Bid-ask prices represent the supply and demand in the market. Bid prices are selling prices, while ask prices are buying prices. Read more about it below.

You've probably heard about bid-ask prices, haven't you? If you decide to trade forex, you must and are obliged to understand the concept of bid and ask prices because it's a fundamental aspect of forex trading.

In short, the bid price represents the maximum price a buyer (or trader) is willing to pay for a specific currency pair.

Meanwhile, the ask price is the minimum price a seller (or trader) is willing to part with a currency pair.

If you ever saw "EUR/USD = 1.3350/1.3360" on a forex broker, it can be confirmed that 1.3350 is the bid price, while 1.3360 is the ask price.

Let's explore the following article for more information.

Understanding the Concept of Bid-Ask Prices

You must be familiar with the fundamental concept of forex trading, which essentially involves selling one currency while simultaneously buying another, right? This concept is similar to when you exchange money at a money changer.

For a simple analogy, let's consider John, an American tourist who wants to visit Europe. The cost of purchasing euros at the money changer is as follows:

1 EUR = 1.30/1.40 USD

In which the higher price (USD 1.40) represents the cost of buying each euro (ask price)

If John intends to buy 5000 EUR, the ask price would be applied to his transaction, so he would need to pay the following amount:

1.40 x 5000 = 7000 USD

Now, let's look at Ben, who happens to be in line behind John and is returning to America after his trip to Europe. He has 5000 EUR left and wants to sell them to get USD again. In this case, his reference price would be the bid price.

Therefore, the amount of USD he can receive is:

1.30 x 5000 = 6500 USD

See how simple it is?

Once you grasp the basic concept of bid and ask prices, you'll find it easier to understand them in the context of forex trading.

Bid-Ask Prices in Forex Brokers

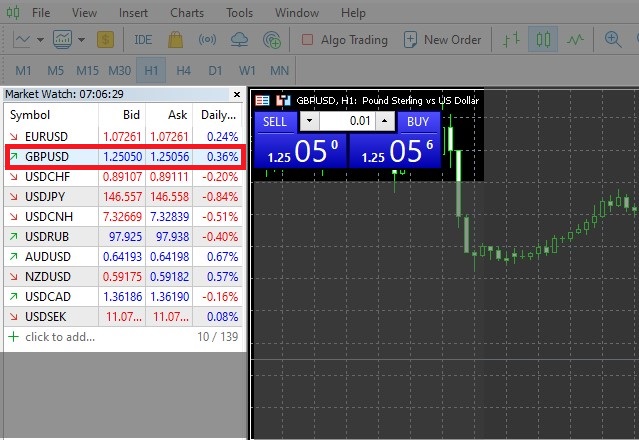

When trading, you won't encounter bid-ask prices at a money changer. Instead, you'll find them at brokers through their trading platforms. For example, on MetaTrader 4, the appearance of bid-ask prices is as follows:

Generally, bid-ask prices at forex brokers use 5 decimal pricing (0.00001). As seen above, the bid price for GBP/USD is 1.25050, while the ask price is 1.25056. This means if you are selling GBP/USD, the price for each GBP is 1.25050 USD. Conversely, if you want to buy GBP against USD, the price for each GBP is 1.25056.

Bid-Ask Prices Generate a Spread

As seen in the example above, there is a 6-point difference between the bid and ask prices. This difference is referred to as "spreads". The formula is as follows:

Spread = Ask - Bid

So, if the ask price is 1.25056 and the bid price is 1.25050, then the spread is 6 points or 0.6 pips. Pips themselves stand for "percentage in point" or sometimes "price interest point."

Pips are commonly used as a measurement of the change in value between two currencies in a currency pair. This difference serves as profit for the broker.

Calculating Broker's Profit from Bid-Ask Price Difference

Let's look at an example of how a broker profits from the difference in pips between bid and ask prices:

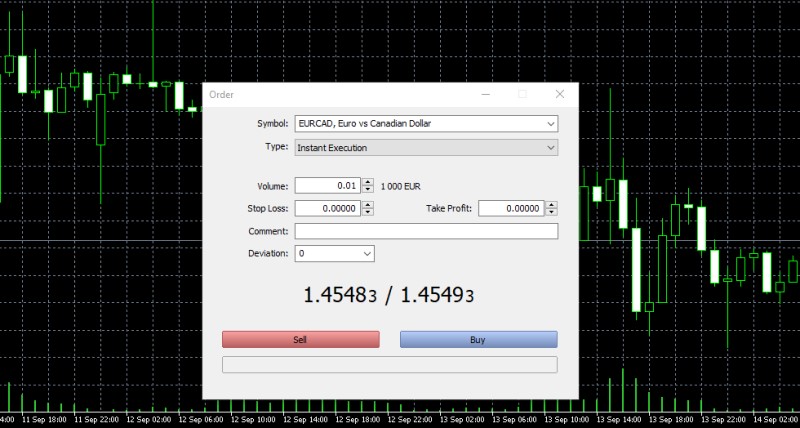

- Currency pair: EUR/CAD

- Bid price: 1.45483

- Ask price: 1.45493

- Spread: 1.0 pips

As the fifth decimal is basically the same, we can calculate the value per pip with the 4-decimal pricing standard. So, we will use 0.0001 instead of 0.00001 in the formula.

Value per Pip = (0.0001 / Exchange Rate) x Lot Size

Say we open a sell order and the volume is 1 lot (equivalent to 100,000), the calculation is:

- Value per pip = (0.0001 / 1.4548) x 100,000 = 6.8738 per pip

- Broker's profit = Spread (in pips) x Value per pip

- Broker's profit = 1 pip x 6.8738 per pip = 6.8738

So, in this example, the broker would make a profit of 6.8738 CAD from the 1-pip difference in bid-ask prices. Brokers often collect this profit as their trading fee.

See Also:

What Makes Bid-Ask Spread Fluctuate

Occasionally, spreads can significantly widen as a result of market dynamics such as significant economic announcements. But the spread would eventually revert to its usual level.

There are several factors that can cause bid-ask prices to fluctuate:

- Market volatility: High levels of volatility in the forex market can lead to wider spreads. This is often seen during major news releases or unexpected events that cause sharp price movements.

- Liquidity: Highly liquid assets, like major currency pairs in the forex market, typically have narrower spreads because there are many buyers and sellers. On the other side, spreads widen when there is less liquidity in the market.

- Trading hours: The bid-ask spread can vary depending on the time of day. During peak trading hours when major financial centers overlap, spreads tend to be tighter. However, during off-hours or weekends when trading volumes decrease, spreads can widen.

- Instrument type: Different financial instruments may inherently have different spread characteristics. Exotic currency pairs like USD/TRY, which involve currencies from emerging economies, usually have wider spreads compared to major pairs like EUR/USD or USD/JPY, due to fewer market participants.

- Market Participants: Large institutional traders and market makers can impact spreads. When these participants enter or exit the market with significant orders, it can lead to temporary spread widening as brokers adjust to accommodate the increased demand or supply.

Tips for Trading with Favorable Bid-Ask Prices

- Be aware of the market hours and when the bid-ask prices tend to narrow. For instance, the overlap of major trading sessions, such as the London-New York overlap in the forex market, often offers tighter prices. Trade during these hours if possible.

- If you're trading during periods of increased volatility, adjust your risk management accordingly by widening stop-loss levels and prepare for more significant price fluctuations.

- Choose your broker wisely. Different brokers offer varying price, and some may provide more competitive rates than others. Research and compare brokers to find one that offers the best pricing.

- Use limit orders to help you control your entry and exit points. A limit order allows you to specify the exact price at which you want to buy or sell. By setting limit orders, you can potentially avoid entering trades at less favorable prices affected by the spread.

Conclusion

It can be concluded that bid-ask prices are the two prices set as your reference points for transactions in the forex market. The bid price is the selling price, while the ask price is the buying price.

To remember this more easily and avoid confusion, simply look at each price. The lower price is definitely the bid price, and the higher price is the ask price. The difference between them is called the spread.

This spread is what you need to pay attention to because, in forex trading, the spread is one of the trading costs you have to bear. If you can manage and adapt it well to your trading style, you can save on your trading expenses altogether.

One way to manage trading costs is by selecting a broker that offers low spreads for trading. For Australians, here is a list of Australian brokers that offer low spreads for forex trading.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance