Not only trading on the go, OANDA mobile app could give access to various financial markets right from your phone.

OANDA started out as one of the first players in the forex trading industry in America. Founded in 1996, the company has certainly defined a solid spot in the global market. Today, it is a leading brand with clients in more than 196 countries. OANDA specializes in offering currency trading solutions for traders with various levels of expertise. Their biggest selling points are excellent market research and robust proprietary platforms.

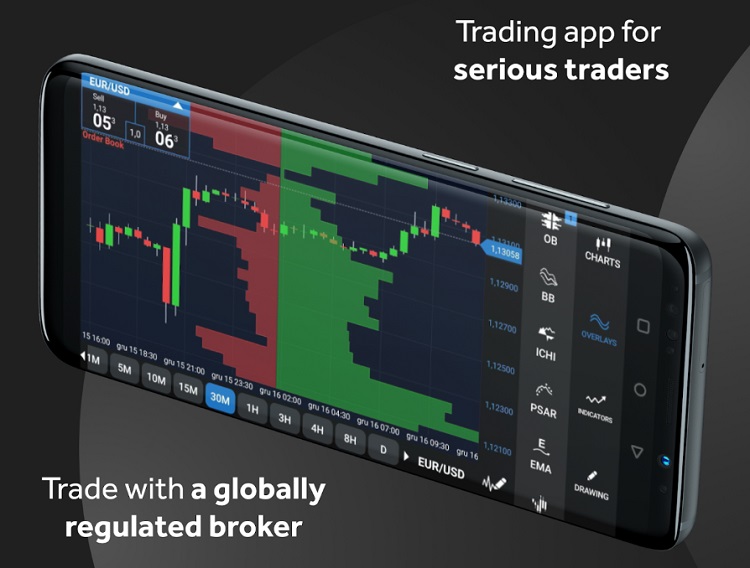

If you wish for easy access to the broker and see what they offer, you can try OANDA's proprietary fxTrade mobile trading app for Android and iOS. The trading platform has over 70 currency pairs available to trade, sophisticated market research, as well as various order types to choose from. Let's take a closer look at it and decide whether the app is right for you.

Contents

What Products are Offered on OANDA's App?

The OANDA app is currently rated 3.5/5 from over 4.65k users on Google Play Store and has been installed more than 1 million times.

As more traders and investors prefer to use their smartphones to trade, it's highly necessary that brokers offer easy-to-use mobile trading apps. In general, the OANDA app focuses primarily on forex trading. It offers more than 70 currency pairs including all the major and minor pairs as well as some exotic pairs. The maximum leverage is 50:1 for major currency pairs and 20:1 for the rest.

In addition, the broker offers CFDs (Contracts for Difference) but the options are quite limited. The app supports 16 stock index CFDs, 31 commodity CFDs, 4 cryptocurrency CFDs, and 6 bond CFDs. Also, keep in mind that CFDs are not available in the US and crypto CFDs are not available for UK residents.

Main Features

The OANDA mobile app has all the basic features one would expect from a trading platform, but it mainly focuses on charting and trading. Here is the complete list of features that you can get from trading with the app:

1. User-friendly and Customizable Interface

First of all, the OANDA app is highly user-friendly. You can easily navigate and use different features of the app in just a few simple taps, making it suitable for practically any trader.

Another great thing about this app is that it's easy to monitor the market. The layout can be extremely useful to trade on the go and there are separate tabs to keep you updated with your active positions as well as historical orders.

On top of that, the app allows users to customize their orders and decide on a set of default parameters, including the number of units traded, risk and profitability levels for pending orders, bounds in pips or percentage prices, and preferred financial instruments. This way, you can easily manage your orders according to your trading style.

2. Mobile Charting

The OANDA app allows you to access over 50 technical indicators, which consist of 32 overlay indicators, 11 drawing tools, and 9 charts. The drawing tools in particular are pretty impressive because you can easily add not only trendlines but also Fibonacci retracements and pivot points.

The best thing about the app, however, is the fact that you can trade directly from technical charts. This means you can enter, modify, or close positions directly from the chart without having to go back to the main menu and open a new order.

Additionally, you can easily add or edit your stop loss and take profit levels by clicking on the chart. However, this can be quite tricky to do on a smartphone, so it's recommended to use a tablet instead.

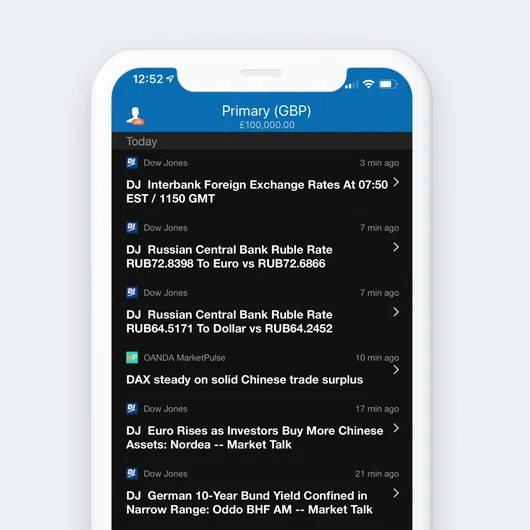

3. Market News and Data

The OANDA mobile app offers access to the world's major financial markets. You can react to market activity in real-time while at the same time, managing your positions, controlling the risk, and monitoring your account's profitability. Apart from that, the app also provides access to a complete economic calendar to help you keep track of current and upcoming events that might affect the market.

4. Alerts and Price Signal Notifications

To manage your account better, you can get mobile notifications on market sentiments for live trading accounts. This ensures that you won't miss any trading opportunities even when you're away from your phone.

You can enable notifications on various aspects of trading, such as price alerts, daily/weekly highs, significant price movements, market highlights, order expiry, upcoming economic events, and global market news from trusted providers. You can also set up custom notifications based on the drawing tools and overlays, so you will be notified when the price crosses a certain level on the chart.

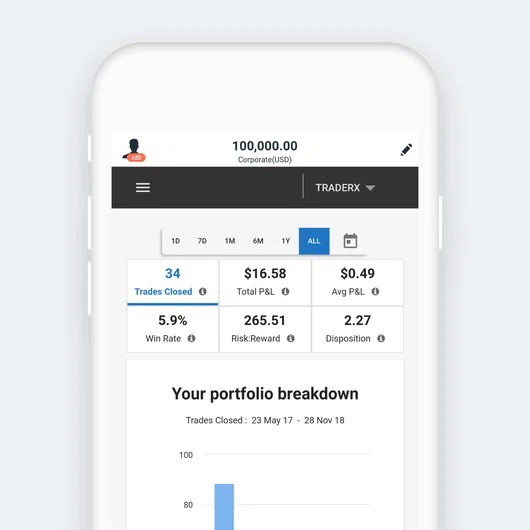

5. Trader Performance Analytics

Lastly, the OANDA mobile app provides a trading performance tool that allows users to see their history and professional grade scores. To access this feature, you can click the "More" tab on the screen.

This tool basically lets you monitor and manage your past trading behavior. You can break down your performance based on the instrument you used, overall and average profit/loss, winning rate, and risk-to-reward ratio. You can use the data to update your trading journal and analyze your trading performance.

Available Accounts

One of the notable features of OANDA is that inside your main trading account, you can have up to 19 separate subaccounts. Each account can have its own base currency, so you can easily switch between different currencies to trade more effectively. You can also use those subaccounts to manage different portfolios.

In order to open a trading account, you just need to do several steps. First, open the website and apply for an account. Bear in mind that you need to be over 18 years old to create an account. Second, verify your identity by submitting all of the necessary documents, such as a driver's license, ID card (proof of identity), or utility bill (proof of address). Then, simply wait for the verification process. Once your account is ready, you can start depositing some funds. You can choose from various payment methods, including debit cards, bank wire transfers, and Automated Clearing House (ACH).

Fees and Commissions

OANDA offers two pricing models for forex trading, namely spread-only and commission plus core spread. If you choose the spread-only model, it means that the commission is wrapped into the spread, so the spread is the only cost that you should pay for your trade. However, this means that the spreads are slightly higher than the market average. The minimum spreads for major pairs is about 1.4 pips for major pairs and 2-3 pips for minor pairs.

See Also:

Meanwhile, the core pricing model offers lower spreads, starting from 0.3 pips for major pairs and 1-2 pips for minor pairs. However, you'll also need to pay a fixed commission on every trade. The commission is $5 per 100,000 worth of currency or roughly $10 per standard lot.

Apart from that, there are some non-trading fees that you should consider. The broker doesn't charge any fees for opening an account, but they will charge an inactivity fee of $10 per month if you're inactive for two full years without placing any orders. You should also pay an additional fee if you make a withdrawal via wire transfer.

Device Compatibility

The OANDA app can be used on smartphones or tablets with the following requirements:

- For iOS users: iOS 11 or 12.

- For Android users: Android Jelly Bean or above.

Final Verdict

OANDA is a great mobile app for forex traders who prefer to trade on the go. The app is very easy to use and has all the features needed to trade effectively, with a special focus on charting and trading. You can trade more than 70 currency pairs with competitive fees, along with CFD trading on stock indices and commodities.

Traders looking for brokers with accurate precision, OANDA can be an option. That is because OANDA is a broker that provides quotes with 5-digit accuracy and active price movements that follow market developments. Order execution speed is also faster in this broker.

It provides benefits for novice traders, as they can trade with smaller volumes using the calculation system based on currency value, unlike other brokers adopting the lot system.

Founded in 1996, OANDA was built by Dr. Michael Stumm who is a lecturer in Computer Engineering at the University of Toronto, Canada, along with his colleague, Dr. Richard Olsen of The Olsen Ltd., which is one of the leading econometric research institutes. They have a head office in San Francisco, United States.

OANDA branch offices can be found everywhere. Some of these offices are located in the United Kingdom, Singapore, Japan, and Canada. With this number of offices spread, OANDA has increasingly attracted the attention of clients worldwide.

OANDA's company is registered under several well-known jurisdictions in financial trading. They are regulated by CFTC and NFA in the US, FCA in the UK, ASIC in Australia, and many others. Traders do not need to worry anymore about security when trading in OANDA. However, these advantages make trading rules at OANDA more stringent compared to other brokers.

For example, OANDA only allows maximum leverage of 1:20, because the rules in the US and Japan do not allow leverage above that. Besides, the registration procedure is more complex due to various additional requirements that are not submitted by other forex brokers. On top of that, hedging is not allowed in one trading account as the client must open an additional account to hedge.

Nevertheless, OANDA is known for being a leading broker with many advantages offered. OANDA faces increased market risk during periods of price volatility, such as economic and political news announcements. When market spreads increase or decrease, their pricing engine widens or narrows spreads accordingly. That way, traders can get the latest conditions from price movements in the market more quickly.

Prices move very fast in the market. Especially when news releases have a large impact on market volatility. This condition is often exploited by brokers to take advantage of clients with Requotes. However, traders do not need to worry about additional costs when trading with OANDA.

The company never withdraws Requotes so traders can get maximum profit. When traders are unavailable to monitor open positions, they can set take profit orders to lock in profits and Stop Loss orders to help protect against further losses.

As an experienced and well-known online forex broker, OANDA is committed to maintain an efficient trading environment that reduces latency and provid tools to help clients manage the degree of acceptable slippage.

With a fast & reliable trading platform by OANDA, clients' trades are executed in 0.012 seconds. This suits traders who choose brokers based on execution speed.

Because of this exceptional execution service, it is not surprising that OANDA won many awards, including the winner of the world's Best Retail FX Platform at the prestigious e-FX awards. The broker is also voted number 1 for Consistency of filling trades at quoted prices, Execution speed, and Reliability of platforms.

There is no minimum deposit or minimum balance required to open an OANDA account. Deposit and withdrawal can be done easily. OANDA provides a variety of payment method facilities, including Paypal, Wire Transfer, Credit Card, and Debit. Traders can adjust it to the region where they live.

OANDA provides more than 100 trading instruments, including 71 currency pairs, 16 indices, 8 commodities (Brent Crude Oil, Copper, Corn, Natural Gas, Soybeans, Sugar, etc.), 6 Bonds, and 23 Metals.

The fxTrade and MetaTrader platform are available at OANDA. These platforms can be used for Desktop and Mobile. Another plus is they have an OANDA Technical Analysis that exists in collaboration with a technical analysis provider called Autochartist.

With these platforms, clients can monitor price movements easier and automatically recognize patterns created on charts, as well as receive alerts when the awaited patterns appear. Access to this technology can be enjoyed free of charge.

In conclusion, OANDA is an ideal broker for traders in need of fast execution backed by many years of experience. The company is also a good alternative for those looking for a well-regulated broker with flexible trading and deposit conditions.

It is worth mentioning that there are actually loads of useful features on OANDA desktop platforms that are not available on the mobile app, such as demo accounts and educational resources. The charts and technical indicators on the app also don't sync with the web or desktop version of the fxTrade platform, so it can be a bit tricky to trade across different devices. As a result, the OANDA app is most suitable for live trading by more experienced traders.

While the OANDA mobile app isn't flawless, we can take advantage of the amazing charting features and customization on the app. The interface makes it easy to open trades without taking your eyes off the market movements, which can be really beneficial for forex traders.

Unlock Max $5,000 Deposit Bonus after Opening an Account

Unlock Max $5,000 Deposit Bonus after Opening an Account Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest

33 Comments

Benny

Sep 22 2022

Is OANDA mobile app safe to use?

Haston B

Feb 27 2023

Benny:

OANDA's mobile app is generally considered safe to use. OANDA is a well-established and reputable online trading platform that is regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS). These regulatory bodies impose strict standards on online trading platforms to ensure that they operate in a fair and transparent manner and that they protect their clients' funds and personal information.

OANDA's mobile app is designed with security in mind and uses industry-standard encryption technology to protect users' personal information and transactions. Additionally, OANDA has implemented two-factor authentication (2FA) for its mobile app, which adds an extra layer of security to the login process.

However, as with any online platform or mobile app, there is always some level of risk involved. It is important to take steps to protect your personal information, such as using strong passwords, avoiding public Wi-Fi networks when accessing the app, and regularly monitoring your account for any suspicious activity.

Wendy

Sep 28 2022

Can we trade stocks on OANDA?

Habib Sadidi

Feb 27 2023

Wendy:

OANDA is primarily a forex trading platform and does not offer stock trading at this time. If you are interested in trading stocks, there are several other platforms that offer stock trading, including online brokers such as Robinhood, E-Trade, TD Ameritrade, and others

However, OANDA offers Contracts for Difference (CFDs) to compensate for that shortcoming. CFDs allow traders to speculate on the price movements of underlying assets, such as stocks, commodities, and indices, without actually owning the assets.

Here are some features of OANDA's CFD trading:

Overall, OANDA's CFD trading platform offers a range of features and tools that can be useful for traders who are looking to speculate on the price movements of underlying assets without owning them directly.

Gerrard

Oct 4 2022

Is there a demo account available on OANDA?

Sweety

Feb 28 2023

Gerrard: Actually, I also admit that OANDA is a broker that adapts their trading features and services more for beginners. I agree with your idea to try trading with demo account before stopping with live account. Most of the knowledge that you will gain from trading on a demo account can be applied to opening real trading positions. Therefore, in order to provide experienced trading for its traders, this broker provides demo accounts for its customers.

The demo account itself is an account that we can use as a learning medium. In this account, the money we use is fake (virtual) money, not real money. To try it you don't need to have money, because you can enjoy the demo account for free and until satisfied.

The OANDA demo account resembles the trading conditions found in the Standard Account (up to 200:1 leverage and access to all tradable instruments) and is available with a virtual balance of 100,000 USD. You can send a request to OANDA customer service to make sure your demo account doesn't expire.

Armstrong

Oct 18 2022

Which one is better, OANDA desktop/web or mobile platform?

Anita Yeoh

Feb 13 2023

Armstrong: In my opinion, it depends on how you trade. If you usually trade with the broker's trading platform, of course with limited trading tools and simpler trading charts, it is better to use the mobile platform because of all the functionality of webtrader is in your hands.

So you don't need a laptop or PC just to trade Forex. Meanwhile, if you are using another trading platform like cTrader or TradingView for example, it is better to use webtrader because the charts in webtrader are clearer and wider than in smartphones.

This is my opinion on both the webtrader and the OANDA mobile platform. You can agree or not. THANK!

Vania

Oct 31 2022

What makes OANDA mobile app better than other mobile platforms?

Theo

Feb 13 2023

Vania : In my opinion, what makes OANDA app better than other broker apps (except metatrader) is mobile charts, first of all, charts can be viewed in portrait or landscape mode. Meanwhile, not all broker trading platforms have this feature.

Second, technical indicators in OANDA include more than 50 technical indicators, including general indicators. While other brokers may offer more technical indicators, I think 50 indicators is enough because in practice we don't use such many indicators for trades. And also with limited indicators, you will not be confused, especially if you are a beginner. Finally, the mobile charting feature allows you to click on the chart to get a trade without going back to the trading menu. It is very suitable for fast trading. And you can even set SL and TP without clicking on the trade list. I mean just do it by clicking on the chart

Sandy

Jan 14 2023

For me, the best trading app is still Metatrader, but if your broker's mobile app is better than Metatrader or as good as Metatrader, I will go with your broker's mobile app. However, the broker's mobile app has some limitations regarding indicators, and I believe mobile charts will be limited as well. I believe this because most traders go to MetaTrader or other trading platforms. Does anyone with the same opinion as me?

Phil

Jan 14 2023

Sandy: I disagree with you! First of all, today's brokers need their own trading platform. Because we know that brokers advance their technology and gain more trust. Secondly, the broker's trading app also offers many technical indicators, for example OANDA which offers 50 indicator tools. Please note that not all indicators need to be used for trading. Even professional traders rarely used indicators. note: For more information you can read this article : (do professional traders rely on Indicator tools?) Thirdly, there are many brokers that offer traders advanced mobile apps with various advantages.I believe the broker follows the trader's trading habits as well as what indicators are used. I have several suggestion about the broker's mobile app:

Finally, a newbie should not be confused by so many indicator his tools. A broker-made mobile app that offers a simple design and easy trading. It helps beginners to trade.

Sandy

Jan 14 2023

Phil: Wow, I don't think a broker's trading platform can have such an advantage.I read all the articles you gave. My view of broker trading platforms has changed a lot. The OANDA mobile platform in particular, actually offers more technical tools than some brokers. Thanks for your opinion; it helps me a lot! But for additional information, I think there is some brokers who provide mobile app not for trading but for a personal app. I think the brokers need to develop more their trading platform if they want to compete with others.

Johan Hendersen

Jan 14 2023

Bernard

Jan 14 2023

i think i can help you. As for major and minor pairs, it's actually quite easy to determine. As you can see, major pairs consist of currency pairs that include USD in the pair. For example:

what about the risks? Which one is more risky? As I know, every pair, major or minor, has its own risks, but of course, when it comes to fees, cross pairs are more expensive. Since the US dollar is the most widely used around the world, we recommend trading major currency pairs first as they provide more liquidity. To make your trade become more easier, you need to know the characteristics of major pairs. You can read the article: Major Pair characteristic

Sammy

Feb 6 2023

To be honest, I'm interested in the OANDA mobile app, especially the mobile charts offered by OANDA Brokers. IT wrote that you can trade by opening a chart and doing your analysis there without having to go back to the main menu. So I can act directly, faster and easier. I can also change trades just by clicking on the chart. In short, I have never heard of a mobile trading app that is user-friendly. Other mobile trading apps usually make trading difficult as the trading tools are very hard to use and using the mobile trading app felt like using the PC version but without the mouse. Just use the PC app to convert it to a mini version which is very unfriendly to me. It's like using a PC without a mouse.

The problem is that on the playstore? because I can't even access the OANDA app. Anyone have any suggestions?

Eleanor

Feb 28 2023

Actually, I'm still new to the world of trading and yes, I rarely hear about brokers that provide trading instruments and platforms. You must be familiar with FBS and OctaFx which always appear in several advertisements on chrome and YouTube. As for the OANDA broker, to be honest I have never heard of this broker.

And yes, I just found out in this article, and yes, what is being discussed here is related to deposits and withdrawals using a debit or credit card at the OANDA broker. As already explained, this broker has only been established since 1996. Wow, this is the first broker that I know has been around for a long time. but I can not confirm whether this broker is good and safe. but it means I will put my card number information in this broker platform.

I ask for an explanation, friends, is the OANDA broker safe for my trading and funds? Is my personal data also safe here? If anyone knows, could you please explain...

Rachel

Feb 28 2023

Eleanor: OANDA has been involved in the currency business since 1996. This broker has become one of the most popular and well-capitalized forex market makers, through which the fxTrade trading platform offers. This broker is also an authoritative source of currency data for leading companies, including tax authorities, accounting firms, and financial institutions.

If you ask whether this broker is safe or not in trading for traders, especially US traders, I believe this broker is safe and worthy of being an option in trading. OANDA Corporation is a registered Retail Foreign Exchange Dealer (RFED) with the US Commodity Futures Trading Commission (CFTC), and an FX Dealer Member (FDM) of the National Futures Association (NFA #0325821).

Even though not all the instruments that OANDA offers are US-licensed, OANDA is still a safe broker for trading, and trading forex or currency pairs is still available on OANDA. But yes, the 2 instruments offered by OANDA in the US market have few products, Forex alone is only about 45 Forex pairs offered by OANDA.

Maybe if asked if this broker is safe or not, I'm sure this broker is safe. But if asked whether it is good or not, it depends on the wishes of the trader himself.

Backy J

Feb 28 2023

Rachel: Hello buddy, I really agree with what you have explained about the security of this broker. as already explained that the OANDA broker is safe for trading because it has been supervised by US regulators.

Yes, apart from that, OANDA also received several awards related to trading. OANDA has won many awards for its services and products over the years, such as Best Educational Material 2018 (Investment Trends – US Foreign Exchange Report) and No.1 Forex Broker. 1 in Singapore 2017 (CFD & FX Singapore Investment Trends Report). Recently, OANDA was voted Most Popular Broker and Best Forex and CFD Broker 2020 by TradingView clients in the company's inaugural TradingView Broker Awards. TradingView is one of the world's largest social networks for traders, with more than 15 million registered users worldwide.

OANDA maintains customer funds in accounts with top banks, and it is its policy to only withdraw customer funds as a direct result of their trade-related activities or withdrawal requests.

however, in Samoing, there are several countries that do not accept negative balance protection, so traders from those countries can lose more than their invested amount.

Queen

Feb 28 2023

I actually like trading at this OANDA broker, because the customer support at this broker is quite agile and responsive, especially when compared to the complicated trading software available from other brokers. In addition, the educational features are very supportive, especially for beginners who are just starting to trade. OANDA offers proper client education, in addition to excellent research.

As a market moving broker, OANDA offers trading on four instruments: Forex, indices, commodities and precious metals. Although only 38 Forex pairs are available and only the MT4 trading platform is supported, this broker offers three account types. Available accounts are Demo Account, Standard Account, Core Account and Swap Free Account for Muslim clients.

The demo account offered here also has no time limit, so it's safe and comfortable for beginners who want to learn to trade with this broker.

Benjamin

Mar 20 2023

What are the major differences in terms of features and functionality between the OANDA mobile app and the desktop version platform, and which one would you recommend for a trader who wants to access a full range of resources, educational materials, and analysis tools?

Additionally, how does the OANDA mobile app stack up against other mobile trading platforms in terms of user experience, charting capabilities, and ease of use, and what are some of the standout features that make it a great choice for traders who prefer to trade on the go?

Cholo

Apr 14 2023

Based on my experience, the OANDA mobile app and desktop platform are kinda different when it comes to features and functionality. The desktop version has more analysis tools like fancy charting, customizable indicators, and expert advisors. It also offers some more advanced order types, like trailing stops and limit orders.

But, if you're always on the move and need to trade while you're out and about, the OANDA mobile app has got you covered. It's got push notifications, real-time market news, and customizable watchlists. Plus, it's really easy to use, with a super-friendly interface and simple charting tools. Also, the OANDA mobile app and desktop platform are kinda different when it comes to features and functionality. The desktop version has more analysis tools like fancy charting, customizable indicators, and expert advisors. It also offers some more advanced order types, like trailing stops and limit orders.

Aston

Apr 14 2023

I'm sorry to say this, but although it is convenient to trade using the app, I still believe that using a notebook can be easier for trading since we can see the details of the chart more clearly without having to zoom in and out. Therefore, if I trade using the mobile app, I would need an app that provides simple indicators. Could you please tell me about the mobile charting features in OANDA, especially the Fibonacci tool? Can it be easily viewed on the screen and convenient to use? Thank you!

Shota

Oct 30 2023

@Aston: I disagree with you. First, I completely understand your preference for using a notebook for trading, as it can offer a larger and more detailed view of charts. However, trading on a mobile app can also be convenient when you're on the go. As for OANDA's mobile charting features, including the Fibonacci tool, they aim to provide a user-friendly experience. The app is designed to allow you to easily view and interact with charts, including applying technical analysis tools like the Fibonacci retracement. The Fibonacci tool should be convenient to use on the mobile screen, with features that allow you to draw and adjust Fibonacci levels with ease, helping you with your trading analysis. It's always a good idea to explore and test the mobile app to see if it meets your specific charting needs and preferences. Thanks for your question, and happy trading!

Phawan

Jun 2 2023

Dude, how long are you going to stay away from trading Forex? I mean OANDA will only charge the account with no activity for 1 year. If you leave it for a month, you will not be charged. But if you are planning to take a break for 1 year, I think you need to learn Forex again if you are going to start Forex again.

I mean, the inactivity fee is like a warning to traders to trade earlier before being charged by the broker. And you don't need to take a break for 1 year, and I think as a trader this is a very unnecessary rest.

George

Jun 3 2023

Certain brokers impose account inactivity fees as a way to encourage their clients to be active and to generate revenue for the broker. An account inactivity fee is typically charged when an account has been inactive for a certain period of time, such as 6 months or a year, and the client has not made any trades or deposited any funds into the account during that time.

Here are some reasons why brokers may impose account inactivity fees:

So, if you consider yourself in a disadvantage here, you can always look for better option elsewhere (no one is forcing you to stay trading with a broker)

Karenna

Jun 4 2023

I don't know much about this broker but I think OANDA is a good broker because they can also expand their market in US. As far as I know, very few brokers can enter the US market. Because of course there are very strict rules for trading.

We can conclude that this broker is recognized by American traders. I think US traders will recognize this broker. I was very surprised that they also have an office there. I think this is a great achievement for a forex broker. But because I rarely hear about this OANDA broker, I don't know if this broker is suitable for beginners. Friends, can you explain that this broker is suitable for novice traders, especially in the US? Thank You

Carolline

Jun 5 2023

Hello friends, your question is very to the point, and I think it's good. Along with technological developments and also interest in forex trading is increasing every day. Lots of brokers offer trading with all the advantages shown. Maybe for experienced traders choosing a good broker for them is not too difficult because they already have knowledge regarding trading. However, for novice traders, it is not easy to choose a suitable broker for them. Not all brokers provide appropriate and decent services for novice traders. Well, this corresponds to your question regarding OANDA for novice traders.

In my opinion, OANDA provides a feature that all novice traders including US traders need, namely its educational features , novice traders will get a relatively friendly user experience with a structured education section available for traders with different experience levels. Considering OANDA's history as an FX data service, it's no surprise that the market analysis it offers is incredibly detailed and excellent.

Even though US traders restrict access to all the instruments offered by this broker, Forex is still available to US brokers. I think for novice brokers, Forex instruments are very popular.

Gavriil

Jun 6 2023

Yes Maybe if I agree with you about educational features, I admit that OANDA is indeed good in terms of educational features and more for novice traders. But I disagree with you, because OANDA's education section cannot be found easily on the OANDA website. This section is not linked from the menu at the top of the page and can only be found in the menu at the bottom of the page. I don't know if this was intentional or a form of negligence on the part of the OANDA team.

And yes, even though the educational features are good because the educational section placement features are not quite right, I can't say whether this broker is good or not for beginners. But what I need to emphasize here is that OANDA has successfully entered the US trading market, and this is an achievement, even though the instruments it offers are very limited, only forex and currency pairs, and even then not many products.

Ketley

Aug 10 2023

By the way, what is negative balance protection and why is it so important? Every broker I know of today has this feature. A floating loss means the position is still open, and you won't incur losses if you don't close it, right? One more thing, I don't understand why in forex we get margin calls, while in the stock market, we don't have that. As long as we keep positions open, we actually don't incur losses.

Zee Pho

Aug 11 2023

A floating loss means the position is still open, and you don't need to incur a loss if you don't close it, right? I agree with your statement, but you have to be careful with the floating loss that can affect your free margin because when the free margin decreases, you will get a margin call. A cut loss or margin call occurs automatically when the floating loss approaches your equity. Stock markets also have margin calls, but this rarely occurs as stock market volatility is still lower than forex, and equity market liquidity is limited. Forex, on the other hand, is highly volatile and highly liquid. This can lead to deeper pending losses and potentially more significant losses. In reality, margin calls are part of a broker's system that warns you to deposit more money. Adding money provides you with more options to manage pending losses. Without a deposit, the broker will cut your losses.

Read more: Seven Don'ts Of Forex Trading To Avoid Losses

Finlay

Aug 13 2023

I remember an incident that led to messy money management for many brokers and bankrupted many of them. So, I don't know exactly in which year the negative balance policy still didn't exist in the foreign exchange market. Several economic events have caused forex volatility to be very high at times, resulting in negative account balances for many traders. As a result, some traders cut their losses while their balances were in the negative to avoid deeper losses, which is the worst-case scenario. Their move to limit losses ultimately turned into a debt owed to the broker. This, in turn, affected brokers and led to bankruptcy. Why didn't brokers attempt to collect the debt from their traders, you might wonder? Their customers are scattered all over the world, making it virtually impossible to collect these debts. Many traders in debt opened new accounts with different brokers, made unfortunate moves in forex trading, ended up with negative balances, and encountered margin calls. This created a vicious cycle of debt. To prevent such situations, financial regulators have issued new rules that allow brokers to cut losses on trading positions that are approaching margin calls.

Read more: OANDA Negative Balance Protection: Everything You Need to Know

Verrel

Nov 18 2023

Hey, I had this not-so-great experience with a broker that offers trading on both a mobile app and Metatrader 5 on desktop – just to clarify, it's not OANDA. So, I was doing my thing on the mobile app, everything seemed cool, right? Then, I attend this trading class, and the mentor, using Metatrader 5, displays his trades for the day. Surprise, surprise – the prices on Metatrader 5 and the mobile app I was using were different!

Now, I'm curious about OANDA's Mobile App. Do they pull a similar move like the one I encountered, or is it genuinely reliable with prices matching up between mobile and desktop trading? Just trying to suss out the real deal here. Appreciate any insights!