IC Markets cTrader offers fast order execution, extremely low spread, advanced trading tools, and many more. Explore further to discover all the details.

cTrader is an all-in-one trading platform developed by Spotware Systems. It started in April 2011 and was first used by Fxpro, followed by IC Markets and Pepperstone.

It's in competition with the popular MetaTrader platform and is all about super-fast trading. cTrader makes trades lightning quick with its ECN system and no-dealing-desk method. It also has tools for automated trading and copy trades.

This platform has many features to help you elevate your trading. Such as extremely low spread, smart stop-out, advanced trading tools, level II pricing, live sentiments, and many more.

Right now, many brokers use this platform, such as IC Markets. You can access cTrader on desktop, web, and mobile devices. We'll explore the platform's features and performance in more detail. Let's dive in!

IC Markets is an online forex broker operating under the company of International Capital Markets Pty Ltd. Traders under the Australian jurisdiction are provided with the trading service of IC Markets AU that is headquartered in Australia and licensed by the Australian Securities and Investments Commission (ASIC).

On the other hand, non-Australian traders who open an account in this broker are registered under IC Markets SEY that is based in Seychelles, and regulated under the Seychelles Financial Services Authority (SFSA). The dual operation is a result of the relatively new rules from ASIC that prohibit their regulated broker to offer trading services outside Australia.

Classified as an ECN broker, IC Markets provide clients with MetaTrader 4, MetaTrader 5, cTrader as platform trading options. This broker also follows market trends to include Cryptocurrencies as one of its products, enriching its already wide selection of trading assets that include Currencies, Indices, Metals, Energies, Softs, Stocks, as well as Bonds.

The minimum deposit in IC Markets is in the middle range compared to other ASIC-regulated brokers, as it reaches $200 for every client. Market analysis materials are also prepared regularly for trading insights on IC Markets's official website, proving their competence to serve their traders with important contents created by market experts that work specifically for them.

For payment methods, IC Markets allows funding and withdrawal via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, as well as Bitcoin via BitPay. The more interesting aspect from this broker is its multi-base currencies that include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

As the trading technology in IC Markets is highly equipped with co-located servers and extremely low latency (especially on cTrader), the broker is widely known for its capability in hosting traders with the special needs for high-frequency trading as well as scalping.

To sum up, IC Markets is a fitting destination for active traders looking for a well-regulated broker. IC Markets is also flexible in terms of base currency and payment methods, signaling their commitment to welcome traders beyond their home country. As of late 2019, IC Markets provided their website in 18 international languages including English, Korean, Indonesian, French, Spanish, Italian, Malay, German, and Chinese.

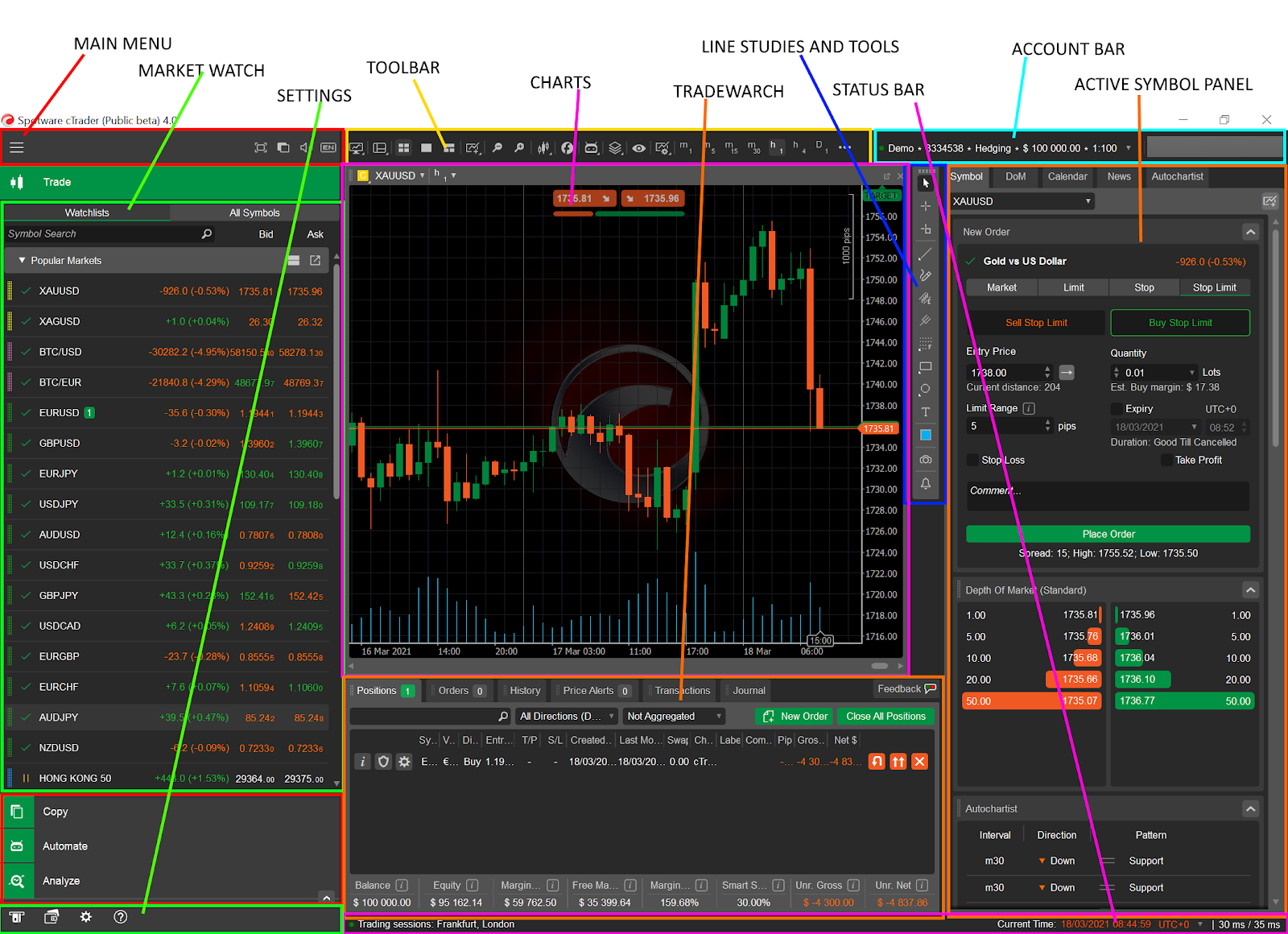

IC Markets cTrader User Interface

The cTrader user interface is made to help you trade easily and efficiently. This means you can access all the tools and options you need right from the main page of the application.

- Main Menu: It's like the control center where you can switch between trading, copying, automating, and analyzing. You can also manage your funds and adjust cTrader settings here.

- Toolbar: This has tools for customizing the interface and charts.

- Account Bar: This lets you switch between the trading accounts connected to your cTID.

- MarketWatch: This is where you choose trading symbols, place trades, and organize watchlists.

- Charts: Shows the market charts for the symbols you select. You can add as many charts as you need and manage your trades right from here.

- TradeWatch: Allows you to create and manage orders and positions, check your balance, review your trade history, and more.

- Instruments Toolbar: This lets you switch between different chart modes, set up market research tools, and create chart snapshots and price alerts.

- Status Bar: Displays info like the current trading session, time, and server and proxy latencies.

- Active Symbol Panel (ASP): Here you can place orders, access the Depth of Market (DoM), and get information on things like market sentiment, trade statistics, and leverage.

- Settings: This is where you can access settings, help, and handle deposits and withdrawals.

IC Markets cTrader Trading Facilities

cTrader provides many useful tools for your trading needs. Here's a closer look at what it offers.

No-Dealing-Desk (NDD)

IC Markets cTrader is a non-dealing desk platform. It means IC Markets can't manipulate pricing, charts, and history. This platform allows customers to trade directly with the interbank rates. When you use an NDD broker, you know your broker won't have any conflicts of interest with your trades.

Extremely Low Spread

Among all global Forex CFD providers, IC Markets Global offers some of the smallest spreads. For the EUR/USD, there are times, especially during European and North American trading sessions, when the spread can be as low as zero.

On average, the spread for EUR/USD is just 0.1 during the week. These tiny spreads can really help traders because they make trading cheaper and can boost how much money you make.

Smart Stop Out

The Smart Stop Out feature in cTrader is all about keeping your trading account safe. It's better than the old Fair Stop Out system. Because it uses a more advanced algorithm, which means it gives you even more protection for your account.

Advance Trading Tools

IC Markets cTrader provides a set of advanced trading tools, including:

- Advanced order types: You get special order types like auto-setting SL and TP orders, fast lot size selection, customizable hotkeys, single-click reversals, and doubling position.

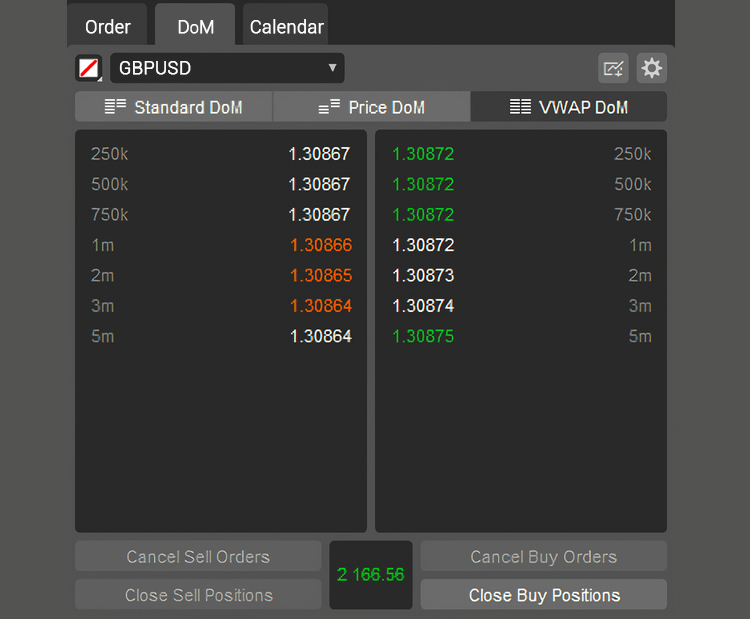

- Volume-weighted average price (VWAP) indicators: VWAP indicators provide insights into the average price of a financial instrument over a certain time, considering trading volume. This helps you understand price trends and figure out when to enter or exit a trade.

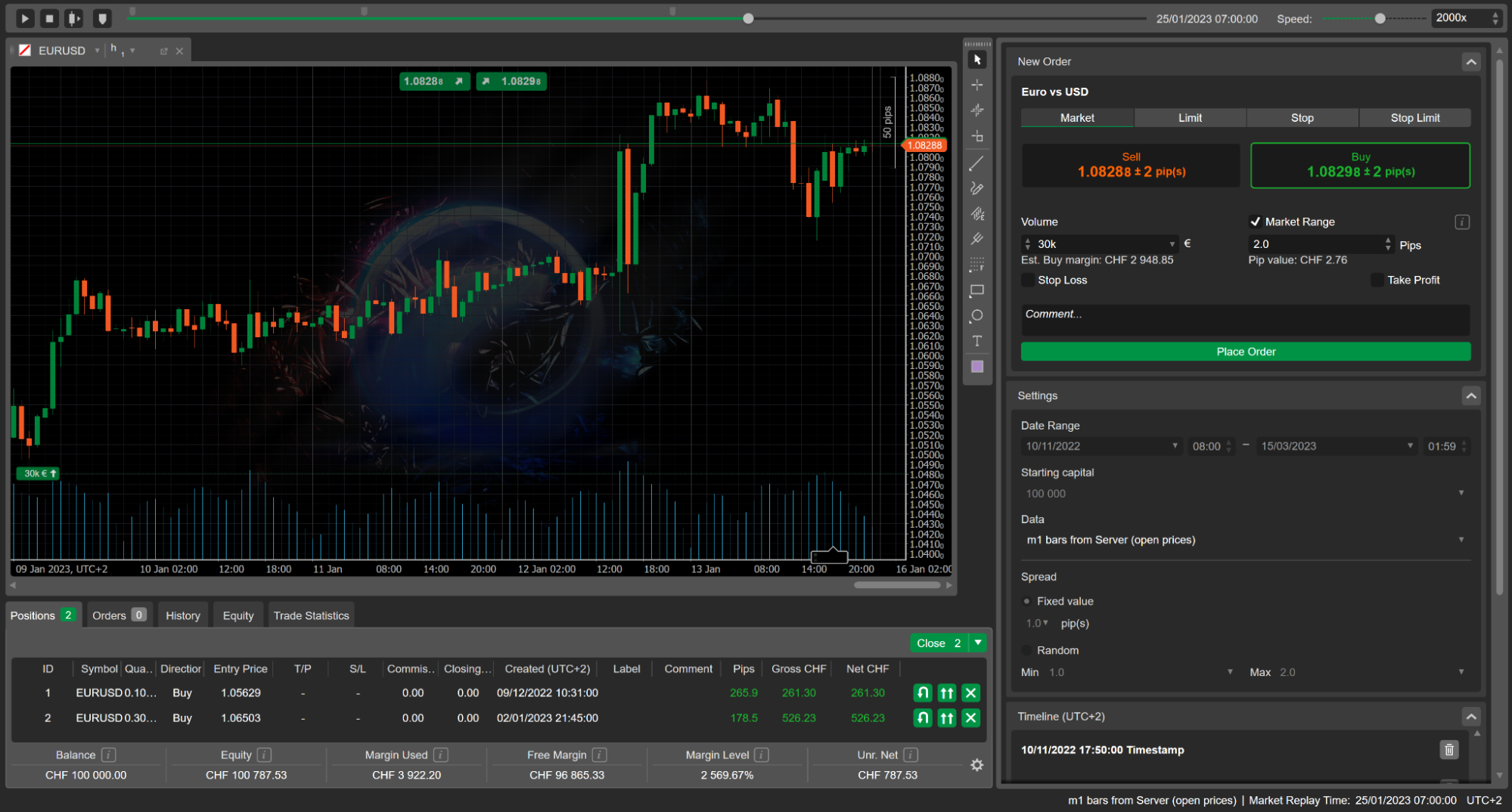

- Market replay: The Market Replay tool is like taking a step back in time. It lets you practice and improve your trading skills using past market data. You can think of it as a way to experience certain market situations again and try different trading methods, all without using real money. You can review how your trading strategies perform by looking at the equity chart and detailed trade statistics. This information helps you get better at trading for future practice rounds.

Level II Pricing with Full Market Depth

On the cTrader platform, you can easily see how much trading activity is going on (liquidity) for each currency pair. It displays the available amounts at different price levels whenever you check.

This helps you understand what's going on in the market in real-time. You can see how many people are trading that currency and where the big orders are. It also helps you find areas where the market might slow down or change direction.

No Restrictions on Trading

This platform offers great trading conditions with no limitations. You can place orders between the spread because there's no minimum order distance, and the freeze level is set at 0. This means you can put orders, including stop loss orders, as close to the market price as you want.

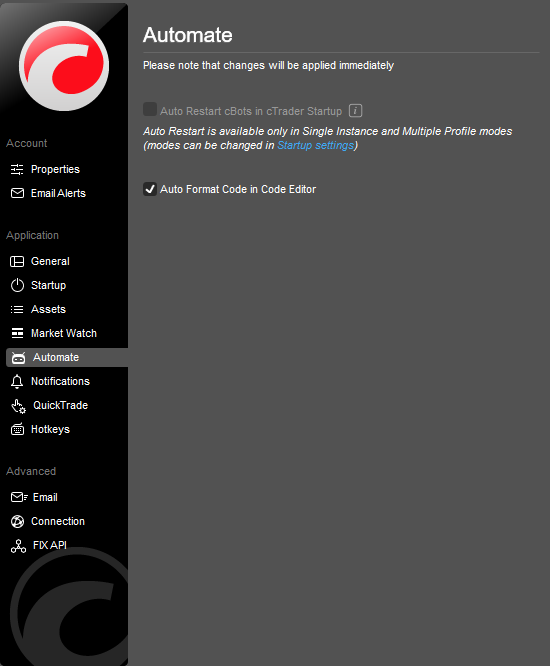

cTrader Automate

cTrader Automate is a tool that helps you create and use automated trading systems with ease. It works with cTrader and lets you build custom technical indicators for analyzing the market. You can do this using a source code editor and the C# language.

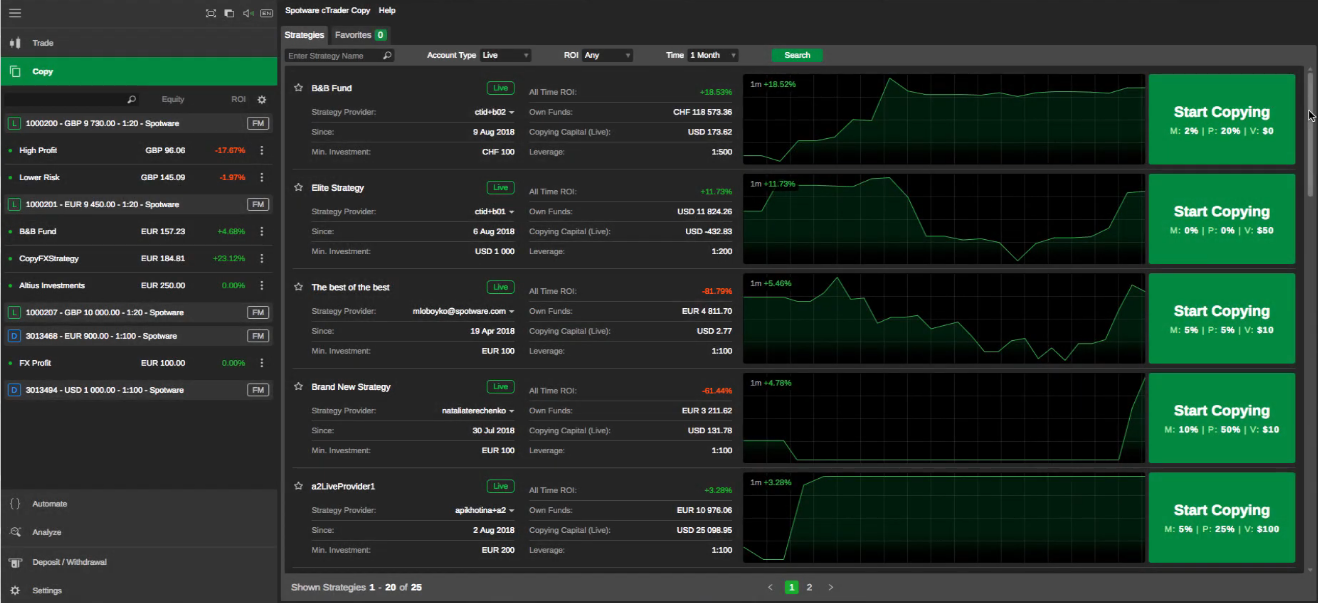

cTrader Copy Trading

IC Markets cTrader offers a copy trading system that's simple and clear. You can use it to grow your investments while keeping things transparent and managing risk.

Here's what it offers:

- It copies trades precisely based on the equity of both the strategy provider and the investor.

- You can see a complete profile of the strategy provider, including their past performance.

- There are advanced analytics to give you a deeper understanding.

- There are tools to help you manage risk.

IC Markets cTrader Trading Performance

IC Markets cTrader is excellent when it comes to trading performance. You can see this in how quickly it carries out trades and its high-quality institutional-grade trading.

Fast Order Execution

Orders are executed very quickly, usually in less than 40 milliseconds. The IC Markets cTrader server is in London at the LD5 IBX Equinix Data Centre.

This place is like a financial hub where more than 600 companies are based. All involved in buying, selling, trading, and offering market data, and services.

Institutional Grade Trading

IC Markets cTrader gives regular traders access to tools and features used in big financial companies. Here are three things that show why it's so special:

- Real, Deep, and Diverse Liquidity: When you use IC Markets' cTrader, it's like being in a really huge and diverse market. This means you can easily trade different assets, and there are lots of people buying and selling stuff.

- Reduced Slippage: IC Markets' cTrader tries to make sure your trades happen just the way you want them to. Normally, sometimes trades don't go as planned due to market changes or not enough people trading. But with cTrader, there's a smaller chance of these "mistakes," or what we call "slippage." So, you're more likely to get the prices you expect, even if you're trading a lot or the market is moving fast.

- Over 29 Billion USD in FX Trades Processed Daily: This tool handles a huge amount of trading every day, especially in the foreign exchange market. We're talking about over $29 billion in trading every day. This shows that cTrader is really good at helping lots of people trade their money.

Is cTrader Performance Steady Across All Devices?

To see how comfortable it is to use IC Markets cTrader on Windows compared to other devices, we conducted tests. We downloaded and tried the cTrader on Mac, the web, Android, and iPhone.

From our experiments, we found that the trader on each device offers similar features and performance. You can find the same features on other devices as you do on Windows.

Moreover, when it comes to speed, it's pretty much the same. Orders are processed quickly in less than a second.

The trading performance is generally good on all platforms, but it can be affected by factors such as internet speed and the specification of the device (hardware). So, you don't need to worry if you use different devices for trading on IC Markets cTrader.

Conclusion

In summary, IC Markets cTrader is a robust tool for traders. This guide has explored its features in detail, helping you understand how it can improve your trading.

With fast order processing, low spreads, advanced tools, and transparency in pricing, cTrader empowers traders to navigate the financial world with confidence. It's a reliable platform known for its quick performance and the ability to handle a high volume of daily trades.

Whether you're new to trading or an experienced trader, this guide equips you with the knowledge to make the most of IC Markets cTrader. By learning and practicing consistently, you can increase your chances of success in the dynamic world of finance.

If you are interested in social trading, IC Markets has IC Social, the ultimate platform that can help you copy other traders' strategies. How to do it? Read the guide here.

Free FOREX Virtual Private Server

Free FOREX Virtual Private Server Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

9 Comments

Kendall

Oct 30 2023

After going through this article, I'm intrigued and want to give cTrader from IC Markets a try. I'd like to test it out myself to see if it lives up to the promises.

By the way, I've been using MetaTrader 4 for my forex trading, but I'm still relatively new to trading, having started just about two weeks ago.

In light of this, I find myself pondering a series of questions: What are the key differentiators between cTrader and MT4? What distinctive features and functionalities set them apart from each other?

David Tristan

Oct 30 2023

Here are some key differentiators between cTrader and MetaTrader 4 (MT4) that can help you understand their distinct features and functionalities:

User Interface

cTrader: cTrader is known for its clean and intuitive user interface. It provides a user-friendly experience with customizable workspaces, advanced charting tools, and support for dark and light themes.

MT4: MT4 has a more dated interface, and while it's functional, it may not be as visually appealing or user-friendly as cTrader.

Charting Tools

cTrader: cTrader offers a wide range of built-in technical analysis tools, a larger number of timeframes, and multiple chart types (candlestick, line, bar, etc.). Traders can also create custom indicators and use a variety of drawing tools.

MT4: MT4 also provides a set of charting tools, but it may have a more limited selection of timeframes and chart types compared to cTrader. Custom indicators can be added, but it requires some coding.

Order Types

cTrader: cTrader supports a broader range of order types, including market orders, limit orders, stop orders, and OCO (One Cancels the Other) orders. This allows for more flexibility in trade execution.

MT4: MT4 primarily offers market and pending orders, but it may not have the same variety of order types as cTrader.

Level II Pricing

cTrader: One of the distinctive features of cTrader is its Level II pricing, which provides traders with a more in-depth view of market liquidity and allows for better order execution decisions.

MT4: MT4 does not have built-in Level II pricing. However, some brokers may offer additional plugins or features to provide similar information.

Algorithmic Trading

cTrader: cTrader has a native algorithmic trading environment called cAlgo, which allows for the creation and automation of trading strategies using C# programming.

MT4: MT4 is well-known for its MetaEditor and support for Expert Advisors (EAs), which enables algorithmic trading through the use of the MQL4 programming language.

Broker Support

cTrader: cTrader is offered by various brokers, and it's known for fast trade execution. You can choose a broker that offers cTrader based on your preferences.

MT4: MT4 is one of the most widely supported trading platforms, and many brokers offer it. It has a vast user base and a large community of traders.

Mobile Trading

Both cTrader and MT4 offer mobile trading apps for iOS and Android devices, allowing you to trade on the go.

David

Oct 30 2023

It's been mentioned that the cTrader platform seems to have fewer users compared to MetaTrader. However, when it comes to the interface and features, I'm quite impressed with cTrader.

In fact, I find cTrader's design more appealing than MetaTrader's. The question that arises in my mind is, why does it seem like a significant portion of the trading community is hesitant to adopt cTrader?

It's interesting because, from my observations, I've noticed that more people in various chart groups tend to use MT4 rather than cTrader. Could it be that the hesitation to embrace cTrader is due to concerns related to its robots or expert advisors (EAs)?

Terry

Oct 30 2023

In MT4, there's a tool known as the 'strategy tester.' Its role is to conduct backtests, whether you're doing them manually or for expert advisors or robots.

As you mentioned earlier, cTrader has CTrader Automate, which was discussed in the article. One key distinction is that it operates with a different programming language compared to MT4; while MT4 uses MQL4, CTrader Automate is based on C#.

Now, I'm curious about the process of testing a robot in cTrader. Could you provide a brief explanation of how it's done? Thank you for your anwer

David Tristan

Oct 30 2023

Here's a brief explanation of how you can test a robot in cTrader:

Yianni

Oct 30 2023

I'm relatively new to trading, and I've been using MT5 for my trading activities. It's a platform that I find quite satisfactory, especially since it's widely adopted by many brokers.

However, this article has piqued my interest in exploring cTrader. The idea of a non-dealing desk (NDD) system and minimal broker intervention is appealing to me.

At the same time, I don't want to limit my options. I'd like to take a comprehensive view of the situation. So, could you kindly provide some insights into the strengths and weaknesses of both MT5 and cTrader for me to consider?

David Tristan

Oct 30 2023

Comparison of the strengths and weaknesses of MetaTrader 5 (MT5) and cTrader to help you make an informed decision as a trader:

MetaTrader 5 (MT5)

Strengths

Weaknesses

cTrader

Strengths

Weaknesses

Jeremy

Oct 30 2023

I'm completely new to cTrader, and this article has piqued my interest in exploring this platform.

I have a pressing question about cTrader's functionality: How can one effectively perform forward testing using this platform? In MT4, there's a strategy tester readily available, but I'm curious about the trader conditions and parameters we should utilize for conducting forward testing in the cTrader environment. If you could shed some light on this aspect, I'd greatly appreciate it.

Oh, one more thing. I'd like to ask how to create a new account in cTrader. Is it possible to create an account directly from cTrader, like in MetaTrader, or do I need to go through the broker first? thankss

David Tristan

Oct 30 2023

While cTrader may not have a built-in strategy tester like MT4, you can perform forward testing using the following approach:

Forward Testing in cTrader

Regarding creating a new account in cTrader, in cTrader, you usually need to go through the broker to create a trading account. Unlike MetaTrader, which allows you to open a demo account directly from the platform, cTrader typically requires you to create an account with your chosen broker first.

Here's how you can create an account in cTrader: