Wherever you are, you can trade forex as long as you have a trading app installed on your phone. What is the best trading app for iOS users?

The existence of mobile trading apps is one of the things that make forex trading easier and highly accessible for anyone. Unlike in the old days, you don't have to be a billionaire to participate in the forex market. You only need a smartphone and install a trading app to make money.

From hundreds of mobile trading apps available worldwide, we have listed some of the best for iOS users in terms of important factors like spreads, transaction speed, features and benefits, resources, etc. Here are some of them.

- FBS: It has 5-star rating on the App Store from 2.2k users.

- TD Ameritrade: In the US App Store it is rated 4.5/5 from 109.5K users

- ThinkTrader: The app is currently rated 4.8/5 by 474 users.

- FXTM: Available in more than 10 languages including Arabic, Indonesian, Chinese, English, Russian, Spanish, Thai.

Each of these broker's mobile apps has different benefits that might improve the trading experience. Which one of them has the best features?

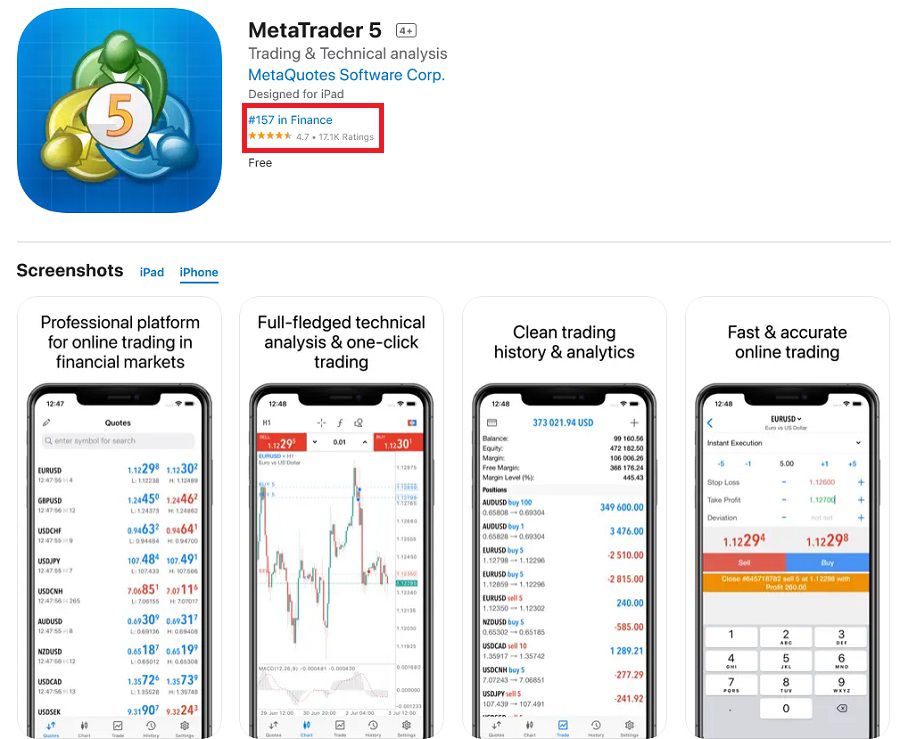

MetaTrader

Regarding trading platforms, MetaTrader is perhaps the most popular option among retail traders. Most traders like Metatrader for its simplicity and impressive platform speed. Apart from the desktop version, MetaTrader is also available for mobile users. The mobile app provides access to trade with various assets, like forex, stocks, futures, options, and others.

Its latest edition, the MetaTrader 5, is currently ranked #157 in the Finance category in the US App Store and is rated 4.7/5 from 17.1K users.

Apart from that, the app offers a bunch of market analyses based on real-time data charts to monitor prices and market conditions. Novice traders must surely like the demo account feature, which allows you to develop trading skills without risking any money. Meanwhile, expert traders can enjoy the app's advanced charting and analytics. You can even design your own trading indicators using the platform's programming language, MQL4.

Like other trading apps, MetaTrader allows you to open positions through instant execution. Another worthy feature is the level of customization. There is an unlimited number of tools available on the app, so you can create a setup that matches your trading strategy and preferences. It's even possible to set up custom audio notifications as a reminder when it's time to take action.

FBS

FBS is a prominent broker that takes trading to a new level with its remarkable offerings. For example, it offers leverage options reaching up to an impressive 1:3000, and spreads that start as low as 0 pips. These features underscore FBS's commitment to delivering a trading environment characterized by speed, flexibility, and cost-efficiency.

The FBS Trading Apps for iOS have garnered a stellar 5-star rating on the App Store, showcasing their exceptional quality and user satisfaction. This mobile trading app provides access to a wide spectrum of financial instruments, including:

- Forex

- Stocks

- Metals

- Energies

- Indices

- Cryptocurrencies

In adition to that, traders can meticulously analyze price movements and make well-informed decisions with the aid of comprehensive charts and tools, including various indicators.

What's more, FBS trading app introduces a unique advantage with its Cashback feature – users can activate Cashback in the FBS Trader app and earn up to an impressive 20% of the spread for every trade. The convenience of managing funds is also seamlessly integrated, as the app allows users to deposit and withdraw funds around the clock, with over 100 methods available.

Since 2009, the action of FBS Holding Inc. or known as FBS in the world of forex trading has been recognized by various international institutions. With clients reaching 14 million as of 2019, FBS has received the title of Most Transparent Forex Broker 2018, Best Investor Education 2017, Best Customer Service Broker Asia 2016, IB FX Program, and many others.

FBS is regulated by FSC Belize and CySEC Cyprus. This broker has been trusted by millions of traders and 370 thousand partners from various countries. Based on their data, FBS garners about 7,000 new traders and partner accounts every day. And, 80% of the clients stay in the FBS for a long time. No wonder the broker is growing rapidly due to the incredible growth in the number of clients.

Trading products offered by FBS range from forex, CFD, precious metal, and stock. For forex trading, CySEC-regulated FBS offers leverage up to 1:30 on Cent and Standard Accounts. Clients who want to try higher leverage than that can alternatively register an account under FBS Belize.

FBS spread begins from 0.5 pips for Pro account type and from 0.7 pips for Standard and Cent accounts. On a standard account, volume orders can be made from 0.01 to 500 lots. Therefore, this account is recommended for experienced traders.

Whereas on Cent Accounts, volume orders can be carried out with a maximum of 500 cent lots or the equivalent of 5 standard lots. Cent Accounts involve a different level of risk. FBS recommends Cent Accounts for beginner traders. All account types support the following trading instruments: 36 Forex pairs, 8 metals, 3 energies, 11 indices, 127 stocks, 5 crypto pairs.

Before plunging into the real forex market, traders can practice with FBS Demo Account which consists of two types, i.e Standard and Cent.

FBS uses the MetaTrader 4 and MetaTrader 5 platforms. They offer them on Windows and Mac as well as Android and iOS mobile. These platforms provide a trading experience at traders' fingertips, allowing traders to progress as a trader anywhere at any time.

MetaTrader platforms also have a variety of mainstay features, including the possibility to create, buy, and use expert advisors (EA) and scripts, One-click trading and embedded news, technical analysis tools, the possibility to copy deals from other traders, hedging positions, and VPS service support.

Another advantage provided by FBS is a deposit bonus of 100% for clients who fulfill certain requirements. The process of FSCing and withdrawing funds can be run easily and quickly. Based on clients' testimonies, each process usually takes no more than 3-4 hours, except on holidays.

Traders also have the opportunity to develop a side business when trading with FBS, namely as an Introducing Broker (IB) or Affiliate. The FBS partnership system provides partner commissions that are already in 3 level positions. Only by introducing new clients to FBS according to certain procedures, traders can earn extra income.

Traders will also get trading education experience at FBS. They have prepared a comprehensive forex course. The course consists of 4 levels: beginner, elementary, intermediate, and experienced. Traders can take courses that will turn them from newbies to professionals. All materials are well-structured. Besides, FBS provides various forex analyzes, webinars, forex news, and daily market analysis that can be accessed easily on their site.

Traders can access the FBS website with many language choices. Of course, this will increasingly provide comfort for traders. Available languages include English, Italian, French, Portuguese, Indonesian, Spanish, and others. Live chat support is also provided 24 hours 7 days a week.

In conclusion, FBS is a widely known broker among retail traders around the world. It continually grows to become a preferred broker because of flexible trading conditions that enable its clients to trade with various instruments, low deposit, and other trading advantages.

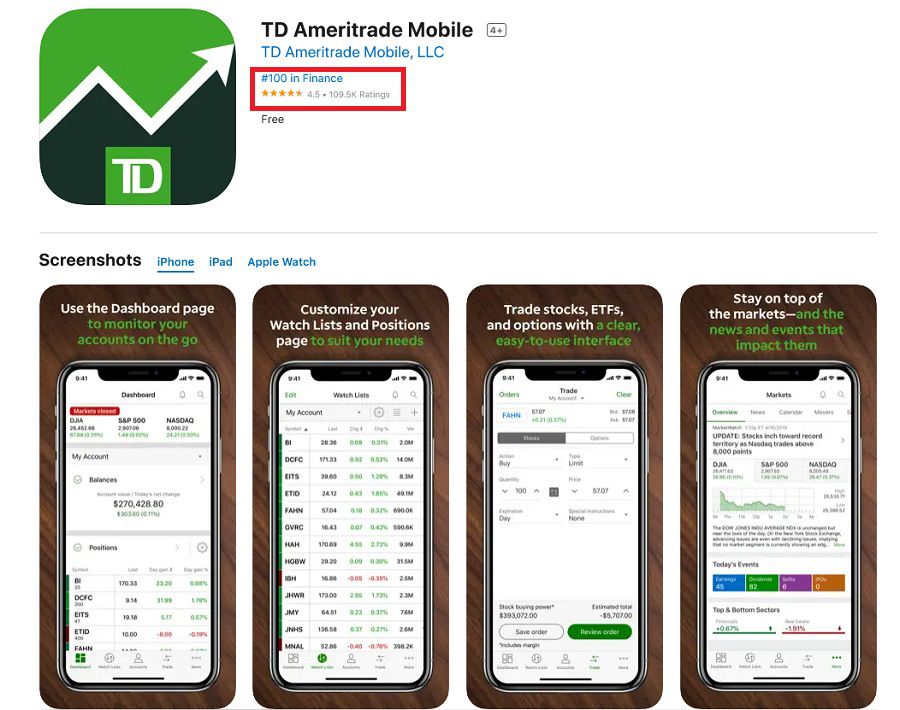

TD Ameritrade

Founded in 1975, TD Ameritrade is one of the top American brokers that has a long track record and is regulated by top-tier authorities like the SEC, FINRA, and CFTC. The online broker has its own desktop trading platform called Thinkorswim, which is pretty popular among traders.

For mobile trading, TD Ameritrade offers two apps suited for different levels of expertise and trading goals. The apps are available on both Android and iOS, and they are supported on Apple Watch devices as well.

The TD Ameritrade app is currently ranked #100 in the Finance category in the US App Store and is rated 4.5/5 from 109.5K users.

Similar to the desktop platform, the mobile platform is user-friendly and easy to use. It requires two-factor authentication to log in, provides a great search function, and offers a wide range of trading products that include stocks, forex, ETFs, bonds, futures, and cryptocurrencies. The order types are also similar to those on the web platform: Market, Limit, Stop-Market, Stop-Limit, Trailing Stop (%), and Trailing Stop ($). As for the order limits, several options are available: Day, GTC, Fill or Kill (FOK), and All or Nothing (AON).

Overall, TD Ameritrade is a great place to start building trading portfolio for US traders. There are loads of courses and learning resources that you can use to improve your skills. You can start funding your account with no minimum deposit for the basic cash account (the amount may vary depending on the account type) and withdraw your earned money with no additional fee, except for wire or bank transfer methods.

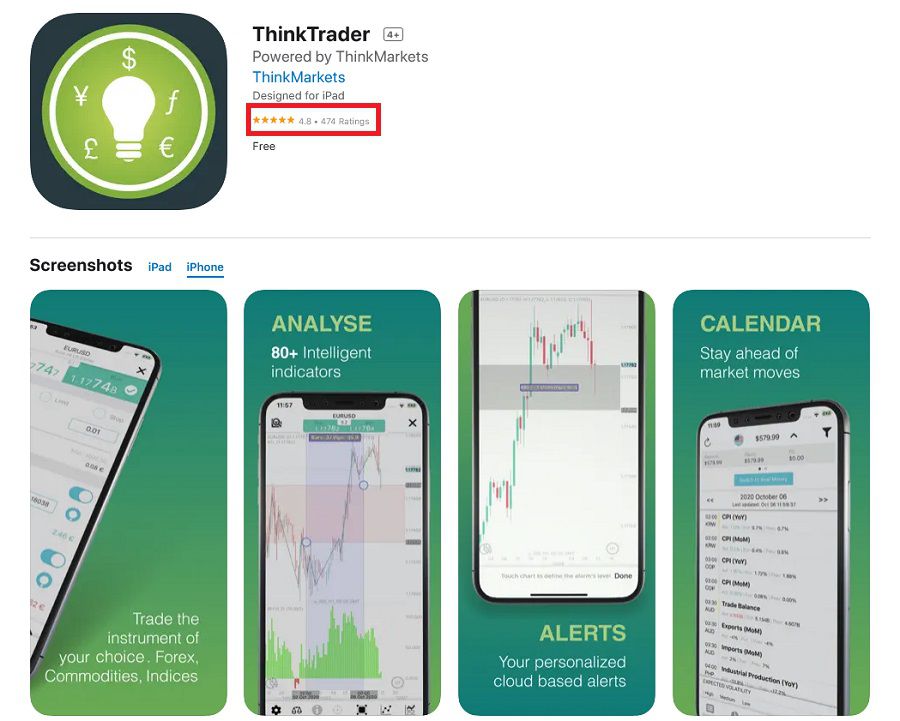

ThinkTrader

ThinkTrader, formerly known as Trade Interceptor, was released in 2017. Originally, the software can only be accessed via desktop, but it expanded and was finally available for mobile phones as well. ThinkTrader provides a wide range of trading products, including forex, indices, cryptocurrencies, precious metals, CFDs, shares, and commodities.

The app is currently rated 4.8/5 by 474 users.

ThinkTrader offers a bunch of useful features that are suitable for traders with various levels of proficiency. Some examples are the economic calendar, data release alerts, intelligence support, and risk scanner. Currently, there are 14 advanced charts as well as 160 intelligence indicators and drawing tools. It's worth mentioning that the ThinkTrader app is powered by cloud-based support, so you can access analysis tools data, and price alerts across several devices. You can also get alerts even when the app is not running.

Another great feature of the app is the one-click order option. This feature allows you to close multiple orders at the same time with only a single click. It also enables you to make instant transactions without having to confirm the orders. It's worth mentioning that ThinkTrader is an in-house product by ThinkMarkets which is a well-respected broker on its own.

As a multi-asset online brokerage, ThinkMarkets present a wide range of trading assets starting from Forex to Precious Metals, Commodities, Indices, Shares, and Cryptocurrencies. The Australian-based broker is established in 2010 and has since opened additional headquarters in London and regional offices throughout Asia-Pacific, Middle East, North Africa, Europe, and South America.

Along with its history operation, ThinkMarkets has been awarded and recognized many times in various aspects. Most recently, they won the Best Value Broker in Asia at the 2020 Global Forex Awards.

Average FX spreads for traders opening an account in ThinkMarkets start from 1.2 pips for the standard account, while ThinkZero provides the best trading experience with 0.1 pips spread. Still, traders may need to consider that ThinkZero applies commission from $3.5 per side for every 1000,000 trading volumes.

As a global online brokerage, ThinkMarkets operates under various financial regulatory institutions. For example, ThinkMarkets Australia is managed by TF Global Markets (Aust) Limited and is licensed by the Australian Financial Services as well as the Australian Securities and Investment Commission (ASIC) with ABN: 69158361561. ThinkMarkets UK is registered under the Financial Conduct Authority (FCA) by the company name of TF Global Markets (UK) Limited (number: 09042646).

ThinkMarkets consistently try to improve their trading environments with various advanced products. Automatic trading fans are provided with free VPS Hosting, while passionate traders who'd like to experience beyond MetaQuote platforms can try ThinkMarkets' proprietary platform called ThinkTrader.

The trading platform is available on 3 different interfaces specifically designed for Web Desktop, Tablet, and Mobile displays. Furthermore, customized tools such as 80+ drawing tools and more than 125 indicators for technical analysis accessible even through Mobile screens would certainly provide a brand new trading on-the-go experience.

As far as market updates go, trading in ThinkMarkets would be accompanied with news from FX Wire Pro that is known for its strict policy toward upholding objective journalism and delivering critical, trusted information in real-time. Information segments covered by FX Wire Pro include Economic Commentary, Technical-level Reports, Currency and Commodities, Central Bank Bulletins, Energies and metals, together with Event-driven Flashes.

For payment methods, ThinkMarkets offer the gateway via bank transfer, credit card (Visa and MasterCard), Skrill, Neteller, POLi internet banking, BPay, and Bitcoin wallet.

All in all, it is safe to say that for a company that started business since 2010, ThinkMarkets is an accomplished broker in terms of legal standing and innovation in trading technology. As an additional safety assurance for traders, this broker underlines its commitment to provide a $1 million insurance protection program which is made possible by ThinkMarkets' insurance policy with Lloyd's of London that protects clients' funds for up to $1 million in the unlikely event of insolvency.

FXTM

The last one on the list is a mobile trading app created by FXTM or ForexTime, a globally known CFD and forex broker that was founded in 2011. The broker is considered safe as it operates under the regulation of a few financial authorities, including the UK's FCA and CySEC. Today, FXTM operates in no less than 180 countries with over 3 million users worldwide.

FXTM offers a quick and easy way to trade forex on trading platforms that can be accessed via desktop, web, and mobile phones. The mobile app in particular supports Android and iOS, so iPhone and iPad users can have full access to it.

FXTM mobile app has many interesting features suitable for beginners and professionals. For example, beginners can get access to educational materials to improve their trading skills. Meanwhile, advanced traders can use complex trading tools and flexible leverage to support their strategy.

To start using the software, you need to make an account, submit your verification documents, and deposit some funds before trading. There is a wide range of trading products available, including forex, stock, CFD, and cryptocurrency. You can easily find the details of each asset and even get daily commentaries from the company's market research team.

FXTM is known for its favorable trading conditions. By using the app, you can operate with both fixed and variable spreads. Transactions are processed almost instantly and there are loads of free trading tools that you can use to make better decisions. There's also a demo account that allows users to test the platform and practice trading with virtual money.

In summary, FXTM mobile trading app is suitable for various types of traders. The interface is clean and easy to navigate, and the trading conditions are certainly worth considering. In addition, the mobile app is available in more than 10 languages including Arabic, Indonesian, Chinese, English, Russian, Spanish, Thai, etc.

FXTM was initially launched in 2011 with a unique vision to provide unparalleled superior trading conditions. Opening an account in FXTM would also bring about access to advanced education and sophisticated trading tools in the forex industry.

Now, FXTM is registered under the Financial Conduct Authority of the UK with the number 600475. The company is also regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12, and is licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, with FSP No. 46614

FXTM has 1 million registered accounts with more traders joining every day. The company continually tries to improve their performance and have got many awards such as Best Trading Experience 2019 by World Finance Awards, Best Online Forex Trading Company Nigeria 2018 by International Finance Awards, Reputable Investor Education Forex Broker Award 2018 by Hexun.com, Forex Brand Of The Year China 2018 by Fxeye.Com, and many more.

As a responsible broker, they determine leverage (expressed as a ratio of transaction size relative to trader's buying power) according to the trader's level of knowledge and experience in trading, which is evaluated by the Appropriateness Assessment. The company also enables trading with leverage up to 1:1000.

As for spreads, FXTM offers low spreads starting from 0.1 pip, so traders can withdraw profits at the start of trading. The company, which has headquarters in several countries, uses No Dealing Desk (NDD) technology and partners with credible liquidity providers to provide the best bid and ask prices.

For beginners, there is an automatic trading facility called algorithmic trading provided. When trading in FXTM, traders can develop their trading strategy or adopt other traders' strategies. Furthermore, the strategy is applied to automated trading systems, such as Expert Advisors. The purpose of this system is traders do not have to worry about losing opportunities while not observing the market so that profits can still be earned.

Three types of ECN accounts use the MT4 and MT5 trading platforms. There are also mobile and Tablet Apps trading platforms. Aside of providing many account variants, FXTM goes above and beyond to ensure that their client receives excellent support that they deserve, making their trading experience optimal and user-friendly.

FXTM also provides a diverse range of products. In addition to over 50 currency pairs, they provide gold, silver, CFD on commodity futures (oil), CFD on ETFs, and indices.

Education about the basic concepts of the forex industry is also accessible in this broker. Traders can read all the concepts provided in the form of e-books, video tutorials, articles, webinars, and forex seminars. There are 17 languages provided on the FXTM website to make it easier for traders to learn about forex.

Traders are also given various choices for payment methods, including Credit Cards (Visa, Mastercard, Maestro) and E-Wallet (Neteller, Skrill, Western Union). For withdrawing funds, traders are not charged a fee with a length of 2 hours to 2 days. Traders can live chat to ask further questions and contact the admin via email. There is also a question and answer page about forex trading on FXTM.

Characteristics of Reliable Trading Apps

When choosing a new mobile trading app, you need to make sure that the app has at least one of the following characteristics:

Provides Updates

As you may already know, currency prices can move in a matter of seconds, which surely affects your trading performance. If you want to be on a winning track, then you must always be up-to-date with the market. Therefore, make sure that the trading app provides real-time data and speedy execution in order to avoid missing any opportunity.

See Also:

Supports Learning Materials

Forex trading is actually far from easy. Apart from practicing, you'd want to improve your skills by learning different strategies, analysis methods, and trading indicators. A good trading platform is one that genuinely cares about its clients and roots for their success. Hence, they should provide tutorials and learning courses that cover at least the basics of forex trading.

Offers Affordable Spreads

Spread is basically the commission that the provider takes from users. While the number is usually small, it can be quite burdensome after a while. Thus, you should try to keep it as low as possible, though you should also make sure that the amount is not too low and unrealistic as it can possibly be a scammer's work.

Conclusion

The forex market is no longer exclusive to giant traders, governments, and institutions. You can access it and make considerable gains simply by installing a trading app on your mobile phone. As explained in this article, there are several important factors to consider when choosing the right trading app. There are many good trading apps out there, but not all of them offer what you need.

So before you sign up, please make sure that the app provides trading conditions that suit your trading style. Last but not least, don't forget to consider the risks before trading and only use money that you can afford to lose.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance