eToro is a well-known company for its social trading platform. One of their main offerings is stock investing in a sophisticated way. Is it worth checking out? How to invest in stocks with eToro?

In 2010, eToro introduced the idea of "copy trading" which allows traders to copy the exact trades of more experienced traders. eToro's copy trading can be used to trade various instruments including stocks.

This means beginners can copy the trade from more experienced traders while learning about different trading strategies. On the other hand, professional traders can get their trades copied, which can benefit them in the popular investor program.

✔️ Pros

- User-friendly and intuitive interface

- Allows you to copy the trades of successful traders on the platform

- A wide range of assets for trading, including stocks, ETFs, cryptocurrencies, and commodities

- Connect with other traders and share ideas through the platform's social features.

- No account management fees

❌ Cons

- Smaller selection of stocks and ETFs compared to other brokers.

- Trading fees, particularly for CFDs, can be higher than some competitors.

- Basic research tools compared to more advanced platforms.

- Customer service options may be limited.

- Past performance of copied traders is not a guarantee of future success

How to Trade with eToro Copy Trading

Copy trading is the best feature offered by eToro. It allows you to copy someone else's trades and make them your own. This means that the money in your account will be traded in real-time to reflect the trading patterns in the same percentages. The feature is handy for new traders who are still learning to trade.

With the help of expert traders or popular investors on eToro social trading, new investors can try different strategies and gain profit from their positions. This is surely a new and attractive way to invest in the stock market instead of going the conventional route.

Furthermore, you can see detailed information about the popular investor's trade history and ask them how to improve your trades. So clearly, the potential for making serious money is huge here.

For beginners, it is okay if you want to start small. In eToro, the minimum money you should invest in a copy trade is $200 and you can pick up several traders to copy. By choosing a few traders at a time, you can try different strategies and keep your portfolio diverse, especially since eToro's instrument list covers anything from stocks, currencies, indices, commodities, cryptocurrencies, to ETFs. Using different trading instruments and strategies, you can lower your risk of failing and losing money because you have several different probabilities.

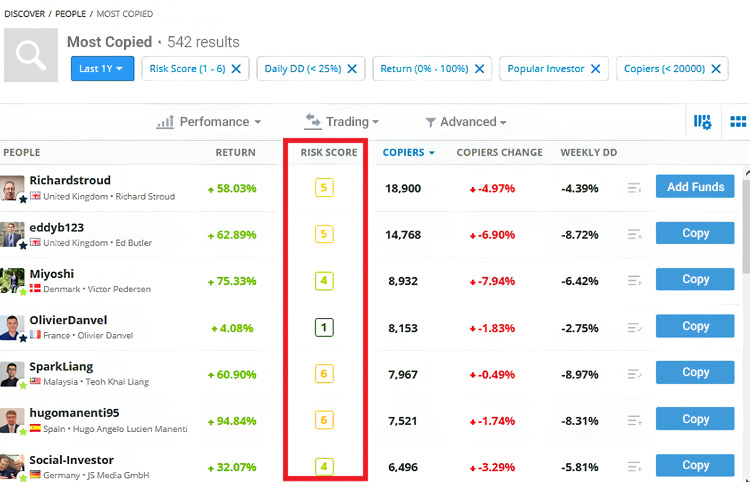

eToro broker offers a very interesting feature called Risk Score to measure the risk of your trade. The score ranges from 0 to 10, with 0 being no risk and 10 being incredibly risky. To maximize the use of your money, we suggest you invest in three low-risk investors, one medium-risk investor, and one high-risk investor. You can see the risk scores of each investor in the special column as displayed below:

Essentially, the more money you have, the more diverse your investments could be. But even so, you must be wise with your money management and not invest more than you can afford.

The main issue with the 68% of people that lose while trading with eToro is dominated by greed and recklessness. They don't follow the initial strategy that works. Remember that though more money means more potential profit, it can also mean more potential loss.

Finding High-Quality Traders to Copy in eToro

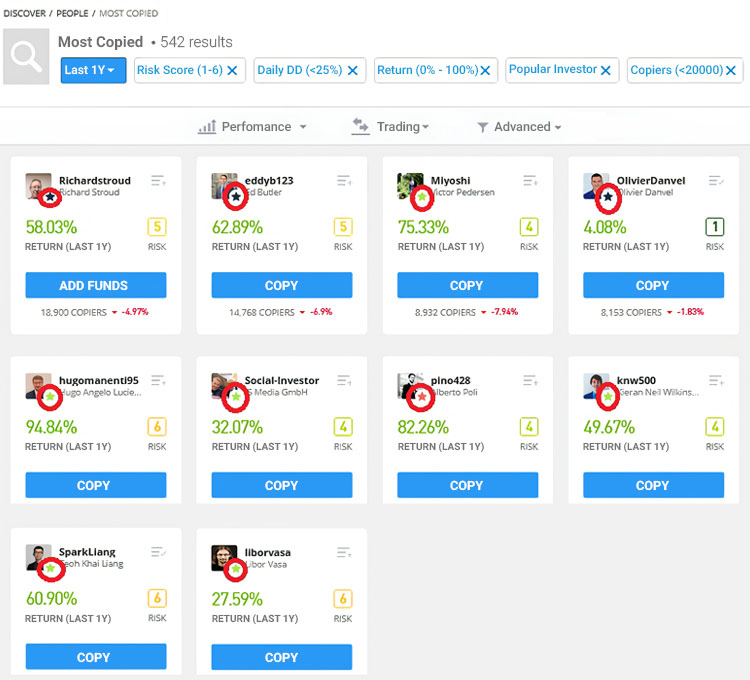

Because you're about to copy someone else's trade, you must ensure the trade is profitable and carried out by a high-quality trader. First off, all traders you copy must be verified and officially a part of the popular investor program. You can gather this information from the colored stars by their profile picture, which shows that their trading style and performance have fulfilled the minimum guidelines set by eToro broker.

Basically, there are 4 levels of investors that you should be aware of:

- Cadet level, indicated by a blue star.

- Champion level, indicated by a red star.

- Elite level, indicated by a green star.

- Elite Pro level, indicated by a black star.

You can see the star indicator on the platform when you open the menu of "Copy People".

Of course, the higher the level, the more recommended an investor is. The following table describes how investors are determined by certain criteria:

| Criteria | Cadet | Champion | Elite | Elite Pro |

| 💰Monthly Payment | ❌ | 1.5% (min $250, max $500) | 1.5% (annual AUC) | 1.5% (annual AUC) |

| 💸Minimum Average Monthly AUC | ❌ | $50k | $400k | $10M |

| 📈Minimum Average Monthly Equity | $1000 | $10k | $50k | $100k |

| 👨💻Minimum copiers | 1 | 5 | 10 | 10 |

| ⌚Minimum time on level | 2 months | 4 months | 2 months | ❌ |

| 📗Educational requirements | ❌ | ❌ | Investment Management Qualification | Advanced Investment Management Qualification |

| 📰Posts on the news feed | ❌ | Monthly, minimum one post of 100 words | Monthly, minimum one post of 100 words | Monthly, minimum one post of 100 words |

| 💲eToro Money | ❌ | Activated | Activated | Activated |

| ⚠️Maximum daily risk score | 7 | 7 | 7 | 7 |

Aside from the abovementioned parameters, there are at least 5 qualities that the trader you copy in eToro must have, such as:

💡Can really show their trading knowledgeIn addition, make sure that you follow traders with years of experience | 🔻Can maintain low weekly and daily drawdownsIn this case, avoid traders with more than 10% drawdowns. |

💹Don't have incredibly high returnsWhile this may sound beneficial at first glance, but if someone gains 1000% returns in a very short period, it most likely to be unsustainable luck and not based on the actual strategy. | 🥇Don't have a 100% win rateEven the most successful traders in eToro experience downfalls once in a while. It is perfectly normal to close some trades in the red zones and get losses. It shows discipline and experience that only a proper trader has. |

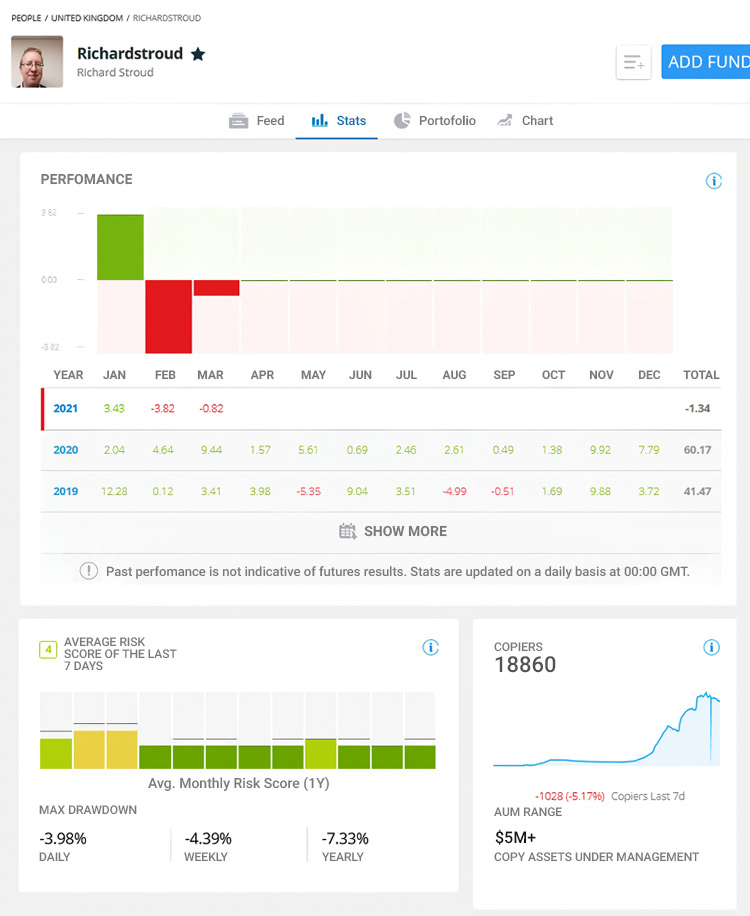

To check the qualities above, you can go to a trader's profile and click the "Stats" menu. Meanwhile, the fifth quality can be checked in the trader's "Feed".

Apart from the aforementioned criteria, it's also recommended to choose traders who are open and communicative. A high-quality trader would help you learn and willing to share their trading methods. If they don't reply to your messages, that could be a sign that they don't care or don't have the answer because they don't know what they're doing.

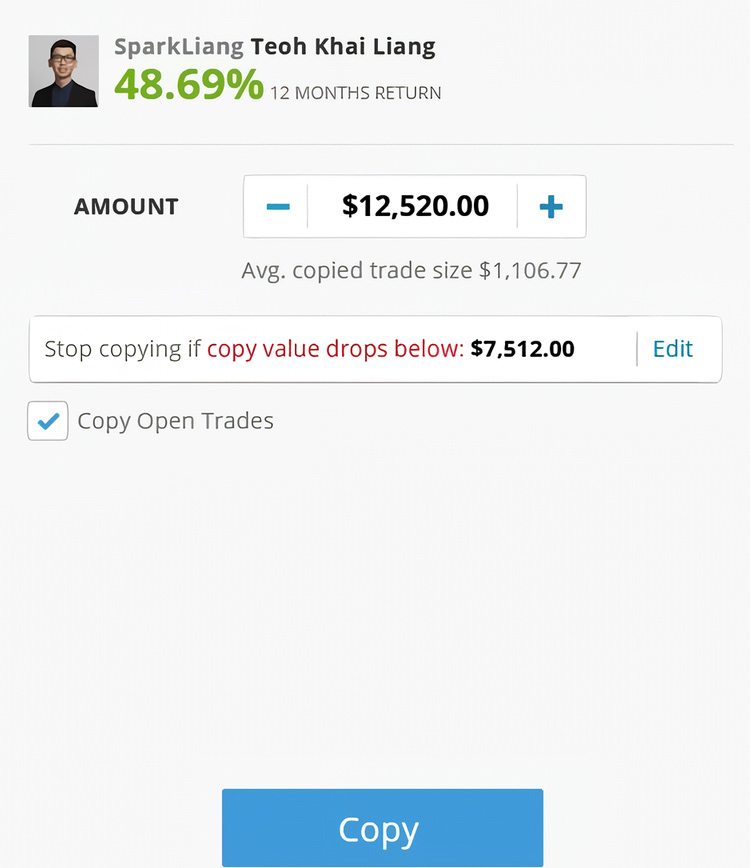

How to Copy a Trader

Once you find the trader you want to copy, open the trader's profile and click the blue "Copy" button. The platform then will ask you to input the amount of money you are willing to invest. You can see some useful information appears on the page as well.

You can also set a stop loss to your trade, which helps protect you against heavy losses. It sets at 40% by default but in eToro broker it is completely customizable. You can set the level to whatever you want based on how much risk you can take. Setting the stop loss at 40% means if the person you copy loses 40% of their trades, your account automatically stops copying them and closes the trade.

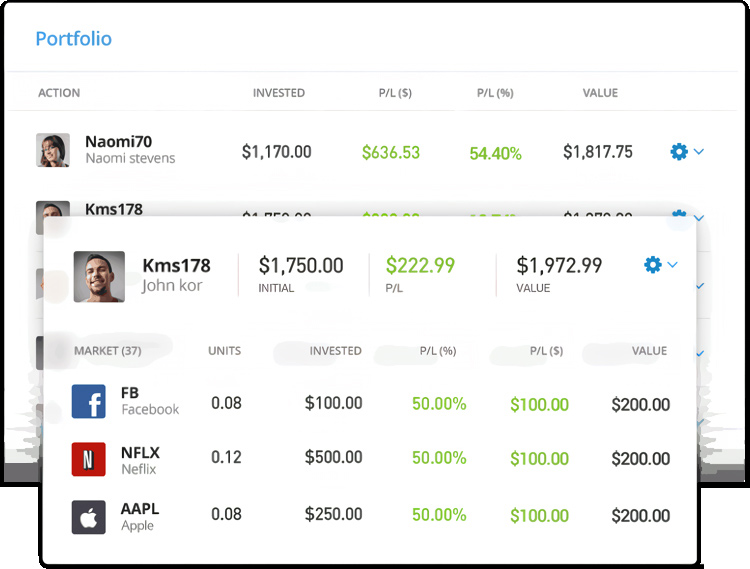

Now that you have an open trade going, you can check your performance on the "Portfolio" page. It shows all of your open positions and also access to your trading history. Other than that, all of your copied traders are also listed there. By clicking on the person, you can see their overall return on the investment in a trader and also see what positions they (and you) currently have.

Becoming Popular Investor

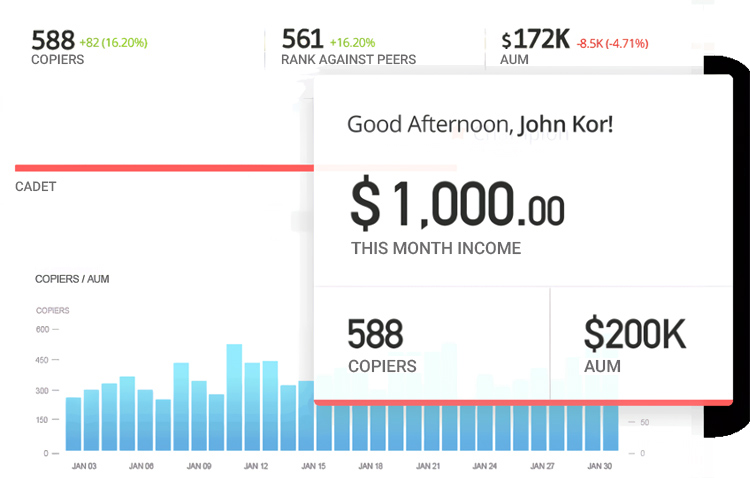

Apart from copying someone else's trade, you can also let other eToro traders copy your trade. You will receive additional income for sharing your expertise. The more people copy your strategy, the higher your income.

In order to get your business to the next level, you can join eToro's Popular Investor Program. It offers a number of benefits such as annual payment of 1.5% under copy (paid out monthly), global exposure, instant credibility, as well as premium access to various perks on the platform.

As soon as you join the program and increase your performance quality, you'll notice that people will start copying you! Apart from being exciting, you can also receive a monthly commission as your number of copiers increases. Therefore, it can motivate you to focus more on your trade and perform well.

To join the program, there are several requirements that you must fulfill. Here is the full list:

- You must have a fully-verified eToro account with at least $1,000 equity in your account.

- Make sure that your real name and photo are visible to the public.

- Have a bio of at least 150 characters, describing your goals and investment strategy.

- To convince your potential followers even further, you'll be required to have an active trading and investing on the platform for at least two months.

- Do not let your average risk score goes below 8 in the last six months. This indicates that your strategy is reliable and consistent.

- Have at least one person copying you.

If you have what it takes, simply log in to your eToro account and apply to the Popular Investor Program. Agree to the terms and conditions, and you're practically done! Your application will be reviewed and you'll get the result within 14 days.

Popular Investor Requirement Levels

To get to the top of the eToro copy trading platform, you'll need to go through several stages. Each stage has a different payment plan for the income you'll be making as well as different perks and benefits. See the details in the following table.

| Criteria | Cadet | Champion | Elite | Elite Pro |

| 👥Refer a friend | ✔️ | ✔️ | ✔️ | ✔️ |

| ⭐Priority customer service 24/6 | ✔️ | ✔️ | ✔️ | ✔️ |

| 🔰Featured in eToro Marketing | ✔️ | ✔️ | ✔️ | ✔️ |

| 🎉Invited to Annual Popular Investor Summit | ✔️ | ✔️ | ✔️ | ✔️ |

| 🆙eToro Club Upgrade | Gold | Platinum | Platinum+ | Diamond |

| 🌐Weekly macro update | ✔️ | ✔️ | ✔️ | ✔️ |

| 🔍Investment Management Exam | $1,000 | $1,000 | $1,000 | $1,000 |

| 💰Investment book reimbursement up to $100 | ❌ | ✔️ | ✔️ | ✔️ |

| 💎TipRanks Premium subscription | ❌ | ❌ | ✔️ | ✔️ |

| 👨💼Client Relationship Manager in Popular Investment Team | ❌ | ❌ | ✔️ | ✔️ |

| 🏢Invitation to eToro global offices | ❌ | ❌ | ✔️ | ✔️ |

| ☎️Conference calls with top copiers and investor fact sheet | ❌ | ❌ | ✔️ | ✔️ |

| 🔔Xperiti subscription | ❌ | ❌ | ❌ | ✔️ |

How to be a Top Investor

Gaining high numbers of copiers may take a while, but it isn't impossible to achieve as long as you follow these recommendations:

🏆Maintain a consistent winning rate and trade regularlyWith a good track record, you can build your professional image and attract new copiers. Remember that your profile is most likely to be the first thing people learn about you, so make sure to show your best side. You can summarize your strategy in your bio and give people a reason why they have to choose you. |

💬Be communicative on the social platformAside from building a good image, it is also important to be active in the community section by posting regular updates on eToro, participating in various forums, and answering other people's questions. By throwing yourself out there, more people will recognize you and if they're interested, they might become your next copiers. |

👩🏫Don't hesitate to share knowledge to your followersHelping other traders to trade well can also bring another advantage as your name will be remembered and probably recommended to other traders. You can share informative trading tips or give advices to beginners. Use this opportunity to show that you actually understand what you're doing and that you're happy to share the knowledge. |

🌐Increase your presence on other platformsLast but not least, you can create a dedicated website or use your existing social media to promote your business further. This allows you to reach a much wider audience outside of eToro platform and perhaps even convince them to join the community. Social media is also a great way to connect with other people and let them learn more about you, so it's definitely worth a try. |

The Pros and Cons of eToro Copy Trading

eToro copy trading can be an attractive option for both beginners and professional investors. But even so, this form of investment should not be taken lightly as it is still risky to some extent. Therefore, please consider the following aspects before putting your money into it.

| ➕Pros | ➖Cons |

| ✔️Allows complete beginners to invest in advanced strategies and earn passive income with less risk than manual trading. ✔️Saves a lot of time and effort to analyze the markets independently. ✔️Allows traders to observe and gain insights from other traders on the platform. ✔️Provides additional income for professional investors. ✔️Get access to various financial education and other features through the Popular Investor Program. | ❌Copy trading is not free of risk. Even a great trader can have a bad day, so even if you copy the strategy of the best trader in the world, profits are not guaranteed. ❌Over-relying on another trader can discourage you from developing your skills and doing your own research. ❌The conditions of becoming a popular investor are quite challenging, especially for small traders. ❌Attracting followers can be difficult sometimes, even with a strong investment strategy. |

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

The Bottom Line

eToro is one of the best trading platforms for copy trading, a perfectly suitable strategy for beginners. By allowing you to copy trade, you can learn about various expert traders' strategies in stock market while gradually preparing your system.

All in all, here are the benefits of using eToro copy trading:

- A wide range of stocks, forex, commodities, cryptocurrencies, and ETFs keeps growing and expanding.

- eToro is a Non-Dealing Desk (NDD) broker, which means they deal with many banks and liquidity providers, so they can show you the best prices at any time.

- You will get zero commission stocks if you buy the underlying asset, which is especially good for long-term strategies.

- eToro has one of the best user interfaces in the industry because it is simple to navigate with a clean and beautiful design.

- What matters the most is the copy trade feature, which is profitable for novice traders and professionals. If used properly, you can make significant money flowing to your account by copying other people's trades.

- eToro has 0% commission options which means the cost of trading will be much lower

Once ready, you can start trading independently and join the popular investor program. But remember to be patient and trade realistically by not investing more money than you can afford.

FAQs on eToro Copy Trading

Can I copy more than one investor?Yes, of course. In eToro broker, you can copy as much as 100 investors at once. |

How do I stop copying someone?You simply need to open your Portfolio page that contains all of your active copy trades. Select the trader that you wish to stop copying from and click "Stop Copying" from the options. You can then choose "Close All" to fully stop copying or "Keep All" to keep the copied trades in your portfolio. Please check that all the details are correct before completing the action. Please note that if the market is currently closed, the trades will remain in your portfolio as "Pending Close" trades. The status will change once every position has been closed. |

How does the payment system work in the Popular Investment Program?Popular investors in eToro are paid according to their level, by the 10th of each month. The payment is sent to the investor's eToro account and the funds are automatically withdrawn to their selected payment method. However, if the requirements are not met, the payment will not be given on that month. |

How can I gain copiers quickly?The best way to attract new followers is to create high-quality strategies with consistent profit. Aside from that, engagement is also very important. Spare some time to interact and share your expertise with other traders on the platform. It is highly advised to post an update at least once a month, but it's even better to do it frequently. |

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Alex

May 18 2023

Hey, I recently came across eToro as an investment platform and discovered that it operates as a Non-Dealing Desk (NDD) Broker. In light of this, I'm curious to know if there are different types of dealing models employed by various brokers in the industry. Could you please explain the different types of dealing models and provide insights into how I can determine if a broker operates as a Non-Dealing Desk or follows a different approach?

Furthermore, I would appreciate it if you could elaborate on the advantages of utilizing a Non-Dealing Desk broker. How does the Non-Dealing Desk model benefit traders in terms of order execution, transparency, pricing, and potential conflicts of interest? Are there any specific features or benefits that traders should consider when selecting a broker, particularly in relation to the dealing model employed?

Dani Cebalos

May 20 2023

Okay! So, when it comes to brokers, there are different types of dealing models they can use. One of them is called the Dealing Desk (DD), where the broker acts as the middleman and handles your trades internally. On the other hand, you have Non-Dealing Desk (NDD) brokers like eToro. NDD brokers connect you directly with other buyers and sellers in the market, which can provide some advantages.

To know if a broker is a Non-Dealing Desk or follows a different model, you can usually find that information on their website or by reaching out to their customer support. They're usually pretty upfront about it and can explain how they execute trades.

Now, let's talk about the advantages of using a Non-Dealing Desk broker. Here's why it can be a good choice:

Sammy

May 21 2023

DD broker actually not bad at all, bud! I will explain to you the advantage using DD Broker :

Remember, it's important to choose a reputable and regulated DD broker. Do your research, read reviews, and find one that suits your trading style. Happy trading, my friend! Also you can read how to choose DD Broker at here : Are Broker DD Always Bad?

Pioli

May 18 2023

Hey admin, I was reading about stock trading on eToro, and it seems like when you trade stocks with CFDs, you don't get dividends and all, but you can still make profits. It got me curious, dude. What's so interesting about trading stocks with CFDs for some people? I mean, why would they choose this approach instead of traditional stock investing? I'd love to know your take on it, man. What makes trading stocks with CFDs on eToro appealing to you or others in the trading community? Thank you!

Michael

May 19 2023

Hi! Let me answer! Trading stocks with CFDs on eToro has its own appeal for a few reasons. First off, with CFDs, you can profit from both upward and downward price movements. So, whether the stock is going up or down, you can potentially make gains. Plus, CFDs allow you to trade on margin, which means you can control larger positions with a smaller amount of capital. This can amplify your potential returns.

Another advantage is the flexibility. Since CFDs are derivative instruments, you don't actually own the underlying asset. This means you can easily trade stocks from various markets around the world, even if you don't have direct access to them. You have a wide range of stocks to choose from, and you can take advantage of different market conditions and opportunities.

Additionally, trading stocks with CFDs on eToro offers convenience and accessibility. The platform provides user-friendly tools and features, allowing you to easily analyze stocks, set stop-loss orders, and manage your portfolio. You can trade on the go with their mobile app, which is handy for active traders.

Of course, it's important to note that trading CFDs involves risks, including the potential for losses. It requires knowledge, strategy, and risk management. But for those who are comfortable with these factors, trading stocks with CFDs can offer a dynamic and potentially profitable trading experience.