NDD brokers are typically favored due to the diminished conflict of interest. However, direct access through a no-dealing desk platform is not always beneficial for certain traders.

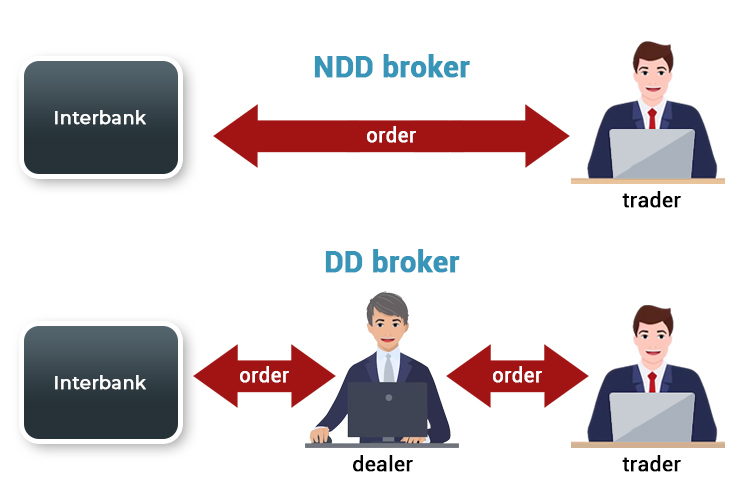

There are two commonly known types of CFD brokers: Dealing Desk (DD) and Non-dealing Desk (NDD). No-dealing Desk refers to online trading services provided by a forex broker that offers direct access to interbank exchange rates without dealing desk interference.

Although dealing desks must exist somewhere in order for the financial markets to do their functions properly, NDD brokers are typically viewed favorably by retail traders due to the diminished conflict of interest.

They can be the right choice, especially if you're an experienced trader, big-cap trader, or high-frequency trader. However, direct access to interbank rates is not always beneficial if you're a beginner or small-cap trader.

NDD Brokers Characteristics

Contrary to DD brokers who act as counterparties against their clients' trades, NDD brokers serve as intermediaries between traders and liquidity providers that generate interbank rates. Here is a summary of the differences between DD brokers and NDD brokers at a glance:

NDD brokers aggregate quotes from numerous providers in the interbank market to provide their clients with various spreads and connect two opposing trades made by two participants (or more) in the market. The more liquidity providers work with a certain NDD broker, the deeper their liquidity and the lower the spreads received by their clients.

In these circumstances, NDD brokers typically offer:

- floating spreads,

- high commission fees,

- higher initial deposit requirements, and

- lower leverage compared to DD brokers.

NDD brokers cannot offer a fixed spread because normal prices in the market are NOT fixed. They also had to pay quite a hefty amount of money to maintain connections with multiple liquidity providers, so they could not afford to provide trading services with cheaper fees.

Additionally, they had to require a higher margin to support all the complicated risk management and legal requirements needed to sustain their services.

Examples of NDD Brokers

Here are several leading NDD brokers providing direct market access for forex and CFD traders:

- Dukascopy

Established in 1998, Swiss-based Dukascopy offers trading services with minimum deposit requirements of $100 and maximum leverage of 1:200. It is one of the few brokerages with solid banking licenses and highly regulated services. Learn more on Dukascopy website. - eToro

Popular online broker eToro has thrived since 2007. The eToro online trading platform and mobile app are known for their capability and reliability in copy trading across a wide range of assets, which allow users to duplicate top trading strategies in real time. Learn more on eToro website. - FP Markets

A reputable international broker, Australian-based FP Markets offers more than 10,000 CFD products in the FX, equities, indices, commodities, and cryptocurrency markets. Thanks to their cooperation with top banking and non-banking financial institutions, FP Markets is offering tight raw spreads starting at 0.0 pips. Learn more on FP Markets website. - FXOpen

FXOpen declares itself an STP/ECN broker that does not trade against clients since 2003. Nevertheless, they are also known as an affordable broker. There is a minimum deposit requirement starting at $1 and maximum leverage up to 1:500 for one of the most popular real account in the industry. - IC Markets

IC Markets is a well-known choice for professional traders who want to run automated trading strategies on the MetaTrader and cTrader platforms. Minimum deposit as low as $200 and maximum leverage up to 1:500. Learn more on IC Markets website.

Why Are NDD Brokers Good for You?

Traders using an NDD broker are immediately exposed to the rates accessible to retail consumers on the interbank market. As such, NDD brokers may offer relatively transparent quotes. NDD brokers typically also have a valid no-requote policy and faster order execution.

Most experienced traders and rich market participants appreciate these qualities, particularly those who apply a high-frequency trading approach. And so, they may be willing to pay more in order to enjoy NDD brokers' services.

Why Might NDD Brokers NOT Be Good for You?

Lots of traders mistakenly think that NDD brokers provide narrower spreads that are beneficial for everyone. However, it is simply not true.

Raw spreads in the market are highly volatile. It may be near zero during normal market conditions but then spike higher due to lower liquidity or unexpected market turmoil. Without the dealing desk as a buffer, traders will directly bear the brunt of any turbulence.

In the mayhem following the Swiss Central Bank's controversial decision to scrap the franc's peg to the euro in January 2015, several NDD brokers were ruined along with their clients. But DD brokers were just fine.

These risks come along with higher trading fees. As such, beginners and traders with lower capital are not advised to work with NDD brokers.

Are you interested to know more about some brokers with NDD characteristics but providing low trading costs? You should check out "Where to Find ECN Accounts with Low Commissions".

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance