Did you know? The end-of-day trading strategy offers 10 major benefits compared to trading at the opening or in the middle of a market session.

End-of-day trading, or EOD trading, is a strategy where traders analyze and execute trades based on daily charts after the market closes or near the forex market session. While this approach may seem conventional, it holds numerous advantages, making it a popular choice among traders.

End-of-day trading offers many benefits for traders. Here are some of them:

- Stress-Free Trading

- More Reliable Trading Setups

- Minimize Transaction Costs

- More Reliable Historical Price Data

- Less Sensitive to News Events

- Trade-Life Balance

- Trading While Working

- Avoid Overtrading

- Larger Return on Time

- Ability to Make Larger Gains

In this article, we will explore the benefits of trading in the closing session and shed light on why many traders prefer this strategy.

1. Stress-Free Trading

Trading in the closing session offers a highly desirable feature: lower stress levels than intraday trading. Unlike the demanding nature of continuously monitoring the markets for hours on end, end-of-day trading provides a more relaxed trading experience.

As the name suggests, the closing session is the final period before the markets close for the day. This means traders are not required to watch the markets constantly and can focus on specific time frames for trading. This significantly reduces the stress of continuously monitoring market movements and allows for better time management.

Additionally, trading in the closing session enables traders to evaluate their performance at the end of the session. This evaluation allows for a thorough review of trading results, allowing traders to make notes, analyze their performance, and make necessary adjustments to their trading strategy for the next trading day. This reflective process enhances the trading approach and contributes to continuous improvement and refinement.

See Also:

2. More Reliable Trading Setups

The daily time frame leading up to the closing session has been shown to provide cleaner price action trading signals than intraday time frames. Each bar or candlestick on the daily chart is formed from a full day of trading action, so it is not as susceptible to random noise. As a result, trading setups in the closing session are more reliable and trustworthy than intraday trading setups.

A few reasons why trading setups in the closing session are more reliable. First, the market has had more time to digest the news and other information, which can help to reduce volatility and create more stable trading conditions.

Second, the closing session is often a time of increased volume, which can add to the reliability of trading signals. Finally, the closing session is often a time of profit-taking and positioning for the next day, creating more opportunities for traders to enter and exit trades profitably.

3. Minimize Transaction Costs

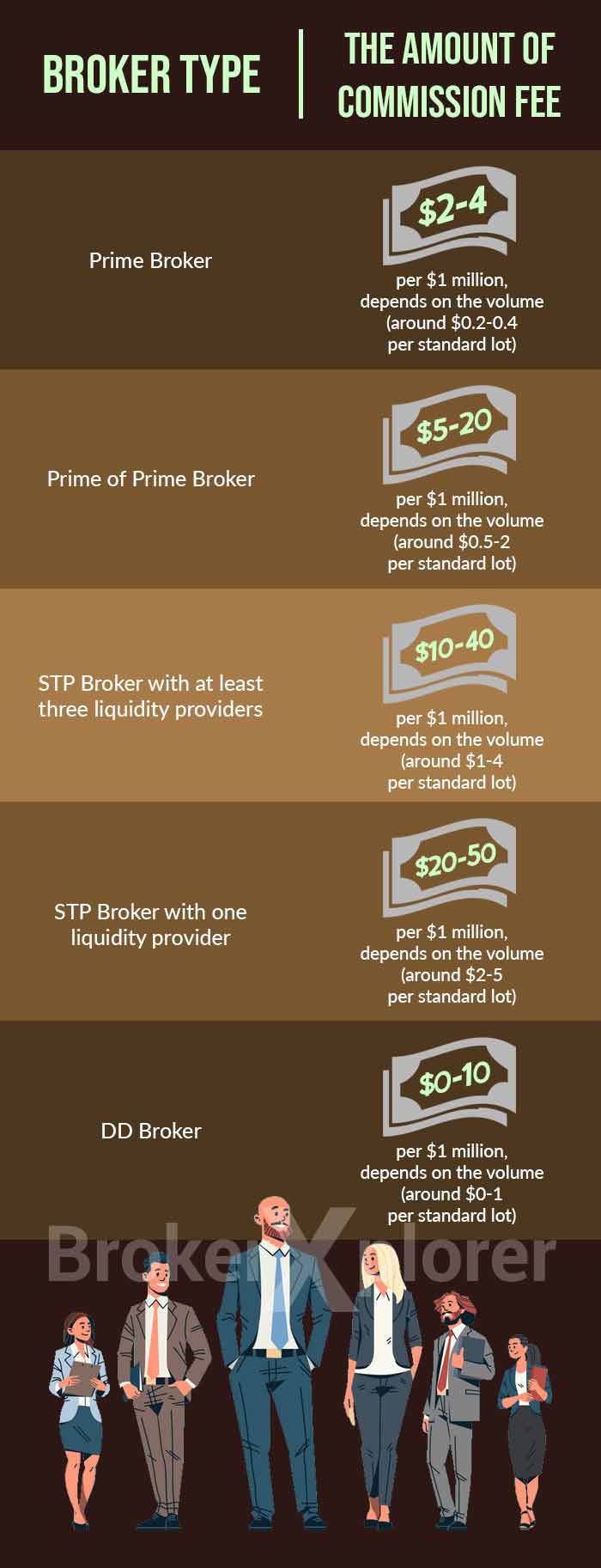

In forex trading, there are several types of trading costs that you have to pay, including commission fees, bid-ask spread, and slippage. These costs can be significant, especially for high-volume traders.

One way to save on these costs is to trade in the closing session. The closing session is the period leading up to the close of the market, and it is often a time of lower volatility. This means there is less risk of incurring large transaction fees due to slippage or wide bid-ask spreads.

In addition, the closing session is often a time of increased volume, which can lead to lower commission fees. As a result, closing session trading can be a cost-effective way to trade the forex market.

See Also:

4. Reliable Historical Price Data

Historical price data is an essential tool for traders, as it can be used to test the efficacy of trading systems and identify trends. However, not all historical price data is created equal. Closing session price data is generally more reliable than intraday price data, as it is less susceptible to noise and volatility.

There are a few reasons why closing session price data is more reliable.

- First, closing prices are typically based on a full day of trading activity, meaning they are less likely to be affected by random fluctuations.

- Second, market participants often use closing prices to set their positions for the next day, which means they can provide a more accurate representation of the asset's underlying value.

If you are looking for reliable historical price data for your trading, closing session price data is a good option. Many sources provide closing price data going back 10, 20, or even 30 years. This data can be used to test trading systems, identify trends, and make informed trading decisions.

5. Less-Sensitive to News Events

News events can significantly impact the volatility of the markets, making it difficult for day traders to profit. However, end-of-day traders are less affected by news events, as they typically trade when there is less volatility.

There are a few reasons why closing session trading is less sensitive to news events.

- First, the closing session is often a time when market participants are positioned for the next day, which means that they are less likely to be influenced by short-term news events.

- Second, the closing session is often when there is less trading volume, which can also help reduce volatility.

As a result, end-of-day traders can often avoid the volatility that can prey on intraday traders. This can be a major advantage, as it can help to reduce the risk of losses and increase the chances of profits.

See Also:

6. Trade-Life Balance

Trading can be a demanding career, but it is important to find a way to balance your trading activities with your personal life. End-of-day trading can help you achieve this balance by allowing you to focus on your trading during specific hours of the day, while still having time for your personal life and other interests.

There is a fine line between being committed to trading and becoming overly obsessive with it. It is important to remember that the markets will always be there, and you can be more productive in your trading if you take breaks from time to time to refresh your mind and body.

Intraday traders, who are constantly monitoring the markets, may not have the luxury of taking breaks from trading. This can lead to burnout and decreased trading performance. End-of-day trading allows you to avoid this problem by allowing you to step away from the markets when you need to.

7. Trading While Working

Trading in the closing session can be a suitable strategy for part-time traders, as it requires a relatively small time commitment. This means you can still trade even if you have a busy day job.

Many closing session traders only need 30 minutes to 1 hour a day to trade. This is because the closing session is a relatively short period, and there is less volatility during this time. As a result, you can analyze the markets, execute trades, and manage your positions without spending too much time.

If you are considering trading in the closing session, keep a few things in mind. First, you need to have a sound trading strategy that is based on technical analysis. Second, you need to be patient and disciplined. Third, you need to be prepared to lose money.

8. Avoid Overtrading

In trading, the amount of time you spend trading does not necessarily correlate with the amount of profit you make. This is unlike a day job, where working more hours typically leads to higher earnings.

A common mistake novice traders make is believing that trading more often will lead to more profit. However, this can lead to overtrading, which can be detrimental to your trading results.

Overtrading occurs when you trade too frequently, often without a clear trading plan or strategy. This can lead to emotional trading, poor decision-making, and increased risk.

One way to avoid overtrading is to trade in the closing session. End-of-day trading is based on daily time frames, which means that there is less data to analyze. This can help you to focus on making fewer, more informed trades.

9. Larger Return On Time

There is no direct correlation between the amount of time you spend trading and the potential profits you can make. In fact, the less time you spend trading, the more you will actually make from it.

This is because day trading is a very fast-paced and volatile activity. It can be difficult to make profits in such a short period of time, and it is easy to make mistakes. End-of-day trading, on the other hand, is a slower and more methodical approach. You have more time to analyze the market and make informed trading decisions. This can lead to higher profits and lower risk.

Of course, there is no guarantee of success in either approach. However, if you are looking to maximize your profits and minimize your risk, end-of-day trading is a better option.

10. Ability to Make Larger Gains

End-of-day trading offers the opportunity for larger gains compared to intraday trading. Focusing on higher time frames, like the daily chart, is key to capitalizing on these opportunities and maximizing profitability. Embracing end-of-day trading can unlock greater earning potential and position traders to take advantage of substantial market trends.

Bottom Line

Regarding effectiveness, trading in the closing session surpasses day trading. The key advantage is the freedom from constantly monitoring the market. By trading in the closing session, you can avoid the distractions of news releases and increase the chances of finding more favorable prices.

This is why many swing traders and position traders prefer to operate in the closing session. It allows them to balance their trading activities and daily life commitments, such as work, school, holidays, and socializing without getting overwhelmed. Trading becomes a simple, enjoyable, and stress-free experience.

However, it's important to note that this article highlights the benefits of trading in the closing session without disregarding other trading strategies. Each trader has their own unique nature and personality, and finding a trading strategy that aligns with your individual preferences and goals is essential.

Choosing a trading strategy is not an easy thing, we have to match it with our personal conditions and preferences. Therefore, you need to find many trading plans and strategy references that suit you.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance