refers to all policies related to the central bank, such as the circulation of money and changes in interest rates.

Meanwhile, fiscal policy relates to the government of the country, especially in terms of income and expenditure budgets. Fiscal policy can take the form of tax cuts, subsidies, or infrastructure development.

For example, if the US government is concerned about a recession, they may lower taxes to encourage consumers to spend more money to stimulate the economy. Conversely, the government may increase taxes to slow down consumer spending and economic growth. All of these conditions contribute to influencing decisions in macro trading.

Technical Analysis

Although not the main focus, technical analysis and trends will still be studied by macro traders. Financial markets go up and down very quickly, so it's impossible for macro traders to identify the best location to enter and exit the market without performing some technical analysis.

Instead of focusing on different types of indicators to combine, macro traders would apply simple technical analysis that mostly involves price action, support and resistance, as well as 1-2 trend indicators.

Geopolitical Factors

Wars and geopolitical events can cause instability that can decrease the value of a country's assets. When a country experiences instability, economic growth becomes impossible. As such, macro traders will exacerbate the situation by withdrawing their assets to other countries. In situations like this, macro traders can move their investments to safer assets such as precious metals and other safe haven options.

Demographics

Demographic changes in a country are also a concern for macro traders. This is because consumer behavior among different groups will affect the country's economy. For example, the US has a high population of elderly people, so they will require a strong healthcare system. In contrast, countries with a larger population of young people may have greater demand for new technology.

How to Start Macro Trading

Macro trading is not difficult. You just need to learn as much as possible about the fundamentals of your assets. Read trading books, join forums, or listen to podcasts on market news and other fundamental topics. Make sure you are selective in choosing the content you consume because there are many fake trading experts and gurus on social media.

To begin your journey as a macro trader, you may apply the following steps:

- Choose the financial assets you want to trade: forex, stocks, ETFs, bonds, commodities, and more.

- Choose countries' assets based on their macroeconomic performance.

- Record all asset price movement histories including their triggers. For example, changes in interest rates, tax policy changes, and so on.

- Set buy and sell rules for the selected assets. Determine accurate entry points.

- Consider technical buy and sell signals based on price charts.

- Apply risk management by placing stop loss and take profit orders. Risk as much as you are willing to lose.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance