IC Markets Correlation Trader is designed to help traders analyze and identify correlations between various currency pairs. Here's a guide on how to use this tool.

IC Markets is one of the largest Australian-based brokers with over 100,000 active clients from more than 140 countries. The multi-regulated broker offers 65 forex pairs, including major and minor pairs.

Across MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, IC Markets provides the Correlation Tool, a powerful trading tool that helps traders to analyze and identify correlations between different currency pairs.

The tool is designed to provide valuable insights into the relationship between various currency pairs. It is vital for savvy traders as they tend to explore opportunities for hedging, arbitrage, or spread trading.

Considering its critical value, we will dive deeper into the IC Markets Correlation Trader and how to use it. Let's take a closer look!

Correlation Trader at a Glance

Correlation in the forex market refers to the statistical relationship between two or more currency pairs. It measures how closely the price movements of these pairs are related to each other. Understanding correlations can be useful because it helps you identify potential opportunities and manage risk more effectively.

Correlation is measured on a scale from -100 to +100:

- +100 means that the price movements of currencies A and B have been identical ("positive correlation").

- -100 means that the price movements of currencies A and B have been exactly opposite: A went up when B went down, and vice versa ("negative correlation").

- 0 means that the currencies have moved independently.

4 Ways IC Markets Correlation Trader Could Help Savvy Traders

IC Markets Correlation Trader Tool is an additional feature designed to help simplify the analysis and decision-making process. Savvy traders can benefit from this tool to optimize their strategy, thus making it a must-have feature for their trades.

Here are 4 benefits of IC Markets Correlation Trader that savvy traders could enjoy:

- Visualize Correlations

The tool offers visual representations of correlations through charts and graphs. This makes it easier for you to visualize the relationships between currency pairs and observe any changes or trends over time. - Identify Hedging and Diversification Opportunities

Correlations can help you to diversify your portfolios. By identifying currency pairs that have low or negative correlations, you can potentially reduce their overall portfolio risk. When one currency pair is experiencing a downturn, a negatively correlated pair may be moving in the opposite direction, potentially providing a hedging or diversification opportunity.

- Help Planning Risk Management

Understanding correlations can assist you in managing risk. If multiple currency pairs have a high positive correlation, it indicates that they tend to move in the same direction. This knowledge can be helpful when determining position sizing, stop-loss levels, or overall exposure to a particular currency.

- Enhance Trading Strategies

You can incorporate correlation analysis into your trading strategies. For example, you may use correlated currency pairs to confirm signals or identify opportunities for hedging positions. By considering correlations alongside other technical or fundamental indicators, traders can gain a more comprehensive view of the market.

How to Use Correlation Trader Tool

The IC Markets Correlation Trader tool will generally be available by default once you have logged into your IC Markets account and accessed your MT4, MT5, or cTrader trading platform. However, if Correlation Trader does not appear on your trading platform, you will need to download and install it yourself. You can contact customer support to facilitate the download and installation process.

The Correlation Trader tool is available for all account types at IC Markets, including live accounts and demo accounts. This aims to make it easier for beginners to apply this tool to strengthen market analysis.

After ensuring that your trading platform has the IC Markets Correlation tool installed, you can follow the steps below to use it.

- Open the MetaTrader 4 (MT4) trading platform provided by IC Markets. Ensure that you have a valid trading account and login credentials.

- Once you are logged in, navigate to the "Navigator" window on the left side of the platform. You can usually find it by pressing Ctrl+N on your keyboard or by selecting "View" from the menu and then choosing "Navigator".

- In the Navigator window, scroll down or expand the "Indicators" section. Look for "IC Markets Correlation Trader" or a similar indicator that represents the Correlation Trader tool.

- Drag and drop the Correlation Trader indicator onto the chart window of the desired currency pair or financial instrument you want to analyze.

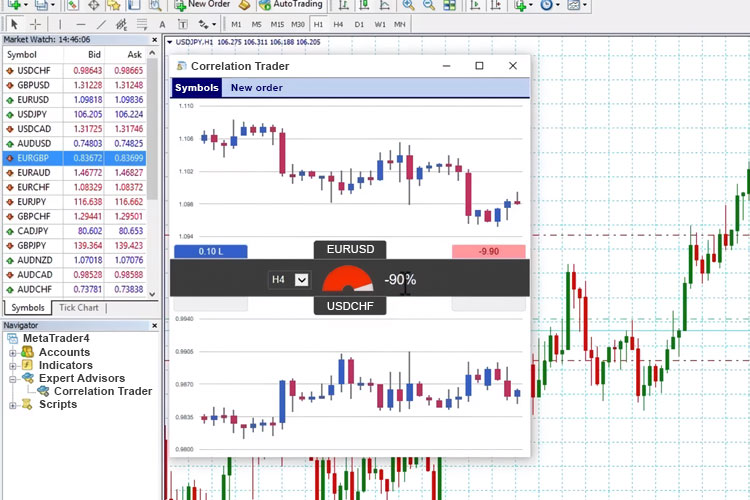

- A separate window or panel will appear on your chart, displaying the correlation coefficients and visual representations of correlations between different currency pairs.

Configure the settings and preferences of the Correlation Trader tool as needed. You may be able to customize the time frame, correlation strength, and other parameters depending on the specific features of the IC Markets Correlation Trader tool.

IC Markets is an online forex broker operating under the company of International Capital Markets Pty Ltd. Traders under the Australian jurisdiction are provided with the trading service of IC Markets AU that is headquartered in Australia and licensed by the Australian Securities and Investments Commission (ASIC).

On the other hand, non-Australian traders who open an account in this broker are registered under IC Markets SEY that is based in Seychelles, and regulated under the Seychelles Financial Services Authority (SFSA). The dual operation is a result of the relatively new rules from ASIC that prohibit their regulated broker to offer trading services outside Australia.

Classified as an ECN broker, IC Markets provide clients with MetaTrader 4, MetaTrader 5, cTrader as platform trading options. This broker also follows market trends to include Cryptocurrencies as one of its products, enriching its already wide selection of trading assets that include Currencies, Indices, Metals, Energies, Softs, Stocks, as well as Bonds.

The minimum deposit in IC Markets is in the middle range compared to other ASIC-regulated brokers, as it reaches $200 for every client. Market analysis materials are also prepared regularly for trading insights on IC Markets's official website, proving their competence to serve their traders with important contents created by market experts that work specifically for them.

For payment methods, IC Markets allows funding and withdrawal via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, as well as Bitcoin via BitPay. The more interesting aspect from this broker is its multi-base currencies that include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

As the trading technology in IC Markets is highly equipped with co-located servers and extremely low latency (especially on cTrader), the broker is widely known for its capability in hosting traders with the special needs for high-frequency trading as well as scalping.

To sum up, IC Markets is a fitting destination for active traders looking for a well-regulated broker. IC Markets is also flexible in terms of base currency and payment methods, signaling their commitment to welcome traders beyond their home country. As of late 2019, IC Markets provided their website in 18 international languages including English, Korean, Indonesian, French, Spanish, Italian, Malay, German, and Chinese.

How to Measure Currency's Correlation Using the Tool

Here is an explanation of the sections and tools of the IC Markets Correlation Trader.

- Recent correlation: The correlation between the two currency pairs over the selected time frame. This gives you an idea of how closely the price movements of the two currency pairs are related.

- Open positions: It displays any open positions you have in each currency pair and shows their profitability. This helps you track the performance of your trades.

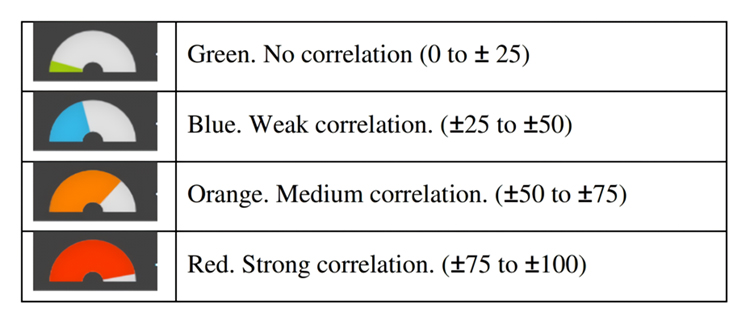

The IC Markets tool also includes a gauge that represents the correlation on a scale of 0 to ±100. The positive or negative values (+90 or -90) have similar meanings, and their interpretation depends on whether you are long (holding a buy position) or short (holding a sell position) in each symbol.

For example:

- A correlation of +90: If you are long or short in both currency pairs, you can expect similar profits or losses in both positions. If you are long in one currency pair and short in the other, you will likely see a matching profit and loss.

- A correlation of -90: If you are long in both or short in both currency pairs, you can expect a matching profit and loss. If you are long in one currency pair and short in the other, you will likely see similar profits or losses in both positions.

The color of the gauge indicates the strength of the correlation. This helps you assess the degree of relationship between the two currency pairs.

Correlation Trade Alternatives

As the name suggests, IC Markets Correlation Trade is an exclusive feature that can only be used by IC Markets clients. You must register as a demo or live account to access the feature on the IC Markets platform.

While this feature is exclusive to IC Markets, similar correlation tools and features are offered by other broker platforms in the forex market. Correlation analysis is a widely used technique among traders, and brokers often provide tools to help their clients understand and utilize correlations effectively.

These tools may vary in terms of functionality and user interface, but their purpose is generally to assist traders in analyzing and interpreting correlations between currency pairs. Different brokers may offer correlation tools in various forms, including:

- Correlation Matrix: A matrix displaying correlation coefficients between multiple currency pairs in strong positive or negative relationships.

- Correlation Charts: Graphical representations of correlations between currency pairs over a specified period, displayed in patterns or trends.

- Customizable Filters: This flexibility enables traders to focus on correlations that are most relevant to their strategies.

- Correlation Coefficient: Measures the relationship between two sets of financial data, like stocks, currencies, or ETFs. It ranges from 1 to -1.

Final Words

IC Markets offers a correlation trader tool for analyzing currency pair correlations. It provides visual representations, aiding in diversification, risk management, and trading strategies. The tool is available to all account types, including demo accounts. Simply log in to your IC Markets account and access the MT4, MT5, or cTrader platforms to use the tool.

Savvy traders can use this tool to their benefit as currency pair correlations are crucial in many strategies like hedging, diversification, and advanced risk management.

IC Markets is a raw spread brokerage that puts all client's funds in segregated trust accounts supported by well-known Australian banks such as Westpac and NAB. On top of that, IC Markets offers various trading instruments like Forex, Indices, Bonds, Crypto, and many more.

Free FOREX Virtual Private Server

Free FOREX Virtual Private Server Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

7 Comments

Alex

Jul 18 2023

Hello BrokerXplorer peoples! Which platform provided by IC Markets, such as MT4, MT5, or cTrader, do you find most suitable and effective for utilizing the correlation trader tool to analyze currency pair correlations? In your experience, which platform offers the best features and user-friendly interface for conducting correlation analysis and integrating it into your trading strategies? Have you noticed any notable differences or advantages among these platforms when it comes to utilizing the correlation tools provided by IC Markets? Your insights would be greatly appreciated as I consider which platform to use for leveraging correlation analysis in my own trading endeavors.

George

Jul 20 2023

I think the choice of platform for utilizing the correlation trader tool offered by IC Markets ultimately depends on your preferences and trading style. MT4 (MetaTrader 4), MT5 (MetaTrader 5), and cTrader are all popular and widely used trading platforms with their own unique features.

When deciding which platform is best for utilizing the correlation trader tool, consider factors such as your familiarity with the platform, the availability of specific features you require, and your overall trading preferences. It may be helpful to explore the functionalities of each platform and see which one aligns best with your trading goals and strategies.

Brandon

Jul 18 2023

Just have some short questions here. Based on the article, I want to ask you guys who have experience with correlations trader tools in IC Market. I mean, have you tried using the correlation trader tool offered by IC Markets to analyze currency pair correlations between gold trading and forex trading? How can these correlations be leveraged to enhance trading strategies, diversify portfolios, and manage risks effectively? Can you share any insights or tips on utilizing the correlation trader tool effectively for optimizing trading decisions and maximizing profitability?

Ojin

Jul 19 2023

The correlation trader tool offered by IC Markets can be a valuable resource for analyzing currency pair correlations, including those between gold trading and forex trading. By leveraging these correlations, traders can enhance their trading strategies by identifying potential trends and patterns that may impact their positions. It can also help in diversifying portfolios by considering complementary or negatively correlated assets, spreading risk across different instruments. Effective risk management is another benefit, as understanding correlations allows traders to assess the potential impact of market movements on their positions and adjust accordingly.

In my experience, I have found that regularly monitoring and updating correlation data is essential. Market conditions can change, and correlations may shift over time, so staying informed is crucial. Additionally, it's important to consider other factors such as fundamental analysis, news events, and risk tolerance when utilizing correlation analysis. Combining correlation analysis with other trading tools and indicators can provide a more comprehensive perspective and improve decision-making.

Boris

Jul 19 2023

Can we completely rely on correlation tools with 100% trustworthiness? While correlation tools can provide valuable insights into currency pair relationships, it's important to remember that no tool or indicator is infallible. I understand that Correlations can vary over time, and there may be instances when correlations break down or behave differently than expected. External factors such as market conditions, economic events, and geopolitical developments can influence correlations as well. Therefore, it's crucial to use correlation tools as a part of a comprehensive analysis and consider other factors like fundamental analysis and market context. Can you share any experiences or tips on effectively utilizing correlation tools while keeping in mind their limitations?

Qyeen

Aug 17 2023

In this article, it's explained that IC Markets provides a tool for analyzing the relationship between two different financial instruments. By examining correlations, traders can pinpoint potential trading opportunities and risks. However, this is the only part I grasp from the article. The rest of it is quite bewildering since I've never engaged in real trading with any broker before. To address this, I've been reading reviews about various brokers to determine the most suitable one.

To be honest, I'm a novice trader, and there might be numerous terms in broker trading that I'm not familiar with. I've never had direct trading experience either; maybe only through a demo account. Upon my initial reading of this article, I was honestly baffled as I couldn't quite grasp the essence of this particular feature. However, as I continued reading, I started to gain a bit more understanding, though confusion still lingers.

Could someone provide a more concise and easily comprehensible explanation of how traders use correlations? Additionally, I'd appreciate insights into the advantages and security measures offered by IC Markets as effective tools are pointless without adequate protection.

Punch T

Aug 19 2023

Sure, let me clarify... Correlation is measured on a scale from -100 to +100. A +100 correlation indicates that the price movements of symbols A and B have been identical, which signifies a positive correlation. Conversely, a -100 correlation means that the price movements of symbols A and B have been exactly opposite: when A went up, B went down, and vice versa, indicating a negative correlation. A correlation of 0 suggests that the symbols have moved independently. Understanding correlation is essential because it can significantly impact your trading risk.

For instance, consider the H1 EURUSD and USDCHF charts over the same period, which exhibit a very strong negative correlation of approximately -95. If you were long on EURUSD and short on USDCHF during this time, or vice versa, you would have seen very similar profits in both positions. Essentially, you effectively held just one position, as being long on both symbols or short on both symbols would have likely resulted in a profit on one and a corresponding loss on the other.

It's generally advisable to minimize correlation between your open positions to avoid either trading the same price action twice or having two positions that offset each other. In essence, Correlation Trader can display current price charts for two symbols side-by-side and can be used as a way to visualize two connected price charts.

Additionally, similar to my experience in trading, I also honed my skills on a Demo Account, much like a Jedi, until I felt completely prepared for a real account. However, the demo account can serve various purposes, including testing new strategies. It's an excellent way to thoroughly evaluate and fine-tune your new strategy.

This broker creates a strong impression, and I have confidence in its safety. You can trade with peace of mind knowing that IC Markets is overseen by some of the world's most stringent regulatory bodies. When you fund your trading account, your funds are held in segregated client accounts at top-tier banking institutions. IC Markets Global adheres to the Securities Act and the Securities (Business Conduct) Regulations, maintaining strict policies and procedures for the management and operation of these accounts.

Read more: Is IC Markets Good for Beginners?