Trading psychology or emotional management is important for a successful forex trader. What are the secrets to implement it to reach the goal of financial independence?

Many professional traders have similar opinions: if you cannot gain profits in the forex market, the most possible cause is not due to your terrible trading system. Yet, it is caused by other factors such as the market condition or your psychological condition.

This opinion shows that trading psychology and emotional management are very important for a successful trader. So, what are the keys and secrets behind trading psychology?

Patrick Stockhausen uses the psychology of trading to achieve success. In the past, he was raised in a poor family and dropped out of school when he was just 16 years old. Because of his good understanding of psychology, business, and people, he managed to become financially independent at the age of 30 years old.

Based on his experience, he helps traders and other investors to arrange their framework and build new mindsets through his web takingstock[dot]biz. He was once interviewed by Justin Pugsley for MahiFX about the major trading mistakes from a psychological point of view. Also, they discuss what it takes to be a successful trader.

Specifically for beginner traders, Stockhausen once revealed 4 important secrets that must be mastered in trading psychology, such as:

- Always prepare for losses

- Have sufficient money

- Never stop learning

- Able to maintain your mentality

For a comprehensive explanation, please read the following article.

Trading Psychology for Noobs

Q: Is it possible for beginners to mastering trading psychology? Where can they start since they were new to this world?

A: "To trade independently, you need deep knowledge about the trading mechanism and forex analysis. If you have mastered all of the knowledge, you will make the right decision in trading. However, the success of a trader does not come only from the knowledge but also relies on the emotional aspect and your mindset during the trading process."

Here are some crucial takeaways of forex psychology that you must learn if you're still a beginner:

1. Prepare for Losses

It is imperative to know that losses are common and all traders have experienced them. Yes, ALL. I put that word in capitals on purpose, so you will always remember it. In other words, you cannot avoid loss in the forex market.

If you keep trapped by your broker marketing schemes such as bonus promotions, think about it again. That kind of promo does not tell that before you get a big profit, there is always the risk of losing. The fact is, 90 percents of traders lose their money (based on a survey conducted by French AMF).

2. More Money, More Chance to Success

Do you know who is not allowed to trade? Although everyone can trade regardless of their job, financial condition, social status, and education degree, not everyone is recommended to choose this business. They are:

- Unemployed people

- Low-income people

- People with a lot of debts

- People who cannot afford electricity bills or basic daily needs.

The main reason they are not suggested to jump into forex trading is that the minimum capital to have successful trading is at least $500 (in micro or mini account).

Also, profit is not something that can be obtained immediately. Oftentimes, traders experience losses and suffer big drawdowns before starting to earn consistently.

3. Forex Learning is a Continuous Process

Just because forex trading involves a lot of money, do not think that forex traders all over the world can earn profit by just clicking their mouse. As mentioned before, only around 10% of traders can earn a big profit. How do we belong to those 10% successful traders? Keep practicing and learning.

One thing that a trader should learn and understand about forex is that profit does not come in a short time. To get some profits, you have to be disciplined and work hard on formulating, applying, and consistently adapting your trading plan to the current market condition.

In reality, a devastating loss is normally caused by:

- Inconsistencies in the trading plans.

- Less practice in the forex demo account.

- Undisciplined way of trading.

- Bad money management.

4. Maintain Your Mentality

Remember to maintain your emotions while trading. Here are some tips:

- Trade only if you feel you can handle your loss.

- Don't put all of your money into one trading.

- Don't trade in too many pairs.

- Practice 'walking' before 'running'.

- Accept the fact that 'the market is always right'.

- Don't be too greedy.

- Be healthy.

Beginner's Mistakes from Psychological Aspect

Q: Psychologically speaking, what areas of difficulty novice traders typically face?

A: "The problem is that they don't love financial trading and investing, yet this is one of the key traits of successful traders. Most successful traders love what they do. It's the game that they love to play. The money is just about keeping the score."

Q: The implication being that many new traders come into the market to make money and that's basically it?

A: "Most people come to the markets with a consumer mindset. Money has a meaning, such as a pair of trainers, the rent, getting out of a boring job. It's therefore not about how well they're playing the game. So they learn some technical analysis and this is where it starts going wrong. They see a pattern in the market and they view it a bit like a slot machine: this is my signal, my trade should work."

At this notion, Patrick Stockhausen pointed out that there's a difference between a slot machine and trading. While a slot machine requires people to put their money in first and hope the "winning" pattern shows up, trading shows the pattern first that we need to analyze so that we can place the trade that we think we're going to win.

However, technical analysis-driven trading is not designed to tell us what is going to happen next. Stockhausen stated that it is designed to put the odds in our favor over a series of trades, making us thinking about individual trades rather than the overall result.

When novices put the importance on a particular trade, they will start calling themselves a loser or say their system fails when it doesn't work even for just one time.

Key Factors in Trading Psychology

Q: So the difference between the person who trades just for money and the one that trades for the love of it is that the former is more short-term in their thinking whilst the latter takes a longer-term view?

A: "Absolutely. It's about gratification and the more you want instant gratification, the more short-term you'll be in your trading. If you are able to gratification the more you're likely to accumulate wealth and play the game for the sake of the game."

Many people trade with the wrong mindset. They do not learn the most important mindsets and tend to make these mistakes:

- The result of every trading and the fluctuation can be predicted.

- You need to be aware of what happens so that you can earn money consistently in trading.

- The profit and loss happen in a certain pattern, so there's no need to anticipate the market's unpredictable factors.

- Entry signals come from the trading system, so you must trade the signals to earn money.

- The market pattern is consistent and reliable. The truth is, to make it happen, you must have exactly the same people, in a similar conditions, to do the exact things. It is impossible for tomorrow there is always a possibility that the people involved may change or that they have their own deliberations to deviate from the previous conditions. So, the patterns in the market do not always work consistently. There are patterns in the market, indeed, but they are subject to change from time to time.

Dealing with the above common mistakes, here are the beliefs of a successful trader.

- Learn and understand that anything may happen in the market and in every trading position you take.

- Once you realized that anything can happen, you will be more focused on what happens in the future and do your best to avoid the risk as well as get the benefit. For example, Richard Dennis starts trading with only $200 and amazingly ends up with $200 million. His trading system relies on several big wins to compensate for the small losses that have been previously set with the right risk management.

- One of the keys is to optimize the opportunities with the highest probability. You may lose 65% of the time but you may end up winning if your trading setup on the best opportunity brings your 35% winning rate to earn a lot of money.

- A random possibility may happen between the win and loss in every trading system.

- Every moment in the market is unique and unrepeatable.

- Last but not least, you must be responsible for your own trading.

Q: Is accepting responsibility for your trading results like saying you have the power to change your results for the better?

A: "Yes. You have your own power to change your environment. But when it comes to trading, when you take a position and it is profitable, it is because other traders, mostly institutions, have to come into the market and move it in your favor. It takes someone else to make you a winner.

So in a way, it's nothing to do with you, it's somebody else. Your job is to recognize the opportunity where you believe others will come in and make you a winner."

The Ideal Condition for Successful Trading

Q: So basically those beliefs are the ways removing the emotional attachment people have to individual trades and avoid actions such as ignoring stop losses and doubling up on a losing trade etc.?

A: "Yes that's correct. There are a sequence of events, which determine if you become financially free, whether you're going to be a successful trader or not and this is it."

Patrick Stockhausen added that success does not refer only to one trade, but also to the whole series of trade. Also, your own decision is affected by your emotional condition (whether you have the right or wrong execution, entering the market late or holding on even after the stop loss is triggered, etc).

Q: Can you explain the bit about the emotional state?

A: "People are more motivated to take action based on fear rather than greed. So you see that markets move faster on the way down than on the way up because of fear."

To this question, Patrick Stockhausen answered with the four infamous fears in trading:

- Fear to lose.

- Fear to make a mistake.

- Fear of missing out (also known as FOMO).

- Fear of leaving money on the table.

Let's say when the market starts to move up, traders are often skeptical and do not believe it. However, when the price keeps moving up, people are suddenly worried to be left behind the uptrend and thus rushing to enter the market.

These emotions screw them up badly. Most of the time, entering the market caused by the fear of being left out is carried out when the trend has begun to stall and prepare for a reversal (or correction) in the opposite direction.

The Disparity between the Rich and the Poor Mindset: Investment vs. Consumption

Q: There are a lot of traders who've read every book about trading and still aren't making money, what's going wrong there?

A: "It's because they don't have a mindset for building wealth. Your values determine what you see in the world. So you must place a value on saving money, which most people don't. You also need to value investing and growing that money and also having some cause for doing that and the bigger the cause the better."

Many people are in fact focused on being consumptive. Once they get money, they spend it on buying whatever they want. They assume that to fulfill their needs is the reason they work for the money.

On the other hand, people who focus on the creation and development of wealth will think of spending their money on buying assets for the purpose of capital gain.

Poor and middle-class people are mostly chased by debts; they think rich people only have money. They don't know that to maintain their wealth, rich people also need the mindset of investing their assets. Poor people think that rich people are stingy because they do not spend a lot on shopping. Meanwhile, the poor and middle-class people spend money on the feeling of the rich.

Q: So this is where the love of trading comes in versus just seeing it as a means of making money to consumers more?

A: "Yes that's right. It's only the person who loves managing money, owning assets and who loves the maths of doing it who ends up rich and financially free. They love the process for the sake of it while everyone else just wants the money to buy stuff."

Q: The problem is that wealth building and saving and investing are simply topics that don't interest most people. So how do you get people to place a high value on these activities?

A: "A first step is being aware of what you believe. People believe all kinds of things, such as 'money is the root of all evil' or that 'rich people must have done something bad or dishonest to make their money' and so on.

Second step, ask yourself about your beliefs whether they're true or not. Because all beliefs are either useful or not in a particular context. So you have to recognize the beliefs that are holding you back. You have to attach pain to those beliefs that are not supporting you and pleasure to the ones that do."

According to Patrick Stockhausen, if you have a negative belief about money, it will affect your trading motivation, because trading deals with money. If you have a belief like "money is the root of all crimes", you are already one step closer to losing since you have believed it in your mind. Your brain commands you not to be a criminal, so it will guide you to make the wrong decision in trading. You will follow your belief that money is a crime.

As belief leads to behavior, it is crucial to understand it and shape it into a constructive way of thinking.

One of the reasons why Hedge Fund managers and professional traders hire private psychologists is because they know well that psychology is a powerful factor in trading and investing. It drills the trading system in your mind in a repeated way so it can be very helpful to enforce discipline in your trading.

Trading Psychology is a Top Priority

Q: To sum up, what should a new trader do for the first time they deal with trading psychology?

A: "People traditionally come to trading along the lines of 'give me a trading system'. Then they think about testing it and then they come to money management and finally psychology. It will take them something like 10 years to master trading if they do it that way."

Hence, Patrick Stockhausen underlined the importance of building a proper mindset as the first attempt of developing the right trading psychology. After that, managing the risk and building your profit will be thousand times much easier. So, work on your psychology first and the rest will be easier.

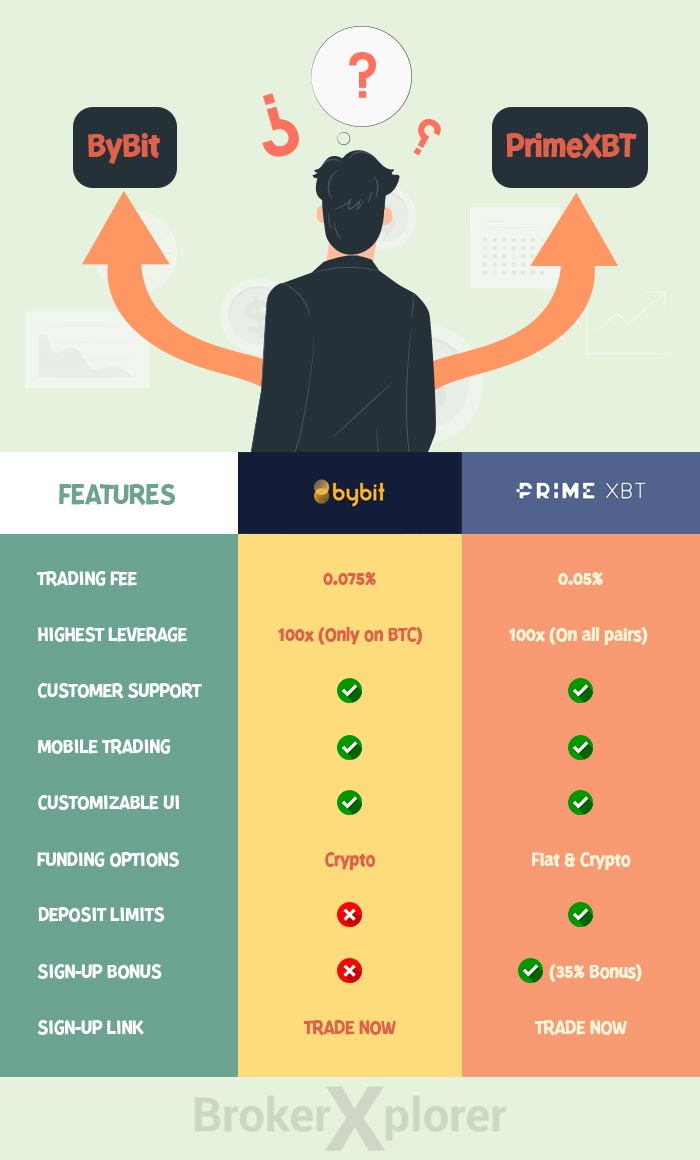

Trading psychology is indeed an important factor in gaining success, but choosing the right broker is as important if not more crucial. There's no point in perfecting your trading emotions if your broker often finds a way to cheat you. How to avoid it? Learn the steps to choose the best forex broker here.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

Samantha

Dec 14 2022

Wow! Your article seems very helpful for physiology and may be the most basic of all aspects of forex trading. I was shocked when I read your statement:

This means that in order to become a successful trader, you must love trading and investing. So, with this passion, I never get bored with Forex all the time and I won't give up on Forex very quickly. Thanks for some tips you give. After reading your article I can really feel that all my trading is based on emotions which can lead to loss. When my psychology is not good I need to stop trading. And the market changes every time I agree that learning forex is an ongoing study because you have to learn every time it changes. Thank you very much

patrick stockhausen

Feb 27 2023

Great article if I do not mind saying so myself. Good to see people are shariung my work and quoting me for my words, work and wisdom.