Where is our position in regard to other players in the forex market? Here's what you need to know about the structure of the forex market.

Foreign currency trading, also known as forex, is often seen as the most profitable financial market. One indication is the daily liquidity of the forex market which reached $5.2 trillion in 2013 alone. As a result, the potential returns that traders can get from the forex market are greater compared to other financial markets with lower liquidity like the stock market. Apart from the high potential profit, the forex market also offers other advantages, such as minimum capital requirement and the flexibility of trading anywhere, any time. But even so, not many people understand the real structure of the forex market and where they stand as retail traders in this market.

The Forex Market Structure

Generally speaking, the forex market is a decentralized global market where all foreign currency trading happens. In this market, traders basically make a profit or loss from the changes in currency values. There are various types of participants in the forex market, including governments, banks, financial institutions, multinational companies, speculators, brokers, and retail traders.

See Also:

It is important to note that even though none of those groups have the ability to control the currency prices, their powers are not equal. Why is that? It's simply because the structure of the forex market is not centralized; very much different from the highly centralized stock market. In a nutshell, this is what the structure of a centralized market looks like.

We can see that the practice of trading is heavily centralized, meaning that all buyers' and sellers' activities are centralized in the exchange. In other words, the exchange basically brings together all market participants. Although the trading is mostly done online, the system still relies on centralized exchanges. In contrast, all forex trading happens over-the-counter (OTC). Take a look at the illustration below.

Notice that every forex market participant trades directly or through brokers and banks, without the use of a particular exchange as the intermediary. At a glance, such a decentralized system may seem random and rather chaotic, but this is not true! In reality, the participants of the forex market can be described in a certain hierarchy.

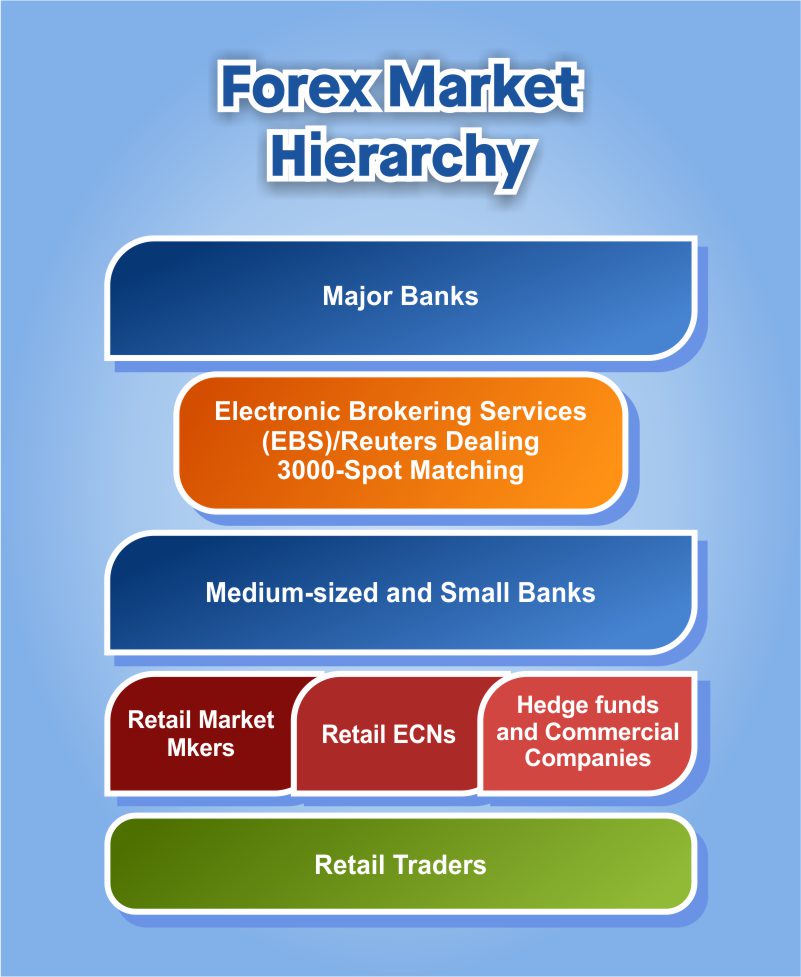

The Hierarchy of the Forex Market

The highest level of the hierarchy is occupied by the interbank market, which refers to the network formed from the transactions of major banks. Some of those major banks are Citi, JP Morgan Chase, UBS, Deutsche Bank, Goldman Sachs, Barclays, HSBC, Morgan Stanley, etc.

Moreover, the interbank network itself consists of the world's central banks, major banks, and some smaller banks. All of them essentially trade against each other either directly or electronically by using the Electronic Brokering Services (EBS) or the Reuters Dealing 3000-Spot Matching. It's worth mentioning that in the EBS platform, certain currency pairs such as EUR/USD, USD/JPY, EUR/JPY, EUR/CHF, and USD/CHF are more liquid than others. Meanwhile, on the Reuters platform, GBP/USD, EUR/GBP, USD/CAD, AUD/USD, and NZD/USD have higher liquidity compared to other pairs.

Next in the hierarchy are institutions like retail market maker brokers, retail ECN brokers, hedge funds, and commercial companies. And finally, at the bottom of the ladder are retail traders (us). Considering how small our power actually is in the forex market, it seems that we really need to thank the internet, electronic trading technology, and retail brokers because they've opened the path for us to take a small portion of profits from the grand forex market.

Conclusion

The structure of the forex market may look messy at first, but this is exactly what makes forex trading different from other types of investment. Our best bet when trading in such a huge market is our analysis to carefully enter and exit the market at the right time.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance