There are certain times when traders are advised to avoid forex trading, including the beginning of the week, the end of the week, holidays, and during news releases.

One of the most known forex trading perks is that you can always trade 24/5. But conveniently speaking, not every day is your ideal forex trading day. There are times when it's the best moment to trade, like from Tuesday to Thursday, for instance. But, there are also times when it's best to steer clear.

The reasons vary. It could be due to high market volatility, making it too risky to open a trade. Or, it might be because market liquidity is low, which can widen the bid-ask spreads.

For these reasons, certain times are suggested for you to temporarily avoid forex trading, such as:

- Mondays

- Fridays

- Holidays, especially US holidays

- Asian trading sessions

- High-impact news releases

- When you're not in the right mental state

Read more to discover why those specific times might be the worst for forex trading.

1. Early Monday Morning

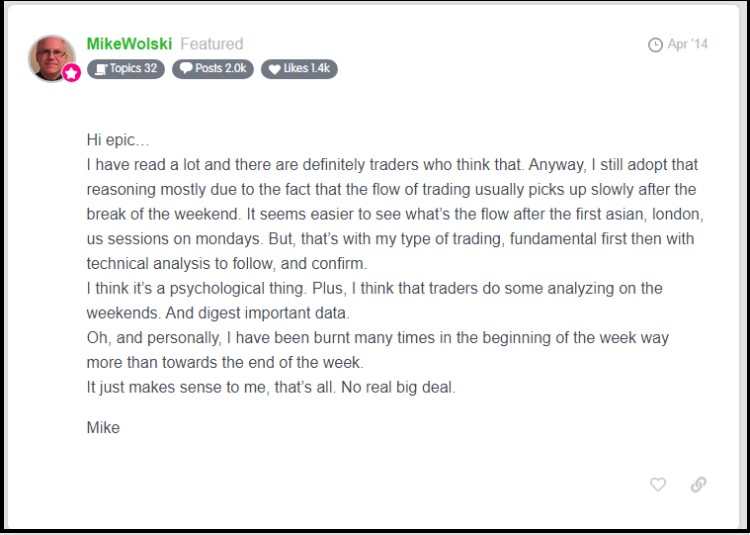

Monday is that kind of day where the weekend vibes still linger as we head back to work after a short break on Saturday and Sunday. Similarly, many traders are still in the process of adjusting to the new week, and they might feel a bit hesitant to dive into new positions.

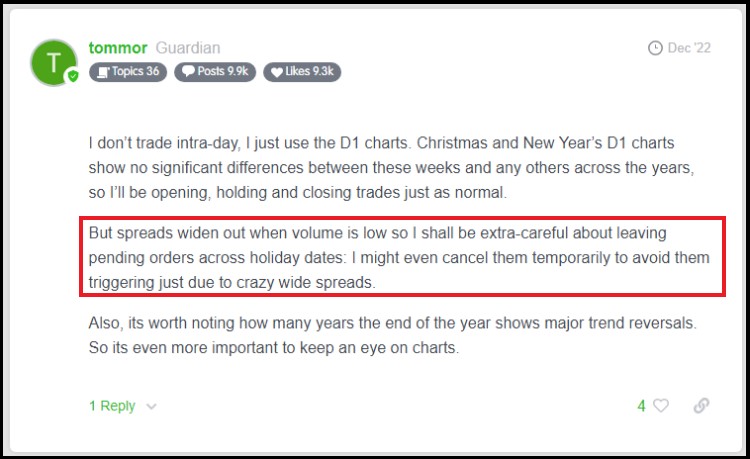

Here's a testimonial from a trader in Babypips.

On top of that, the forex market opens up at 5 p.m. EST on Sunday, which can sometimes create a pricing gap when Monday rolls in. These gaps can be sparked by unexpected weekend news or events, and they're not the easiest things to predict.

On this day, traders are carefully observing the market conditions while figuring out the direction to take for the week. Unless you've got an absolutely brilliant plan that would make you go crazy to miss out on, it's best to steer clear of Monday mornings for forex trading.

What would happen if I continued trading at this time?

If you continued trading on early Monday morning, you could potentially face increased market volatility and erratic price movements.What should I do at this time?

It's advisable to start the week with a thorough market analysis, considering any significant events or news expected for the week. Make notes, trading plans, or anything that can help you make a clear analysis.

2. Late Friday Afternoon

Late Friday afternoon is often considered the worst time for forex trading. The thought of initiating a new position just before a 48-hour period where we're essentially powerless to act but watch doesn't quite resonate with most traders.

Fridays also tend to be when traders close their positions and take their profits before the weekend. This can lead to erratic trading patterns, sudden price movements, and heightened volatility.

What would happen if I continued trading at this time?

You might encounter reduced liquidity in the market, which could lead to wider spreads and increased volatility.What should I do at this time?

During this time, you better exercise caution and consider closing any open positions before the weekend. It's a good opportunity to review your trading activities for the week, analyze your performance, and plan for the upcoming trading week. It's generally a time for risk management and preparation rather than active trading.

3. Holidays

Outside of weekends, the forex market also closes on certain holidays like Christmas, New Year, and Easter. Trading during these times can be quite risky due to low liquidity, which can lead to wider bid-ask spreads and increased volatility.

US holidays have the most significant impact on the market, typically resulting in quieter Asian and European sessions. Hence, it's usually advisable to avoid trading during the European or US sessions on US holidays, as there are fewer profitable trading opportunities.

On the other hand, Japanese or Chinese holidays, like Obon or Chinese New Year, tend to make the European open quieter but have little impact on forex market volatility afterward. This means you can trade the European and US sessions as usual during these holidays.

What would happen if I continued trading at this time?

You could experience lower market liquidity and volatility, resulting in price fluctuations that are hard to anticipate.What should I do at this time?

It's often best to avoid trading during holidays if you don't want to deal with trading losses. Instead, use this time to step away from the markets, relax, and recharge.

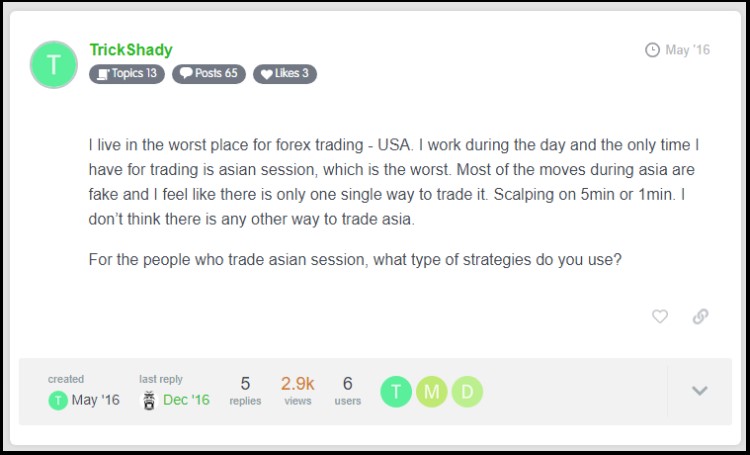

4. Asian Market Session

The Asian market session tends to be the most tranquil compared to others. During this session, you'll encounter lower liquidity and fewer participants. This might make it difficult to spot trading opportunities, and the lack of volatility can make it a bit harder to generate profits.

Additionally, when unexpected news or events occur, their impact can be significantly greater during this session, as there are fewer traders to absorb the shock.

What would happen if I continued trading at this time?

Continuing to trade during the Asian market session may lead to wider spreads between bid and ask prices because of less liquidity. However, that doesn't mean there is no liquidity at all in this session. It exists, but it may not generate a good profitablity.What should I do at this time?

The Asian forex session is typically known to adhere to key levels of support and resistance due to the lower liquidity and volatility experienced. As such, it is easier if you employ sideways strategy based on support and resistance levels as they are generally well-defined and coincide with the trading range.

5. High Impact News Release

Economic data releases such as Non-farm Payroll, GDP, the Consumer Price Index (CPI), and the like fall into the high-impact category. It's essential to remember that news like this can set off some seriously volatile conditions.

Traders often wait for these releases and enter positions based on the news.

What would happen if I continued trading at this time?

If you continued trading during a high-impact news release, there's a possibility that market volatility and price fluctuations can be significantly higher than usual. This can expose you to higher risk, as it might be challenging to predict price movements accurately during such events.What should I do at this time?

Wait for the session to close at 5 p.m. EST before making any further considerations. If you're trading on the 4-hour chart, refrain from considering any investment until the closure of the following 4-hour candle.

6. When You're Feeling Off

In the world of forex trading, maintaining the right psychological mindset is crucial. It's what keeps your thinking clear and prevents you from making impulsive decisions that could lead to losses.

Regardless of how resilient your mental state is, there will inevitably be "those days" when everything seems to go awry, and there's always a reason behind it.

On "days like that", it's a good idea to step away from your trading desk for a while. Your emotions are bound to influence your trading outcomes, especially if you've experienced consecutive losses.

Emotions might push you towards seeking revenge or taking positions outside your well-thought-out plans. In the end, it's you who'll bear the brunt of it.

No matter the cause, if you're not feeling up to trading, don't force it. There's no rule that says you must trade today. There are other days, better opportunities.

What would happen if I continued trading at this time?

If you continued, you might make impulsive decisions, deviate from your trading plan, and potentially incur losses from overtrading.What should I do at this time?

During such times, it's advisable to step away from trading. Take a break, clear your mind, get some fresh air, and relax for a moment. Return only when you feel mentally prepared for trading.

Final Thoughts

Based on the discussion above, two categories can be identified:

- Times when you should completely avoid forex trading: early Monday morning, late Friday afternoon, holidays, and when your mental state is not ready.

- Times are generally not recommended for trading forex but sought after by certain traders: the Asian session and around high-impact news releases.

Early Monday mornings, late Friday afternoons, and holidays are periods to steer clear of forex trading due to their high volatility and low liquidity.

In times of low liquidity, spreads can widen significantly due to the difference between bid and ask prices, incurring higher costs for traders. Additionally, price fluctuations during these hours are highly unpredictable.

Conversely, the Asian session does have lower liquidity compared to other sessions, but price movements during this time tend to consolidate after significant movements in the preceding New York session. Therefore, trading during this session is suitable for those who employ sideways strategies based on support and resistance levels.

Meanwhile, during high-impact news releases, trading is generally less recommended for most traders, except for those who follow fundamental news and know exactly how to take advantage of it.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance