In Forex trading, the technical analysis is used to know the key levels, while the market fluctuator is determined by fundamental aspects.

Forex trading analysis is majorly defined into two categories: technical analysis and fundamental analysis. In setting the strategy, generally, a trader chooses to use the combination of both analyses. Technical analysis is used for defining the key levels, while market fluctuation is defined by the fundamental aspect. By understanding the fundamental aspect, we will know what are the main market movers so we can better predict a currency outlook and make an ideal trading decision.

The fundamental aspect of Forex trading is economic data or events that cause the flow of cash in currency transactions. As a trader, we try to find the strongest currency to be paired with the weaker one.

Contents

The fundamental analysis in Forex trading is used for learning the economic factors which cause the dynamic transaction of traders of a currency pair. In other words, applying the fundamental strategy uses some data and important events as the fundamentals of analyzing market outlook to determine the ideal trade. The data or the events are generally mentioned as a high-impact factor.

For getting information on high impact data or events, a trader must regularly update the news about the main issue in the Forex market. They include the employment data, inflation, interest rate, as well as a country's economic, political, or even geological situation that may influence its stability.

If there are economic data that performs better than expected and affects the economic situation in a country, we then can find another currency from a country that experiences a weaker economic situation. For instance, if the economic data of the Euro area or Germany is in a good situation while the United States' situation is weaker, it means we can buy EUR/USD.

The Main Aspects of Fundamental Analysis

There are 5 main aspects of fundamental analysis that a trader must know. They are the economic calendar, capital flow, interest rates, central bank policy, and fundamental data. Let's discuss them one by one.

Economic Calendar

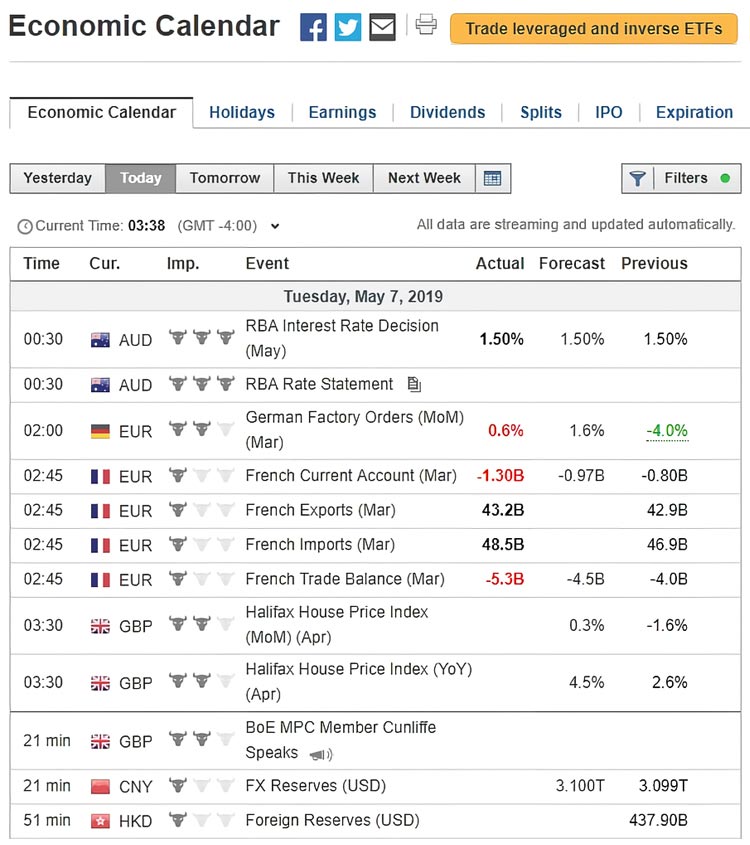

In an economic calendar, you can see that data or events which have high impact and the time of release. The calendar informs and explains scheduled data-release and important events every day, as well as the estimated results. A trader must always monitor the economic calendar to get updated about the schedule or event, especially on the weekdays.

The key to trading with fundamental analysis is analyzing the various data and events. Due to a lot of economic data released, we must focus on the data with high and (sometimes) medium-impact. They are usually indicated by "two or three bull heads" that accompany the data list as pictured above.

The medium-impact data may turn to high-impact if the eventual number is drastically different from the market expectation. Besides, the statement or the speech of the central bank authority will also bring a high-impact and often more affected the newly released important data.

Capital Flow

Capital flow is the flow of some capital to a certain currency. In general, this flow relates directly to capital investment in a country. For example, if an investor outside the United States will buy the stocks in the S&P 500 listing, the investor needs to use the US Dollar for buying the stocks. Hence, some capital will flow into USD from other currencies to do the transaction.

The mentioned example shows the supply and demand dynamic of a currency. If the capital inflow is bigger than the outflow, it means that the demand for the currency is higher. As a result, the currency value of the country is increasing for responding to the demand. For a trader, this is the right time to buy the currency.

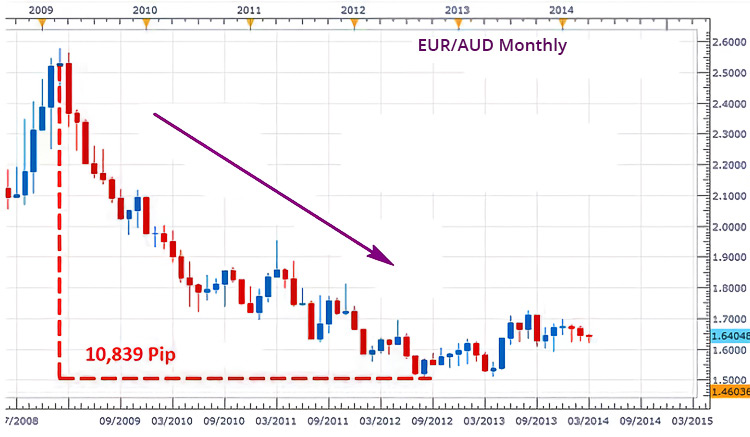

The opposite thing happens for capital outflow. If the demand for the currency decreases, it is the opportunity for a trader to sell the currency. For example, if the economic data in the Euro area is getting weak and the investor prefers to attach their positive sentiment on the Australian economic situation, some capital will flow to Euro rather than Australian Dollar; or you can sell EUR to buy AUD (EUR/AUD).

Interest Rates

This factor is important for inflow and outflow. All investors, speculators, as well as traders, always consider these capital instruments for getting the biggest profit thus increasing their investment portfolios. Therefore, countries with higher interest and better economic fundamentals will tend to attract capital flow.

The only way to know the change of interest rates of any major country is by monitoring the economic calendar. Besides, the released schedule of the interesting announcement of central banks, which is released once a month, is also important. The demand for a currency will be very sensitive to the central bank interest rate. Traders using certain strategies like carry trade pay the most attention to the news of interest rates changes.

Here's a scenario:

The picture above is a chart of EUR/AUD in the monthly time frame, during the period of 2009 to 2014. A currency pair experienced a decrease of 10,839 pips. Why could it happen? It was caused by a capital outflow from the Euro. At the time it happened, the interest rate of the Australian central bank (Reserve Bank of Australia) is 4.75%. On the other hand, the Euro central bank (European Central Bank) only puts a 1.50% rate. Traders and investors use the difference in interest rates for getting profit by selling EUR to buy AUD.

Central Bank's Policy

This section discusses the effects of the monetary policy of a central bank against the currency exchange rate, especially the policy to increase or decrease the amount of money supply. A Forex trader who uses fundamental analysis will always pay attention to the policy. They are arranged and issued by the central banks of pair major countries.

The central bank has a very significant role. Its policy does not only affect the economy, but also the currency exchange rate. A central bank is established by a government to run the function of fulfilling the economic target. The target has to be achieved through the interest rate level arrangement and other kinds of monetary policies. Another duty of a central bank is to manage and monitor commercial banks and financial institutions for preventing the rule violation.

The central banks of the major pairs at the moment are:

- The Federal Reserve (The Fed) in the United States

- Bank of England (BoE) in the United Kingdom

- Bank of Japan (BoJ) in Japan

- European Central Bank (ECB) in the Euro area

- Swiss National Bank (SNB) in Switzerland

- Bank of Canada (BoC) in Canada

- Reserve Bank of Australia (RBA) in Australia

- Reserve Bank of New Zealand (RBNZ) in New Zealand

A central bank has the authority to achieve its planned targets. The monetary policy is some actions taken by a central bank based on its authority for managing and controlling the amount of money in the country.

When the economic condition is in crisis, the central bank will apply the loose monetary policy. It is done by buying certain assets for increasing the money supply and adding liquidity to the market. Decreasing the interest rate level is also a way to apply loose monetary policy. The target is to maintain the money supply so that it can be supplied to the commercial banks. The money supply needs to be maintained for supporting economic activity and increasing growth. The expansion result can be seen in the GDP increase and the decrease of the unemployment level.

By controlling the money supply and changing the interest rate level, a central bank can make a change in the currency exchange rate. If the tight monetary policy is applied, the money supply will be decreased. It means the loan to the commercial banks will be limited and the money supply will increase. This usually causes the currency exchange rate to increase.

On the other hand, if the central bank applies the loose monetary policy, the exchange rate of the currency will be weaker. This policy causes the loan to commercial banks to increase due to the low interest rate.

Major central banks commonly announce their interest rates every month and you can see the schedule on the economic calendar.

The monetary policy of central banks can also be noted from the statements of their authorities or the meeting notes, economic projection, and an official monthly bulletin.

The Fundamental Data

Three fundamental and important data affect the demand for a currency. They are the Gross Domestic Product (GDP), Consumer Price Index (CPI), and the Employment Figure. Those three indicators reflect the economic condition of a country and they directly affect the exchange rate of the currency.

Whatever strategy you use in trading, you must monitor the three data mentioned for determining the tendency of currency's price movement based on the capital inflow and outflow in the country. The country with a strong economic condition will attract more investors so more money supply will flow into the country, and vice versa.

Gross Domestic Product (GDP)

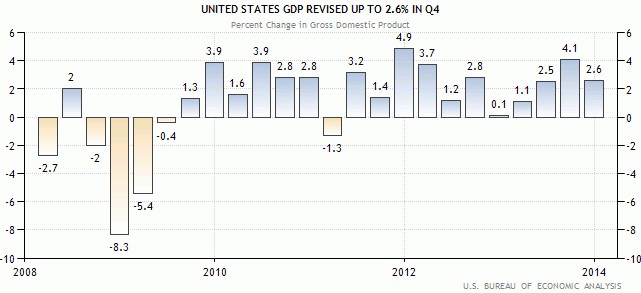

Gross Domestic Product (GDP) measures the specific change in the economic growth by considering the consumer sector of household, the government expenses, the domestic investment, and the export volume of the country. If the GD growth increase, it means the economic expansion will cause a higher demand for the currency. On the other hand, if the GDP growth decrease or experiences the contraction, the demand for the currency will decrease.

In addition, the growth change of GDP will cause the CPI change, too. In this case, the central bank will make a change through the monetary policy based on the inflation target planned.

In some big countries over the world, the main currencies in the GDP are released in quarters. The data released is the presentation of the growth change compared to the previous period, and can be revised in the next data release. Here is the GDP of the United States (per quarter) which is released by the Economy Analysis Bureau in 2008-2013. At that time, the 4th quarter GDP in 2013 was revised from 2.4% to 2.6% (the result on March 27th, 2014).

Consumer Price Index (CPI)

CPI is an indicator used in some countries with strong currencies and is released monthly. The indicator used to measure the inflation level from the previous month. CPI measures the inflation level specifically by calculating the purchasing power of the consumers and the price changes of goods and services among consumers. The prices that increase significantly in a certain period show high inflation and the increasing economic growth.

Contradictorily, the lower inflation level shows the decreasing economic growth and the central bank will stimulate economic activities by decreasing the interest rate level. The central bank also conducts market operations for increasing the money supply amount. In the high inflation case, the central bank will try to affect the money demand by increasing the interest rate level.

Employment Figures

The employment amount depends on the jobs available. Active employees will affect the economic condition of the country significantly. The best economic condition is when there are more job vacancies available, so it will decrease the unemployed level. On the contrary, the economic contraction will cause the rise of the unemployed level that endangers the economy.

Some indicators of the employment figures are usually released in a month, one of them is Non-Farm Payroll AS that attracts many traders' attention. The indicators determine the employment amount outside the agriculture sector as the reflection of the economic power of the United States. In other countries of the pair major such as Australia, Canada, and the Euro regions, the indicator is called the Employment Change.

World-class Traders Who Use Fundamental Analysis

The fundamental analysis has significant information, but it is often ignored. A trader often ignores the economic condition update to put more importance on the technical aspects. However, do you know the story of these widely popular figures who become very successful due to their sharp fundamental analysis?

- Benjamin Graham

Graham had discussed the absolute price and mispricing in his phenomenal books, Security Analysis (1934) and The Intelligent Investor (1949). The books revealed the mispricing in the stock exchange that mostly do not reflect the real condition of the company. The controversial opinion has been approved in real life when the informant of the company works with an inside trader to get the actual information. - Warren Buffett

He's Graham's 'student' who also revealed the amazing principles that emphasize the fundamental analysis essential as an instrument to analyze and explore the intrinsic rate of the companies with 'hidden gems'. The hidden gems are found in unpopular companies that have low P/E and P/B, but they have potential assets. - George Soros

If you are not a new trader, you must recognize George Soros. He is a legendary speculator who experienced the fabulous winning at the "Black Wednesday" event. He brought home USD 1 Billion at that time! Soros ensures that "The faster a country expands more than the fundamental capacity; the bigger it will suffer from recession."

Are you inspired? Be one of the next legend traders by exploring fundamental approach to complete your trading analysis.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

4 Comments

Karen Lay

Nov 20 2022

Kane

Dec 17 2022

Karen Lay: "only some smart and rich people can use this analysis as a long term investment/trading tool." No, I do not agree with you. Anyone can learn and even know about fundamental analysis, which can serve as a guide to whether the market is bearish or bullish. In this example you can take my experience, for me to make sure my trading is more strongly profitable, fundamental analysis is used to ensure that the technical analysis set is the same. That's my method! When my market is technically bullish, I also use news to know where the market is headed.If there is the same signal, enter the position, otherwise wait for a move. Fundamental analysis therefore becomes another indicator of how well I trade and helps me trade more decisively.

Kane

Dec 17 2022

Karen Lay: "only some smart and rich people can use this analysis as a long term investment/trading tool." No, I do not agree with you. Anyone can learn and even know about fundamental analysis, which can serve as a guide to whether the market is bearish or bullish. In this example you can take my experience, for me to make sure my trading is more strongly profitable, fundamental analysis is used to ensure that the technical analysis set is the same. That's my method! When my market is technically bullish, I also use news to know where the market is headed.If there is the same signal, enter the position, otherwise wait for a move. Fundamental analysis therefore becomes another indicator of how well I trade and helps me trade more decisively.

Kane

Dec 17 2022

Karen Lay: "only some smart and rich people can use this analysis as a long term investment/trading tool." No, I do not agree with you. Anyone can learn and even know about fundamental analysis, which can serve as a guide to whether the market is bearish or bullish. In this example you can take my experience, for me to make sure my trading is more strongly profitable, fundamental analysis is used to ensure that the technical analysis set is the same. That's my method! When my market is technically bullish, I also use news to know where the market is headed.If there is the same signal, enter the position, otherwise wait for a move. Fundamental analysis therefore becomes another indicator of how well I trade and helps me trade more decisively.