Day trading is a strategy preferred by many retail traders for its multiple opportunities to earn profits in a day. Is the famous OANDA good for day trading?

Due to the opportunities presented in day trading, it is quite popular among retail forex traders. They are careful about the kind of brokers they do business with because if a broker cannot offer trading tools and a high-quality platform that supports day trading, then such a broker is not suitable for that purpose.

Ideally, a broker that is good for day trading should offer trading tools and reliable market execution. These conditions will ensure that traders are well-equipped to come up with potential entry and exit points for their trades that will increase their chances of making profits.

The ideal broker should also be well-regulated and fully authorized to operate in whatever country they are located. Taking the information into account, it then brings us to the main question this article intends to answer, "Is OANDA good for day trading?"

In one sentence, yes, OANDA is ideal for day trading and we will be examining the reasons for that.

Benefits of Day Trading with OANDA

Day trading in OANDA offers several benefits for traders. First, they are authorized and regulated by reputable regulatory bodies such as the FCA, ASIC, and IIROC.

Second, OANDA provides three kinds of platforms: fxTrade, MT4, and MT5 with each platform available in Android, iOS, and Desktop versions. Using those platforms, traders can access real-time market data, execute trades quickly and efficiently, and monitor their positions in real-time.

Next, OANDA offers a diverse range of tradable instruments. Starting with 45 pairs including major currency and minor currency pairs, 7 indices, 8 commodities, 2 precious metals (gold and silver), 27 shares, and 13 popular cryptocurrencies. Plus, swap free account is also available.

Last but not least, OANDA is well-known for providing competitive spreads and transparent pricing. The broker operates on a no-commission model, with spreads that vary depending on the market conditions.

For example, spreads for EUR/USD is starting from 0.8 pips only. For minor currency pairs, the spread is starting from just 1.1 pips. This can be beneficial for forex day traders who aim to capture small price movements and require tight spreads to minimize trading costs.

OANDA's Platform for Day Trading

OANDA offers day trading in two options: mobile and desktop. OANDA's mobile app allows traders to access their trading accounts and trade on the go. While OANDA's desktop version has advanced algorithmic trading and customization for professional traders.

OANDA Mobile App

The mobile app provides a user-friendly interface designed for seamless navigation and easy access to account information and trading features.

The app provides real-time streaming market data, including live price quotes, charts, and market news. Traders can place market orders, limit orders, stop-loss orders, and take-profit orders just by using their phones.

Traders can also set price alerts to receive notifications when specific price levels are reached. This feature allows traders to stay informed about market movements and potential trading opportunities even when they are not actively monitoring the app.

See Also:

OANDA Desktop

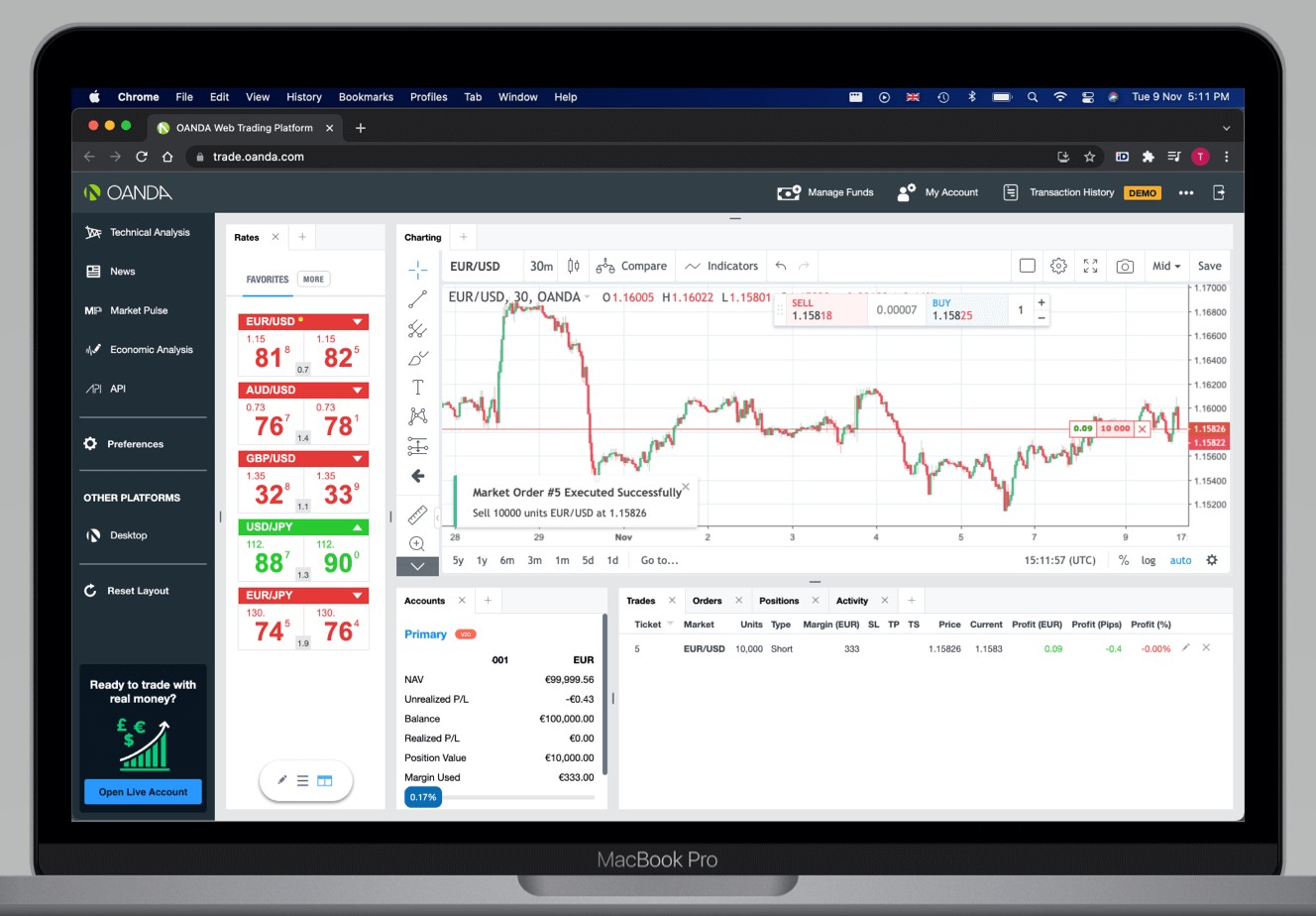

The other version, the desktop, allows traders to customize their workspace and layouts based on their preferences. Traders can arrange multiple charts, watchlists, and order entry panels to create a personalized trading environment that suits their trading style.

The desktop version is also integrated with API, allowing traders with programming skills to develop and deploy their own automated trading strategies. This enables advanced algorithmic trading and customization options for experienced traders.

OANDA and Day Trading

For starters, OANDA offers an online brokerage service to retail forex traders, and considering the popularity of day trading among this group of forex traders, OANDA is built to cater to the needs of day traders.

Also, it is highly regulated by top-tier authorities like the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) which are both in the United States. It is also regulated by the Financial Conduct Authority (FCA) in the United Kingdom thus making OANDA safe to trade with.

OANDA also provides its clients with top-notch and easy-to-use trading platforms along with powerful research tools as well as multiple technical indicators and an excellent API offer.

The process of opening an account is also fast and user-friendly, which means traders can get started with trading very quickly. The web trading platform from OANDA is user-friendly and secure with a two-step login while also giving traders the option to customize it.

The minimum deposit requirement is incredibly small and there are no fees charged on deposits and withdrawals except when made through bank transfers.

OANDA has a demo account where traders can test their trading strategies to determine the best one that will suit the purpose of day trading.

With no expiration date attached, OANDA does not charge any inactivity fees in their demo account, which means traders can go back to it after they open a live account to test out new trading strategies in the future.

OANDA also supports margin trading in which traders can open trading positions that are bigger than their account balance. Since day trading favors quick returns, it enables traders to maximize this feature and make substantial profits.

Generally, the trading fees for OANDA are low as it charges spread costs rather than commissions per trade. This is quite beneficial for day traders considering they tend to open multiple trading positions within a day.

Traders looking for brokers with accurate precision, OANDA can be an option. That is because OANDA is a broker that provides quotes with 5-digit accuracy and active price movements that follow market developments. Order execution speed is also faster in this broker.

It provides benefits for novice traders, as they can trade with smaller volumes using the calculation system based on currency value, unlike other brokers adopting the lot system.

Founded in 1996, OANDA was built by Dr. Michael Stumm who is a lecturer in Computer Engineering at the University of Toronto, Canada, along with his colleague, Dr. Richard Olsen of The Olsen Ltd., which is one of the leading econometric research institutes. They have a head office in San Francisco, United States.

OANDA branch offices can be found everywhere. Some of these offices are located in the United Kingdom, Singapore, Japan, and Canada. With this number of offices spread, OANDA has increasingly attracted the attention of clients worldwide.

OANDA's company is registered under several well-known jurisdictions in financial trading. They are regulated by CFTC and NFA in the US, FCA in the UK, ASIC in Australia, and many others. Traders do not need to worry anymore about security when trading in OANDA. However, these advantages make trading rules at OANDA more stringent compared to other brokers.

For example, OANDA only allows maximum leverage of 1:20, because the rules in the US and Japan do not allow leverage above that. Besides, the registration procedure is more complex due to various additional requirements that are not submitted by other forex brokers. On top of that, hedging is not allowed in one trading account as the client must open an additional account to hedge.

Nevertheless, OANDA is known for being a leading broker with many advantages offered. OANDA faces increased market risk during periods of price volatility, such as economic and political news announcements. When market spreads increase or decrease, their pricing engine widens or narrows spreads accordingly. That way, traders can get the latest conditions from price movements in the market more quickly.

Prices move very fast in the market. Especially when news releases have a large impact on market volatility. This condition is often exploited by brokers to take advantage of clients with Requotes. However, traders do not need to worry about additional costs when trading with OANDA.

The company never withdraws Requotes so traders can get maximum profit. When traders are unavailable to monitor open positions, they can set take profit orders to lock in profits and Stop Loss orders to help protect against further losses.

As an experienced and well-known online forex broker, OANDA is committed to maintain an efficient trading environment that reduces latency and provid tools to help clients manage the degree of acceptable slippage.

With a fast & reliable trading platform by OANDA, clients' trades are executed in 0.012 seconds. This suits traders who choose brokers based on execution speed.

Because of this exceptional execution service, it is not surprising that OANDA won many awards, including the winner of the world's Best Retail FX Platform at the prestigious e-FX awards. The broker is also voted number 1 for Consistency of filling trades at quoted prices, Execution speed, and Reliability of platforms.

There is no minimum deposit or minimum balance required to open an OANDA account. Deposit and withdrawal can be done easily. OANDA provides a variety of payment method facilities, including Paypal, Wire Transfer, Credit Card, and Debit. Traders can adjust it to the region where they live.

OANDA provides more than 100 trading instruments, including 71 currency pairs, 16 indices, 8 commodities (Brent Crude Oil, Copper, Corn, Natural Gas, Soybeans, Sugar, etc.), 6 Bonds, and 23 Metals.

The fxTrade and MetaTrader platform are available at OANDA. These platforms can be used for Desktop and Mobile. Another plus is they have an OANDA Technical Analysis that exists in collaboration with a technical analysis provider called Autochartist.

With these platforms, clients can monitor price movements easier and automatically recognize patterns created on charts, as well as receive alerts when the awaited patterns appear. Access to this technology can be enjoyed free of charge.

In conclusion, OANDA is an ideal broker for traders in need of fast execution backed by many years of experience. The company is also a good alternative for those looking for a well-regulated broker with flexible trading and deposit conditions.

It's quite clear now that day traders will enjoy trading in OANDA due to the various favorable features along with the high level of regulation and security.

Unlock Max $5,000 Deposit Bonus after Opening an Account

Unlock Max $5,000 Deposit Bonus after Opening an Account Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest

23 Comments

Marco

Jan 12 2023

There are some regulators that have confused me. The United States has two regulatory bodies that govern brokers: the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). In the meantime, other countries have only one regulator governing futures trading. The question is, what is the difference between the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA)? Do they have different regulations for brokers? And what about their ranked in the world?

Erwin

Jan 12 2023

Dion

Jan 12 2023

Ferran

Jan 12 2023

Dion

Jan 12 2023

Catherine Azzam

Jan 23 2023

Ferran:

this all comes back to legal matters. The regulator will only regulate forex trading regulations in the country that oversees it and according to its jurisdiction. CTFC and NFA ONLY REGULATING SERVICES IN United States.

You can read it here: Top 5 Best Regulatory Agencies In the World

It's like playing at your friend's house, of course you can't force your friend to follow the rules at your house right? BTW, in Indonesia, the regulators for futures trading are Bappebti, directly supervised by the ministry of trades. So as long as OANDA does not register its trading services with Bappebti to get legal recognition, it will still be blocked.

Muse

Feb 6 2023

Sorry, I still don't understand why OANDA is good for day trading. I mean the criteria that needed. First, at least you need to know OANDA's exact fees. As you mentioned in the article, OANDA's trading fees are low because they charge a spread cost rather than commission trade fee. What is exactly that charged?

Also, are there any criteria required to be such a good day trading broker? I don't think you can fully capture the details of a broker just talking about commissions. That is, examples like scalping where low spreads and fast execution are required, details such as minimum deposit amount, leverage and accounts to choose from are also required. What are the good criteria for day trading?

Habib Sadidi

Feb 28 2023

@Muse:

Oanda is a popular forex broker that offers a range of features and benefits that make it a good choice for day trading. Here are some reasons why Oanda is good for day trading:

However, in general day traders may need to consider honing some of these skills/criteria to be more reliable, such as:

Jahid Bin

Mar 23 2023

What are the key features and benefits of OANDA's trading platform that make it well-suited for day trading, and how do these compare to other popular day trading platforms in terms of functionality, usability, and cost?

Sayed Bin

Mar 23 2023

What are the potential risks and drawbacks of using OANDA for day trading, such as concerns about platform stability, order execution speed, slippage, and customer support, and how can traders mitigate these risks to ensure they can effectively capitalize on short-term market movements and generate consistent profits over time?

Altair

Oct 30 2023

@Sayed Bin: Day trading with OANDA can have its risks and drawbacks for traders, as I feel when I trade with OANDA. Platform stability can be a concern as occasional instability can disrupt trading. Order execution speed, especially during high market volatility, may lead to slower execution, impacting trade opportunities. Slippage, the gap between expected and executed prices, can affect profitability, and customer support experiences may vary. To mitigate these risks, consider diversifying your trading platforms by maintaining accounts with multiple brokers to ensure you have alternatives during platform issues. Stress test OANDA's platform under various market conditions to understand its performance, utilize risk management with stop-loss and take-profit orders, and stay informed about market-moving events. Practicing on a demo account can help you become familiar with the platform, and choosing the right account type is crucial for your trading strategy. Regularly monitor your trading performance, especially during platform issues or slippage, and contact customer support when needed for issue resolution and improvements to your trading experience. Day trading is inherently risky, so approach it with a well-thought-out strategy, discipline, and a keen awareness of potential risks.

Jimin

Jun 12 2023

In this article there is something that discusses pending orders that interest me. In my opinion, of course all traders often use this type of executing orders. I think that Pending orders are a very good option for traders who still work full time or are generally very busy. You don't have to wait in front of the screen to see price movements. Just set the order and wait for it to be executed.

However, can pending orders be used on the MT4 and MT5 platforms? Pending orders MT4 vs MT5, which is the best? Please reply..

Petrict

Jun 13 2023

Actually, both MT4 and MT5 can use this feature. However, there are differences between the two platforms: MT4 : Suitable for basic orders such as stop orders and limit orders, whereas, MT5 : Best if you need to adopt a strategy that requires more flexibility in setting pending orders

MT5 by nature offers more advanced features than MT4, from better tools to more technical indicators and pending order types to choose from. Hence, it allows traders to explore more items and diversify their portfolios with various advanced trading techniques.

Maybe to further understand the pending order functions on the two platforms, you can read this.

MT4 vs MT5 Execution: Types of Pending Orders

Galaxy

Jun 15 2023

As explained in this article, OANDA is one of the brokers who have successfully entered the American trading market. I think OANDA is a good broker when it comes to customer support.

In trading, every second is money. This means that if there is a problem with the platform or account it can prevent you from making profits in trading. Therefore a broker with agile customer support is what traders need. In my opinion, OANDA has fulfilled its customer rights 24/5 with multi-language support.

Despite the holiday trading jams, traders can still contact their customer support team at any time via email. there is also online live chat and phone support also available during trading hours. So I think all customers from OANDA get comfortable trading, including traders from America.

Vadenia

Jun 16 2023

I agree with you that OANDA broker's customer support is good enough for all traders. After all, OANDA is a broker with the perfect trading platform for everyone. FxTrade is powered by OANDA. The system is designed to be easy to use and offers some of the best tools to support Forex and CFD trading, although CFDs are not available to US traders.

But each feature naturally has its drawbacks. And as for this feature of FxTrade, the downside is that it doesn't have a super modern design and the functionality is still quite a pain to use. If you wish to view forums, news, and analysis on the platform, you will be redirected to a new browser instead of being opened on the platform.

Despite the lack of features, FxTrade still caters to the trading needs of all experience levels. You have all the tools you need to trade and other useful features to help you trade with a few clicks.

Shawn

Jun 15 2023

I don't know much about this broker but I think OANDA is a good broker because they can also expand their market in US. As far as I know, very few brokers can enter the US market. Because of course there are very strict rules for trading.

We can conclude that this broker is recognized by American traders. I think US traders will recognize this broker. I was very surprised that they also have an office there. I think this is a great achievement for a forex broker. But because I rarely hear about this OANDA broker, I don't know if this broker is suitable for beginners. Friends, can you explain that this broker is suitable for novice traders, especially in the US? Thank You

Hailey

Jun 17 2023

Hello friends, your question is very to the point, and I think it's good. Along with technological developments and also interest in forex trading is increasing every day. Lots of brokers offer trading with all the advantages shown. Maybe for experienced traders choosing a good broker for them is not too difficult because they already have knowledge regarding trading. However, for novice traders, it is not easy to choose a suitable broker for them. Not all brokers provide appropriate and decent services for novice traders. Well, this corresponds to your question regarding OANDA for novice traders.

In my opinion, OANDA provides a feature that all novice traders including US traders need, namely its educational features , novice traders will get a relatively friendly user experience with a structured education section available for traders with different experience levels. Considering OANDA's history as an FX data service, it's no surprise that the market analysis it offers is incredibly detailed and excellent.

Even though US traders restrict access to all the instruments offered by this broker, Forex is still available to US brokers. I think for novice brokers, Forex instruments are very popular.

Garry K

Jun 18 2023

Yes Maybe if I agree with you about educational features, I admit that OANDA is indeed good in terms of educational features and more for novice traders. But I disagree with you, because OANDA's education section cannot be found easily on the OANDA website. This section is not linked from the menu at the top of the page and can only be found in the menu at the bottom of the page. I don't know if this was intentional or a form of negligence on the part of the OANDA team.

And yes, even though the educational features are good because the educational section placement features are not quite right, I can't say whether this broker is good or not for beginners. But what I need to emphasize here is that OANDA has successfully entered the US trading market, and this is an achievement, even though the instruments it offers are very limited, only forex and currency pairs, and even then not many products.

Noelle

Sep 12 2023

As an aspiring forex trader, I'm curious to understand how brokers determine the spreads they offer on currency pairs. I'd like to know what factors OANDA takes into consideration when making modifications to the spreads. Can somebody explain it to me?

Julious

Sep 13 2023

Overall, brokers determine the spreads they offer on currency pairs based on a combination of market conditions, liquidity, their own costs and profit margin, and the trading volume of their clients. SO, it is not just add some modification of the spread with proftbale but also many factor included and more detail, I can list at below :

All the factor above, it's basically the same from broker to broker. It's the same with OANDA too

Paul

Sep 14 2023

I know that every broker is competing to provide comfortable trading with low costs, including spreads. However, there are several things I'm curious about, including the currency pairs provided by the broker. There are so many currencies on offer that I'm confused about which one is the most profitable. In your opinion, what is the best currency to trade? Is OANDA really friendly to beginners like me?

Zenith

Sep 15 2023

Maybe some people who don't understand trading will choose to trade EUR/USD because they think it will provide a more volatile market and a more stable market.

However, For me, as a novice trader and most of my coaches have also said, there is no one "best" currency pair to trade in forex, as the optimal choice of currency pair depends largely on your individual trading style, risk tolerance, and personal preference. Some currency pairs that are very friendly to trade:

EUR/USD (Euro/US Dollar)

USD/JPY (US Dollar/Japanese Yen)

GBP/USD (British Pound/US Dollar)

USD/CHF (US Dollar/Swiss Franc)

AUD/USD (Australian Dollar/US Dollar)

USD/CAD (US Dollar/Canadian Dollar)

NZD/USD (New Zealand Dollar/US Dollar)

These currency pairs are known as "major pairs" because they represent the most traded currencies in the world. However, there are also "minor pairs" and "exotic pairs" that can be traded in forex, and these may offer unique opportunities depending on market conditions and your trading strategy. However, this pair is not widely traded. So, it is best to have a Main Pair.

OANDA has very low spreads and standard accounts have no commission. Therefore, it is helpful for new traders to trade without worrying about high transaction fees.

Gianluigi

Nov 21 2023

Hey there! Quick question on my mind: Does OANDA offer both desktop and mobile trading with their very own platform? I'm not talking about them relying on external ones like Metatrader or Trading View – I'm curious about their in-house gem, the OANDA trading app.

And, you know, here's the scoop: how safe is it? I've got this nagging worry that brokers with their own apps might have a sneaky way of tinkering with the price movements, you feel me? It's like when game developers throw in some secret sauce to make players win or lose. Any chance you could shed some light on that? I'm all ears and appreciate the insight! Thanks a bunch!