The Moving Average fakeouts is a unique approach among many other pullback trading strategies. But it is not supposed to be applied all by themselves.

The Moving Average has been a long-time favorite among worldwide traders. Stock traders, forex traders, and crypto traders alike. As such, trivial issues related to Moving Average often rise to prominence in online forums. One of the issues is: are Moving Average fakeouts tradable?

To answer this question, we have to first understand what is Moving Average fakeouts. And then experiment with it to measure its feasibility.

What are Moving Average Fakeouts?

Mark Fisher explained the Moving Average fakeouts trading strategy in his book "The Logical Trader". The idea is to seek inaccurate counter-trend moves (the so-called "fakeouts") using Moving Averages, and then make use of it as a buy/sell entry signal or initial trading direction (confirmed by other indicators).

This approach does not use closing prices when computing the Moving Averages. Instead, we have to calculate the average of each bar's pivot point (Pivot Point = (High+Low+Close)/3).

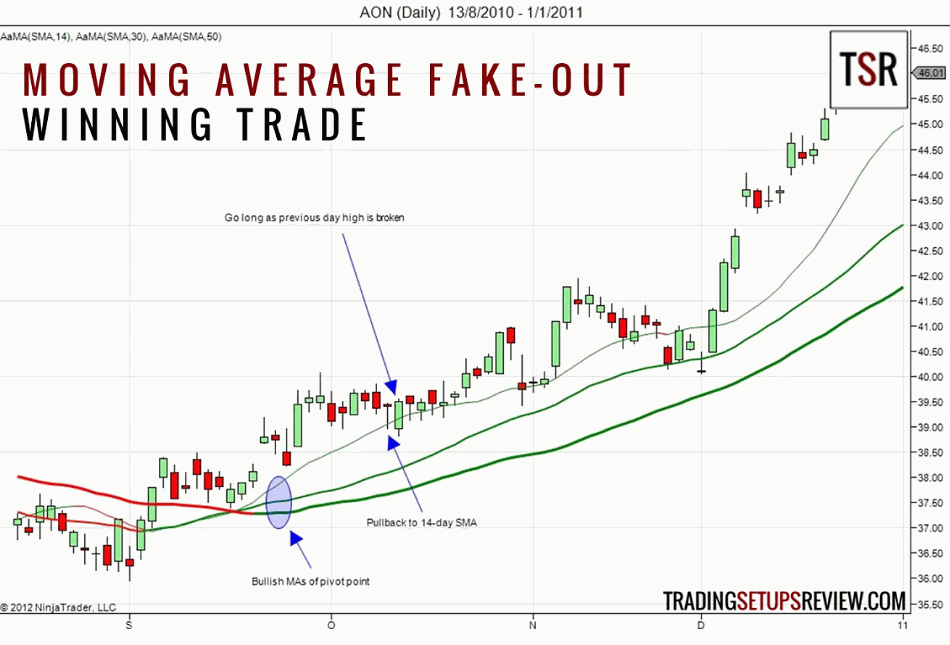

An example of Moving Average fakeouts consists of three Simple Moving Averages (SMAs), they are 14-period, 30-period, and 50-period SMAs. A buy signal appears when the pivot points of all three SMAs are sloping upward, and prices have pulled back to the 14-period SMA without dropping below the 30-period SMA. Traders then may go long when prices move above the lowest previous high beyond the 14-period SMA, as shown below.

In the other direction, a sell signal appears when the pivot points of all three SMAs are sloping downward, and prices have gone up to the 14-period SMA without going over the 30-period SMA. Traders then may go short when prices move below the highest previous low under the 14-period SMA.

In the other direction, a sell signal appears when the pivot points of all three SMAs are sloping downward, and prices have gone up to the 14-period SMA without going over the 30-period SMA. Traders then may go short when prices move below the highest previous low under the 14-period SMA.

Can We Use This Setup for Day Trading?

This setup is a unique approach among many other pullback trading strategies. First, the application of three Moving Averages enables traders to find daily trading opportunities through crossovers and fakeouts.

Second, all three Moving Averages are of reasonably significant intermediate periods —14, 30, and 50—. A shorter period Moving Average simply serves to muddle price action because it is a near proxy for the price itself, while a longer period Moving Average is ineffective in filtering daily range and lags as a trend indicator.

Third, Mark Fischer does not focus on the Moving Averages themselves but instead on the slope of their pivot points. This is the crucial component of the Moving Average fakeouts strategy and is very suitable for intraday charts.

Nevertheless, Moving Average fakeouts are not supposed to be applied all by themselves. Traders may supplement their own Moving Average setups with this idea, as Mark Fisher himself advised using the Moving Average fakeout to supplement other trading strategies. But opening trades based on unconfirmed fakeouts is simply preposterous as this is not a 100% accurate trading setup.

A brief trial in a demo account shows that Moving Average fakeouts are as liable to fakes as the Moving Averages themselves -pun intended-, because they are lagging indicators. Most notably, we have to exit as soon as possible if recent candlesticks display remarkable changes in buying/selling pressures. As such, you should still center your strategies around the price action instead of the Moving Averages.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance