Being the first to know what is about to happen is surely beneficial in forex trading, but is it really mandatory in order to reap good profit? If traders do not necessarily need to be the first to know, then is it really worth knowing anyway?

Some traders claim that understanding technical analysis is all you need to become a successful trader because making a decision based on fundamental news is useless. In reality, that is not the case. It is true that the news is not always translated into an accurate reading of the market.

For example, Nonfarm Payroll that did not reach an expected number is supposed to weaken USD. But it turns out to be a bullish trend for days because the average hourly earnings rose better than expected.

Such circumstances can occur not because the news is not trustworthy, but because each market player can react differently to the news and the impact of said news itself might not be that significant.

Besides, some news might be relatively impactful but can't compete with the sentiment from the underlying situation, or they coincide with some breaking news that is considered more important.

There are several things traders need to understand, including:

- Understanding that trading with the news is not about speed.

- Find a reliable source for better analysis results.

- Traders should check the time-release of high-impact news carefully.

- Understand that not all news impact the price, so choose the news carefully.

- Make sure to understand the news in terms of its effect on different trading styles.

Why do those factors play an important part in trading with the news? Here is the reason why.

1. Trading with News Is Not About the Speed

Some people still think that finding pre-released data is one way to strike gold in forex trading and that is how top traders can get to where they are now. The fact is, the release of economic data is a very important event and the data itself is confidential; no one can acquire it before the official release except the people who work on it.

Speaking from experience, you can get this data earlier than everyone else on the planet. Lukas Kamay and Christopher Hill from Australia did just that.

In 2014, they managed to earn AUD8 million plus a prison sentence (3 years and 3 months for Hill and 7 years 3 months for Kamay). They were arrested for abusing the information that they were supposed to keep as a secret before releasing it to the public.

For general traders, data can be acquired through a press release at a scheduled time. There are a few economic calendar websites that can repost the news in a matter of minutes or even seconds, so there are easy ways for traders to discover the data early.

2. Find a Reliable Source of Information

Forexfactory and Investing are currently the most popular news outlet, although they only publish rough estimates. For a detailed speech or election result, you may want to follow a Twitter account that often posts forex-related information or global media websites such as Bloomberg or Reuters. Or other trusted websites.

3. Adjust Your Time

If you are serious about fundamental analysis, you must read that news while it is still hot, maybe a few minutes after its release. But if you live on the other side of the world, you need to check the time-release of high impact news carefully and see how long it has been after it was released before you trade the news.

4. Measure the Impact

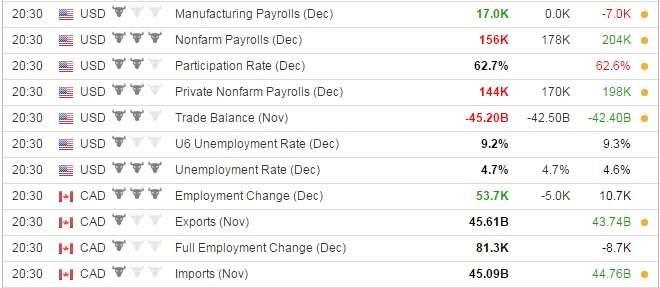

Different news affects the currency market differently. Some news has a higher impact than others. Here is an example:

The bulls' head indicates how impactful a piece of news could be. On a scale of one to three, one bulls' head represents the least impactful news, while three bulls' heads identify the most impactful news. It is worth to note that many recommend only trade the most impactful news as they are usually capable of making a difference in the price movement.

5. Understand The News

Oftentimes, an economic calendar or article displays the news as they are so it will be easier to understand. But always remember that it is not a hundred percent certainty, as it might miss the mark every now and then. There are 4 purposes of trading with fundamental news:

- To give the context on the previous price movements, so traders can comprehend whether the preceding reversal or breakout is permanent or just temporary.

- For medium to long term traders, cumulative data can give insight and project the next price movement.

- For news traders, the purpose is to view the market bias before a big event and find trading opportunities.

- For short term traders, trading with fundamental news could give information on when to avoid the market.

Unlike technical analysis, that has a strict calculation, fundamental news analysis does not have a certain way to calculate how it would affect the currency.

But in reality, both technical and fundamental analyses are used simultaneously to determine the right entry and exit points. Short-term and long term traders also use both analysis methods, including Kathy Lien, Managing Director of BK Asset Management.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance