Long-tailed pin bars signal potential trend reversals, providing traders with lucrative entry points. Unlock effective trading strategies for this pattern in this article.

In the vast and dynamic world of financial markets, traders are constantly on the lookout for reliable and effective strategies to gain an edge and maximize their profits. Among the multitude of trading techniques, one particular candlestick pattern has garnered significant attention for its potential to signal market reversals and continuations with remarkable accuracy - the long-tailed pin bar.

The long-tailed pin bar, often referred to as the long-wick or hammer candlestick, is a powerful formation that can provide valuable insights into market sentiment and price action. Its distinctive structure, characterized by a small body and a long tail or wick, holds key information about the battle between buyers and sellers, offering traders an opportunity to capitalize on favorable market conditions.

In this article, we will learn 5 ways to trade with long-tailed pin bars such as:

- Long-tailed pin bars with confluence.

- Counter-trend long-tailed pin bars with confluence.

- Long-tailed pin bars with trend and confluence.

- Long-tailed pin bars as a breakout play.

- Long-tailed pin bars can create event areas.

But before getting into each method, we'll dive further into the basic readings of a long-tailed pin bar.

What Is A Long-Tailed Pin Bar?

Pin bars exhibit a range of sizes, but they can be broadly divided into two categories: "Normal" pin bars and "Long-Tailed" pin bars. Long-tailed pin bars stand out with their conspicuously long tails, distinguishing them from surrounding bars, while normal pin bars have tails that are not excessively elongated.

Here are the key characteristics of long-tailed pin bars:

- Long-tailed pin bars have long tails that stand out from surrounding bars.

- They are high-probability signals and occur less frequently but often precede major market moves.

- Entering trades based on long-tailed pin bars can be challenging due to wider stop loss requirements, requiring patience for potential re-entry opportunities.

- Long-tailed pin bars can set the stage for significant trend reversals or continuations.

- They offer a high risk/reward ratio, especially when entry points can be fine-tuned.

Long-tailed pin bars possess a crucial characteristic that sets them apart: they are not solely isolated trade signals. Their immense power can reshape the market's landscape for months or even years to come. Once a long-tailed pin bar forms and the market reacts accordingly, we can interpret the market's narrative by reading it from left to right, like a book

This approach allows us to understand the story the market is trying to convey.

5 Ways to Trade Long-Tailed Pin Bar

When it comes to trading long-tailed pin bars, there are several approaches that traders can consider.

1. Long-tailed Pin Bars with Confluence

Confluence, in this context, refers to the alignment of different factors that enhance the validity and reliability of the trade setup. The concept of confluence is based on the T.L.S principle, which stands for trend, level, and signal.

To achieve optimal confluence, it is ideal to have at least two out of the three components working in harmony. These components can be:

- Trend: Assess the prevailing trend in the market. A long-tailed pin bar that aligns with the dominant trend is considered more robust. It provides an additional layer of confirmation and increases the probability of a successful trade.

- Level: Identify key support or resistance levels on the chart. These levels can be derived from previous swing highs or lows, Fibonacci retracement levels, or horizontal support/resistance zones. When a long-tailed pin bar forms near these significant levels, it strengthens the trade signal.

- Signal: The long-tailed pin bar itself serves as the primary trade signal. Its distinctive structure, with a long tail protruding from the surrounding bars, indicates a potential reversal or continuation of the trend.

The chart example below illustrates a long-tailed pin bar trade setup that exhibits confluence across all three components of T.L.S.

2. Counter-trend Long-tailed Pin Bar With Confluence

Counter-trend long-tailed pin bars, by their very nature, tend to form against the prevailing trend or follow a significant price move. These pin bars often provide valuable trading opportunities, especially when supported by confluence factors.

When analyzing counter-trend long-tailed pin bars, it is important to look for specific confluence elements that enhance their validity. One such factor is the protrusion of the pin bar's tail through key levels, particularly within a clearly defined range. This protrusion signifies a rejection of the price at those levels and adds strength to the counter-trend signal.

Additionally, a false break of a level, where the tail of the pin bar extends beyond a level and quickly reverses, can also serve as a strong confluence for counter-trend long-tailed pin bars.

These confluence elements act as confirmation signals, indicating that market participants have reached a point of exhaustion after a sustained move in one direction. The formation of a long-tailed pin bar in such situations can be viewed as the market "putting on the breaks" following an excessive and rapid price movement.

To further illustrate, consider the example below, where a major reversal occurs after a prolonged uptrend, and a long-tailed pin bar forms. This pin bar serves as a clear signal of a potential trend reversal, supported by the confluence of the pin bar's protrusion through key levels or false breaks.

3. Long-tailed Pin Bars With Trend And Confluence

Long-tailed pin bars hold great significance as trend-continuation signals. These pin bars can be observed in two specific scenarios:

- After a pullback within a prevailing trend, or

- in proximity to key swing points.

When a long-tailed pin bar forms after a pullback within a trend, it suggests that the prevailing trend is likely to continue. This indicates that market participants have rejected the lower (in an uptrend) or higher (in a downtrend) prices during the pullback, reaffirming the strength of the underlying trend.

Traders can use this as a signal to enter trades in the direction of the trend, capitalizing on the anticipated continuation of the price movement.

However, it is crucial to exercise caution when encountering large pin bars forming near the top or levels of a trend. These scenarios can potentially signal an impending collapse or reversal in the trend. Such large pin bars may indicate a significant rejection of prices at extreme levels, suggesting that market sentiment may be shifting.

Traders should approach these situations with trend confirmation indicators or reversal patterns before making trading decisions.

4. Long-tailed Pin Bars as a Breakout Play

Long-tailed pin bars can serve as effective breakout signals, particularly in markets that have been confined within a long trading range. In such situations, where the price has been consolidating within a defined range for an extended period, the emergence of a long-tailed pin bar can indicate an imminent aggressive breakout.

Once the established support or resistance levels are breached, traders can take advantage of the breakout by entering positions either for selling or buying, depending on the direction of the breakout. This approach allows traders to capitalize on the momentum generated by the breakout and potentially profit from significant market moves.

5. Long-tailed Pin Bars Can Create Event Areas

An event area is a price zone where significant market activity has occurred, leaving a lasting impact on future price movements. Long-tailed pin bars have a significant role in the formation of event areas.

These areas act as zones of potential support or resistance, serving as points of interest for market participants. As traders, we should closely monitor these areas, even weeks or months later, as the market retraces and potentially provides second-chance entries.

How to Enter Using Long-Tailed Pin Bar

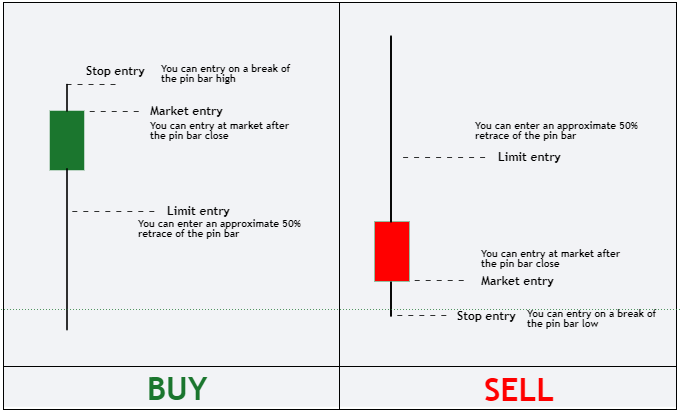

Entering trades based on long-tailed pin bars can be accomplished through three different methods:

- At market entry: This approach involves placing a "market" order that is immediately filled at the best available market price. For a bullish pin bar, a "buy market" order is used, while for a bearish pin bar, a "sell market" order is employed.

- On stop entry: With this method, a stop entry order is placed at the desired entry level. The market must subsequently move up to trigger a buy stop or down to activate a sell stop. Generally, in a bullish pin bar formation, traders often buy on a break of the pin bar's high, whereas in a bearish pin bar formation, selling is typically initiated upon a break of the pin bar's low.

- Limit entry: For a sell entry, this method involves placing an order above the current market price, while for a buy entry, the order is placed below the current market price. By entering the trade at this retracement level using a limit order, traders can set a tight stop loss just above or below the pin bar's high or low. This approach enhances the risk-reward ratio of the trade, offering a potentially substantial payoff.

Trading Tips

Here are some valuable tips to enhance your trading with long-tailed pin bars:

- Trust your instincts: When you spot a long-tailed pin bar, don't hesitate. Recognize the opportunity and plan your entry strategy without overthinking. Long-tailed pin bars are signals you don't want to miss.

- Monitor key chart levels: Keeping an eye on these key levels can increase the chances of identifying high-quality pin bars.

- Look for clear protrusion: When you see a tail sticking out prominently, it's time to take action.

- False breaks and trend changes: These powerful formations often precede trend reversals, making them particularly noteworthy.

- Beware of large pin bars near trend extremes: They can sometimes signal a potential market reversal in the opposite direction of what the pin bar suggests.

- Observe failed pin bars: If the market disregards the long-tailed pin bar and violates the high or low of its tail, take note of this signal. Failed pin bars can provide valuable insights into potential market dynamics.

- Seek confluence: Look for alignment between the pin bar, key levels, and the prevailing trend. When these factors come together, it's an opportune time to initiate a trade and capitalize on the market move.

Final Words

In conclusion, trading using long-tailed pin bars can be a powerful strategy for traders seeking high-probability trading opportunities. These unique candlestick patterns offer valuable insights into market dynamics and can serve as reliable signals for potential trend reversals or trend continuation.

It's important to consider the different entry methods for long-tailed pin bars, such as market entry, on-stop entry, or using limit orders. Each approach has its advantages and should be selected based on specific market conditions and risk tolerance.

Furthermore, long-tailed pin bars can create significant event areas that can influence price action in the future. Paying attention to these areas and looking for second-chance entries can provide additional trading opportunities with favorable risk-reward ratios. As with any trading strategy, proper risk management is crucial. Implementing appropriate stop-loss orders, position sizing, and trade management techniques will help protect your capital and optimize your trading outcomes.

Trade wisely and may the long-tailed pin bars lead you to successful trades in the dynamic world of the foreign exchange market.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

10 Comments

Benn

Jun 30 2023

What are the potential reasons behind the formation of a long-tailed pin bar?

David Tristan

Jun 30 2023

There are several potential reasons behind the formation of a long-tailed pin bar, which can provide insights into market sentiment and potential price reversals. Let's explore some of these reasons in more detail:

Jack

Jun 30 2023

What are some effective methods for backtesting and analyzing the performance of trading strategies based on long-tailed pin bars?

Eddy

Jun 30 2023

Backtesting and analyzing the performance of trading strategies based on long-tailed pin bars require a systematic approach to evaluate their effectiveness. Here are some effective methods for conducting backtesting and analyzing such strategies:

Logan

Jun 30 2023

What are some common mistakes to avoid when trading with long-tailed pin bars?

Fred

Jun 30 2023

When trading with long-tailed pin bars or any trading strategy, it's essential to be aware of common mistakes that can hinder your success. Here are some mistakes to avoid:

Erica

Jun 30 2023

What are the potential advantages and disadvantages of using long-tailed pin bars compared to other candlestick patterns?

David Tristan

Jun 30 2023

Using long-tailed pin bars as a trading signal offers several potential advantages and disadvantages compared to other candlestick patterns.

Advantages of Long-Tailed Pin Bars:

Disadvantages of Long-Tailed Pin Bars:

Matt

Jun 30 2023

What are some techniques for filtering out false signals when trading with long-tailed pin bars?

James

Jun 30 2023

Here are some techniques that can help you minimize false signals: