The entry position is key to trade outcomes. Follow these 7 trading principles (mindset and strategy) before entering a trade.

The entry position is a crucial factor in a trader's success. To trade profitably, it is essential to identify an accurate entry point. Therefore, thorough preparation is necessary before entering a trade.

For novice traders, adopting these 7 trading principles as pre-entry "rituals" can be highly beneficial:

- Mentally prepared.

- Utilize stop loss.

- Don't be swayed by the news.

- Set and Forget.

- Approach trading professionally, not as gambling.

- Keep your trading strategy simple.

- Be confident in your trading decisions.

Although the above points may seem simple, their implementation requires consistency to increase the probability of trading success. For a detailed explanation, please refer to the full article below!

1. Mentally Prepared

Are you familiar with the "High Risk, High Return" principle? This widely recognized concept highlights the substantial profit potential and associated risks in forex trading. Hence, beginner traders aiming to enter the market directly must prioritize mental preparedness.

Renowned trader Mark Douglas emphasizes the significance of a trader's mental readiness.

Without a strong mindset, even the most effective strategies with high probabilities can result in losses.

2. Utilize Stop Loss

It is common for beginner traders to mistakenly believe that trading always guarantees profits. However, the reality is that trading does not guarantee 100% success and there is always a possibility of experiencing losses. That is why it is crucial to adhere to this trading principle and practice effective risk management.

There are various ways to set stop-loss orders, here are some of the best strategies you can try:

- Volatility stop: adapting in response to evolving market conditions.

- Time-based stop: know when is the right time to exit a trade.

- Trailing stop: trail the market movement by fixed amounts

Implementing good risk management involves utilizing a stop loss, which serves as a safeguard for your trading account. If the price reaches the predetermined stop loss level, the trading position will be automatically closed to prevent further losses. This helps protect your funds from significant adverse movements in the market.

See Also:

3. Don't be Swayed by The News

Excessive focus on forex news is unproductive and draining. Such news often generates noise that hinders analysis. Moreover, becoming too preoccupied with rumors and speculation can lead to impulsive actions, even in the absence of concrete news releases.

See Also:

4. Set and Forget

Embrace the "set and forget" principle in trading. Once you've executed a position based on your strategy, close the trading screen and allow the market to follow its natural course based on prevailing conditions.

Continuously monitoring the screen after entering a position may lead to impulsive modifications or opening additional positions without a well-defined strategy. This behavior carries significant risks and the outcomes are unpredictable.

5. Avoid Gambling

Trading is frequently associated with gambling; however, the two activities are fundamentally distinct. Gamblers depend solely on luck and often make impulsive, high-risk decisions without a solid plan as a reference.

On the contrary, traders require an effective approach that goes beyond relying on chance. Therefore, it is crucial to avoid treating trading as a gamble before entering a trade.

6. Simplify Your Strategy

Trading does not have to be complex and convoluted, although many traders tend to make it so. Remember, simplicity and reliability can be achieved by employing straightforward yet effective trading methods, such as using a single indicator or price action strategy.

Nial Fuller, an experienced trader from Australia, has highlighted that price action is the simplest and most potent trading strategy. It doesn't necessitate convoluted indicators or cluttered charts. Instead, you only need to focus on three key elements: trends, levels, and signals.

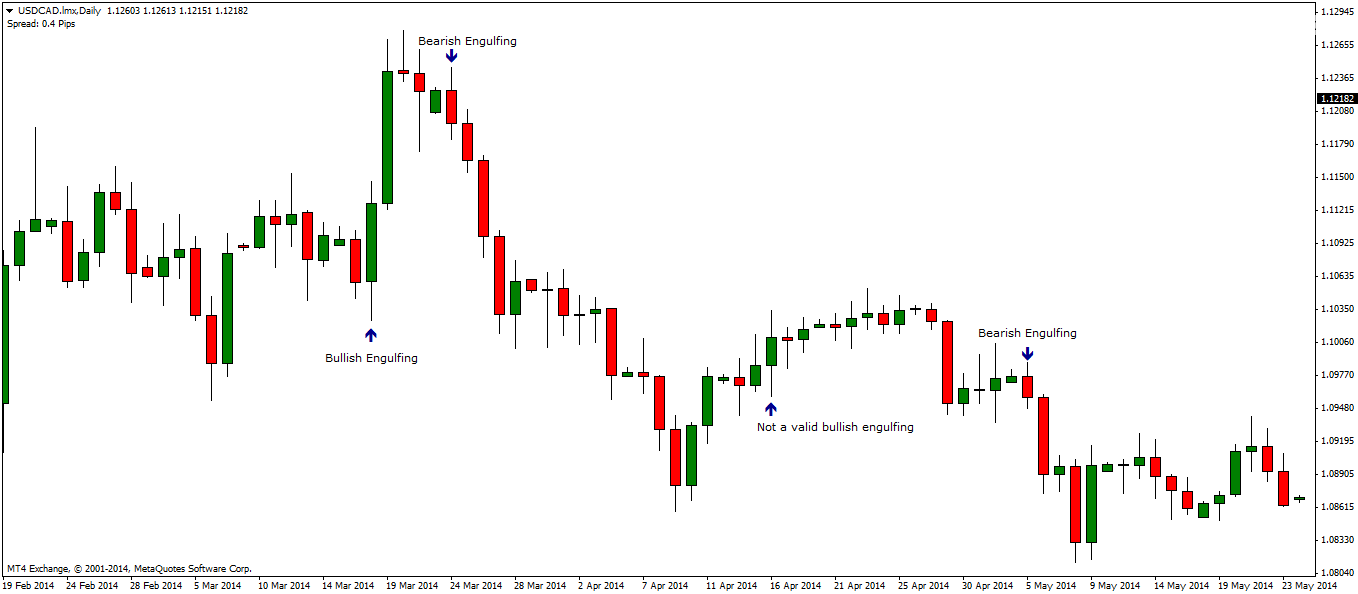

In the price action strategy, traders search for specific candlestick patterns, such as reversal or continuation patterns. These patterns provide clues about potential trend reversals or trend continuation.

For example, a candlestick pattern like the "engulfing pattern" can indicate a reversal in the current trend. This pattern occurs when a bullish candlestick (rising) completely engulfs the previous bearish candlestick (falling), suggesting a potential change in trend to the upside.

7. Be Confident

According to William Eckhardt, a prominent figure in Turtle Trading, academic degrees hold no significance in trading. You don't need a degree in finance, a doctorate, or any specific trading certification to be successful. The only essential requirement for becoming a trader is perseverance.

Therefore, don't be disheartened if you are self-taught. Many prosperous and affluent traders have succeeded without a college education. Some even pursued entirely unrelated majors, like John Wen, for instance. As long as you maintain consistency and perseverance in executing your trading strategy, there is every possibility of attaining the desired trading success.

Bottom Line

The entry position is a crucial factor in a trader's success. To trade profitably, it is essential to identify an accurate entry point. Therefore, thorough preparation is necessary before entering a trade. Traders need to be prepared in terms of psychology, strategy maturity, and risk management mastery.

Trading principles serve as valuable guidance for both beginners and professionals alike. They act as a compass, keeping you on the right path. By adopting these principles, beginners can learn from successful professional traders and navigate their trading journey with confidence.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance