FxPro is one of the few brokers that are regulated under multiple regulatory bodies. What are the benefits for the traders?

Among many brokers in the forex and CFD industry, FxPro is known as one of the most well-known. This broker has been providing online trading services since 2006 and now serves 173 countries worldwide. There are many reasons why FxPro managed to survive in the industry. First of all, they care about their customers by providing a great deal of trading platforms to ensure their comfort.

In addition, this broker also cares about the safety of their traders. FxPro has gained licenses from various regulatory bodies to gain their trust.

These are some regulating bodies where FxPro is listed in:

- Financial Conduct Authority (FCA): Registration number 509956.

- Cyprus Securities and Exchange Commission (CySEC): License number 078/07.

- Financial Sector Conduct Authority (FSCA): Authorization number 45052.

- Securities Commission of The Bahamas (SCB): License number SIA-F184.

What does it mean to be regulated by those authorities? This article will talk more about it.

1. Financial Conduct Authority (FCA)

The Financial Conduct Authority (FCA) is a regulatory body in the United Kingdom responsible for overseeing and regulating financial markets and financial services firms to ensure that they operate fairly, transparently, and competitively. The FCA was established on April 1, 2013, and it operates independently of the UK government.

FxPro offers its service in the UK, so it's not unusual for it to be regulated by the FCA. This broker is authorized and regulated by the Financial Conduct Authority under registration number 509956. That means FxPro adheres to the rules implemented by FCA, thus providing a safe service for UK traders.

But what does this mean for traders?

- FCA-regulated brokers must have a leverage limit between 1:2 and 1:30. It means traders will be protected from the risk of high leverage.

- In case of insolvency, FCA will compensate clients with limits of up to £85,000 per eligible individual per firm.

- Regarding bonuses, FCA-regulated brokers cannot offer all account-opening bonus payments to retail traders.

- An FCA-regulated broker will treat customers well by giving them fair prices and quality.

- A segregated account will protect the trader's fund safety.

- Diverse consumer needs are met through high operational resilience and low exclusion.

2. Cyprus Securities and Exchange Commission (CySEC)

CySEC stands for the Cyprus Securities and Exchange Commission. The regulatory authority oversees Cyprus's financial markets and financial services firms. CySEC regulation is particularly relevant in the forex trading industries, as many forex brokers and financial firms choose to establish their operations in Cyprus due to the country's favorable regulatory environment within the European Union.

FxPro is authorized and regulated by the CySEC under license 078/07. This broker holds a cross-border CySEC license that allows FxPro to participate as a trading provider in the European area.

There are various conditions and perks for trading with a broker that CySEC regulates:

- CySEC has adopted the ESMA rules and scrapped their higher leverage license. Now, CySEC brokers can only have leverage up to 1:30 on major currency pairs.

- CySEC does not allow bonuses to incentivize retail clients to trade in complex speculative products (CFDs, Binary Options, etc.).

- CySEC may compensate with a maximum amount of €20,000 in case of insolvency.

- CySEC protects European traders by ensuring brokers use segregated accounts and prove their EU identity.

- CySEC-regulated brokers also have a high priority for transparency and fairness.

- CySEC ensures that a broker is always ready to assist traders.

See Also:

3. Financial Sector Conduct Authority (FSCA)

FSCA stands for the Financial Sector Conduct Authority. It is a regulatory authority in South Africa responsible for overseeing and regulating various financial institutions and financial services in the country. The FSCA was established to promote fair and transparent financial markets, protect consumers, and ensure the stability and integrity of the financial sector in South Africa.

FxPro also has a global presence in South Africa. This broker is authorized and regulated by FSCA with authorization number 45052 to maintain the trader's trust towards them. That means this broker has to abide by the rules set by FSCA.

What benefits can traders get from an FSCA-regulated broker?

- The South African traders will be compensated if the broker goes bankrupt.

- An FSCA-regulated broker is required by law to maintain the highest standards of fairness, security, and openness.

- FSCA must answer for misconduct, and disgruntled clients can appeal to the Ombudsman.

4. Securities Commission of The Bahamas (SCB)

SCB stands for Securities Commission of The Bahamas (the Commission). The SCB regulates and oversees investment funds, securities, financial and corporate service providers, digital assets, registered exchanges, and capital markets in The Bahamas.

SCB is an offshore regulation. While there is some debate regarding its reliability, there are several benefits that traders can get from it. One of the main benefits is that traders will have more flexible options regarding trading instruments due to more relaxed rules. Another thing is that the trader's investment is kept confidential and secure. This can be a great way to keep your trading activity anonymous and private.

To broaden their service to worldwide traders, FxPro is also authorized and regulated by the SCB with license number SIA-F184. That means traders are protected under the SCB rules and regulations.

Here are some benefits the traders can get from SCB-regulated brokers:

- Traders can get higher leverage up to a maximum of 1:200 for all underlying CFD assets.

- The SCB regulations adopted ESMA rules, which means this regulation does not allow the broker to offer binary options.

- In a dispute with a broker, traders can contact SCB through phone, email, or mail.

How FxPro Complies with Regulations

While it is good that FxPro is regulated by various trusted regulating bodies, the real question is whether this broker complies with the rules. To answer this, a trader should look deeply into the rules of the regulations and check whether FxPro obeys them.

For example, FxPro is under the FCA regulation. One of the key requirements of the FCA regulations is a maximum leverage of 1:30. This is what FxPro applied for all of their UK traders. Their maximum leverage is 1:30 for forex majors. Other instruments also have fairly lower leverage. These are the details of their leverage rules for UK traders.

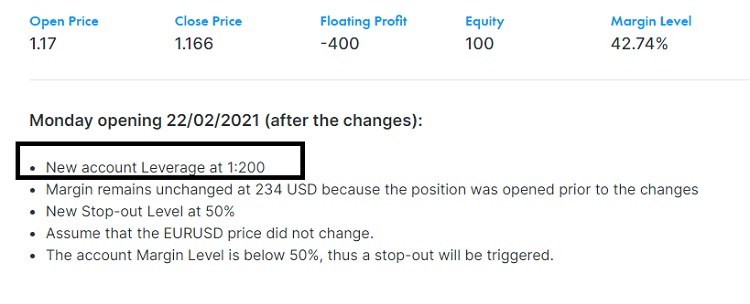

On the other hand, offshore regulation tends to have more relaxed rules regarding leverage. So it's unsurprising if an offshore regulations body has 'better' leverage than an onshore one. Here is an example of FxPro's leverage in the Bahamas.

The picture above shows the new leverage limit set by FxPro according to the SCB. As it appears, the leverage is much higher than the one under FCA regulations. It means that with each regulation, FxPro follows different rules.

Benefits of Trading with a Regulated Broker

Trading with a broker under trusted regulators offers several benefits for traders and investors. Regulators play a crucial role in ensuring the integrity and fairness of financial markets, protecting investors, and maintaining the overall stability of the financial system.

- Investor Protection: Trusted regulators, such as FCA, have strict rules and regulations in place to safeguard the interests of investors.

- Segregation of Funds: Regulated brokers are typically required to separate client funds from their operational funds.

- Financial Stability: Regulators help ensure the overall stability of the financial system by setting capital requirements for brokers and conducting regular financial audits.

- Dispute Resolution: Regulators often provide mechanisms for resolving disputes between traders and brokers. Good regulators would implement these rules more strictly than others.

- International Credibility: Traders often see brokers regulated by well-respected international regulatory bodies as more credible and trustworthy.

Considering how FxPro is licensed by multiple regulations, this broker is subject to stricter oversight and compliance requirements. This can provide a higher level of security for the trader's funds and investments.

Brokers that have obtained multiple regulatory approvals often have a better reputation and are seen as more trustworthy in the industry. That means FxPro is likelier to follow ethical practices and provide transparent services.

FxPro is a leading forex and CFD broker since its establishment in 2006. The company is regulated by several top financial regulators including the UK's FCA to provide tradable instruments like oil, gold, currencies, and more CFDs with 70% lower spreads in the market.

Trading Central Signals

Trading Central Signals Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest