MT5 and cTrader are two of the most popular trading platforms known for advanced charting and accessibility. Which one is better to optimize your trade?

Every forex trader needs a trading platform. Many platforms are existing on the market, but the two most popular ones are undoubtedly the MetaTrader series and cTrader.

For novice traders, cTrader's clean and user-friendly interface makes it an ideal choice, but once you get used to it, switching platforms may be challenging unless cTrader falls short of meeting your specific needs.

On the other hand, experienced traders or MT4 users may prefer the classic aesthetics of MetaTrader 5, which offers a wide range of assets and trading tools to effectively support their trading requirements and help them achieve their goals.

So, today we will compare MetaTrader 5 and cTrader to see which platform is better for the trading experience.

Brief Introduction to MT5

MetaTrader 5 (MT5) was first released in 2010 by MetaQuotes Software Corp. It was initially designed to be the successor of the famous MetaTrader 4 platform. But since MetaTrader 4 has been deeply rooted in the trading world, it becomes really hard for MetaTrader 5 to take its spot.

Many forex brokers are still hesitant to completely move on to MetaTrader 5 as its predecessor is still heavily preferred by most traders. However, there are indications that it's beginning to change as more traders start using the platform.

At first glance, it might appear that MetaTrader 5 is not much different than MetaTrader 4. The platform is actually branded as a multi-asset platform so that traders can access more asset types, including everything in MetaTrader 4 and non-forex CFD broker.

It can also be an excellent choice for those who wish to take their technical analysis and research to the next level because there are more indicators, drawing tools, execution types, and orders. Hence, it's very suitable for experienced traders who use a diversified portfolio and complex trading tools.

Recently, the platform has experienced a massive boom due to the compatibility issue between the new macOS Catalina and MetaTrader 4. Since MetaQuotes will no longer support MetaTrader 4, Mac users will more likely migrate to MetaTrader 5 or seek a new trading platform altogether.

Brokers with MT5 trading platforms are:

- IC Markets

- Exness

- FBS

- OctaFX, and many more.

Brief Introduction to cTrader

cTrader was launched back in April 2011 by a Fintech company called Spotware Systems, with FxPro being the first broker that adopted it. IC Markets and Pepperstone followed shortly after in 2013.

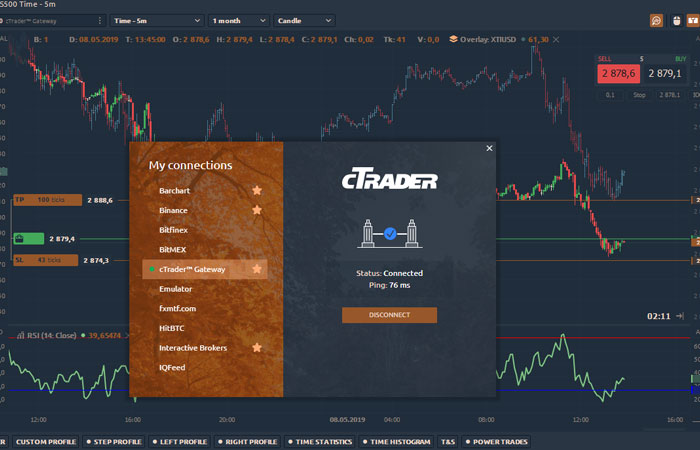

cTrader is widely known as an all-in-one multi-asset trading platform with more advanced trading features. The most vital benefits of cTrader are ECN/STP market execution, algorithmic trading via cBots, the Depth of Market (DOM) feature with level II, backtesting capabilities, and various order types.

Over the years, cTrader has been updated several times. By using the "traders first" approach, Spotware has proven that traders' interests are their top priority by providing major updates based on community feedback.

Notable brokers offering cTraders are:

- IC Markets

- FxPro

- RoboForex

- Pepperstone, and many more.

MT5 Vs cTrader: Aspects to Compare

Now that we get a glimpse of what MT5 and cTrader really are, let's compare them on the following aspects:

User Interface

If we compare the user interface, the two platforms have different designs. MetaTrader 5 seems to display a somewhat outdated design that follows the same rigid Windows 98 style pattern with all of the features and settings mainly in the same place. With such a design choice, perhaps it would make you think the platform targeted older users.

On the other hand, cTrader offers a smooth, clean, and modern interface. While both platforms allow users to customize the chart elements' colors, cTrader steps ahead by offering a light and dark theme.

his might sound trivial, but it can actually have a significant impact on its users. Although the popularity of the MetaTrader series is definitely hard to match, when it comes to user interface and ease of use, the cTrader is more likely to take the crown.

Charts and Tools

In concern to the way users interact with charts, there are several differences that you should know.

First off, MetaTrader 5 offers 3 types of charts, 21 time frames, and 38 built-in technical indicators. It provides various settings so that users can customize and match them with their personalities. The templates also allow users to save color schemes and analytical objects applied to the chart. But, users would need to an active chart and apply the changes to the settings.

On the other hand, cTrader provides 9 types of charts, 54 time frames, and 70 built-in technical indicators along with various custom indicators created in cTrader Automate or downloaded from the cTrader Store. Each chart has its own toolbar so traders can easily control the charts.

While both platforms enable trading forex and CFDs directly from the charts, cTrader also allows users to detach charts, which means that the charts can be used stand-alone across several screens. Every chart window provides all of the customization tools and is able to present charts in various layout modes.

Another advantage cTrader offers is the variable time frames and the ability to show ticks on the main chart, where the indicators and different chart types are available. While on MetaTrader 5, the ticks can only be displayed in the Market Watch section with a Line Chart.

Types of Orders

When it comes to ordering types, both platforms actually have the most important types. But the main difference is regarding of how each type functions. For instance, both platforms offer pending orders, but only cTrader allows users to place pending orders when the market is closed.

cTrader also enables users to choose the trade-side that will trigger the stop loss orders and lets users choose for the stop orders to be triggered by the second consecutive price. As a result, this will prevent the stop orders from being triggered off-market; a scenario that would end up in losses most of the time.

cTrader offers a mechanism that makes it easy to configure order protection settings before entering the market. The platform will calculate and show the rewards and risks of the current settings in various contexts before users can place an order. In addition, the platform also offers server-side trailing stop losses and many other protection mechanisms, including take profit.

Transparency

Transparency is undoubtedly one of the most crucial aspects for traders. Even small hidden fees can actually be significant to the accuracy of the trading strategy. In this case, cTrader is known to have better transparency compared to MetaTrader 5. In fact, some MetaTrader 4 and 5 brokers have got a bad reputation in regard to this matter.

cTrader is able to connect directly with liquidity providers so it can offer actual market conditions and allow brokers to really act as brokers that pass the clients' orders to their counterparties. Spotware has stated several times that cTrader brokers don't have access to trade s, so they won't be able to manipulate the data.

Meanwhile, MetaTrader 5 is hosted by brokers, so data manipulation is possible. But keep in mind that this doesn't mean the platform supports such an illegal act in any way. Besides, there's a very small to no chance that trusted brokers would manipulate the data, especially the regulated ones. The point being made is that it is possible.

Accessibility

Both platforms have excellent accessibility. Users can access both MetaTrader 5 and cTrader on Windows Desktops, web browser, and mobile screens. Additionally, MetaTrader 5 can also be accessed on macOS and Linux systems.

The difference is that cTrader gives the broker all versions of the applications they offer. In contrast, MetaTrader charges for each version of the application, so not all brokers provide all of the versions.

Moreover, Metatrader 5 is easier to find because the number of brokers offering the platform is greater than cTrader. After all, the domination of MetaTrader in the forex market is still undeniable. But even so, it won't be hard to find cTrader because many top brokers have provided it. It's just that the number of brokers offering cTrader is still considered much less than MT5 brokers.

Final Words

In summary, both MetaTrader 5 and cTrader have their own strengths and weaknesses. MetaTrader 5 is highly popular and is widely known for its simplicity, great technical trading support, built-in tools, and accessibility. Meanwhile, the strength of cTrader lies in its smooth user interface, transparency, and flexibility.

For beginners, perhaps cTrader is a better choice because the user interface is incredibly clean and easy to navigate, which is crucial for someone who just started using a trading platform. Once you are accustomed to the user-friendly interface of cTrader, you might not be willing to switch to another platform, unless cTrader couldn't provide what you're looking for.

But if you are an expert trader or an existing MT4 user, then you might prefer to see the old-school aesthetic of MetaTrader 5. The wide variety of assets and trading tools will definitely support your trading needs and help you to achieve your goals.

For web trading purposes, MetaTrader 5 has better adaptability than MetaTrader 4 for mobile devices. But finding a good broker supporting MT5 webtrader can be quite difficult. To introduce you with some choices, here are the 5 best forex brokers offering MT5 webtrader.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance