To be successful in scalping, you need to pay attention on lot size, price movement, leverage, and some broker terms that may limit your scalping activities.

A scalping method is opening and closing one or several trades quickly. The duration is relative and depends on the trader, and the time frame ranges from 1 minute to 1 hour. Scalping becomes popular because it is played in a small time frame.

In order to successfully apply the scalping strategy, these tips are important but not known by many traders:

- Make sure you have what it takes

- Use an automated trading system

- Pick your lot size carefully

- Take advantage of volatility

- Make use of the leverage

- Don't forget technical analysis

- Choose the right broker

Those are some things scalpers can do to boost their chances of success. Why are these things important for scalpers? Here is the complete explanation.

Check If You Could Be a Good Scalper

All traders do not use the scalping method. The profit gained in every trading position is small, but you will get a large amount if all the profits are summed up. Scalpers always avoid taking a high risk; they never make one single entry to get a big profit. As a result, a scalper should persist in observing the market price movement to get as much profit as possible.

The scalping strategy needs more focus and attention than other trading strategies, such as swing or long-term position trading. A true scalper can open and close 10 positions at once or even more than 100. However, a scalper must be very careful in opening and closing the positions and pay attention closely when deciding the stop loss and profit target.

In the beginning, the method seems so hard to apply. Yet, traders who like to gain small profits quickly will feel more comfortable and are reluctant to move to other trading methods after experiencing a lot of practice. For a successful scalper, an ability to focus and concentrate on the trading position is absolute. It is not a born talent, but it needs a lot of practice and commitment.

See Also:

Get a Trusted Automated Trading System

For a full-time trader, a scalping method will seize the time. The ones who trade only to get additional income usually do not want to spend much time in front of their charts. Therefore, some software companies release automated trading systems to assist part-time traders eager to try the scalping strategy.

Nevertheless, you must be careful in choosing the software because not all of the features work properly. You need to know that the software is not wholly automated because sometimes you still have to decide the stop loss level and the profit target by yourself. The software function is just for helping in monitoring the positions when you can't be bothered to check them.

Learning and trying the features of automated trading software can save a lot of time. However, some experienced scalpers prefer not to use automated trading software. They come with a complicated system, and the results sometimes do not fit the target.

Mind Your Lot Size

A scalper must be consistent in calculating the lot size. Placing different lot sizes for every open position is very risky. You might want to apply the more flexible lot size if you do not use the scalping method or when you stop the scalping method and use other trading strategies.

The principle of trading management for scalping strategy is overcoming the loss with the profit gained. If you use the lot size randomly, sooner or later, it will cause an anomaly in the profit calculation. So, a scalper must be patient, practices a lot, and concentrate fully when the trading positions are still floating.

To be successful, a scalper needs to be skillful in taking advantage of the current price movement and paying attention to the leverage risk. Although the profits collected are not big, a scalper needs accuracy when aiming for profitability in every trade.

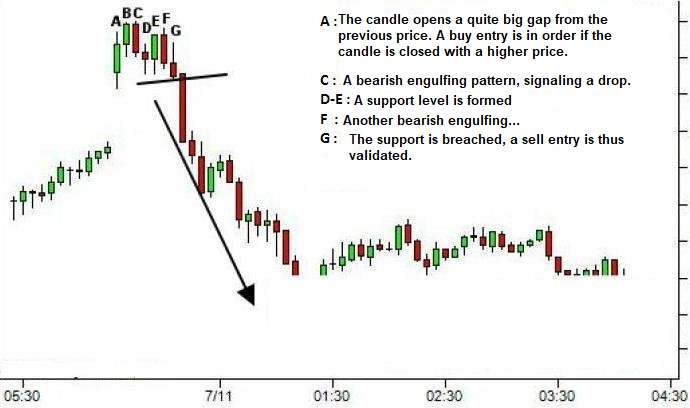

A successful scalper uses a combination of analysis on the price movement to make decisions. Basic technical analyses, such as price trends, candlestick formations, and price patterns, may come into play. In addition, the release of high-impact news is also important for scalpers.

Take Advantage of Volatility

Most scalpers focus on an extreme price movement in the forex market. It aims at utilizing the sudden movement of price to take profit quickly. This scalping type does not pay much attention to the actual market condition, because it only capitalizes on the price volatility. The main target is to benefit from the unbalanced demand and supply of the market caused by the lack of liquidity that may happen temporarily.

For example, market liquidity of EUR/USD in a normal situation is enough to avoid a significant gap in price movement. However, in a certain situation that some important fundamental news may cause, the market liquidity might decrease and create a significant gap between the bid and ask prices.

A scalper takes advantage of this quick and sudden fluctuation to gain profit. In this case, a scalper profits from the emotional reaction against the market condition. Therefore, the gap that happened in the moment of a fundamental news release can be used by a scalper to open a trade.

Boost Power with Leverage

Scalpers often feel dissatisfied with the profit they got as they collect only small profits. They think it is not worth of all the efforts they do. To overcome this, a scalper can use leverage for their advantage. The higher their leverage, the lower their margins need to be. It means they can use the bigger lot sizes to increase their profit targets.

However, many experienced scalpers recommend beginners to use small leverage in the first three months of trading until they find a suitable and tested trading method. Higher leverage means higher risk, as a low margin makes your position prone to the change of price movement. In a high-volatility market that most scalpers favor, trading with high leverage will bring more risks than benefits.

Apply Good Technical Analysis

A scalping method is generally applied in a 1-minute to the 1-hour time frame and needs a deep understanding of technical analysis, especially when applying indicators with fixed-parameter settings. Besides the technical indicators, the reading and interpreting abilities on the price movement, as you can see on the following chart, are very helpful and necessary. The example below is taken in a 5-minute chart.

A scalper has to be diligent, careful, and disciplined in monitoring the price movement and following the method. A small carelessness may lead to a big loss. The fundamental analysis role in scalping is very small in proportion and thus is almost neglected. During news releases, a scalper usually focuses more on technical readings or avoids trading altogether.

In a certain situation, a scalper uses trend analysis in a bigger time frame to identify the main trend direction. However, they still use small time frames to set their trades.

Choose the Right Broker for Scalping

For a scalper, broker is a crucial variable that determines their success. Here are some factors that determine a broker's quality for scalping.

1. Low Spread

Spread is a fee you must pay a broker for every position you place. A trader who does not use a scalping method might only open and close orders in a small number for a certain period. They usually highly tolerate their brokers' spreads or other trading commissions.

The situation will be different if a scalper opens and closes up to tens of positions relatively quickly. The spread will bring a very significant impact on their profit/loss and so it must be calculated carefully.

For instance, a scalper opens and closes 30 positions in a day. His broker charges 3 pips as the spread for every position. Meanwhile, his profit average is 5 pips, and the loss average is 3 pips. In total, he makes 20 winning trades and 10 losing trades. The total profit and loss without the spread are:

(20 x 5) - (10 x 3) = +70 pips

Here is the result if you calculate the spread fee as well:

(20 x 5) - (10 x 3 + 30 x 3) = -20 pips

The result is disappointing, right? Although you have made twenty profitable trades, the total profit/loss turns to minus once the spread is applied.

What if he trades in a broker whose spread is only 1 pip per position? With the same condition as assumed before, the calculation of the net profit/loss and spread will be:

(20 X 5) - (10 X 3 + 30 X 1) = +40 pips

That is why scalpers need to choose a broker with competitive pricing.

2. Trading Tools

A scalping method involves a technical analysis. A scalper is always more focused on the action and reaction pattern of the price movement from time to time. Therefore, they need a complete and qualified technical analysis feature. In this case, many brokers have provided sufficient technical analysis tools in their trading platforms.

Brokers offering the popular MetaTrader platform would usually allow the use of Expert Advisors (EA), a trading robot software that can be categorized as one of the automated trading tools.

EA is an installed program in MetaTrader designed by MetaQuotes Language 4 (MQL4). EA is programmed to manage trading activities based on the strategy and method automatically. Hence, a trader should not be anxious about making mistakes in analyzing, especially if he plans to open many trading positions. EA is quite popular among scalpers, particularly for those who can't manage to be full-time scalpers.

3. The Scalping Policy

Because of its nature, many brokers set some definitions and limitations for applying a scalping strategy. A forex broker may arrange terms such as the minimum pips for every stop loss and profit target, the minimum duration of a holding position, or other terms related to scalping. Although most brokers now allow their clients to apply the scalping method freely, some prohibit the strategy strictly.

Furthermore, some brokers may say that they allow scalping but then set some limitations for clients' orders that are suspected of practicing scalping. This usually results in brokers' intervention, resulting in clients' loss. In other words, some brokers may try to discourage scalping indirectly by using hidden strategies that put their clients at a disadvantage.

See Also:

Forex Brokers that Allow Scalping

Scalping is a trading strategy that involves frequently opening small positions that last for short periods, aiming to accumulate small profits. This approach exposes scalpers to various advantages and disadvantages associated with trading terms and conditions.

Regarding forex trading, brokers offer trading services to clients based on specific criteria that may or may not be suitable for scalpers. If you are a scalper or intend to engage in scalping, additional factors should be considered beyond the basic features, such as forex demo accounts and affordable capital.

Here are some brokers that allow scalping:

After Words

Based on the phenomenon above, a scalper should choose a broker that allows scalping without restrictions or the Non-Dealing Desk (NDD) type. It is to avoid scam brokers who often intervene in clients' orders.

NDD brokers usually channel their clients' orders directly to the market or bigger NDD brokers. In this case, clients do not trade against the broker but directly against the market. The spread in NDD brokers normally follows the real market's fluctuation but is generally lower than in other brokers. Some broker variants categorized under the NDD brokers are STP (Straight Through Processing), ECN (Electronic Communication Network), and DMA (Direct Access Market).

In need of guidance to an ideal forex broker for scalping? Don't worry, we have recommended a few of them based on the criteria above. Explore the options in Best Forex Brokers for Scalping.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

4 Comments

Linden

Nov 25 2023

I'm a bit confused about the terms and conditions related to scalping. The article mentions that brokers have specific criteria for offering trading services, and I'm not clear on which criteria may not be suitable for scalpers. I've come across recommendations from seasoned traders supporting scalping, and my research indicates that it's a legitimate strategy among the four time-based approaches. I'm hoping to get a clearer explanation on this. Thanks!

Phil

Nov 28 2023

Concerning the terms and conditions, I might not fully grasp your question, but based on what I understood, you're asking why some brokers are not suitable for scalpers, correct? This inference is drawn from the phrases I encountered at the end of the article.

So, why is this the case? It stems from the nature of scalping itself, which involves frequent order entries within short timeframes. For instance, a hardcore scalper may execute multiple trades in just one minute, and during a single trading session, they might place tens or even hundreds of orders. Given that scalpers constitute a significant portion of traders, brokers need a robust infrastructure to efficiently handle the high volume of orders within tight time constraints. One crucial aspect of this infrastructure is speed. If a broker offers low latency, it indicates they can accommodate scalping. Conversely, brokers who don't typically accept scalping might not have the infrastructure to process orders swiftly, potentially disrupting non-scalping traders.

Udin

Apr 7 2024

Apart from Expert Advisors (EA), what other tools are most suitable for scalping? The article emphasizes that scalpers prioritize monitoring the action and reaction patterns of price movements constantly. Therefore, they require a comprehensive and reliable set of technical analysis features. However, considering the variety of tools offered by brokers mentioned in the article, many seem to provide similar trading tools. So, which one stands out as the best option?

Liam

Apr 10 2024

Hey, let me answer your questions! In addition to Expert Advisors (EA), scalpers might utilize tools such as advanced charting software with customizable indicators, fast order execution platforms, and real-time market news feeds. These tools can provide scalpers with the necessary information and speed to quickly analyze price movements and execute trades accordingly. For instance, a scalper might use a combination of candlestick patterns, moving averages, and stochastic oscillators on a charting platform to identify short-term trading opportunities (examples, read : Best Indicators for 5-Minute Charts).

They may then rely on a trading platform with low latency and efficient order execution to enter and exit trades swiftly. Additionally, access to real-time market news and economic data feeds can help scalpers stay informed about events that may impact price movements, allowing them to adjust their strategies accordingly.