By employing appropriate techniques, avoiding complex maneuvers, and maintaining consistency, it is possible to engage in trading with a limited amount of capital.

People say that forex trading is only for the rich because it involves a lot of money. They still don't believe that forex trading is also available for traders with small funds. Is that true? The trading journal in this article is a proof that trading can be done by using capital as small as USD50. With the proper technique applied, without complicated tricks, and by being consistent, you can do it.

1. Choosing the Forex Broker

First step to do forex trading with small capital, the first requirement is to find suitable forex brokers. The characteristics are as follows:

- Allows a minimum deposit of USD50.

- Provides trading with micro lots (0.01).

- Charges no commission.

- Offers low spreads (less than 2 pips for major pairs).

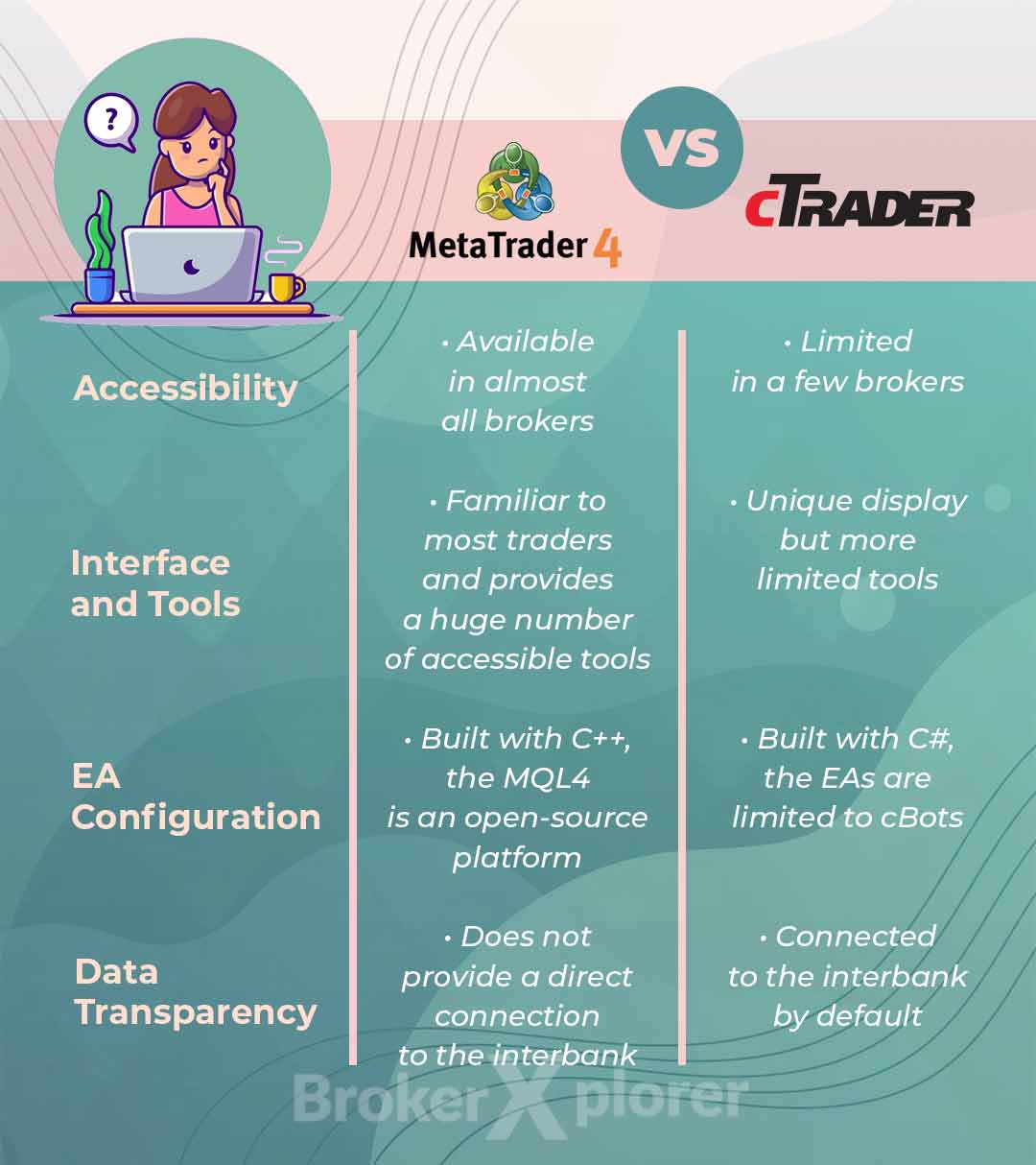

See Also:

2. Setting Up the Account

For the experiment, a trader opened a mini account in a broker providing Trading Central signals. The account details are:

- The Leverage is 1:100.

- The account currency is USD.

- The first capital is USD50.

- The platform used is MT5 Mobile App.

In short, the trader only needs a smartphone, a USD50 capital, and a good internet connection.

3. The Trading System

- Method: Day trading.

- Currency pairs: EUR/USD, GBP/USD, and AUD/USD.

- Risk/reward ratio: 1:1.

- Profit target per trade: anywhere between USD1-3 (10-30 pips).

- Trading volume: 0.01 lots per trade.

- Maximum number of trades opened: 1 trade at a time. You can open one more trade if the first trade shows a positive floating or has been closed.

- Trade frequency: 0-3 trade per day. Avoid opening trade repeatedly on one pair on the same day.

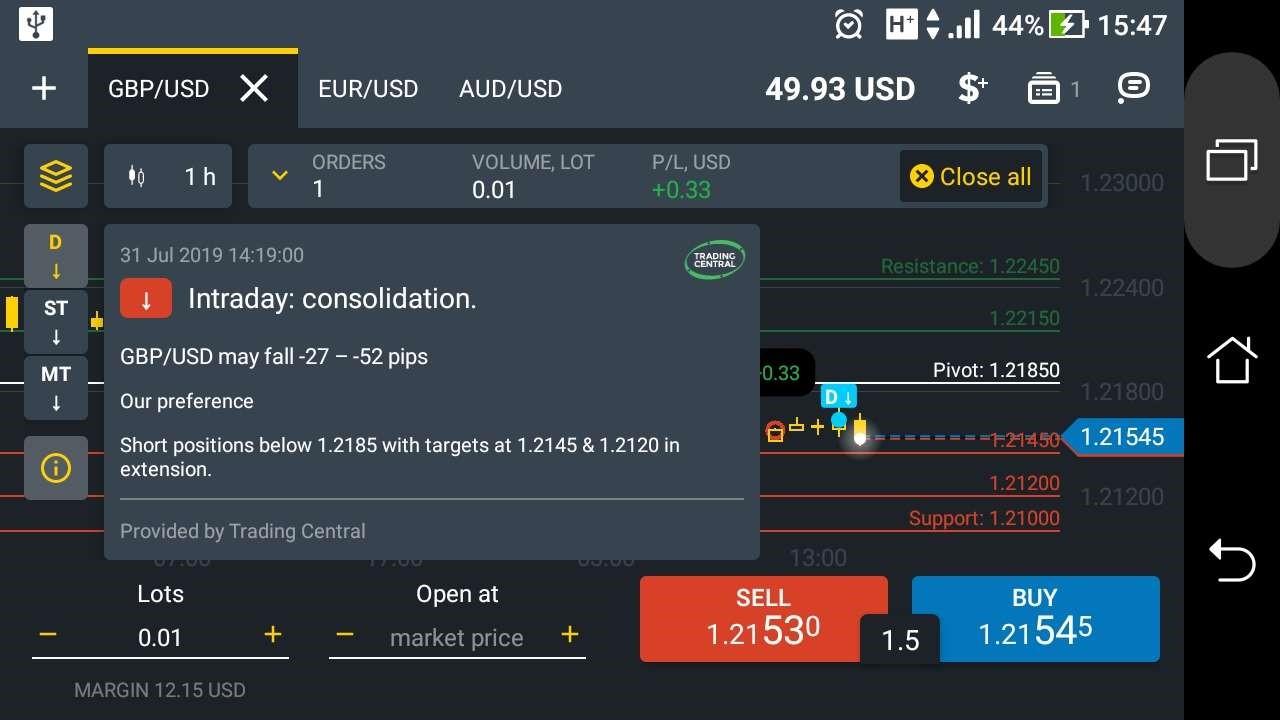

- Indicator: Trading Central Signals.

4. Entry and Exit Rules

Since the experiment uses simple money management for beginners, you may not apply any indicator. The only thing you can use is the Trading Central signals that have been integrated for free in the broker's platform. The signal will appear as below:

You don't need to use all signals, but apply some ively with the following entry rules:

- Open a position in Tokyo or London session, max. 1-2 hours after the session opening.

- Open a sell position if the Daily signal is bearish and one or both signals from the ST and MT are also bearish.

- Open a buy position if the Daily signal is bullish and one or both signals from the ST and MT are also bullish.

- All the trading positions are executed with the Market Order, not the Pending Order.

- Be cautious when the Daily signal is sideways or is the opposite of ST's and MT's signals. Keep in mind that you don't need to trade every day. If the situation does not follow the rules, staying away is better.

- Avoid opening positions during the New York session. This period is better for closing positions.

Next, the exit rules are as follows:

- Set the profit target between 10-20 pips or until the price touches the limit of Daily Support/Resistance in the Trading Central SR plot (shown with the red lines in the graphic).

- After opening a position and setting the profit target, close the platform, and leave it until the price reaches the target and triggers your profit target. You can check the chart a few times, but you don't need to watch the application the whole time. You can set the profit target manually after earning at least USD1.

- Open a trading position without a Stop Loss. However, don't hesitate to cut loss if the price movement has reached the nearest Daily Support/Resistance in the Trading Central SR plot. If you cannot follow through with the cut loss, you should set Stop Loss automatically.

- Avoid opening position a session before the release of high impact news related to central banks' interest rates and speeches. If you have a floating position, trigger your take profit or cut loss early. Check the forex calendar every week to follow what happens in the market.

- All of the floating positions have to be closed before the end of the New York session on the same trading day.

5. The Result

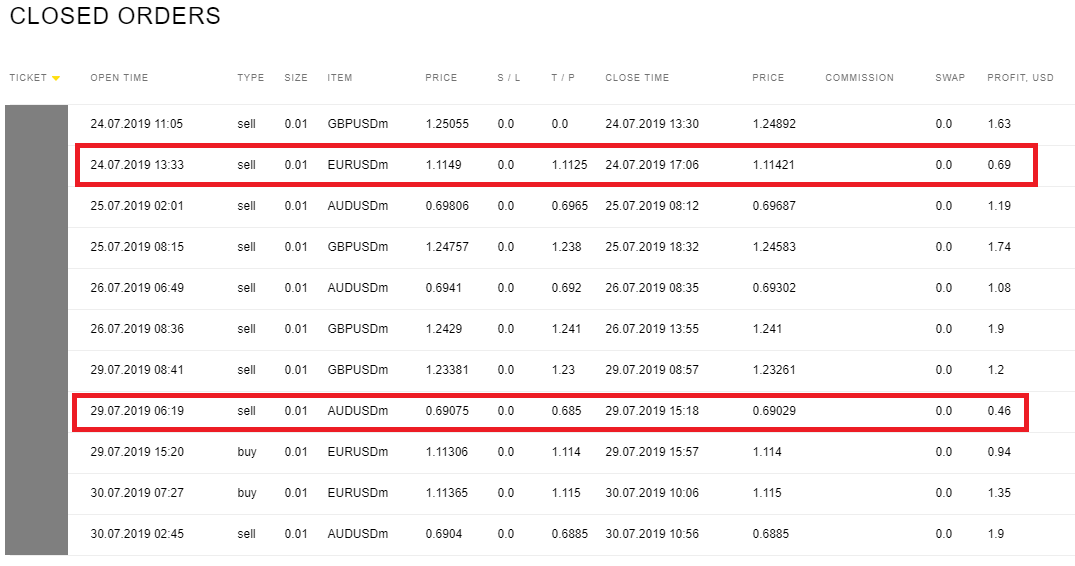

This trading strategy has been applied successfully by a trader. The trader tried this strategy for a week and they managed to gain USD14.08 without any loss positions. Their profitability is about 28% from 11 closed positions. Here is the account history:

Most of the profits were from manual take profits and the rest were earned from pre-determined take profits. Early take profits were conducted twice (before the position gained USD1) because of a central bank event and a misplaced position due to human errors. Sounds interesting?

If you are attracted to apply this system, please take notes that the experiment was only conducted for one week so the data sample was not quite relevant for long-term implementation. Also, the near 30% profitability with no loss might be due to the good market condition during the experiment week, and it does not happen all the time.

In additional, make sure to put a long-term perspective in your vision instead of just instant gratification. It is not guaranteed that you will always be free from loss from trading journal with small capital above. Try it in a forex demo account for a longer period of time.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance