MT4 is commonly known as the go-to platform when it comes to forex trading. But cTrader comes quite close to challenge that notion. MT4 vs cTrader, how to find out the best one?

Often, several tools are available for any given job to be done correctly, and some tools are better than others. Since not every tool is made equal, it is almost impossible for you to run out of options regarding trading platforms. Several reliable platforms are popping around, but there are two most prominent trading platforms today: MetaTrader 4 and cTrader.

They have become the most popular trading platforms for a good reason, and that is why we will discuss their pros and cons when compared to each other so you may find it easier to determine which one is best for your trading needs.

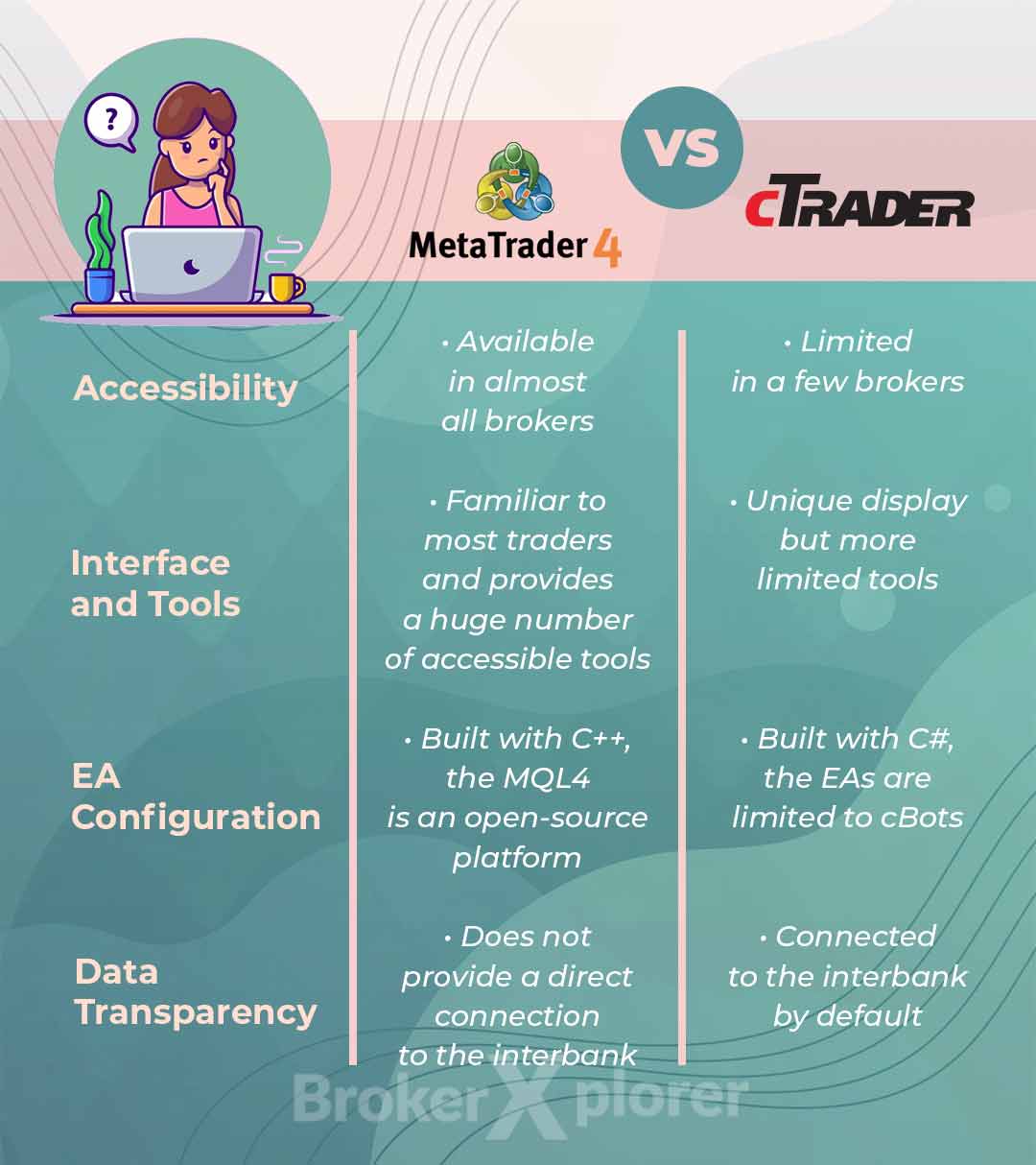

1. Accessibility

Accessibility is crucial in enabling traders of all skill levels and backgrounds to participate in forex trading. It encompasses user-friendliness, flexibility, and platform availability across various devices. In this subheading, we will explore how cTrader and MT4 offer different solutions in terms of accessibility.

- MT4

This MetaQuotes platform is so popular because everyone can download it for free. Many brokers offer this platform, so anyone can access MetaTrader by opening an account with any forex broker. Many people develop plugins for this platform as tools or custom indicators. - cTrader

cTrader by Spotware System now has many eyes set on them thanks to their NDD feature. That is why many brokers introduce them to their clients. However, the number of brokers offering the cTrader platform is more limited when compared to MT4 brokers.

2. Interface and Tools

Tools that get the job done are good, but what if the developer can make said tool attractive and intuitive as well? Better yet, more people will stick to a tool that can make them feel comfortable using it.

- MT4

MT4 has an interface that is very friendly to many traders. That is because many brokers already offer them for their clients when they want to try out a demo account.

- cTrader

The interface cTrader uses can be switched from bright to dark mode and vice versa, whichever suits the user. They also arrange the layout options dynamically so the user feels comfortable using this platform for an extended time. This platform also has several extra plugins you can install but they are still not as numerous as those on MT4.

3. Expert Advisor Configuration

In algorithmic trading, configuring and utilizing Expert Advisors (EAs) is highly valued. EAs offer automated trading solutions, executing trades based on pre-defined rules and parameters. The configuration options available in a platform can significantly impact the effectiveness and flexibility of these automated strategies. By comparing the Expert Advisor configuration of cTrader and MT4, traders can get insights into which platform offers a more robust and customizable environment for optimizing their trading strategies.

- MT4

MT4 is built using C++ as its programming language. Also, there are a lot of plugins and Expert Advisor bots made by MT4's users. MQL4 is commonly known as an open-source platform, so everyone can adjust its basic program to fit their trading style. - cTrader

This platform was built using C#. Although the amount of Expert Advisors in this platform is limited to cBots, the developer allows its users to use cAlgo to build their own Expert Advisors around. Users that have become very comfortable with the MT4 trading bots will probably have difficulty adapting to cTrader because plenty of trading bots are specifically made for MT4. On the other hand, cAlgo provides an exciting challenge for users that want to create a great bot.

See Also:

4. Data Clarity

This aspect holds great importance for traders. A platform must display the most recent data to get a valid trading signal because any in the delivery can result in additional trading costs.

- MT4

MT4 does not provide a direct connection to the interbank and requires another party as an alternative. Thus, there is a possibility that the broker itself becomes the liquidity provider. If the market is leaning toward either sellers or buyers, the broker may be able to adjust the supply and demand. That makes the data clarity of MT4 susceptible to misuse and brokers' interference. - cTrader

This platform is connected to the interbank by default. All data feed and slippage are shown in real-time according to the global market's data. Moreover, cTrader has a Depth of Market feature that allows users to get a different spread according to the amount of traded lots. Scalpers or traders favor this high-precision trading with big trading sizes.

Desk dealing brokers usually offer the MT4 platform for their clients. Therefore, data clarity solely depends on the broker's honesty. While on the cTrader, all live data feed is sent from the interbank, so you can have more actual data that is not easily faked.

Conclusion

New traders may want to stick to MT4 for their ease of access, availability of plugins, and plenty of Expert Advisor. They can help new traders to overcome the steep learning curve in forex trading.

Meanwhile, professional and experienced traders may want to move differently. They prefer data clarity and precision found on cTrader, although the brokers that provide this platform are very limited compared to MT4. To provide the advantages of cTrader while maintaining their client base that favors the MetaQuotes-based platform, some brokers offer cTrader as an alternative along with MT4 or MT5.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

7 Comments

rabih el jamal

Jun 9 2021

very nice clarification

Matt

Jun 21 2021

What a BS

Interbank for CFD :)

There is no "interbank" in the CFD world. CFD providers do not trade with banks, they are just bucket shops betting against their clients.

Gjert Mikalsen

Jun 25 2021

Ay, mate! I've been using this trading platform for three years now, and it's a bloody beaut. The order execution time is as quick as a flash, and you can even run multiple trades all at once without any hassle. Plus, you can create your own point plots alongside the standard ones. Now, I'm not saying there's no risk involved, but as long as you've got the right info under your belt, you'll be cruising along in no time.

Loi Barrows

Jun 30 2021

I've been havin' a crack at tradind with cTrader for the past few months now, and I'm quite pleased with what I've seen so far. For one thing, bein' able to trade straight from the charts gives me a clear picture of the most profitable entry points, and I can even choose the trade volume with the click o' me finger. The charts also keep a handy record of all me past trades. I was wonderin' if there's a way to analyze me past performance in a separate window, like.

Kalpit Bath

Aug 3 2021

cTrader is a multifunctional trading platform and you can do it through the platform menu.

Bertrand Baudry

Jul 6 2021

1. Listen up. cTrader offers lightning-fast order executions, all thanks to its no-dealing-desk mode. There's no mucking about with bridges or whatnot, so brokers can't meddle with the trading process or mess with quotes and spreads.

2. Now, this platform was designed by traders, so you can bet it's packed with features for manual trading. The charts are a prime example. Fancy placing a pending order? Just drag and drop the line to the price level you want. And if you're keen on following trading signals, simply double-click on the target, and cTrader will automatically open a market order along with stop-loss and take-profit orders. When it comes to choosing trade volume, you'll find all the info you need on the chart, including lot size, pip cost, and margin requirements for the asset.

3. As for past performance, cTrader keeps a record of your trades right on the charts, so you can always see how you've been doing.

Santhara Rayer

Aug 28 2021

This trading platform is a fair dinkum ripper in the world of financial trading. From the interface perspective, you can choose from two bloomin' options - black and white variants.

Now, let's delve into the technical features. This platform offers one-click trading, which is a bloody beaut for quick and easy trades. And get this, you can even set up one-click trading, which is a real time-saver. In the settings, you can determine the allowable price slippage and automatically set SL, TS, and TP for open positions. Top stuff, mate!