Hedging is a powerful tool to help forex traders diversify their trading portfolios. How does it happen and what are the advantages? Let's delve further.

Embarking on the thrilling journey of Foreign Exchange (Forex) trading is akin to stepping onto a rollercoaster – exhilarating but marked by twists and turns. As traders navigate the dynamic and volatile nature of forex, the quest for strategies to safeguard investments becomes paramount.

One such strategy that has captured the attention of traders seeking stability is hedging. In this article, we'll delve into the human side of hedging, exploring its concept, mechanisms, and the tangible benefits it brings to forex enthusiasts aiming for a robust and diverse portfolio.

Understanding Hedging

At its core, hedging is a crucial risk management strategy. After analyzing the core concepts of FX which you can find here, it will be simpler to add hedging knowledge to your strategy as it involves balancing the scales by taking an opposing position in another investment. In the context of forex trading, hedging becomes a strategic dance of opening positions to counteract adverse movements in exchange rates. It's like having a financial safety net to cushion against market uncertainties.

How Hedging Builds a Diversified Forex Portfolio

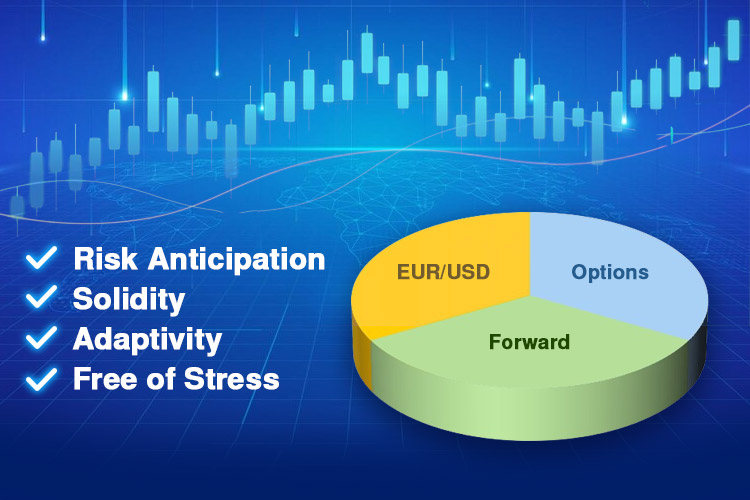

Hedging in forex involves strategically placing trades to offset the potential losses in existing positions. By doing so, hedging plays a crucial role in building a diversified forex portfolio through the following mechanisms:

Using Multiple Currency Pairs

Picture this as orchestrating a symphony of currencies. Traders can embrace the art of hedging by juggling positions in multiple currency pairs. The key is choosing pairs that perform a dance of opposites – when one rises, the other gracefully descends.

For example, a trader decides to go long on EUR/USD, anticipating a rise in the Euro against the US Dollar. Simultaneously, they offset potential losses by taking a short stance on USD/JPY, where a decline in the US Dollar benefits their position.

Utilizing Derivative Instruments

Enter the world of options and futures contracts — the supporting cast in the drama of hedging. Options, endowed with the distinctive capacity to purchase or sell a currency pair at a predetermined price within a specified timeframe, take center stage.

Imagine, a trader, holding a significant long position, uses options contracts to limit potential losses. If the market moves unfavorably, the trader can exercise the options, selling the currency pair at a predetermined price and minimizing the impact of adverse market conditions.

Forward Contracts

Imagine entering into a forward contract as making a promise to the future. In this scenario, two parties come to an agreement to swap currencies at a prearranged rate on a specified date.

For instance, a trader expects volatility due to geopolitical events and enters into a forward contract to secure a favorable exchange rate. This commitment shields the trader from the tempest of adverse currency fluctuations.

Benefits of Hedging in Achieving a Diversified Portfolio

Hedging plays a pivotal role in constructing a diversified forex portfolio with the following advantages:

Risk Mitigation

The drama of forex trading is rife with unpredictability, and hedging emerges as the hero mitigating risks. Traders, armed with strategic hedging techniques, safeguard their portfolios from the plot twists of adverse market conditions.

During the COVID-19 pandemic, global markets experienced unprecedented volatility. Traders employing hedging strategies mitigated losses as they anticipated and offset the impacts of market uncertainties.

Stability and Consistency

Think of hedging as the steady hand guiding a ship through turbulent waters. Instead of relying on the success of individual trades, a diversified portfolio with hedged positions offers a more predictable and consistent performance.

As a scenario, let's imagine a trader maintains a balanced portfolio with both long and short positions, ensuring that the overall performance remains stable, even if some individual trades encounter losses.

Flexibility in Market Conditions

Hedging is the adaptive dance partner in the ever-changing tango of market conditions. Whether the market is in an upbeat salsa or a melancholic waltz, a diversified portfolio with hedged positions gracefully adapts to different scenarios.

More specifically, amidst economic downturns, traders with diversified portfolios and well-timed hedges were able to navigate the market, seizing opportunities for profits while minimizing losses.

Reduced Emotional Stress

Trading in the forex market can be an emotional rollercoaster, with unexpected losses triggering anxiety and stress. Here, hedging steps in as the calming voice of reason.

Imagine, a trader faces a sudden downturn in a major currency pair. However, having implemented hedging strategies, they remain calm, knowing that potential losses are offset by gains in other positions.

In Closing: Hedging as the Guiding Beacon in the Unpredictable Forex Market

In the enthralling narrative of forex trading, where unpredictability is the protagonist, hedging emerges as the seasoned storyteller. Through various hedging mechanisms, traders add a human touch to their portfolios, effectively managing risks, enhancing stability, and confidently navigating the intricacies of the forex market.

While hedging may not erase all risks, it becomes a powerful tool for minimizing potential losses and crafting a resilient and well-rounded trading portfolio. Traders embracing the principles of hedging are not merely spectators but active participants, better positioned to savor the challenges of the forex market and increase their chances of long-term success.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance