Forex Calendar - Real-time Info on Data Releases

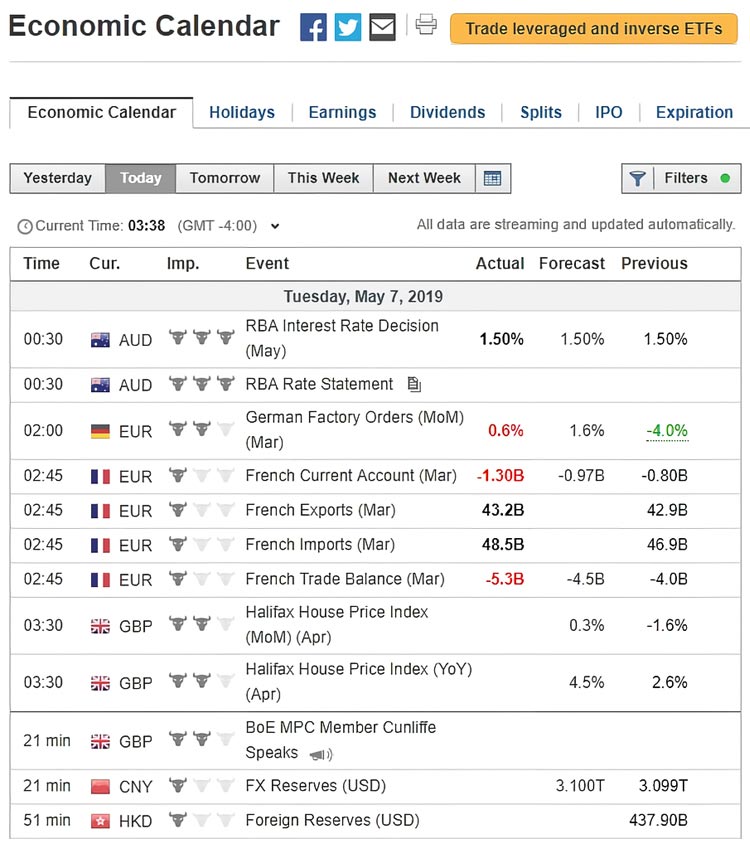

Forex Calendar contains upcoming and the most recent global events that impact the forex market. The scale of effect is indicated by the "Impact" bar.

Scroll for more details

| Cur | Event | Actual | Forecast | Previous |

|---|

What is economic calendar in forex trading?

In an economic calendar, you can see that data or events which have high impact and the time of release. The calendar informs and explains scheduled data-release and important events every day, as well as the estimated results. A trader must always monitor the economic calendar to get updated about the schedule or event, especially on the weekdays.

Due to a lot of economic data released, we must focus on the data with high and (sometimes) medium-impact. They are usually indicated by "two or three bull heads" that accompany the data list as pictured below.

Continue Reading at Everything You Need to Know About Fundamental Analysis

Why is it essential for traders to stay updated on economic news releases?

Staying informed about economic news releases is vital for traders because these events can significantly impact the financial markets. Failure to consider these events in your trading strategy can lead to unexpected market volatility and potential losses.

Continue Reading at Trading Software To Try In 2016

What are the most important UK news for GBP/USD traders?

- MPC Meeting (BoE rate decision) and the subsequent BoE Governor Speech

- MPC Meeting Minutes publication

- UK GDP

- UK Unemployment Reports (Claimant Count Change)

- UK Housing Prices (Housing Prices Index)

GBP/USD is also often influenced by geopolitical matters such as referendums and elections. The UK rarely holds referendums, but when they do, it is on highly influential topics, such as the Scottish Independence and their exit from the EU (Brexit). Aside from those, it will also be useful to note commodities prices as the US Dollar is quite sensitive towards changes in commodities prices, particularly oil and gold.

Continue Reading at Tips on How to Trade GBP/USD

Why should forex traders always follow the news?

Observing the news related to currencies is a must for forex traders. Even forex trader who uses technical analysis is advised to frequently check on the fundamental calendar to avoid collision and keep track of the news. It is always good to know why the market moves in a certain direction and not the other one. Just because you do your trade once or twice a month, does not mean that you could disregard the news.

Continue Reading at Beware Of Misleading Myths About Forex News Trading

Forex Calendar Articles

-

10 Brokers to Trade with Autochartist

-

eToro Honest Review: the Pros and Cons

-

InstaForex Chancy Deposit: Boost Your Deposit Every Month

-

Best Brokers with Mobile Apps for Trading on the Go

-

MT5 Brokers with Low Spread to Try

-

What Traders Should Look For in a Forex Broker Platform

-

Is Guaranteed Stop Loss Better than Regular Stop Loss?

-

Trading Binary Options In Ranges

-

Top Forex Brokers with VIP Accounts

-

FXOpen Vs Tickmill for Cryptocurrency Trading

- More