Myfxbook Autotrade has a lot of benefits for both professional traders and beginners. You can copy trading systems or become a provider yourself.

There are a lot of reasons why some traders prefer copy trading over regular one. Whether it's the convenience or the simplicity, there is no denying that this method has gained popularity over the years. No wonder more and more websites offer copy trading tools for traders.

But not all of them are trustworthy. If you don't make the right choice, you might be scammed. Myfxbook Autotrade is probably one of the most recognized copy trading tools in the market. Professional and new traders come to this platform because it's simple.

Get to Know Myfxbook and Its Benefits

Myfxbook Autotrade is a copy trading service allowing you to copy other professional traders on the platform. It also enables professionals to evaluate, analyze, share, and compare their strategies and account performance. This tool lets them track and analyze behind every trade they did

Two brothers from Israel created these tools, Alexa and Pavel Rekun. The two creators started working on their ideas when they were teenagers and managed to launch the service in 2009. At the time, they aimed to create a social trading community for both newbies and professionals.

They want to help traders to learn more about the trading industry by joining community discussions and copying veteran traders, so they could have an idea on how experienced traders do their trades.

You can use Myfxbook Autotrade free of charge, but if you decide to trade using this service from a broker, you might be charged a commission fee. Currently, Myfxbook Autotrade has joined hands with hundreds of brokers across the industry and continues to be one of the best copy trading services.

That is because the platform strives to give you accurate statistics to ensure you have the best trading experience. Despite it being a copy trading tool, you still get full control of your account. That means you can add or remove a system at any time, making you the master of your account.

For better ideas about Myfxbook Autotrade, check out the pros and cons below.

Pros:

- Plenty of options for trading platforms

- Available in a lot of reliable brokers

- There are three types of financial charts

- Plenty of tools to help you trade

- Easy access to multiple markets

- Test copy trading in a demo account

Cons:

- Outdated user interface

- No filter is available for searching for traders

- The minimum investment for copy trading is $1,000

- Only 162 signal providers are available.

How Does MyfxBook Autotrade Work?

A common misconception among new traders is that Myfxbook Autotrade is a broker itself, while the reality couldn't be further than that. This platform doesn't act as a broker, so they mostly partner with a broker. Using Myfxbook Autotrade is not too complicated, but you do need to pick a good broker that integrates with their system.

1. Pick Your Broker

Before you sign up for an account, the first and most important step is to choose your Myfxbook broker. There are a lot of brokers who partnered with Myfxbook Autotrade to provide their clients with the best auto trading features. IC Markets, for one, is an ASIC-regulated broker and has one of the best raw spreads in the market.

Other brokers that can be connected with Myfxbook Autotrade are:

2. Sign Up for Automated Trading

The next step is to sign up with your broker. Remember that terms and conditions might differ from one broker to another. For example, registering for automated trading in IC Markets only takes a few steps. For existing clients, they still need to open a new live account to be connected to Myfxbook Autotrade. However, such a case might not be needed in other brokers.

3. Deposit Your Funds

Just like any other trading method, auto trading will require you to deposit some funds into your account. Each broker might have different policies regarding the money needed to start autotrade. Sometimes, brokers might set different minimum deposits for each asset they provide. But luckily, most of them give out this information on their official websites.

Another thing to consider is what kind of payment options they have. Some brokers might limit their service to bank transfers and credit card, while others might be willing to accept e-payments and even Bitcoin.

4. Pick Your System

Trading systems listed in Myfxbook Autotrade are plentiful. The question is how do you distinguish the best one? Luckily, you can check out trading portfolios so long as the system providers make them public. You need to understand the basic knowledge of the market to know whether a system will work in your favor or not, and how they maneuver around difficult times.

But remember, trading is risky no matter what methods you choose. You can single out the best trader to copy and still end up losing. What determines a successful copy trading is the overall amount you win can cover the amount you lose as well as the service's expenses.

See Also:

5. Starts Copy Trading

Once you've done all the steps above, it's time to start copy trading. Myfxbook tool links to your trading platform and automatically imports all past and active transactions from one's trading account.

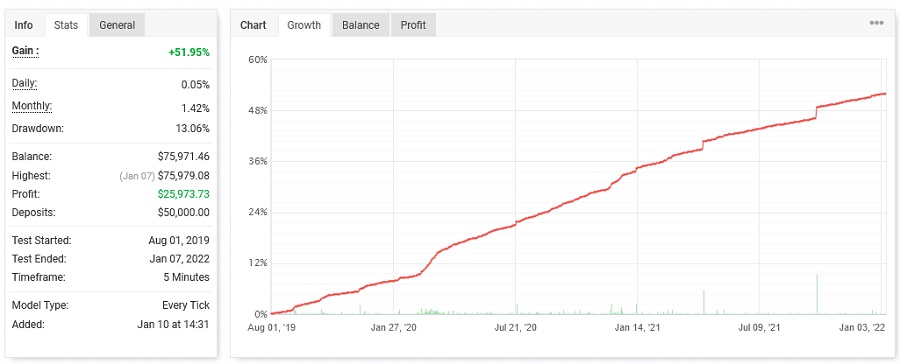

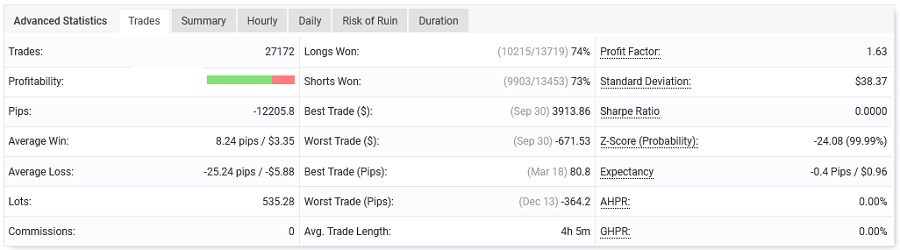

It lets you graphically view all of your provider's trading statistics including balance movements, equity, and drawdown. You can also view statistics of past trades, performance in pips or percentages, and visualize which products traded the most or best. This info can be made public or kept private.

The Key to Copy Trading with Myfxbook Autotrade

Profit is commonly the main concern when trading. After all, it is the main reason why traders enter the market. Copy trading itself can be a great way to bring you a lot of gains if done correctly.

Especially if you are a super busy person with a full-time job, while it might seem easy, there is more about copy trading that you should know. There are other steps to ensure you get what you are looking for.

1. Analyze

Now, you probably think that copy trading doesn't require market analysis. At some level, it is true. You don't have to study the most complicated technical analysis. Nonetheless, it's always important to have a basic understanding of trading system and how it works. Once you find a system you like in the table, you can drill down to get the description and detailed stats.

You can see a detailed performance or go to the more advanced zones and check out what indicators are being used, profit factor, standard deviation, and many more. These should be your guides to choosing the best system to copy. But, you won't be able to do it if you don't understand any of it.

Some copy trading platforms like Myfxbook Autotrade allow users to filter traders based on specific criteria, such as trading styles, preferred assets, or focus on fundamental or technical analysis.

By considering upcoming economic events, copy traders can align their strategies with those they choose to copy, ensuring compatibility and consistency in their trading approach.

2. Understand the Risk

When you copy a system in Myfxbook, by default, it will copy all open trades when they can be opened at a price better than the system. Sadly, this also means all trades in losing positions will be copied immediately. To avoid this, you must wait for the systems to have no open trades before you start copying. Don't forget to apply solid risk management in your strategies.

Applying a good risk and reward ratio before you start copy trading is always best for better results. For ideal risk and reward ratios, aim for a 2:1 or 3:1. Additionally, limiting the investment to a maximum of 2% of your total capital per trade is advisable. Patience is key; waiting for spike downs or ups can provide favorable entry points.

See Also:

3. Check the Economic Calendar

An economic calendar is essential for copy trading. It helps copy traders stay informed, manage risks, time their trades effectively, understand market dynamics, and align their strategies with chosen traders.

Economic events like central bank meetings, interest rate decisions, GDP releases, employment reports, and inflation data can cause significant market volatility.

Luckily, this feature is available in Myfxbook Autotrade. This way, traders can check what kind of economic releases will be coming soon. However, It is also important for traders to know which economic releases have a significant impact.

4. Diversify Your Trades

It is crucial to prioritize portfolio diversification and risk distribution. This involves following multiple investors instead of relying solely on one source. By diversifying your selections, you minimize the likelihood of substantial losses in case any of the investors you follow encounter a challenging period.

To achieve diversification, consider investing in various asset classes and tracking investors with different risk profiles. For instance, you may follow one or two high-risk investors alongside a few more conservative ones. This approach enhances your overall risk management strategy and promotes a balanced investment portfolio.

How to Be a Strategy Provider in Myfxbook Autotrade

Anyone, including you, can become a provider in Myfxbook Autotrade if they fulfill the requirements:

- First, you must own a verified MetaTrader 4 account connected to Myfxbook with a minimum balance of $1,000, at least 3 months of trade history, and 100 previous closed trades.

- Second, you need a historical account drawdown of no more than 50% with at least 10% returns of the maximum drawdown. Lastly, you will need an average trade time of 5 minutes and an average pip gain per trade of at least 10 pips. If you succeed, you will get paid 0.5 pips per winning trade.

In general, the tools and features provided by Myfxbook Autotrade are very useful. If you look at it, it seems to make trading easier for busy traders or newbies. However, there are some limitations to it. For example, the risk management features are limited and only useful if you copy one strategy at a time.

Since the system uses "hypothetical" results, it means there's always a possibility that your expectations might be wrong. After all, the forex market is highly unpredictable and prone to unexpected movements. If the question is whether it's a good copy trading service or not, of course, it's as good as any other trading method you can find. The key is to keep your reality checked and don't forget to take safety measurements beforehand.

Besides Myfxbook Autotrade, Expert Advisors (EA) often become a popular choice among busy traders. Find out the answer to all your questions about EA in Expert Advisors, Is It Worth Trying?

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

6 Comments

Jackie

Feb 1 2022

Marlie

Feb 3 2022

Jackie:

Algorithmic trading in simple terms means automating the set of rules based on your trading decision like where to buy and sell by analyzing the Markets.

You can implement Algorithmic trading for any of your desired financial instruments such as stocks, commodities, bonds, or Forex. All you need to do is to program your strategy on a computer, and it will trade on your behalf of you. There are no emotions or human errors involved at all.

In short, Algorithmic/Automated trading can be highly profitable if you do it the right way. I have seen people who have quadrupled their capital in less than a year using Algo trading. I have 3 trading systems deployed on my trading platform and they have been consistently profitable for three years now.

Mathews

Feb 6 2022

Jackie: Not always.

Trading software is mostly used by those who are too lazy to research the market or those who wish to save their time. Both these features are fatal for a trader.

Some of the apps may be more effective than the others, but in common they don’t hold a candle to manual trading which you control on your own.

Rhanu

Feb 8 2022

Marcus

Feb 10 2022

Rhanu: From my Trading experience it's not possible to earn on a daily basis with this platform. Moreover, you can follow a certain strategy that was created by someone. So there is always space for error which may result in loss.

No one can find a 100% working strategy in a market.

Carrick

Feb 9 2022

In my view, this tool has really improved my trading and has helped me to understand where I'm going wrong and what I need to do to improve. This analytical tool is second to none. My only negative is that sometimes it doesn't update for days.

My account hasn't been updated for 10 days now so not sure what has happened. Apart from this, I'm really happy with everything else.