Implementing entry and exit rules based on risk/reward ratio can maximize a trader's profit potential. How is it possible? What is the method like?

One of the keys to success in the trading world is to have clear rules for entry and exit. Various rules can be used, but entry and exit rules based on risk/reward ratio have been proven effective in avoiding large losses and maximizing profit potential.

By using entry and exit rules based on the risk/reward ratio, traders will only enter the market if their profit potential exceeds their potential loss. For example, a minimum risk/reward ratio of 1:2 requires traders to target twice the profit potential than their potential loss. Thus, traders will only enter the market if they are confident that the trade has greater profit potential than the potential loss.

This article will provide an in-depth discussion of entry and exit rules based on risk/reward ratio and how to apply them in trading.

What is the Risk/Reward Ratio in Forex Trading?

The risk/reward ratio in forex trading is the ratio between a position's potential profit and loss. This ratio is used to help traders determine the risk they are taking and ensure that the potential profit is greater than the potential loss.

The risk/reward ratio is one of the important factors in forex risk management. The higher the ratio, the greater the potential profit that can be obtained. However, the risk of loss also increases accordingly. Therefore, traders must carefully consider the risk/reward ratio and make trading decisions based on careful and accurate market analysis.

See Also:

How to Use Entry and Exit Rules Using Risk/Reward Ratio?

Forex traders use an entry and exit strategy based on risk/reward ratio to determine when to enter and exit the market by considering the potential profit and loss in trading.

The first step in using entry and exit rules based on risk/reward ratio is to determine the stop loss and take profit levels. Stop loss is the level at which the trader will close the trade if the price moves against their prediction, while take profit is the level at which the trader will close the trade if the price moves as predicted.

After determining the stop loss and take profit levels, the trader can calculate that trade's risk/reward ratio. Risk/reward ratio is calculated by comparing the distance between the entry position and stop loss position (risk) and the distance between the entry position and take profit position (reward).

Example of Using Risk/Reward Ratio for Entry and Exit

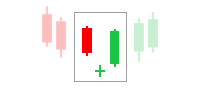

A trader decides to trade EUR/USD at the level of 1.20000 with a profit target at the level of 1.22000 and a stop loss at the level of 1.19500.

In this case, the trader has determined a take profit of 200 and a stop loss of 50. Therefore, the risk/reward ratio for the trade is 1:4 (potential profit is 4 times larger than potential loss).

After entering the market, the trader must monitor the price movement and decide when to exit. If the price reaches the profit level of 1.22000, the trader must close the position to get a profit of 200 pips.

However, if the price moves against the prediction and reaches 1.19500, the trader must close the position to limit the loss to only 50 pips, just like the picture below.

Advantages of Entry and Exit Based on Risk/Reward Ratio

- Minimizing risk: By setting the appropriate stop loss level, traders can minimize the risk of loss and protect their capital. Determining potential losses before entering the market allows traders to avoid large losses and limit risk according to tolerance limits.

- Maximizing profit potential: By setting the appropriate take profit level, traders can obtain the desired profit potential, prevent profits from being 'cut' by market volatility, and ensure that the profit ratio remains higher than the risk.

- Simplify decision-making: Entry and exit rules based on risk/reward ratio can help traders determine trading positions intelligently and structured.

Disadvantages of Entry and Exit Based on Risk/Reward Ratio

- Overemphasis on ratio: Traders may become too focused on the risk/reward ratio and overlook other factors affecting trading, such as market volatility and external factors.

- Not always suitable for all situations: Entry and exit rules based on risk/reward ratio may not always be applicable in all market conditions. In some cases, traders may need to adjust the risk/reward ratio to remain relevant to changes in market conditions.

Conclusion

In forex trading, entry and exit rules based on risk/reward ratio are crucial in determining the appropriate stop loss and target profit levels. Traders can minimize risks and maximize potential profits by considering a balanced risk/reward ratio and other factors.

However, traders should conduct in-depth market analysis and follow clear, structured trading strategies. Overemphasizing the risk/reward ratio or disregarding other factors affecting trading can result in losses.

In conclusion, entry and exit rules based on risk/reward ratio can serve as guidelines for making more structured and intelligent trading decisions. However, traders must remain vigilant and follow current market conditions to optimize their trading activities.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance